Intro

Do you know that once you make a transfer on Ethereum, there’s a hidden, high-stakes recreation taking part in out?

And what if I advised you this recreation may very well be the key to cheaper, extra environment friendly transactions or, typically, the trigger behind these sudden excessive charges and delays?

Meet MEV, an idea that’s reshaping the Ethereum we all know.

However who drives this recreation? What roles do searchers, builders and proposers play? How do Flashbots come into the image, and what’s their mission? And does MEV present additional incentives for validators or create an existential risk to the decentralisation of the entire community? You’ll discover solutions to those questions and extra on this submit.

And we promise you, by the tip of this submit, Ethereum won't ever look the identical to you once more.

What's MEV

To outline the idea of MEV, let’s first have a look at the simplified mannequin that many individuals consider represents how Ethereum transactions work.

At its core, once you provoke a transaction, it first enters the ‘mempool’. Consider the ‘mempool’ as a ready room for pending transactions. When constructing a brand new block, the block proposer can select and prioritise transactions from the mempool primarily based on their transaction charges.

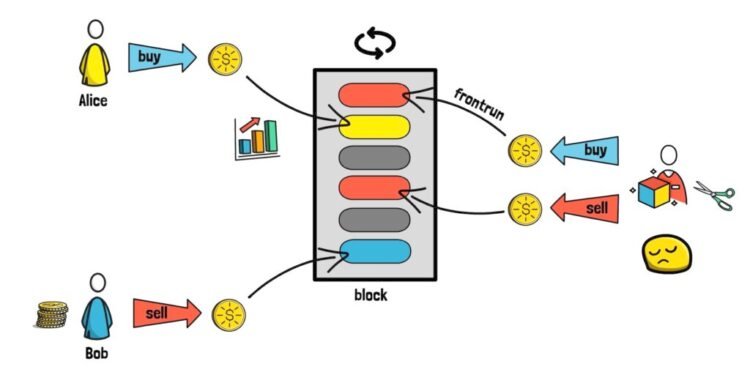

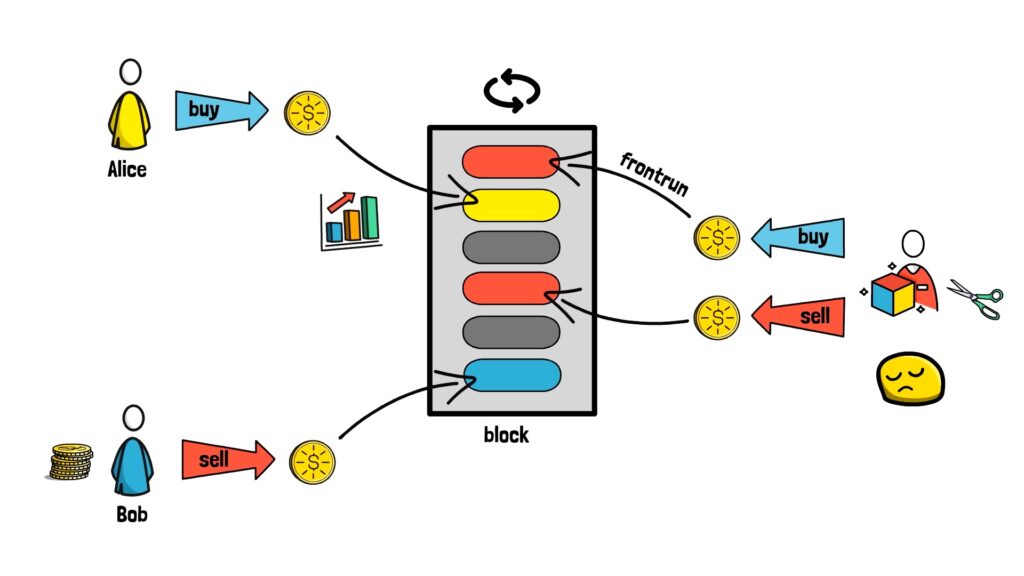

Nonetheless, MEV introduces a novel twist. Block proposers can't solely select which transactions to incorporate and their order inside a block but additionally add their very own. The sequence of those transactions can sometimes yield substantial earnings.

