- Hyperliquid whales who management important funds out there have opened extra brief positions

- Institutional traders, alternatively, have continued to purchase Bitcoin

Bitcoin [BTC], after gaining by 1.59% final week, took a distinct route over the past 24 hours. Actually, the aforementioned interval noticed the crypto lose nearly 3% of its worth.

That is value taking a look at, particularly since AMBCrypto’s evaluation revealed that this decline may lengthen itself as Hyperliquid whales took management of the derivatives market with a detrimental web BTC place. This raises an essential query although – Can institutional traders regain floor and reverse the downturn?

Hyperliquid whales wager on a significant drop

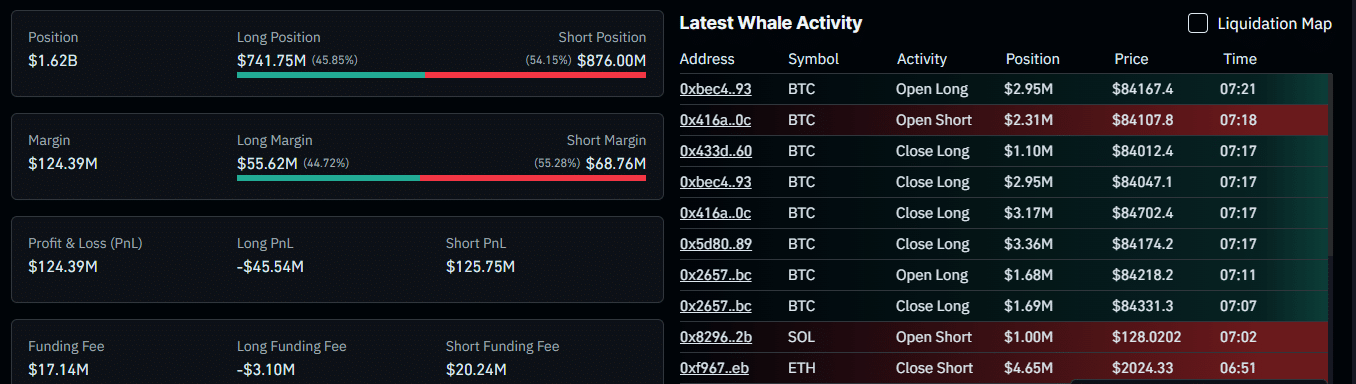

In keeping with Coinglass, there was a surge in spinoff positions on Hyperliquid – A platform that screens giant merchants’ positions – with figures for a similar climbing to $1.62 billion.

Curiously, brief positions appeared to account for 54.15% of those open positions, value $876 million. Usually, when market information reveals exercise skewed in favor of the bears, it’d trace at an absence of curiosity from high market members. This might probably result in a significant market decline on the charts.

Additional information revealed that merchants who positioned opposing bets—lengthy trades—are at a loss now. On the time of writing, lengthy revenue and loss (PnL) was down by $45.5 million, whereas brief merchants gained $125.75 million inside this era.

To place it merely, this urged that promoting has been extra worthwhile – One thing that will have influenced Bitcoin’s decline within the final 24 hours. AMBCrypto additionally discovered that institutional gamers are actively shopping for, probably for the long run.

Institutional traders maintain accumulating

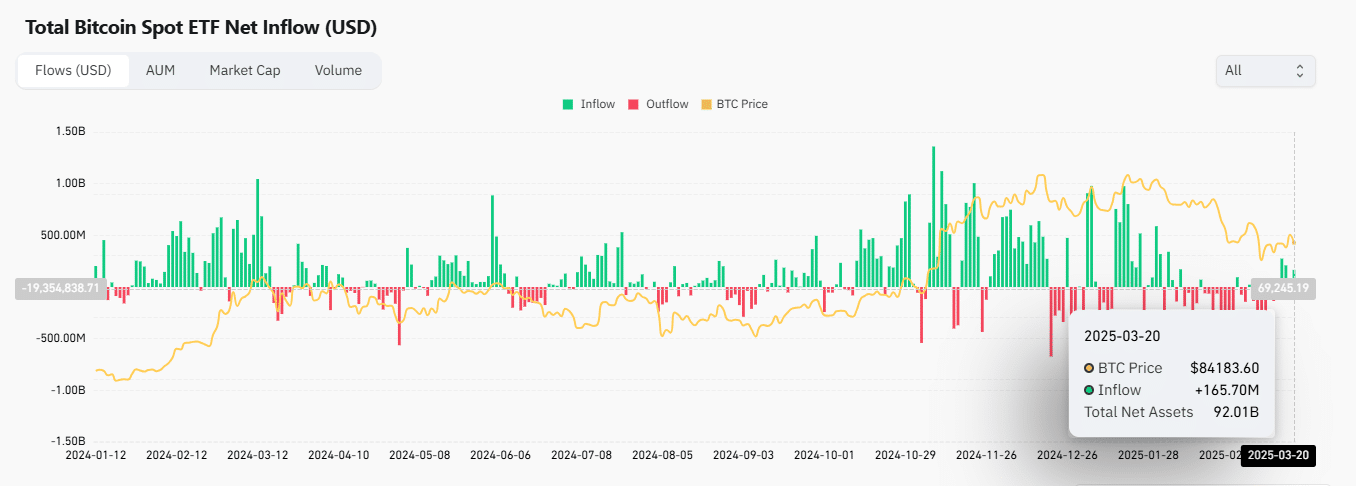

Whereas whales on Hyperliquid are predominantly promoting, institutional traders have been actively buying Bitcoin. This may be evidenced by the netflows monitoring inflows and outflows.

