- Eric Trump’s endorsement amplified retail confidence as coverage uncertainty fuels decentralized asset curiosity.

- Institutional accumulation and bullish technicals align, suggesting that BTC is primed for a breakout.

Donald Trump’s declaration of “Liberation Day” marks a pivotal shift in U.S. commerce coverage, sparking hypothesis throughout international markets and inside the crypto trade alike.

These tariffs, positioned as a strategic transfer to renegotiate international commerce dynamics, have launched recent uncertainty into the macroeconomic panorama.

Nevertheless, somewhat than weakening crypto, some imagine the transfer might enhance demand for decentralized property. Analysts recommend that potential market tightening would possibly immediate central banks to ease financial coverage.

Subsequently, Bitcoin [BTC] may gain advantage from diminished rates of interest and renewed investor curiosity in non-sovereign shops of worth. As international capital adjusts, the crypto market’s response will hinge on how swiftly coverage shifts unfold.

Is Eric Trump’s Bitcoin endorsement driving momentum?

Eric Trump’s current remarks have added gas to the Bitcoin narrative. In a Fox Business interview, he acknowledged,

“It’s cheaper, quicker, extra clear, and it may possibly’t be canceled… that’s why I like Bitcoin.”

His phrases replicate a rising mistrust in conventional finance, particularly as he cited de-banking and cancel tradition as key motivators for his household’s crypto involvement.

Moreover, Eric highlighted the WLFI challenge and the USD1 stablecoin, expressing confidence of their contribution to stabilizing the U.S. greenback. His daring assertion, “The most effective days of BTC are forward,” unfold quickly throughout social media, strengthening bullish sentiment.

Subsequently, public assist from politically influential figures could possibly be a strong catalyst for retail investor enthusiasm. His feedback, whereas private, align with a broader narrative of institutional pushback in opposition to centralized techniques.

BTC worth motion outlook – Is Bitcoin flashing bullish indicators?

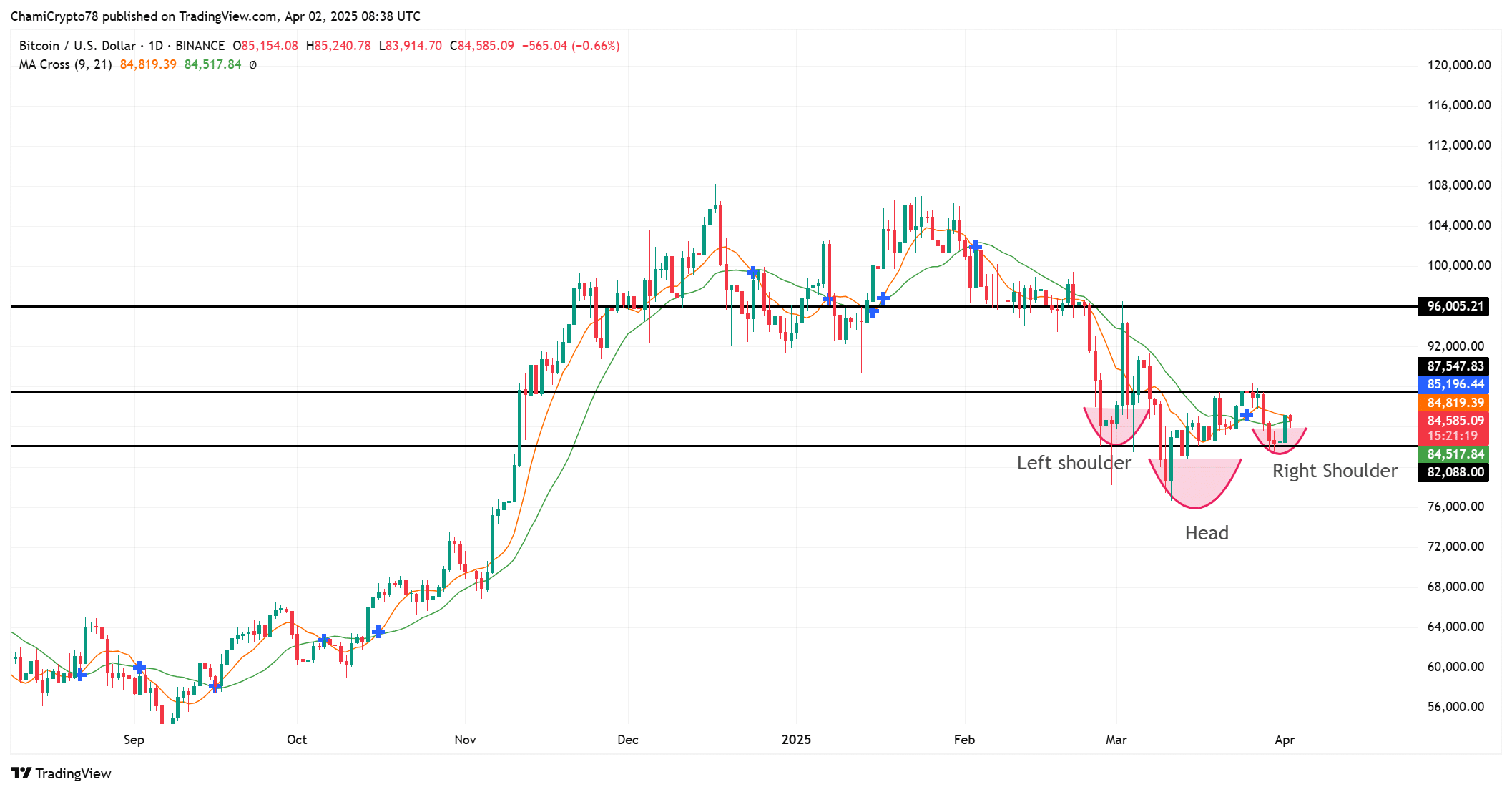

At press time, Bitcoin was buying and selling at $84,606.67, registering a 0.75% achieve prior to now 24 hours. The current rebound follows an earlier dip triggered by Trump’s tariff announcement.

Extra notably, on the time of writing, the BTC chart reveals an inverse head and shoulders sample, a bullish formation indicating a possible reversal. The neckline sits close to $87,547, which acts as a key resistance zone. If bulls handle to interrupt above that stage, worth motion might surge towards the $96,005 mark.

Moreover, the 9/21 Day by day Transferring Common crossover reveals that purchasing momentum is strengthening. Subsequently, technical indicators recommend that BTC is likely to be making ready for a breakout. Merchants are eyeing quantity spikes for affirmation.

BTC whale exercise – are establishments accumulating regardless of uncertainty?

Institutional demand for Bitcoin is exhibiting regular progress. Metaplanet lately added 160 BTC value $13.3 million to its portfolio, bringing its whole holdings to 4,206 BTC. Equally, GameStop raised $1.48 billion to allocate particularly towards Bitcoin for its treasury.

In one other main growth, Texas lawmakers proposed a invoice advocating a $250 million BTC funding for state reserves, signaling growing political assist.

These actions spotlight rising confidence in Bitcoin as a invaluable retailer of wealth and a strategic asset. Regardless of market volatility, giant entities are ramping up accumulation efforts, with whale exercise driving long-term market developments.

Will Trump’s tariffs crash or gas crypto?

Whereas Trump’s “Liberation Day” tariffs initially brought about volatility throughout crypto markets, the broader implications recommend a distinct final result.

Present on-chain developments, institutional accumulation, and favorable technical indicators level towards resilience somewhat than decline. Furthermore, rising political endorsements and macroeconomic shifts might place Bitcoin as a hedge in opposition to conventional market disruptions.