Dogecoin (DOGE) is buying and selling at key demand ranges after two weeks of intense promoting strain, with bears driving DOGE down over 30%. The broader crypto market has confronted a protracted correction that began in mid-January, however meme cash have been essentially the most impacted. Because the market chief within the meme coin sector, Dogecoin has suffered excessive volatility, testing decrease assist ranges as investor sentiment stays bearish.

Associated Studying

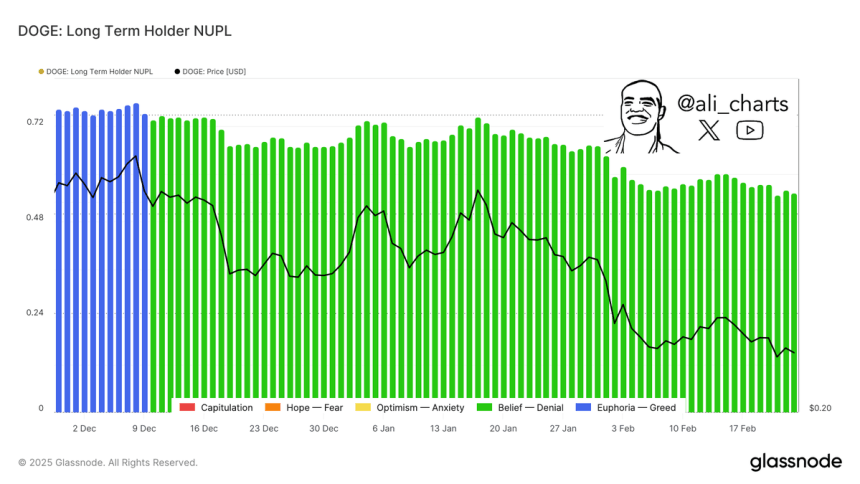

Glassnode’s on-chain metrics reveal that long-term Dogecoin holders are in “denial”, signaling rising uncertainty amongst those that have held DOGE for prolonged intervals. The DOGE Lengthy-Time period Holder Internet Unrealized Revenue/Loss (NUPL) indicator has been in a declining pattern, which means that many long-term holders are seeing diminishing unrealized income and even slipping into losses. This pattern means that holders who as soon as remained assured in Dogecoin’s long-term potential are actually going through market doubt and will contemplate promoting if circumstances don’t enhance.

As DOGE trades close to essential assist, the following few days will likely be essential for figuring out whether or not bulls can reclaim management and push for restoration or if promoting strain will proceed, forcing DOGE into deeper correction territory. Bitcoin and the whole market are setting contemporary lows, and this week will likely be essential for bulls to defend key demand at these ranges.

Dogecoin Crashes: Can Bulls Regain Management?

Dogecoin has skilled an enormous sell-off, plunging greater than 59% from its December excessive of round $0.48 to a current low of $0.19. This dramatic decline has fueled panic throughout the market, with sentiment deteriorating additional as many analysts start calling for the beginning of a bear market. The downturn has weakened traders’ confidence, and meme cash—as soon as the most well liked sector out there—are actually going through the harshest corrections.

Regardless of the continued decline, on-chain knowledge suggests not all hope is misplaced for DOGE. Crypto analyst Ali Martinez shared Glassnode metrics indicating that long-term Dogecoin holders are in “denial”, based on the DOGE Lengthy-Time period Holder Internet Unrealized Revenue/Loss (NUPL) indicator.

This knowledge means that many long-term traders are nonetheless holding onto their DOGE regardless of the downturn however are beginning to develop uninterested in the extended downtrend. Traditionally, such “denial phases” can precede both a closing capitulation or a robust rebound if bulls reclaim management.

Associated Studying

The upcoming week will likely be essential in figuring out whether or not Dogecoin can bounce again from present ranges or if sellers will proceed to dominate. If DOGE manages to carry key assist ranges and reclaim momentum, a aid rally could possibly be in sight. Nonetheless, if promoting strain persists, the value could proceed trending downward, extending the correction additional.

Dogecoin Value Struggles After 19% Drop

Dogecoin is buying and selling at $0.21 after a pointy 19% drop since Monday, persevering with its downward trajectory amid broader market weak point. The meme coin sector has been one of many hardest hit in current weeks, with DOGE struggling to search out sturdy assist as promoting strain stays dominant.

Bulls now face a essential check as holding above present ranges is important to keep away from additional draw back. To provoke a restoration rally, DOGE must reclaim the $0.24 mark, a key resistance stage that might sign the beginning of an uptrend. Nonetheless, market sentiment stays cautious, and worth motion means that DOGE may enter a consolidation section under this stage earlier than any significant restoration begins.

Associated Studying

If Dogecoin fails to carry above $0.21, bears could proceed pushing the value decrease, probably revisiting earlier assist ranges. Nonetheless, if consumers step in and DOGE stabilizes, it may construct momentum for a future push towards larger costs. Within the brief time period, merchants ought to intently watch whether or not bulls can defend present demand ranges and reclaim key resistance ranges to substantiate a possible reversal in worth motion.

Featured picture from Dall-E, chart from TradingView