Within the XRP lawsuit, Ripple has filed its opposition to the US Securities and Alternate Fee’s (SEC) movement for treatments and entry of ultimate judgment. The fintech firm counters the company’s for practically $2 billion in penalties with a proposed tremendous of simply $10 million most. Filed late Monday, Ripple’s 186-page opposition doc particulars its arguments towards the SEC’s extreme calls for following a courtroom ruling that discovered Ripple in violation of securities legal guidelines by promoting XRP to institutional traders with out correct registration.

Ripple Vs. SEC: $10 Million Or $2 Billion?

Ripple begins by acknowledging the violation, affirming its recognition of the courtroom’s resolution and detailing its compliance changes. “Ripple has publicly acknowledged that ruling, and does so once more now. It has modified the way in which it sells XRP and altered its contracts to keep away from the issues recognized by this Courtroom,” the doc states. This acknowledgment is essential because it units the stage for the corporate’s argument that no additional punitive measures, reminiscent of an injunction, are needed.

The corporate strongly opposes the SEC’s proposed injunction, arguing that it has already applied vital adjustments to forestall future violations. A key passage from the doc asserts, “The SEC fails to determine an affordable probability of future violations.” This argument is constructed on the premise that Ripple’s proactive remedial measures successfully mitigate the chance of repeating the previous missteps.

Addressing the SEC’s demand for disgorgement, the fintech firm contends that the request is unwarranted as a result of the SEC has not demonstrated that Ripple’s actions induced any pecuniary hurt to traders. The opposition states, “The SEC fails to point out that any disgorgement is warranted. Govil bars disgorgement as a result of the SEC can’t present pecuniary hurt.” This level is essential in Ripple’s protection, emphasizing the dearth of direct monetary injury to traders because of its actions.

Concerning civil penalties, Ripple argues for a considerably lowered quantity, citing the disproportionality of the SEC’s request in comparison with penalties in related instances. “ANY CIVIL PENALTY SHOULD NOT EXCEED $10 MILLION,” the doc states, suggesting that such a determine is extra in keeping with precedent and the character of the violations.

Authorized precedents play a major position within the protection, with quite a few citations meant to bolster its place towards harsh penalties. One such precedent is Arthur Lipper Corp. v. SEC, which the corporate makes use of to argue towards the need of an injunction. The doc notes that an injunction serves to “stop threatened future hurt” and requires “constructive proof of an affordable probability that previous wrongdoing will recur,” one thing Ripple contends just isn’t current given its corrective actions.

Reactions From The XRP Lawyer Group

Reactions from the pro-XRP authorized group replicate a perception within the power of arguments. Invoice Morgan, a notable pro-XRP lawyer, commented on the power of Ripple’s place towards disgorgement, “In abstract, I believe this argument is right and disgorgement shouldn’t be awarded the place it might give traders a windfall. Ripple appears in good condition for Torres to use Govil and order no disgorgement.”

Moreover, Jeremy Hogan argued by way of X, “The SEC has BIG authorized issues to deal with if it desires to get a win towards Ripple, and I nonetheless assume it squandered its alternative to get forward with its first temporary.”

James “MetaLawMan” Murphy explained what to anticipate subsequent. In keeping with him, Choose Torres has not set a deadline for a choice. “However, I might anticipate that this resolution will come considerably faster than the summary judgment rulings. Greatest guess can be 60 to 90 days after the final temporary (Might 6).”

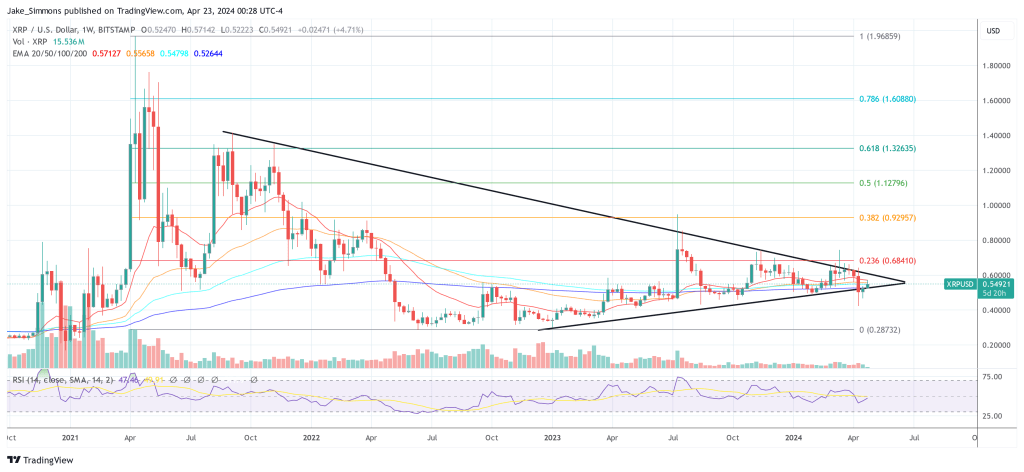

At press time, XRP traded at $0.54921, up 2.5% within the final 24 hours.

Featured picture from Shutterstock, chart from TradingView.com