Think about this state of affairs: Alice purchases a considerable amount of a particular token. Following her, Bob opts to promote the identical token. If Bob’s transaction is processed after Alice’s, he capitalises on a greater sale value as a result of elevated demand Alice’s buy creates. Recognizing such alternatives, a block proposer may rearrange the order of transactions to profit and take a ‘reduce’. The proposer can obtain this by inserting its personal purchase transaction simply earlier than Alice’s transaction and inserting a promote transaction after Alice’s transaction and proper earlier than Bob’s transaction.

On this moderately nasty instance, the block proposer basically frontruns Alice’s transaction, benefiting from the worth motion they'll predict and affect.

This extra revenue, ensuing from altering the transaction sequence, is termed MEV, which stands for Maximal Extractable Worth.

Understanding MEV is extraordinarily essential because it creates numerous challenges for a community like Ethereum.

From an end-user perspective, MEV can manifest in several methods, together with affecting commerce executions. As an example, in case you obtain fewer tokens from a DEX commerce than initially anticipated, it may very well be because of MEV.

From the community’s standpoint, MEV dangers pushing a decentralised system towards centralisation. Below proof-of-work, mining swimming pools have been incentivised to develop into extremely specialised, doubtlessly resulting in centralization amongst them. This attracts uncomfortable parallels with conventional finance, shifting away from the aspirational, clear, decentralized finance mannequin.

Outdoors of transaction ordering, block proposers can even resolve to incorporate or exclude a specific transaction, both by prioritising one providing larger charges or censoring particular transactions.

Generally, MEV might be extracted and categorized in quite a few methods.

MEV Methods

Let’s go to the realm of MEV with these frequent methods:

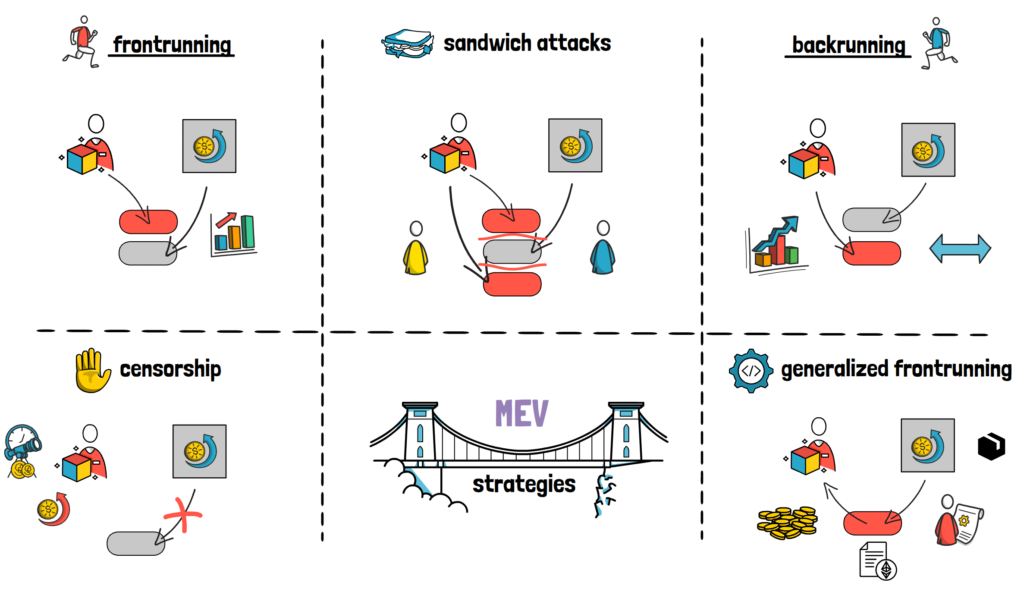

- Frontrunning: Proposers spot a pending transaction within the mempool that may shift the market and leap proper forward to profit from the worth change.

