- Bitcoin’s 129% YTD acquire was pushed by halving and macroeconomic components.

- Analysts predicted additional positive factors, however challenges like altcoin dominance and market corrections remained.

Bitcoin [BTC] has had an distinctive 2024, reaching a outstanding 129% year-to-date acquire, pushed by a sequence of pivotal occasions, together with the April halving and the result of the U.S. Presidential election.

With the cryptocurrency now approaching the $100,000 mark, all eyes are on Bitcoin’s subsequent transfer. Analysts are optimistic, with many predicting additional positive factors as market circumstances proceed to evolve.

As Bitcoin rides this wave of momentum, the query stays: will it break by way of the $100K threshold and push even increased?

Bitcoin’s post-halving surge

Bitcoin’s 2024 halving in April considerably lowered miner rewards, reducing new BTC issuance to three.125 BTC per block.

Traditionally, halvings set off provide shocks that bolster worth momentum over the next months. True to type, Bitcoin surged by over 85% since April, crossing $95,000 in December.

This rally has been fueled by a mixture of macro and sector-specific components. Bitcoin’s standing as “digital gold” gained additional enchantment amid inflation issues and geopolitical instability, drawing institutional buyers.

Moreover, renewed retail curiosity and the U.S. Presidential election, which introduced crypto-friendly insurance policies into focus, bolstered optimism.

