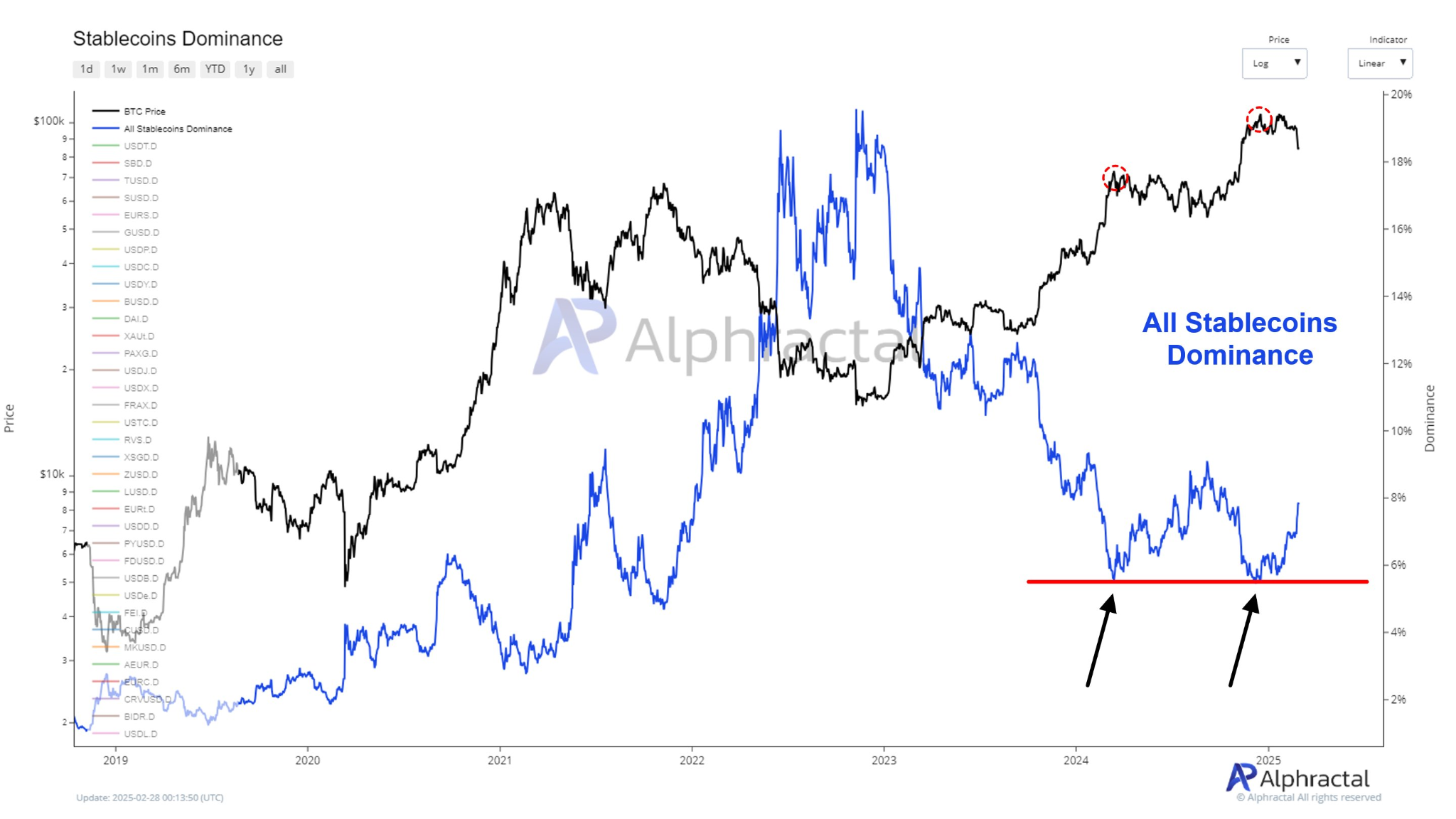

- Stablecoin liquidity has been declining to allude to BTC’s incapability to maintain its upward momentum

- Stablecoin dominance helps have beforehand signaled Bitcoin’s worth consolidation or corrections

Stablecoin liquidity has been declining over the previous few weeks, regardless of a hike in minting and provide. In truth, only recently, Bitcoin noticed its worth plunge from its prime in This autumn 2024, with the crypto falling effectively beneath $80,000 too.

