*Disclaimer: None of that is meant as a slight towards any consumer specifically. There’s a excessive probability that every consumer and presumably even the specification has its personal oversights and bugs. Eth2 is a sophisticated protocol, and the folks implementing it are solely human. The purpose of this text is to focus on how and why the dangers are mitigated.*

With the launch of the Medalla testnet, folks had been inspired to experiment with completely different purchasers. And proper from genesis, we noticed why: Nimbus and Lodestar nodes had been unable to deal with the workload of a full testnet and obtained caught. [0][1] In consequence, Medalla didn’t finalise for the primary half hour of its existence.

On the 14th of August, Prysm nodes misplaced observe of time when one of many time servers they had been utilizing as a reference instantly jumped in the future into the long run. These nodes then began making blocks and attestations as if they had been additionally sooner or later. When the clocks on these nodes had been corrected (both by updating the consumer, or as a result of the timeserver returned to the proper time), those who had disabled the default slashing safety discovered their stakes slashed.

Precisely what occurred is a little more refined, I extremely advocate studying Raul Jordan’s write-up of the incident.

Clock Failure – The enworsening

The second when Prysm nodes began time touring, they made up ~62% of the community. This meant that the edge for finalising blocks (>2/3 on one chain) couldn’t be met. Worse nonetheless, these nodes could not discover the chain that they had been anticipating (there was a 4 hour “hole” within the historical past they usually all jumped forward to barely completely different instances) and they also flooded the community with quick forks as they guessed on the “lacking” information.

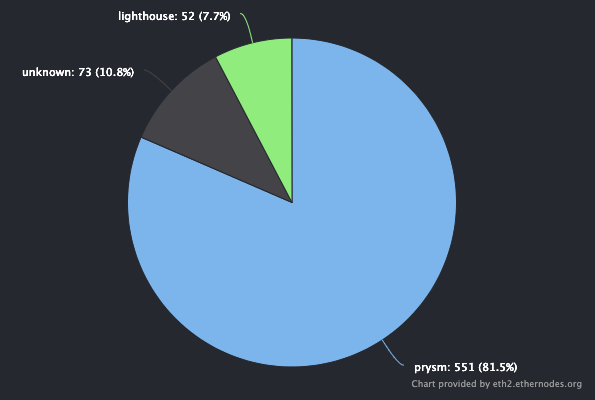

Prysm at present makes up 82% of Medalla nodes ???? ! [ethernodes.org]

At this level, the community was flooded with 1000’s of various guesses at what the top of the chain was and all of the purchasers began to buckle underneath the elevated workload of determining which chain was the precise one. This led to nodes falling behind, needing to sync, operating out of reminiscence, and different types of chaos, all of which worsened the issue.

In the end this was a superb factor, because it allowed us to not solely repair the foundation drawback regarding clocks, however to emphasize check the purchasers underneath situation of mass node failure and community load. That stated, this failure needn’t have been so excessive, and the perpetrator on this case was Prysm’s dominance.

Shilling Decentralisation – Half I, it is good for eth2

As I’ve discussed previously, 1/3 is the magic quantity on the subject of secure, asynchronous BFT algorithms. If greater than 1/3 of validators are offline, epochs can now not be finalised. So whereas the chain nonetheless grows, it’s now not attainable to level to a block and assure that it’s going to stay part of the canonical chain.

Shilling Decentralisation – Half II, it is good for you

To the utmost attainable extent, validators are incentived to do what is sweet for the community and never merely trusted to do one thing as a result of it’s the proper factor to do.

If greater than 1/3 of nodes are offline, then penalties for the offline nodes begin ramping up. That is referred to as the inactivity penalty.

Which means that, as a validator, you wish to strive to make sure that if one thing goes to take your node offline, it’s unlikely to take many different nodes offline on the identical time.

The identical goes for being slashed. Whereas, there’s all the time an opportunity that your validators are slashed attributable to a spec or software program mistake/bug, the penalties for single slashings are “solely” 1 ETH.

Nevertheless, if many validators are slashed similtaneously you, then penalties go as much as as excessive as 32 ETH. The purpose at which this occurs is once more the magic 1/3 threshold. [An explanation of why this is the case can be found here].

These incentives are referred to as liveness anti-correlation and security anti-correlation respectively, and are very intentional features of eth2’s design. Anti-correlation mechanisms incentivise validators to make selections which might be in one of the best curiosity of the community, by tying particular person penalties to how a lot every validator is impacting the community.

Shilling Decentralisation – Half III, the numbers

Eth2 is being carried out by many impartial groups, every creating impartial purchasers based on the specification written primarily by the eth2 analysis crew. This ensures that there are a number of beacon node & validator consumer implementations, every making completely different selections in regards to the expertise, languages, optimisations, trade-offs and so on required to construct an eth2 consumer. This manner, a bug in any layer of the system will solely influence these operating a selected consumer, and never the entire community.

If, within the instance of the Prysm Medalla time-bug, solely 20% of eth2 nodes had been operating Prysm and 85% of individuals had been on-line, then the inactivity penalty would not have kicked in for Prysm nodes and the issue may have been mounted with solely minor penalties and a few sleepless nights for the devs.

In distinction, as a result of so many individuals had been operating the identical consumer (lots of whom had disabled slashing safety), someplace between 3500 and 5000 validators had been slashed in a brief time frame.* The excessive diploma of correlation signifies that slashings had been ~16 ETH for these validators as a result of they had been utilizing a preferred consumer.

* On the time of writing, slashings are nonetheless pouring in, so there is no such thing as a last quantity but.

Attempt one thing new

Now’s the time to experiment with completely different purchasers. Discover a consumer {that a} minority of validators are utilizing, (you possibly can have a look at the distribution here). Lighthouse, Teku, Nimbus, and Prysm are all fairly secure in the mean time whereas Lodestar is catching up quick.

Most significantly, TRY A NEW CLIENT! We’ve a possibility to create a extra wholesome distribution on Medalla in preparation for a decentralised mainnet.