- Backrunning: Reverse of frontrunning, proposers place their transaction proper after a major one, typically exploiting potential value discrepancies or arbitrage alternatives between exchanges.

- Sandwich Assaults: A mixture of frontrunning and backrunning. Proposers see a big order, place their very own order forward of it (frontrun) after which place one other order after it (backrun). Primarily, they “sandwich” the person’s transaction. That's what occurred in our earlier Alice and Bob instance.

- Censorship: A proposer may censor transactions to profit from MEV elsewhere, demand larger charges or manipulate oracles.

- Generalised frontrunning: A proposer may execute any worthwhile transaction for themselves, even with out totally understanding the transaction content material. This technique is feasible by simulating transaction execution and figuring out if the caller of a given good contract technique finally ends up with extra funds than earlier than the execution.

MEV methods can typically be categorized as poisonous or non-toxic.

Poisonous MEV is the kind of MEV that has unfavourable results on the blockchain ecosystem and its customers. Examples of poisonous MEV embody:

- Entrance-Working,

- Sandwich Assaults,

- Censorship

With front-running and sandwich assaults, customers find yourself having worse execution of their transactions. With censorship, the decentralised and secure nature of the ecosystem is in danger.

Non-toxic MEV, however, refers back to the types of MEV that don’t negatively impression customers or the integrity of the blockchain.

Again-running serves as a first-rate instance of this. Nonetheless, it’s value noting that the classification of MEV as ‘non-toxic’ might be subjective.

For instance, whereas arbitrage and back-running result in extra environment friendly costs, in addition they result in losses for liquidity suppliers.

As we will see, it’s useful to categorise MEV because it permits us to know its impression higher.

Earlier than we leap into the present MEV panorama, let’s have a look at how we acquired right here and the way the MEV area developed over time.

The PGA Period

Although MEV has been an intrinsic a part of Ethereum since its inception, its prominence surged notably from 2018 onwards, particularly with the rise of DeFi and the introduction of flash loans.

In these early days, MEV alternatives have been primarily seized by outbidding rivals within the public mempool, marking the period referred to as PGA, or Precedence Gasoline Public sale.

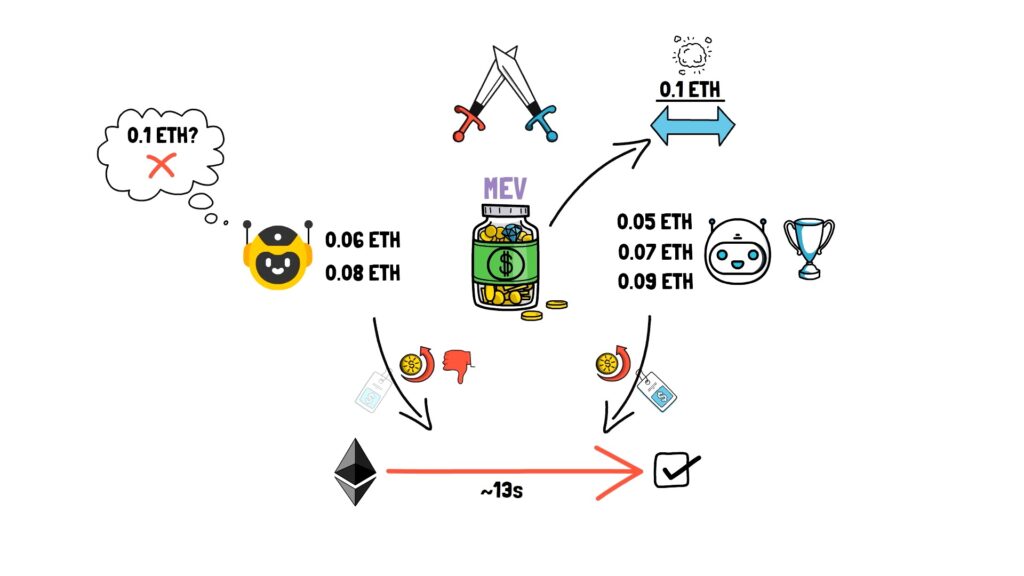

Think about two MEV bots seeing a worthwhile MEV alternative. Let’s say there's a cross-DEX arbitrage that may seize 0.1 ETH of worth. Each bots are incentivised to maintain rising their bids till the chance turns into unprofitable.