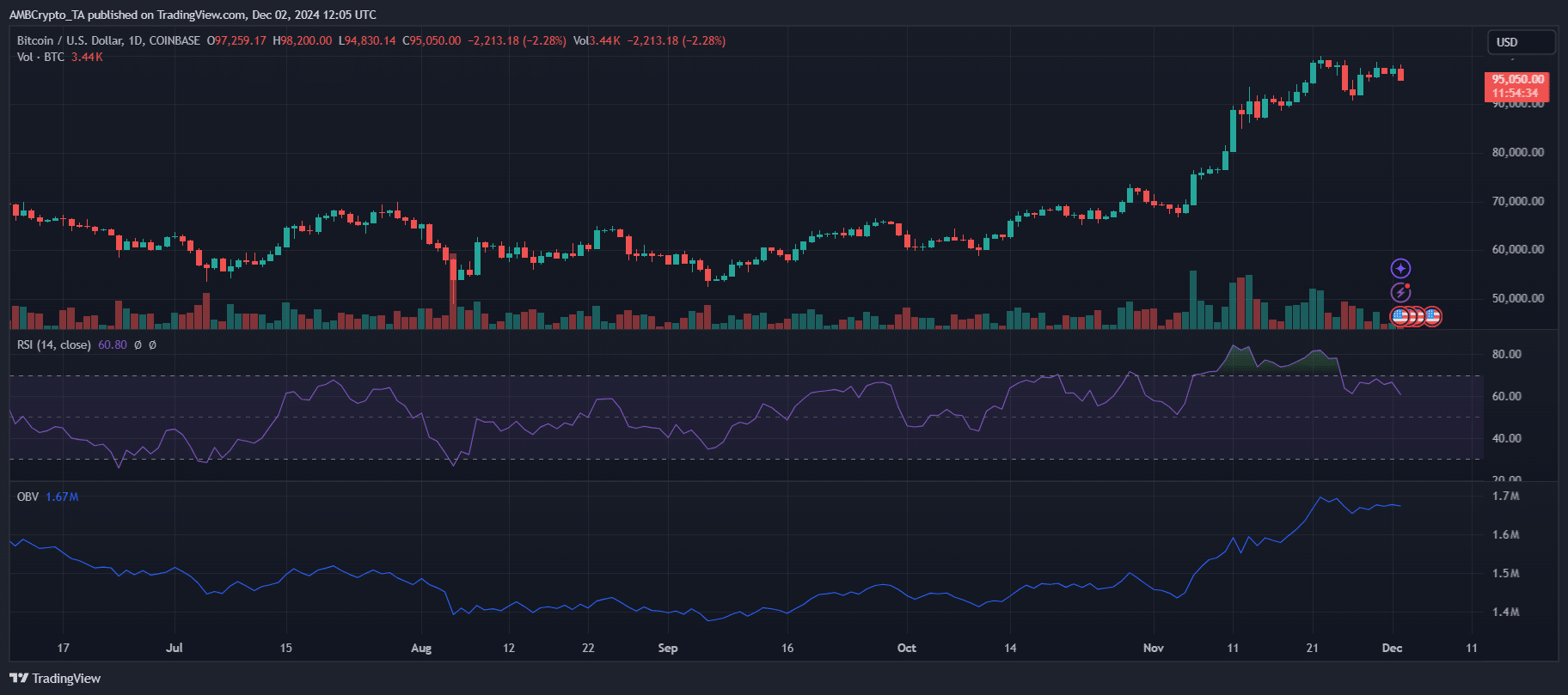

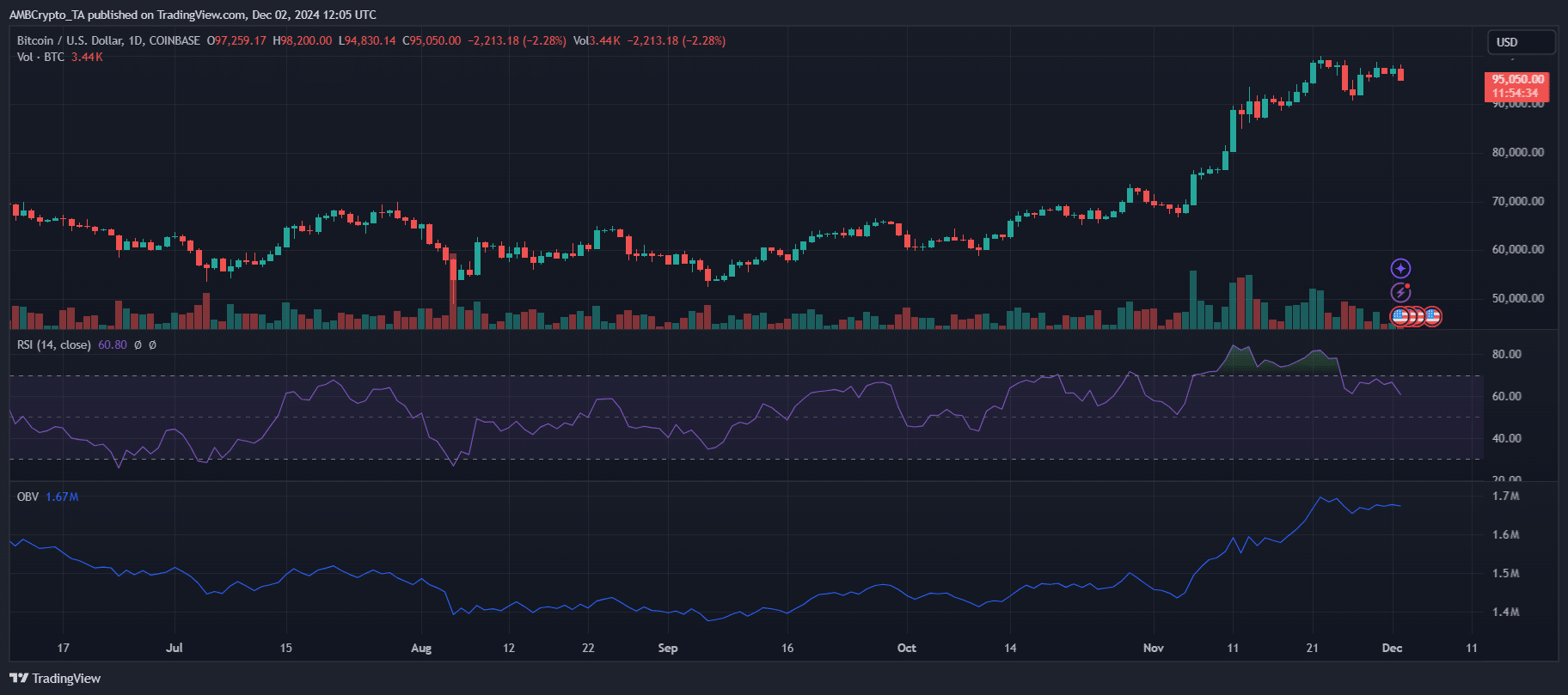

Supply: TradingView

The chart exhibits a gradual uptrend supported by robust on-chain metrics, comparable to rising lively addresses and rising open curiosity in BTC futures.

Nonetheless, the RSI close to 61 suggests the asset is nearing overbought territory, signaling potential short-term consolidation.

The $100K threshold and shifting market dynamics

Bitcoin’s march towards $100,000 stays a defining narrative for the market. On the twenty second of November, BTC briefly touched $99,000 earlier than retreating to the $96,000-$98,000 vary.

In the meantime, Bitcoin Futures on the Chicago Mercantile Trade (CME) crossed $100,200 twice inside per week by the twenty ninth of November, fueling hypothesis that spot costs might quickly comply with.

Whereas breaking $100K is essentially psychological, it represents a crucial milestone for market sentiment as properly.

Regardless of Bitcoin’s positive factors, dominance fell to 56.1% on the thirtieth of November, as buyers rotated into altcoins, suggesting the onset of a possible altcoin season.

This drop in dominance signifies profit-taking amongst Bitcoin holders and renewed curiosity in higher-risk belongings, signaling a diversification of market focus.

Bitcoin’s fast trajectory relies on whether or not the psychological $100K barrier turns into a actuality, alongside its skill to take care of dominance amid rising altcoin exercise.

What lies forward for Bitcoin?

Bitcoin’s trajectory pointed to additional development, with analysts like Raoul Pal forecasting an area prime of $110,000 by early 2025 and a possible peak in late 2025.

Macro components just like the April halving and institutional adoption proceed to bolster long-term bullish sentiment. Nonetheless, dangers comparable to regulatory modifications and broader market corrections might mood positive factors.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

As altcoins acquire momentum, Bitcoin’s dominance might face extra stress, signaling a diversifying market.

Whether or not Bitcoin breaches the $100K psychological barrier and sustains its upward momentum will rely on renewed shopping for stress and broader crypto market tendencies.