Particular due to Sacha Yves Saint-Leger & Joseph Schweitzer for evaluation.

Sharding is without doubt one of the many enhancements that eth2 has over eth1. The time period was borrowed from database analysis the place a shard means a bit of a bigger complete. Within the context of databases and eth2, sharding means breaking apart the storage and computation of the entire system into shards, processing the shards individually, and mixing the outcomes as wanted. Particularly, eth2 implements many shard chains, the place every shard has comparable capabilities to the eth1 chain. This ends in large scaling enhancements.

Nevertheless, there is a less-well-known kind of sharding in eth2. One which is arguably extra thrilling from a protocol design viewpoint. Enter sharded consensus.

Sharding Consensus

In a lot the identical means that the processing energy of the slowest node limits the throughput of the community, the computing sources of a single validator restrict the whole variety of validators that may take part in consensus. Since every further validator introduces further work for each different validator within the system, there’ll come some extent the place the validator with the least sources can not take part (as a result of it could actually not preserve monitor of the votes of all the different validators). The answer eth2 employs to that is sharding consensus.

Breaking it down

Eth2 breaks time down into two durations, slots and epochs.

A slot is the 12 second timeframe by which a brand new block is anticipated to be added to the chain. Blocks are the mechanism by which votes forged by validators are included on the chain along with the transactions that really make the chain helpful.

An epoch is comprised of 32 slots (6.4 minutes) throughout which the beacon chain performs all the calculations related to the maintenance of the chain, together with: justifying and finalising new blocks, and issuing rewards and penalties to validators.

As we touched upon within the first post of this series, validators are organised into committees to do their work. At anybody time, every validator is a member of precisely one beacon chain and one shard chain committee, and known as on to make an attestation precisely as soon as per epoch – the place an attestation is a vote for a beacon chain block that has been proposed for a slot.