Now, think about this intense standoff however compressed inside Ethereum’s typical block time, which was averaging 13 seconds pre-Merge. As soon as a bot secures its transaction in a confirmed block, the revenue window vanishes.

On this state of affairs, whereas the profitable bot pays the complete transaction price to safe its spot within the block, the competing bot typically finds its transaction included as effectively – however as a failed try, nonetheless incurring some transaction payment.

Extrapolate this state of affairs to lots of and even hundreds of bots competing for analogous worthwhile alternatives, and we will shortly see why this turned an enormous downside. Such aggressive bidding not solely escalated transaction charges but additionally contributed to community congestion, detrimentally impacting Ethereum’s common customers.

This chaotic chapter of early MEV and its Precedence Gasoline Auctions was effectively documented in “Flash Boys 2.0”. The title of this paper was impressed by the well-known Michael Lewis ebook Flashboys, which dives deep into the early days of high-frequency buying and selling – an idea with loads of analogies to the MEV world.

The Flashbots Period

To mitigate issues brought on by PGAs, a gaggle of Ethereum group members rallied round and fashioned Flashbots with the first aim of addressing the unfavourable externalities of MEV in a clear and community-driven method.

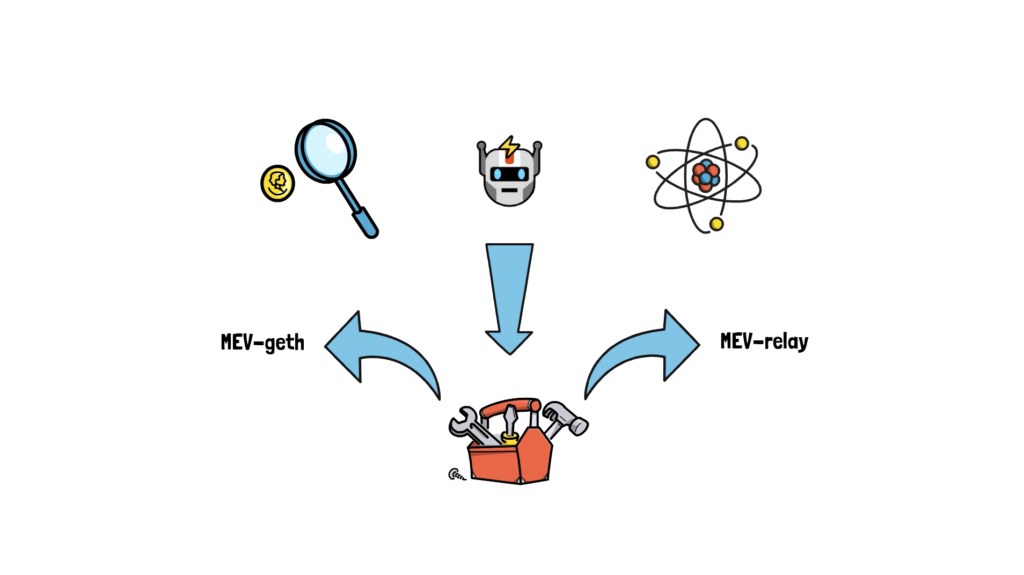

After deeply investigating MEV to know its dynamics, the Flashbots group launched two integral instruments: MEV-Geth and MEV-Relay.

MEV-Geth is a modified model of the Ethereum Geth consumer that permits miners to speak instantly with the MEV searchers and prioritise their transaction bundles.

