Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

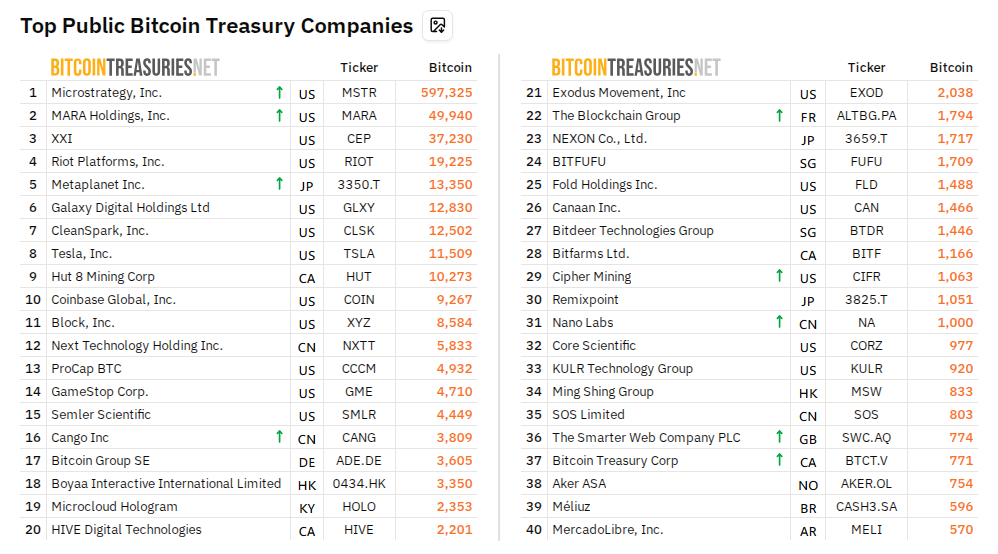

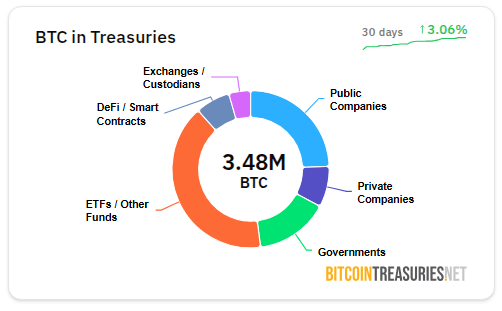

Based on current information, public firms have raced forward of Bitcoin spot ETF issuers by snapping up greater than twice as a lot BTC within the first half of 2025.

Public companies added 245,510 BTC to their steadiness sheets from January by means of June, a 375% bounce over the 51,653 BTC they purchased in the identical stretch final yr.

On the identical time, spot ETF issuers bought 118,424 BTC, leaving them nicely behind their company counterparts.

Associated Studying

Public Agency Purchases Smash ETF Buys

Based on information from Bitcoin Treasuries, the 245,510 BTC purchased by public firms throughout H1 2025 is greater than 4 instances the 118,424 BTC ETF issuers gathered.

That ETF part is 56% decrease than the 267,878 BTC they bought in H1 2024, regardless of the funds experiencing extra sturdy inflows than they skilled in direction of the tip of 2024.

The distinction signifies more and more firms are holding Bitcoin immediately as a substitute of counting on trade‑traded merchandise.

Extra Firms Be a part of Bitcoin Rush

Knowledge exhibits 254 entities now maintain Bitcoin, and 141 of these are public firms. That marks huge development from the beginning of the yr, when solely 67 companies had BTC, and the tip of March, when the quantity hit 79.

These counts translate to a 140% rise in six months and a virtually 80% achieve in three months, underlining what number of new gamers have jumped in.

Technique’s Share Of Acquisition Dips

Strategy (previously MicroStrategy) nonetheless leads company patrons, however its slice of the whole has shrunk. In H1 2024, Technique’s buy of 37,190 BTC made up 72% of all company buys.

Within the first half of 2025, the Michael Saylor‑led firm bought 135,600 BTC however now accounts for 55% of the whole—down from its earlier dominance. Corporations akin to Metaplanet,

GameStop and ProCap have stepped into the highlight, every including massive sums to their Bitcoin holdings.

Provide Shock May Be Coming

Based on trade commentary, the rise in company buying along with persevering with ETF demand might take a chew out of accessible provide.

When the following halving occasion reduces new Bitcoin issuance, much less will move into the market. Analysts warning that rising institutional curiosity and declining provide may produce a major worth response.

Associated Studying

As public companies climb aboard and ETFs carry on shopping for—although at a lowered price—the battle for Bitcoin is escalating. Though Technique’s investments have elevated in absolute worth, the arrival of latest patrons signifies the market is increasing.

If that pattern continues and reward for miners decreases following the halving, the battle for Bitcoin’s scarce provide might get fiercer.

Traders and analysts alike shall be paying shut consideration to how these forces affect the worth of Bitcoin within the second half of 2025.

Featured picture from StormGain, chart from TradingView