- Ethereum’s Q1 struggles have sparked a debate about its long-term worth

- Regardless of current losses, Trump’s backing might sign confidence in Ethereum’s potential for future restoration

As Ethereum [ETH] faces its most difficult quarter in years, with a delayed improve and a sluggish market efficiency, one element stands out – 91% of President Trump’s crypto holdings are anchored on the Ethereum blockchain.

Because the community grapples with its present hurdles, this important funding has ignited hypothesis about Ethereum’s long-term prospects. Might Trump’s backing be a sign of untapped potential, or is Ethereum’s battle only the start of a deeper downturn?

Ethereum – A rocky begin to 2025

ETH has been recording one in every of its worst Q1 performances in recent times. In reality, at press time, March’s returns stood at -10.95%, following a steeper decline of -31.95% in February – Considerably beneath the typical March returns of +19.48%.

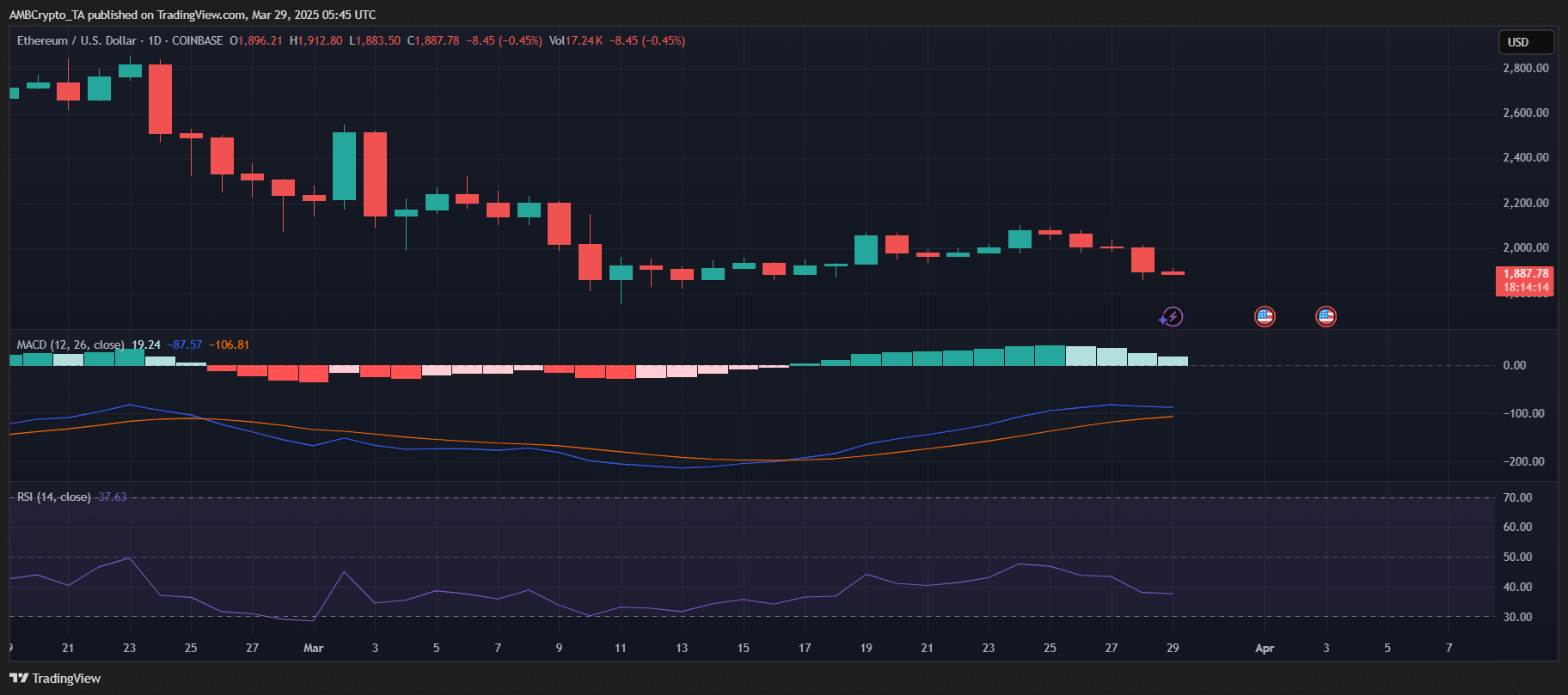

Technical indicators highlighted this bearish development, with ETH buying and selling at round $1,887 at press time. The MACD revealed rising bearish momentum, whereas the RSI was close to 37 – Indicating oversold situations. A sequence of pink candles on the day by day chart underlined sustained promoting strain all through March.

