- Lengthy-term holders transitioning because of spot ETFs might point out Bitcoin’s maturation and decreased volatility.

- Whale transactions are growing, however new addresses stay steady, suggesting cautious market sentiment.

Bitcoin [BTC] worth has remained comparatively steady following a short spike above $64,000 final week after the U.S. Federal Reserve introduced a price reduce. The asset has settled throughout the $63,000 area, fluctuating inside a good vary over the previous few days.

As of this writing, Bitcoin was buying and selling at roughly $63,728, down by 0.1% within the final 24 hours, displaying consolidation moderately than sharp price movements.

Bitcoin’s maturation and worth stability

A current analysis from CryptoQuant means that the maturing habits of Bitcoin holders is enjoying a big function in shaping the asset’s market traits.

Analyst Kripto Mevsimi signifies that because the introduction of Bitcoin Spot Alternate-Traded Funds (ETFs), long-term holders are regularly shifting their positions to new house owners by taking income.

This transition, based on the report, is perhaps partly because of former Grayscale traders shifting to Spot ETFs to profit from decrease charges. These new holders, having surpassed the vital 155-day on-chain holding threshold, are actually categorized as long-term traders.

The shift from short-term to long-term holding has traditionally resulted in sharp worth swings for Bitcoin. Nevertheless, the rising affect of Spot ETFs and their integration into conventional monetary devices appear to have a stabilizing impact on the cryptocurrency’s volatility.

As highlighted in Mevsimi’s evaluation, the gradual enhance in long-term provide and the corresponding lower in short-term provide mirror a altering market construction. The extra steady costs counsel that Bitcoin is changing into a extra mature asset, displaying decreased volatility in comparison with its earlier years.

The expectation is that with higher stability and decreased worth swings, Bitcoin might appeal to elevated institutional demand. The present maturation course of suggests a possible situation the place Bitcoin turns into extra built-in into the worldwide financial system, interesting to a broader vary of traders searching for extra steady and predictable belongings.