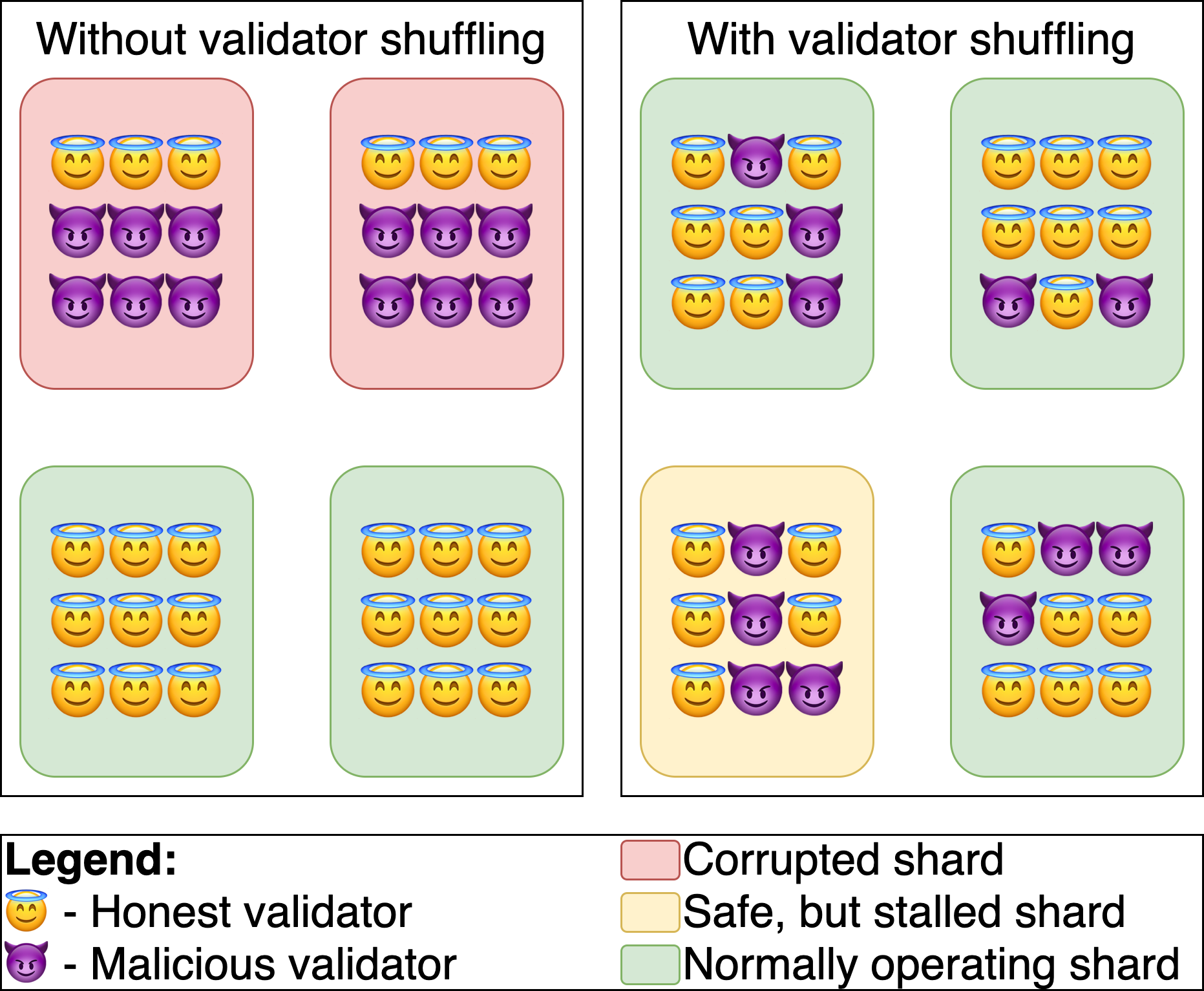

The safety mannequin of eth2’s sharded consensus rests upon the concept that committees are kind of an correct statistical illustration of the general validator set.

For instance, if we have now a state of affairs by which 33% of validators within the total set are malicious, there’s a probability that they might find yourself in the identical committee. This is able to be a catastrophe for our safety mannequin.

So we’d like a means to make sure that this could’t occur. In different phrases, we’d like a means to make sure that if 33% of validators are malicious, solely about ~33% of validators in a committee can be malicious.

It seems we are able to obtain this by doing two issues:

- Making certain committee assignments are random

- Requiring a minimal variety of validators in every committee

For instance, with 128 randomly sampled validators per committee, the prospect of an attacker with 1/3 of the validators gaining management of > 2/3 committee is vanishingly small (probability less than 2^-40).

Constructing it up

Votes forged by validators are referred to as attestations. An attestation is comprised of many components, particularly:

- a vote for the present beacon chain head

- a vote on which beacon block needs to be justified/finalised

- a vote on the present state of the shard chain

- the signatures of all the validators who agree with that vote

By combining as many parts as potential into an attestation, the general effectivity of the system is elevated. That is potential since, as a substitute of getting to verify votes and signatures for beacon blocks and shard blocks individually, nodes want solely do the mathematics on attestations to be told concerning the state of the beacon chain and of each shard chain.

If each validator produced their very own attestation and each attestation wanted to be verified by all different nodes, then being an eth2 node could be prohibitively costly. Enter aggregation.

Attestations are designed to be simply mixed such that if two or extra validators have attestations with the identical votes, they are often mixed by including the signatures fields collectively in a single attestation. That is what we imply by aggregation.

Committees, by their development, may have votes which can be simple to mixture as a result of they’re assigned to the identical shard, and due to this fact ought to have the identical votes for each the shard state and beacon chain. That is the mechanism by which eth2 scales the variety of validators. By breaking the validators up into committees, validators want solely to care about their fellow committee members and solely should verify only a few aggregated attestations from every of the opposite committees.

Signature aggregation

Eth2 makes use of the BLS signatures – a signature scheme outlined over a number of elliptic curves that’s pleasant to aggregation. On the particular curve chosen, signatures are 96 bytes every.

If 10% of all ETH finally ends up staked, then there can be ~350,000 validators on eth2. Because of this an epoch’s price of signatures could be 33.6 megabytes which involves ~7.6 gigabytes per day. On this case, all the false claims concerning the eth1 state-size reaching 1TB back in 2018 could be true in eth2’s case in fewer than 133 days (based mostly on signatures alone).

The trick right here is that BLS signatures might be aggregated: If Alice produces signature A, and Bob’s signature is B on the identical knowledge, then each Alice’s and Bob’s signatures might be saved and checked collectively by solely storing C = A + B. Through the use of signature aggregation, only one signature must be saved and checked for your complete committee. This reduces the storage necessities to lower than 2 megabytes per day.

In abstract,

By separating validators out into committees, the hassle required to confirm eth2 is lowered by orders of magnitude.

For a node to validate the beacon chain and all the shard chains, it solely wants to take a look at the aggregated attestations from every of the committees. On this means it could actually know the state of each shard, and each validator’s opinions on which blocks are and are not part of the chain.

The committee mechanism due to this fact helps eth2 obtain two of the design targets established within the first article: particularly that collaborating within the eth2 community have to be potential on a consumer-grade laptop computer, and that it should attempt to be maximally decentralised by supporting as many validators as potential.

To place numbers to it, whereas most Byzantine Fault Tolerant Proof of Stake protocols scale to tens (and in excessive instances, a whole lot of validators), eth2 is able to having a whole lot of 1000’s of validators all contributing to safety with out compromising on latency or throughput.