- A looming US recession and BoJ’s price hike have been liable for the latest market losses.

- US recession final result presents a conflicting state of affairs for crypto markets.

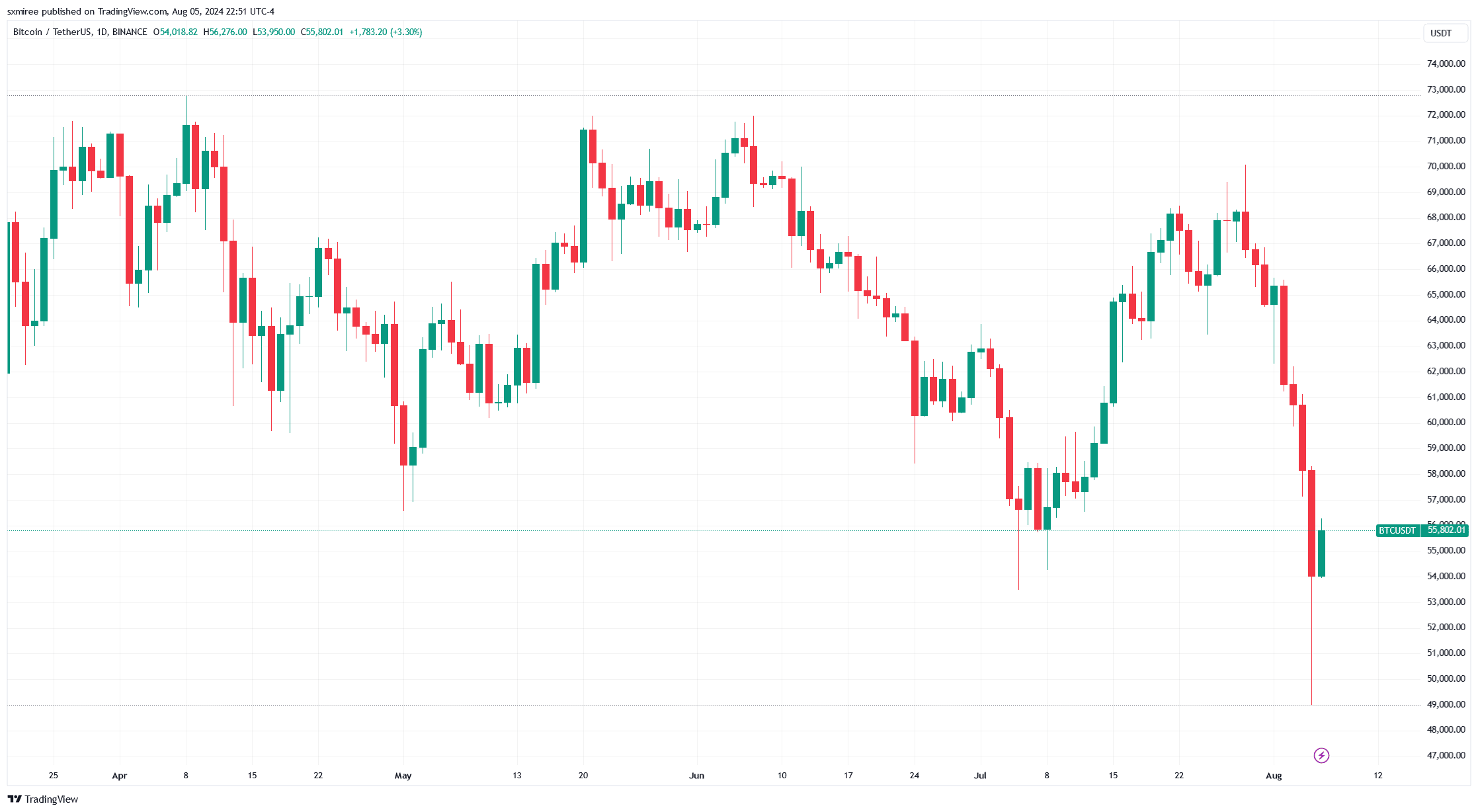

Bitcoin [BTC] and different altcoin costs fell sharply on Friday, the 2nd of August, with the losses extending all through the weekend. The flagship crypto tumbled via $60,000 over the weekend earlier than nosediving below key support levels on Monday, fifth August.

Friday’s market pullback, which lower throughout international equities, was triggered by a weaker-than-expected US jobs report launched after market hours.