Including to the uncertainty, the ecosystem stays in limbo as merchants anticipate upcoming upgrades. Sentiment stays cautious, with ETH’s value motion persevering with to replicate the broader market’s skepticism too.

Trump’s crypto holdings – What we all know

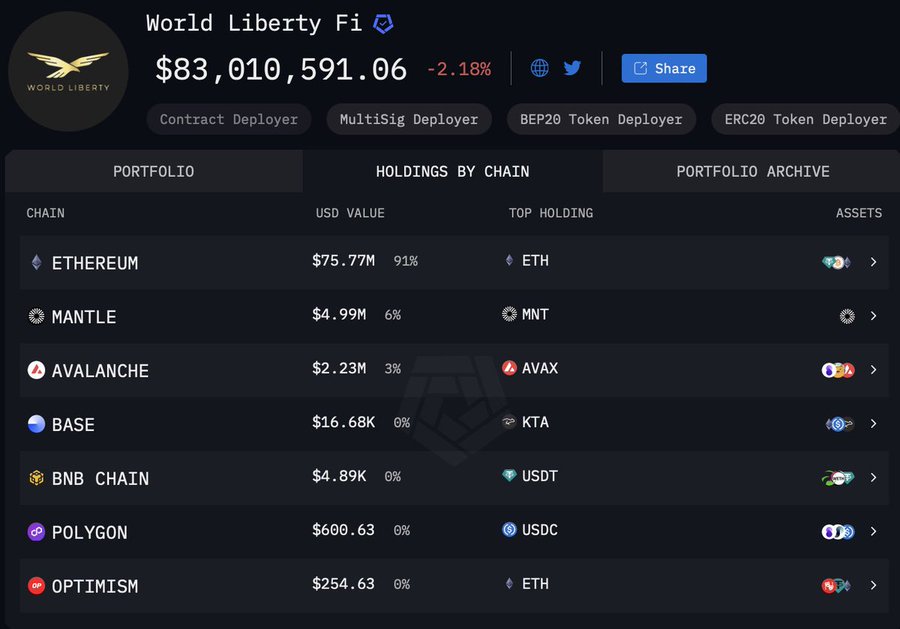

President Donald Trump’s monetary footprint within the crypto world is bigger than many may count on. Via his household’s important management over World Liberty Monetary (WLFi), it’s clear that Ethereum performs a central position.

Latest information revealed that 91% of WLFi’s crypto portfolio – price roughly $75.77 million – is anchored in Ethereum proper now.

This substantial dedication to ETH raises questions on Trump’s affect on the community’s future, particularly amid Ethereum’s ongoing struggles. Whereas market sentiment stays shaky, Trump’s oblique endorsement might replicate confidence in Ethereum’s long-term worth proposition.

Given the size of his holdings, any shifts in Trump’s crypto place might ripple by the market, influencing each ETH’s valuation and broader public notion.

The case for undervaluation

Some market observers argue that ETH may at present be undervalued, seeing the Trump household’s important stake as a vote of confidence within the asset’s resilience. This attitude pertains to historic information – Like Ethereum’s downturn in 2020 – the place bearish cycles finally gave option to restoration. This may very well be an indication that present struggles might mirror previous patterns.

Nonetheless, not everyone seems to be satisfied.

Skeptics consider that ETH’s sustained decline might result in new lows, risking extended bearish momentum. Bitcoin’s persistently unfavourable 1-year share change may also affect ETH, dragging it additional down. Moreover, considerations over decreased liquidity and waning investor confidence current potential dangers that might problem the asset’s stability.

Balancing these views, Ethereum’s trajectory might rely on broader market dynamics and whether or not monetary endorsements like Trump’s actually sign energy or a fleeting vote of confidence.

What’s subsequent for Ethereum?

ETH’s future restoration could also be pushed by a number of elements. One potential catalyst is the implementation of sharding, which goals to boost scalability and scale back charges. Institutional curiosity can be rising, with Deutsche Boerse’s Clearstream planning to supply custody and settlement companies for ether, boosting participation.

Lastly, the potential approval of Ether-based ETFs might entice important capital inflows, particularly because the Trump administration maintains a pro-crypto place. Within the DeFi house, Ethereum stays foundational regardless of market challenges, with its position in decentralized purposes intact.

Nonetheless, regulatory readability round staking and Ethereum-based tokens can be important, and the administration’s supportive method might strengthen investor confidence and foster additional adoption.