These bundles are teams of transactions packaged collectively by searchers to extract worthwhile MEV alternatives. MEV-Relay, however, is a relay community facilitating the submission of those bundles from searchers to miners.

The time period “searchers” refers to entities or algorithms looking out the Ethereum mempool for MEV alternatives, crafting specialised transaction bundles to maximise potential earnings.

With MEV-Geth and MEV-Relay, miners, as a substitute of simply counting on the transactions within the mempool, would run these further items of software program to realize entry to a different transaction stream that in any other case wouldn’t be seen within the mempool.

A miner would have a look at the mempool and transaction bundles coming by MEV-Relay and assemble probably the most worthwhile block.

Collectively, these instruments aimed to create a extra organised, clear, and environment friendly framework for MEV extraction, decreasing community congestion and aligning incentives amongst completely different members.

Over time, MEV-Geth began gaining an increasing number of market share, reaching round 90% of the mining energy.

Though it seemed just like the MEV panorama matured and the primary ache factors have been addressed, the area was prepared for a giant disruption brought on by one of the crucial important adjustments to Ethereum itself – the shift from Proof-of-Work to Proof-of-Stake and the Merge.

The Publish-Merge Period

Within the post-Merge world, the idea of miners on Ethereum ceased to exist.

Validators have been now the entities accountable for including blocks to the chain.

Alongside this shift, MEV developed from “Miner Extractable Worth” to “Maximal Extractable Worth.”

Anticipating these adjustments, Flashbots, along with consumer groups and the Ethereum Basis, commenced the event of a brand new protocol devoted to Proof-of-Stake Ethereum referred to as MEV-Enhance, which was activated as quickly because the Merge was accomplished.

MEV-Enhance is a kind of proposer-builder separation (PBS). PBS is a design philosophy that permits validators to successfully use third-party block builders for his or her block-building duties.

A block builder is a brand new function launched by PBS. Utilizing MEV-Enhance, validators can promote blockspace to specialised third events referred to as block builders, which gather, sequence and introduce transactions to provide a block. Builders need to produce a block that maximises the charges collected.

MEV-Enhance works by permitting validators to choose the highest-paying block provided by builders. Builders then compete to provide blocks. The validator then chooses the highest-paying block and proposes it to the community.

In contrast to MEV-Geth, the place miners needed to run Flashbots software program alongside their consumer, MEV-Enhance operates as an add-on, permitting any validator to make use of it no matter their chosen consensus and execution shoppers.

But once more, the answer began shortly gaining important adoption, reaching round 90% of the community members.

MEV Provide Chain

Though the MEV ecosystem undergoes frequent adjustments, let’s paint a complete image of the present MEV panorama by inspecting the MEV provide chain step-by-step.

