- Bitcoin’s Giant Holders Netflow fell by 191%, marking a shift in whale conduct and weakening demand assist

- Realized Earnings dropped under $1 billion, mirroring late-October 2024 ranges

Bitcoin’s [BTC] market has remained in a fragile steadiness currently. In reality, it gave the impression to be supported by low realized income and fading demand alerts that elevate the percentages of a directional shift quickly.

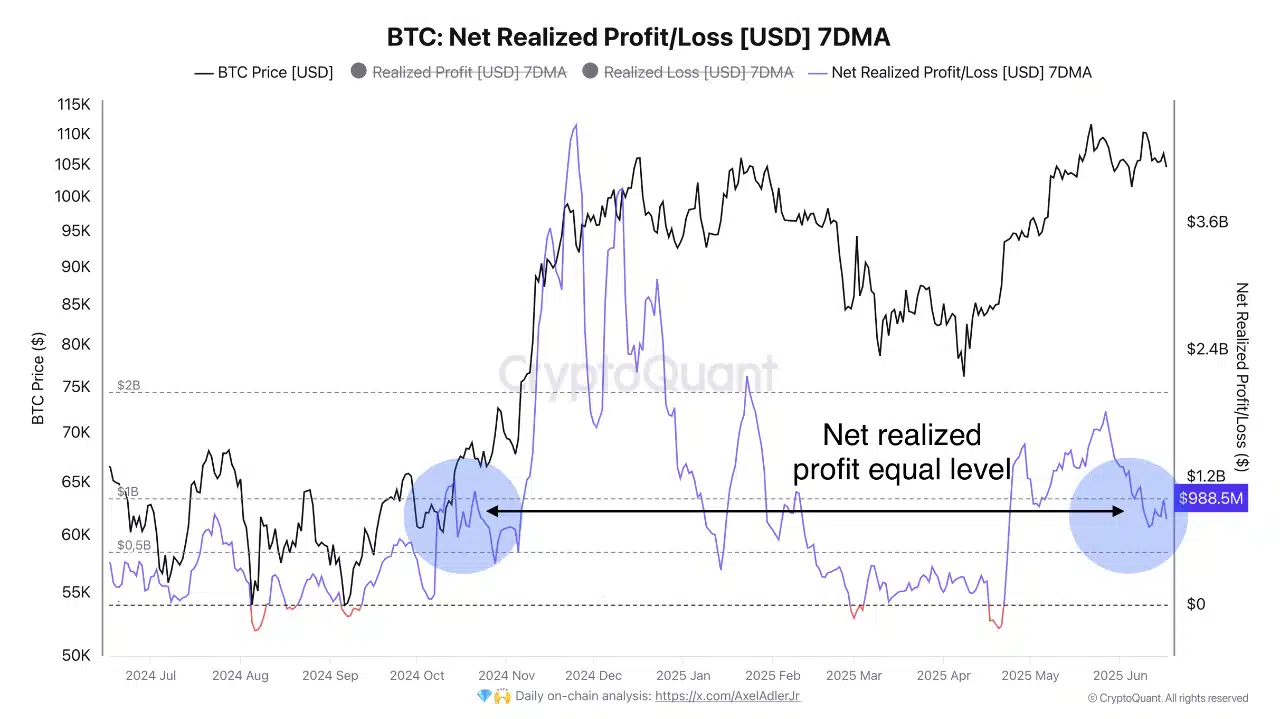

On the time of writing, BTC was priced round $106,000, with its Realized Earnings (7DMA) hovering slightly below the $1 billion threshold – Ranges not seen since late October 2024.

Regardless of a current native excessive, nevertheless, profit-taking has remained subdued – According to the low Realized Earnings development.

And but, the backdrop tells a unique story – One in every of declining demand and mounting fragility.

Are whales backing out? AMBCrypto’s evaluation breaks it down…

The Giant Holders Netflow metric highlighted a regarding shift although.

During the last seven days alone, netflows fell by a staggering 191.44% – An indication that whales dramatically diminished their accumulation patterns.

All through April and Might, netflows had been comparatively impartial. Nonetheless, June has seen a constant drop to this point. This recommended that some giant holders could also be stepping again or distributing cautiously.

With out their regular inflows, Bitcoin will develop into extra uncovered to draw back threat. Significantly if different demand sources proceed to weaken in tandem.

What do destructive Funding Charges reveal?

Properly, the image from the derivatives markets entrance hasn’t been reassuring both. In reality, persistently destructive Funding Charges on dYdX revealed that merchants could also be leaning bearish and betting towards a sustained rally.

Each try by longs to regain floor has fizzled out shortly. Even transient flips into optimistic territory failed to carry.

Except Funding Charges stabilize or flip optimistic for longer intervals, patrons will probably wrestle to regain any management. This would depart Bitcoin susceptible to speculative sell-offs.

Has Bitcoin’s Unrealized Earnings cushion thinned?

The MVRV Z-score fell to 2.47 from an area peak of two.97 earlier in June. This drop might trace at thinning unrealized income following a pointy Might rally.

With out hefty unrealized income to fall again on, holders, and particularly short-term ones, may need much less incentive to remain put.

On the identical time, LTHs have been persevering with to withstand exit triggers, making a gridlock with no clear route.

Are on-chain valuation alerts overstretched?

Lastly, a few of Bitcoin’s on-chain valuation fashions is likely to be flashing crimson proper now.

Metrics such because the NVT and NVM ratios surged, rising by 37.78% and 27.45% respectively. These spikes alluded to a rising disconnect between market cap and community utility.

In previous cycles, such divergences have preceded both sharp corrections or extended sideways motion. With the NVT at 45.83 and the NVM at 3.05, BTC may appear overvalued relative to its on-chain exercise.

It’s a warning – Crowd sentiment could drive the worth greater than natural development.

Additionally, the Inventory-to-Move (S2F) ratio dropped by 16.66% to 1.060M, indicating a lower in perceived shortage. This metric historically helps bullish narratives round post-halving provide shocks.

Nonetheless, the current decline recommended that both Bitcoin issuance has risen or investor accumulation has slowed down. In both case, the weakening of this shortage sign might undermine long-term bullish expectations.

Can weakening demand assist Bitcoin’s place?

Regardless of fragility throughout a number of metrics, Bitcoin has to this point managed to carry its impartial floor. Nonetheless, falling whale exercise, bearish funding charges, and rising valuation metrics are indicators of a fragile state.

If demand continues to deteriorate, this steadiness is extra more likely to break – Probably triggering a transfer away from the present consolidation part.