Now, it’s price mentioning that at press time, Bitcoin had recovered to commerce above $85,000 on the charts. What concerning the Stablecoin Provide Ratio (SSR) Oscillator although? Effectively, it assesses liquidity and BTC’s market shopping for habits relative to stablecoins. What does the most recent SSR studying recommend?

A glance into the Stablecoin Provide Ratio – Market liquidity & Bollinger Bands

The SSR metric establishes Bitcoin’s market capitalization relative to the person stablecoins or the mixed stablecoin market. A low SSR signifies that stablecoins have larger buying energy and elevated liquidity that might move into BTC. As of February, the SSR oscillator had surged and stood at round 14.

Potential development reversals and market volatility insights will be evaluated utilizing the Bollinger Bands surrounding the SSR. The SSR approaching the higher band hinted that stablecoins’ liquidity has been declining, relative to BTC’s market cap.

Stablecoin dominance vs Bitcoin – Historic correlation

earlier SSR key helps, a rising SSR has usually preceded BTC’s worth corrections. In late 2024, Bitcoin’s peak aligned with a low stablecoin dominance and a subsequent development reversal because the SSR rose.

Conversely, in circumstances the place the SSR dropped in direction of the decrease Bollinger Band, the market noticed higher stablecoin liquidity, resulting in Bitcoin’s bullish momentum. In accordance with Alphractal’s evaluation on X (previously Twitter), this historic relationship might be held within the present market volatility.

Market evaluation and tendencies

Over the earlier week, the crypto market has seen elevated volatility as BTC fell beneath the $80,000 key degree. Components such because the current Bybit Alternate hack and prevailing Trump tariffs have led to world financial uncertainties and higher market volatility.

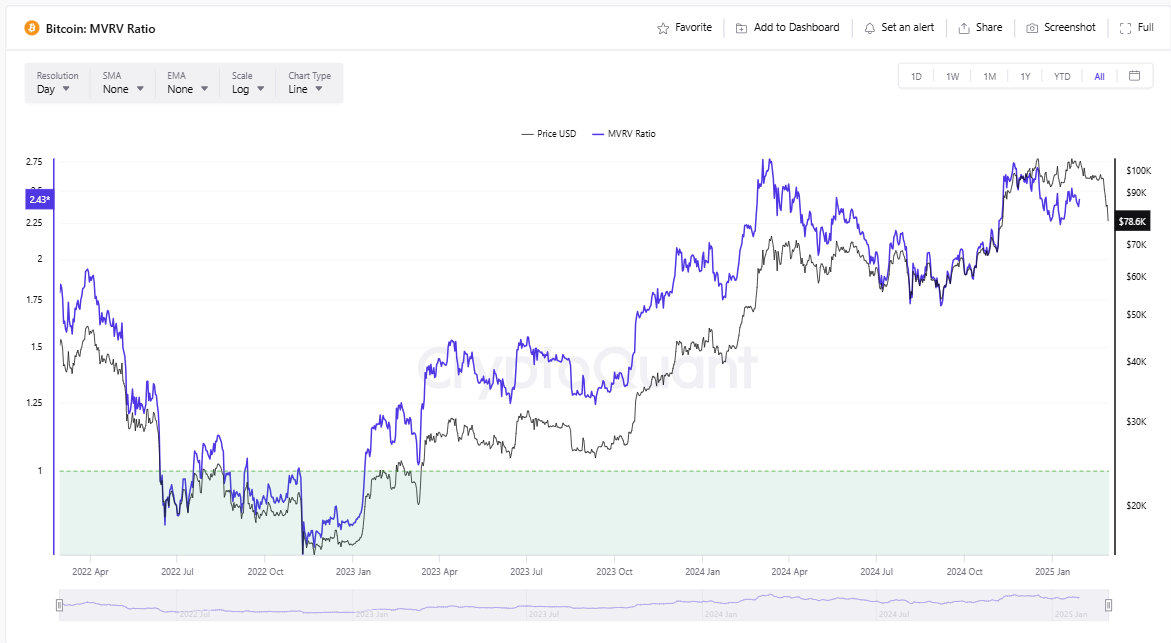

With the SSR bouncing off a key assist degree, Bitcoin’s subsequent worth motion stays undetermined. On the time of writing, BTC’s MVRV ratio was 2.43 – An indication that it was neither extraordinarily overvalued or overbought.

Bitcoin at crossroads – What subsequent?

If the SSR ratio maintains an uptrend amid market volatility, BTC might face additional downsides. Nonetheless, higher stablecoin liquidity resulting in a decreased SSR might increase Bitcoin’s resurgence and bullish momentum within the subsequent few weeks.