Markedly, the three-day heavy sell-off got here lower than every week since Bitcoin was buying and selling near its March all-time excessive on twenty ninth July, highlighting the affect of macroeconomic components on crypto belongings.

Influence of a US recession on Bitcoin worth

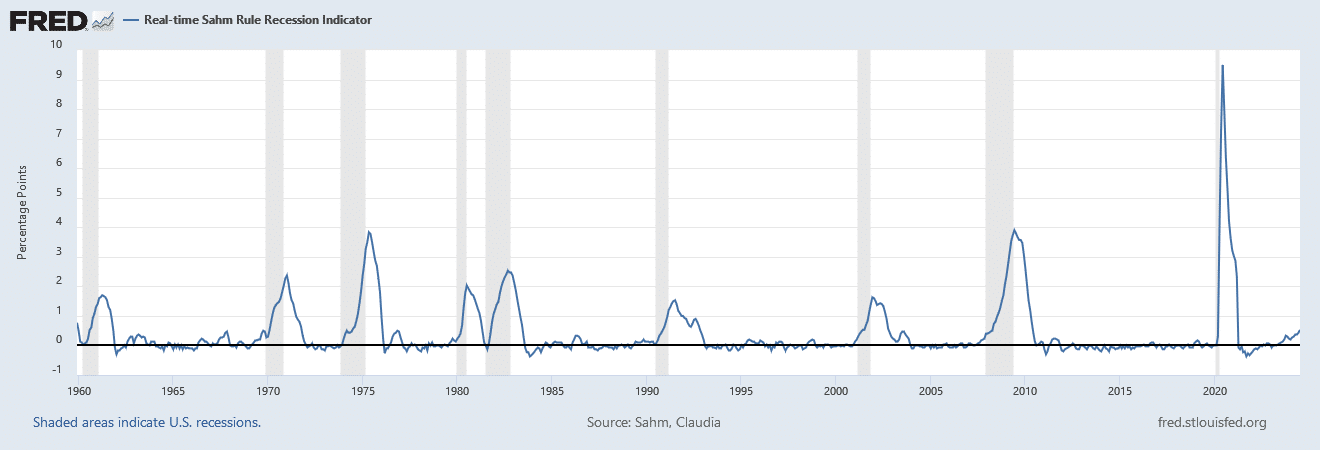

The narrative of a US recession has been occurring over the previous yr amid mixed opinions on the state of the economic system.

Friday’s disappointing employment knowledge additional spooked buyers within the US fairness markets and rekindled concerns of an financial downtrend.

It hasn’t helped that geopolitical tensions have stirred financial uncertainty on the worldwide stage. The continuing conflicts within the Center East and Ukraine have contributed to the fragile financial panorama for the US, which is looped in each.

Right here is how a doable recession would have an effect on Bitcoin worth within the present cycle.

Investor sentiment

Investor sentiment sometimes shifts in direction of threat aversion in recessionary environments. Danger-averse market contributors primarily undertake conservative asset allocation, favoring low-risk devices over risky belongings like cryptocurrencies.

Shifting sentiment by buyers selecting to retreat to conventional protected belongings would seemingly mount strain on Bitcoin worth, however its mounted provide enchantment.

Some market commentators have additionally opined {that a} recessionary setting would set the stage for Bitcoin to decouple from equities within the present cycle.

Recessions sometimes constrict liquidity, birthing tighter circumstances as market contributors prioritize capital preservation. A recessionary setting would lead to curtailed inflows into crypto belongings, thus exerting downward strain on their costs.

Governments and monetary regulators might resolve to tighten controls and implement new insurance policies in response to financial contractions. Up to now, the crypto market has proven sensitivity to regulatory developments, and any new restrictions would seemingly introduce extra volatility.

Conversely, a recession also can immediate financial easing and monetary stimulus measures like decreased rates of interest. Market confidence is rising that the Fed will now cut its benchmark interest rate by a warranted 0.5% in September as a substitute of the preliminary 0.25% projection.

Given the present market dynamics, a price lower would inject extra liquidity, with Bitcoin poised to learn from such a supportive macroeconomic situation that might lead to a weaker US greenback.