In keeping with the identical, traders bought a complete of $165.7 million value of BTC over the past 24 hours. Such a big quantity is an indication of excessive degree of curiosity in Bitcoin.

The Fund Market Premium, one other key metric evaluating Bitcoin costs on institutional funding platforms to the broader spot market, confirmed shopping for exercise from these platforms. On the time of writing, the metric sat above the impartial degree of 0.

AMBCrypto additionally discovered that this institutional shopping for sentiment gave the impression to be in step with long-term holders’ choices to build up. The motion of their belongings up to now seven days has notably declined, with a Binary CDD (Coin Days Destroyed) studying of 0.285.

Right here, Binary CDD tracks long-term holders’ exercise primarily based on a scale from 1 to 0. The nearer it’s to 0, like within the current case, the extra shopping for and holding actions are happening. This can be a signal that these traders are regaining a bullish outlook throughout the market.

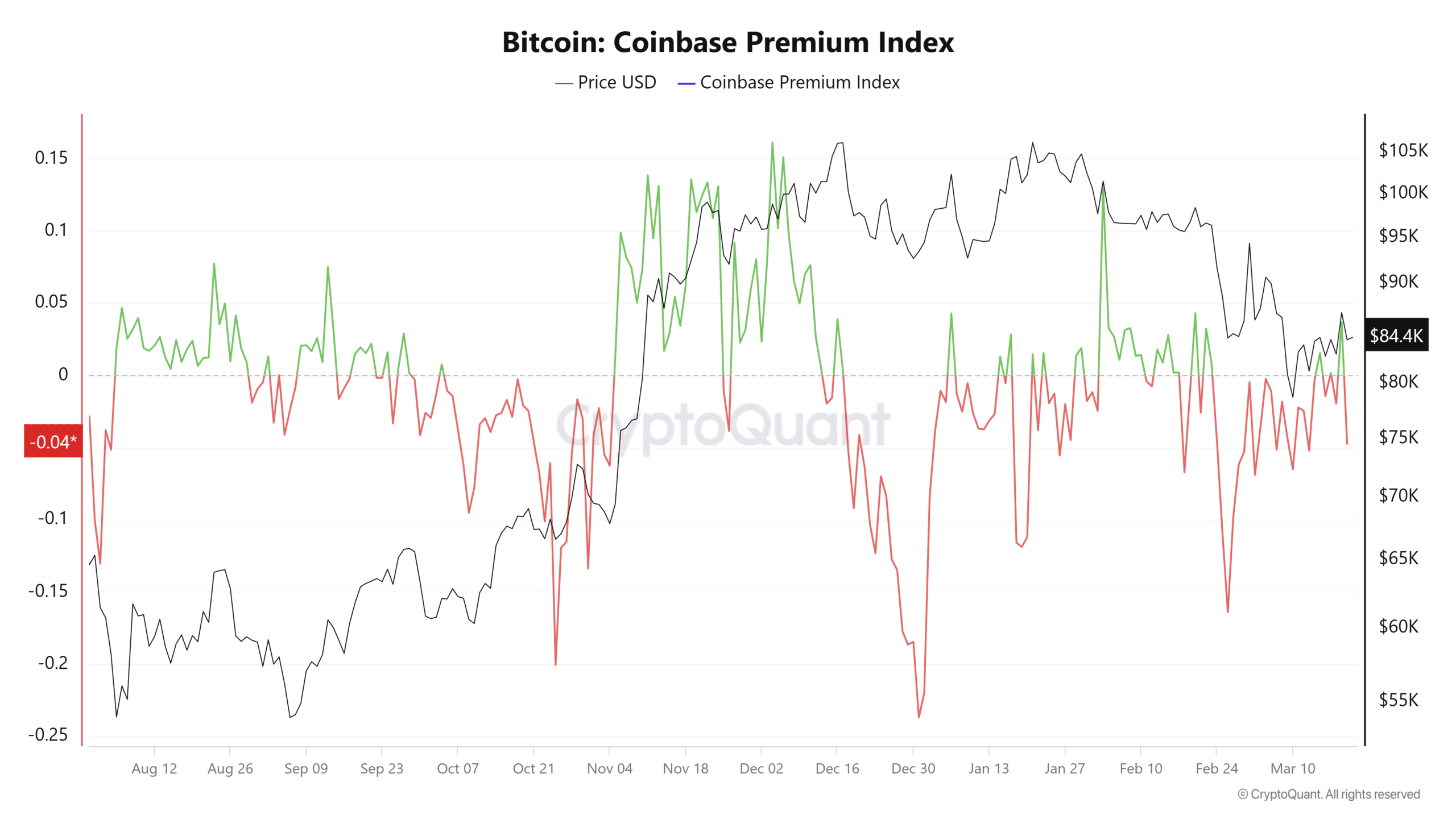

U.S traders are promoting

Lastly, American traders are following the identical path as Hyperliquid whales, at present promoting, as mirrored by the Coinbase premium dropping to -0.04. When this premium enters detrimental territory, it alludes to important promoting strain.

Usually, U.S traders affect Bitcoin’s long-term motion, that means that if their promoting strain continues to climb, Bitcoin may fall additional. Nevertheless, if promoting eases, Bitcoin may rebound in step with the institutional traders’ bullish wave.

Total, a key shift in both path—bullish or bearish—will lend us extra readability on Bitcoin’s subsequent few weeks and months.