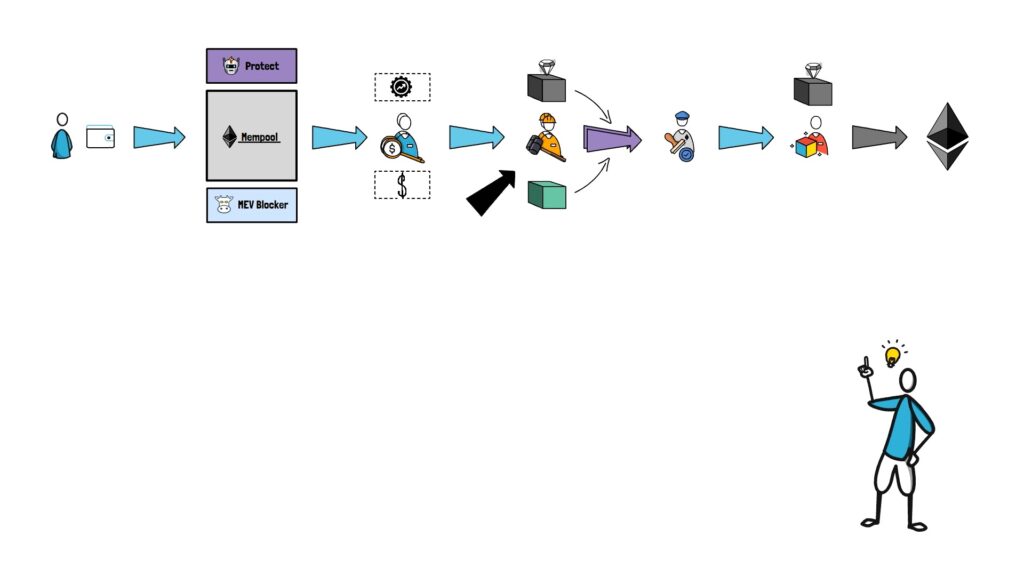

The journey begins with a person initiating a transaction from their pockets. Usually, this transaction results in the mempool, though different personal mempools resembling Shield (by Flashbots) and mev-blocker (by Cowswap) are additionally out there.

That is the place searchers come into play. They seek for probably the most optimum and worthwhile transaction bundles and ship them to the builders.

The builder, with entry to a number of searchers, potential personal order flows, and the mempool itself constructs probably the most worthwhile block it will probably and sends it to a relay.

Validators are linked to a number of relays and hearken to all of the incoming blocks from a number of builders.

The validator that turns into the following block proposer selects probably the most worthwhile block and proposes it.

As we will see, the present panorama diverged considerably from the early, easy Ethereum mannequin of person → pockets → mempool → miner.

Though this technique is extra sophisticated, it permits members to profit from builders’ work without having to belief them.

The Way forward for MEV

Outdoors of the present MEV panorama, It’s additionally value discussing the way forward for this area.

One of many predominant challenges within the present panorama is builder centralisation. Presently, the 5 predominant builders construct round 90% of Ethereum blocks.

Moreover, unique order stream and cross-domain MEV current new, rising centralization threats to not solely Ethereum however many different chains.

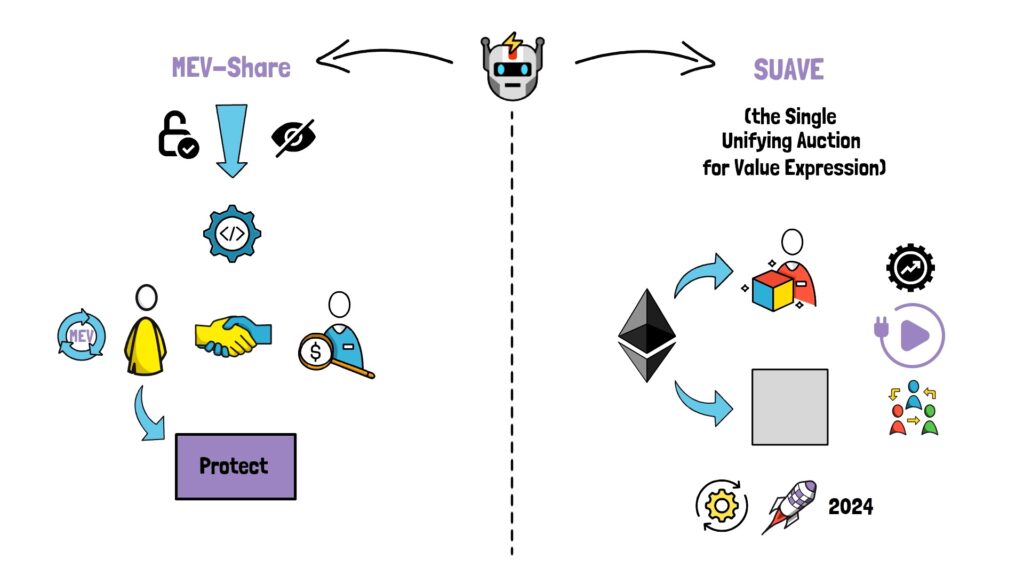

To deal with these issues, Flashbots began engaged on two new initiatives: MEV-Share and SUAVE.