Historic context

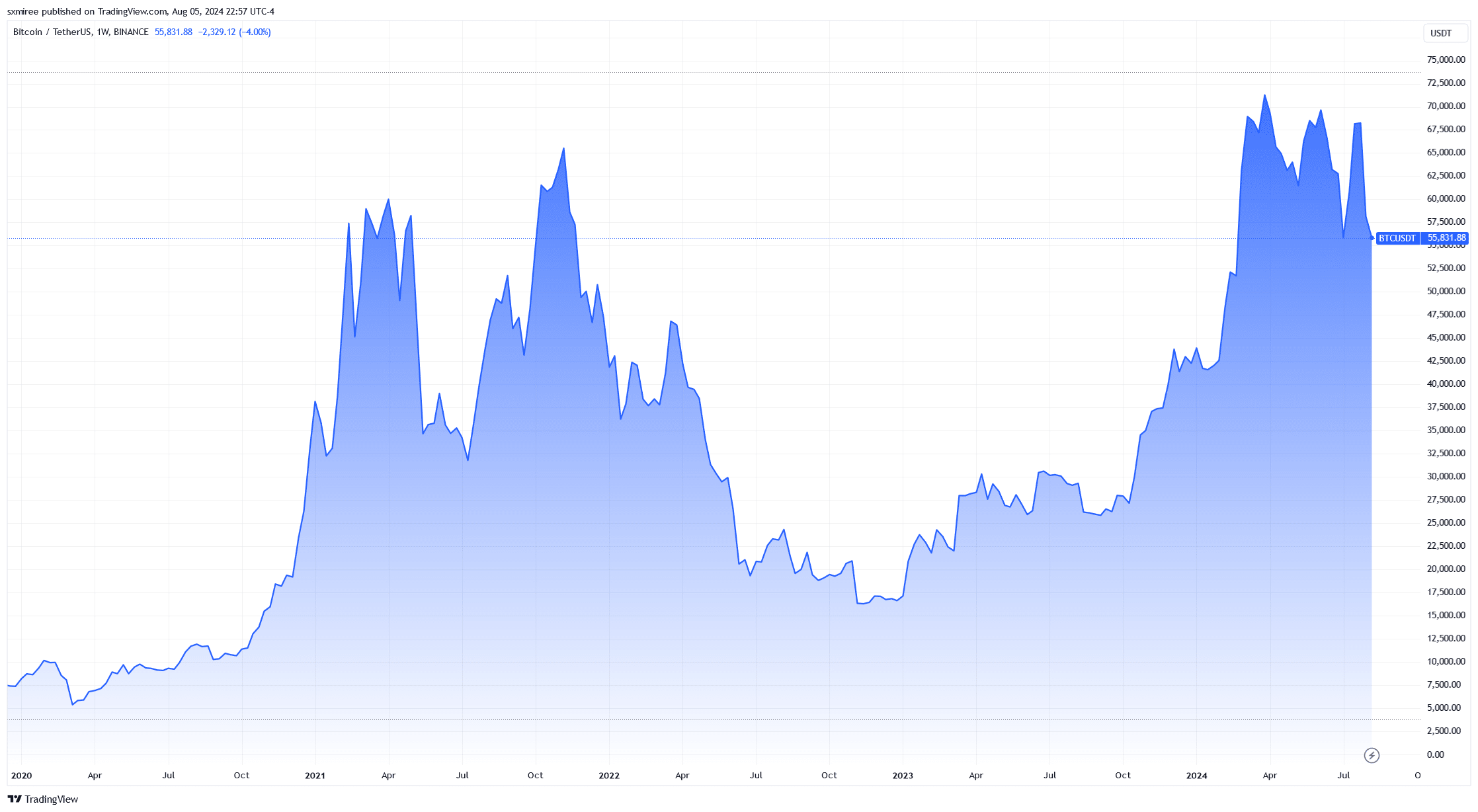

Previous knowledge signifies combined Bitcoin market efficiency in periods of an financial downtrend, reflecting its simultaneous speculative and store-of-value attributes.

When the Fed final lower rates of interest in March 2020, Bitcoin traded beneath $7,000, rising to $60,000 over the next yr.

In distinction to the thirty first July Fed resolution to depart rates of interest unchanged at their 23-year excessive, Japan’s central financial institution tightened its monetary policy on fifth August.

The Financial institution of Japan (BoJ) raised its benchmark rate of interest from near-zero to 0.25%.

Trajectory forward

Whereas the rapid response to recession fears has been bearish, it doesn’t point out any long-term unfavorable pattern. Most financial releases this week are gentle, drawing the eye of market watchers to subsequent week’s July CPI inflation report.

The most important query is whether or not the US can muddle via prevailing financial challenges with out regression right into a extreme melancholy. That stated, market contributors ought to carefully monitor financial indicators and coverage responses within the coming weeks.