- Institutional inflows, like BlackRock’s Bitcoin ETF, have propelled BTC’s rise above $100K.

- Regulatory shifts and Putin’s help for BTC add momentum to its ongoing market surge.

Bitcoin [BTC] has crossed the $100,000 mark, reaching a significant milestone for the crypto market. The value surge has drawn consideration to elements comparable to institutional curiosity, regulatory developments, and international help for digital property.

Beneath, we discover the principle causes behind this rise.

Bitcoin market knowledge displays robust momentum

As of press time, Bitcoin was buying and selling at $102,570 with a 24-hour buying and selling quantity of $141.34 billion. During the last 24 hours, its worth has risen by 6.19%, whereas a 6.78% achieve has been recorded over the previous week.

Bitcoin’s market capitalization now stands at $2.01 trillion, based mostly on a circulating provide of 20 million BTC.

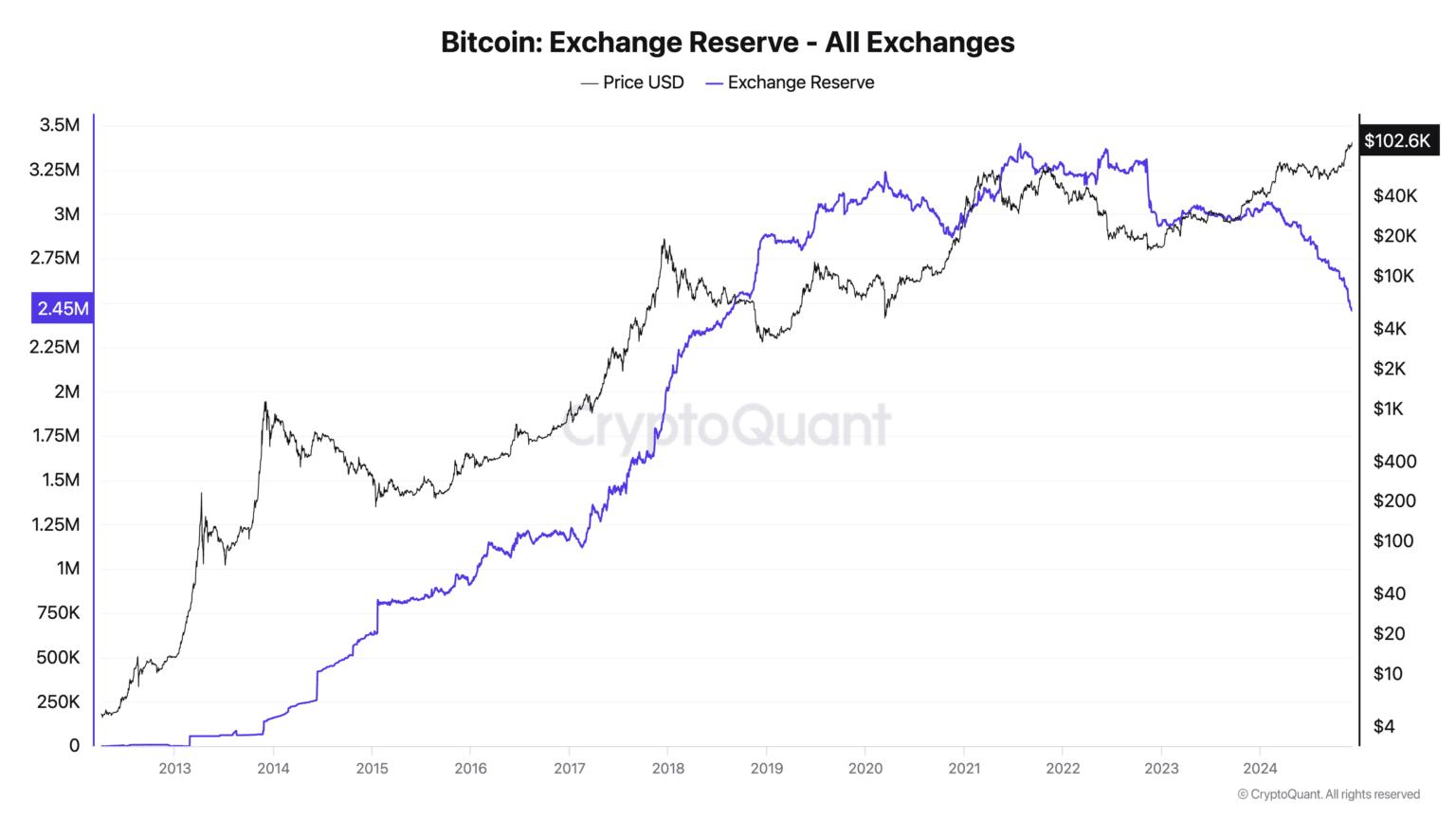

Bitcoin’s buying and selling vary during the last day spanned between $94,870 and $103,679, marking a brand new all-time excessive of $103,679. BTC alternate reserves have additionally been falling, indicating lowered promoting exercise.

This implies that buyers are selecting to carry their property.

Institutional inflows bolster Bitcoin rally

Institutional curiosity has performed a big position in Bitcoin’s rise previous $100,000. A significant contributor has been BlackRock’s iShares Bitcoin Belief ETF (IBIT), which just lately crossed $50 billion in property below administration.

Notably, IBIT achieved this milestone inside simply 228 days, far sooner than conventional ETFs, a few of which have taken years to succeed in related ranges.

The speedy progress of IBIT illustrates the growing demand for Bitcoin amongst institutional buyers. BlackRock has additionally built-in Bitcoin publicity into its conventional funds, additional demonstrating its religion within the cryptocurrency’s potential.

As extra establishments undertake BTC as a key monetary asset, the market continues to point out energy.

Regulatory shifts drive constructive sentiment

Regulatory adjustments have additional fueled Bitcoin’s momentum. On 4th December, Donald Trump announced Paul Atkins, recognized for his crypto-friendly stance, as the brand new SEC chair, changing Gary Gensler.

This transfer has created optimism throughout the crypto business, because it raises expectations for clearer and extra supportive rules within the U.S.

Moreover, Russian President Vladimir Putin expressed robust help for BTC through the Russia Calling Funding Discussion board. Putin famous,

“These instruments will develop a technique or one other as a result of everybody will try to scale back prices and improve reliability.”

His remarks spotlight the worldwide recognition of Bitcoin as a transformative monetary expertise, contributing to the continued rally.

Surge in futures market exercise

The derivatives market has additionally skilled important progress alongside Bitcoin’s worth surge. Open curiosity in Bitcoin futures has climbed to $64.70 billion, indicating heightened exercise amongst each institutional and retail merchants, based on an AMBCrypto report.

The rise in open curiosity suggests continued confidence in BTC, at the same time as profit-taking could happen within the quick time period.

This uptick in futures buying and selling exercise reinforces BTC’s place as a sought-after asset in each spot and derivatives markets.