Bitcoin elementary outlook

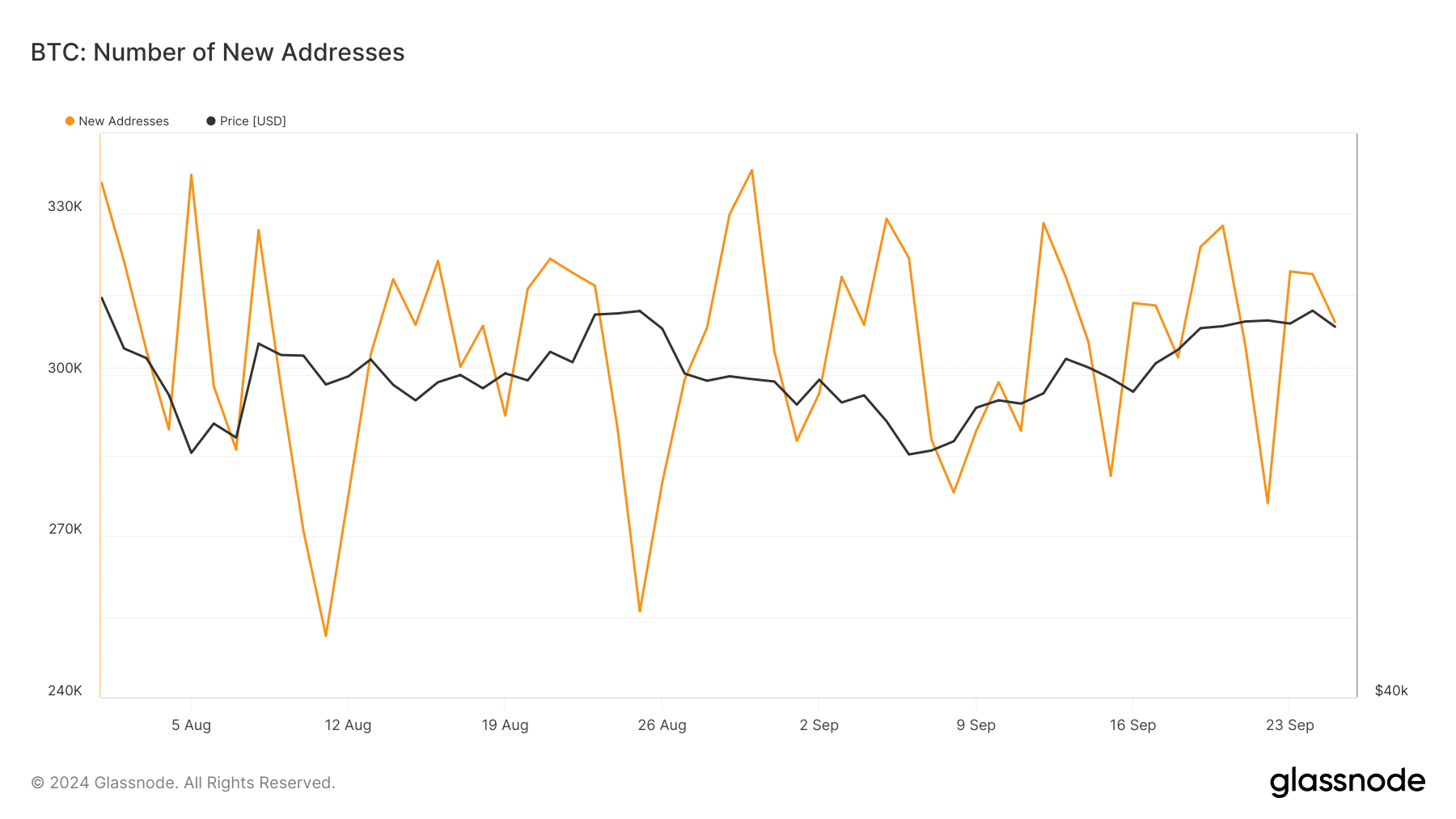

Regardless of this pattern in the direction of maturity, inspecting Bitcoin’s elementary metrics is essential in understanding its present and future potential. One such key metric is the variety of new addresses.

Data from Glassnode reveals that the variety of new Bitcoin addresses has remained comparatively fixed up to now month, ranging between 250,000 and 390,000.

Whereas stability in new tackle creation typically signifies a gentle base of customers, the shortage of serious development might sign that investor enthusiasm has but to set off a wave of recent market members.

This might imply that regardless of anticipation of a possible bull run within the upcoming quarter, Bitcoin is experiencing extra cautious engagement from potential traders.

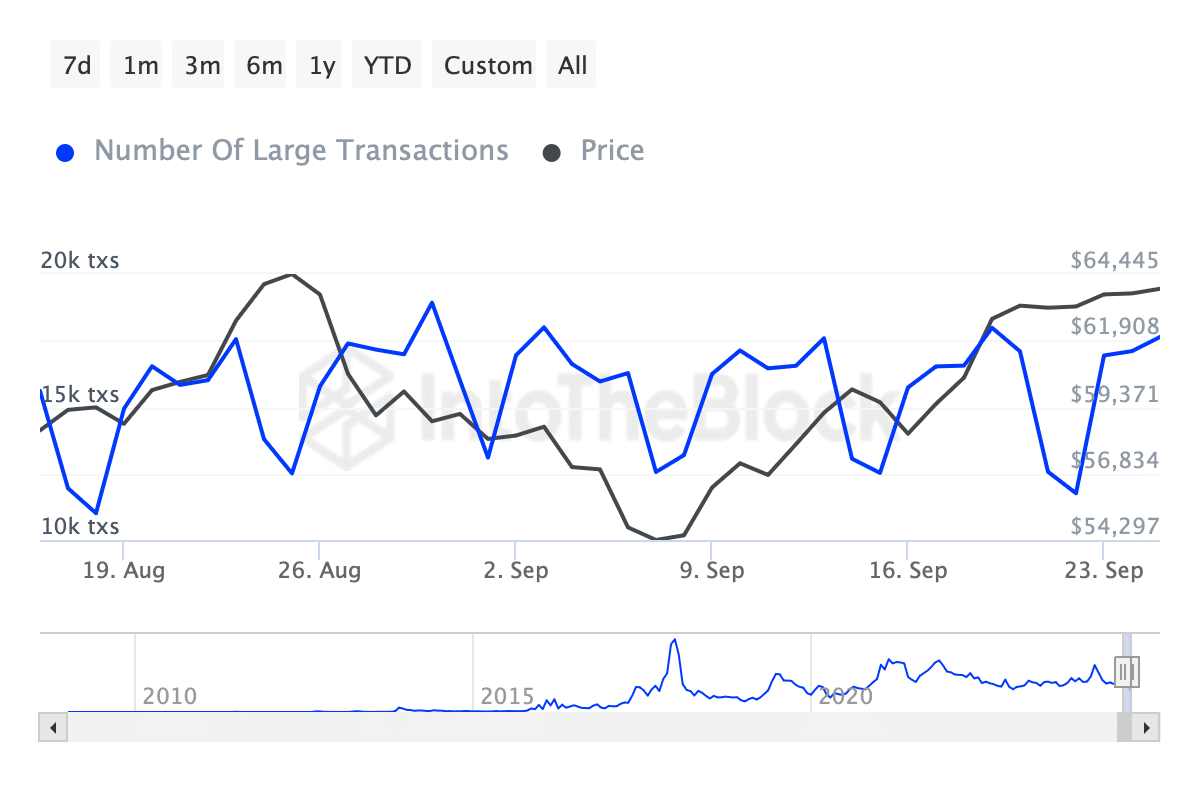

Whereas new tackle development has plateaued, one other metric — whale transactions (these higher than $100,000) — has proven a notable uptick.

In line with data from IntoTheBlock, whale transactions have elevated from lows of round 11,000 to over 17,000 up to now month. This uptick might counsel heightened exercise amongst institutional traders or high-net-worth people, doubtlessly influencing market dynamics in favor of bullish momentum.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Elevated whale transactions typically point out rising curiosity from those that usually tend to have vital affect on market actions.

It stays to be seen whether or not this pattern will contribute to additional worth appreciation or whether or not it represents profit-taking by long-term holders.