MEV-Share focuses on making a permissionless and personal matchmaking protocol between customers and searchers the place customers can profit instantly from the MEV they generate. Customers can entry MEV-Share robotically by sending transactions by Flashbots Shield.

SUAVE (the Single Unifying Public sale for Worth Expression) unbundles the mempool and block builder roles from current blockchains and gives a extremely specialised and decentralised plug-and-play different. SUAVE is at present being developed, with a primary launch anticipated someday in 2024.

There are additionally some optimisations that may be utilized to MEV. One in all them is MEV-Burn, proposed by Justin Drake.

It describes a easy enshrined PBS add-on to clean and redistribute MEV spikes – a design much like EIP-1559.

Talking about enshrined PBS, it will likely be attention-grabbing to see its impression on current out-of-protocol implementations of PBS, resembling MEV-Enhance and the MEV area basically, as soon as it’s materialised.

We’ll, for certain, dive deeper into a few of these matters within the following posts.

Abstract

To sum up, MEV, with its intricate dynamics, is a basic facet of the Ethereum machine. The MEV extraction is a perpetual dance, with searchers, builders and block proposers on a relentless quest for MEV rewards, countered by the Ethereum group’s pursuit of a balanced, honest and environment friendly ecosystem.

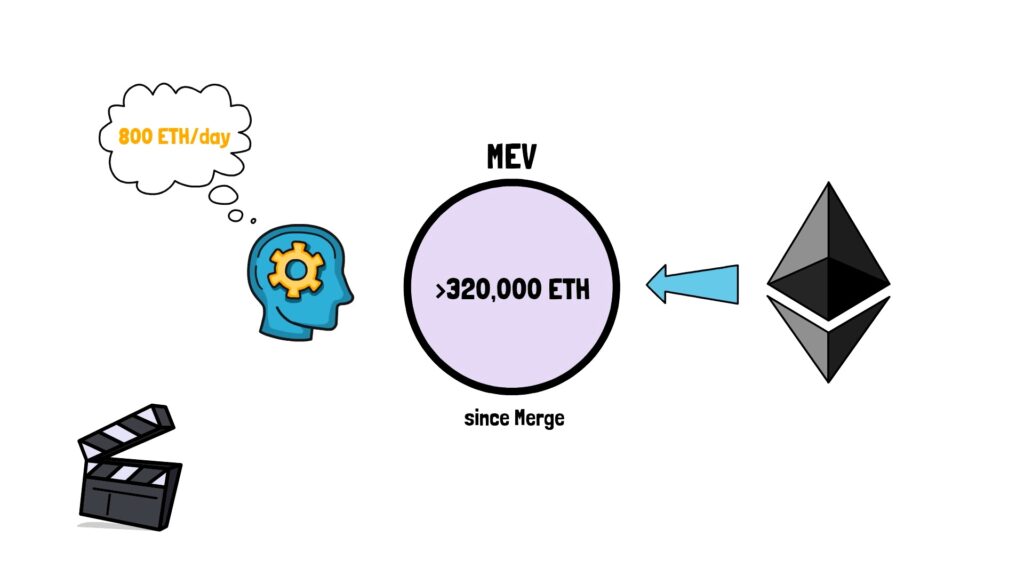

On the time of this submit, the dimensions of MEV alternatives on Ethereum itself lay in upwards of 320,000 ETH – and that is simply because the Merge. That’s roughly 800 ETH/day of MEV.

The long run continues to be unsure: Will we advance in direction of an MEV utopia, decentralising all points of the MEV provide chain and returning the generated MEV to customers? Or may we see an MEV dystopia emerge, the place a couple of centralised entities management block manufacturing throughout all important chains, extracting worth from unsuspecting customers?

It’s going to be fascinating to look at how the MEV panorama evolves.

When you loved studying this submit, take a look at Finematics on Youtube and Twitter.