- The FOMC assembly, coupled with Donald Trump’s put up, hinted at a possible finish to QT in April.

- Optimistic sentiment was additional fueled by key metrics and notable figures like Brad Garlinghouse addressing the crypto summit.

The crypto markets reacted positively to expectations of lowered financial system charges for the medium time period. FOMC feedback had been much less strict than anticipated, and rising exercise in standard monetary markets fueled optimism.

Regardless of this, charges remained unchanged, with no clear indication of potential reductions.

Jerome Powell, Chair of the Federal Reserve, emphasised that top rates of interest are important to fight inflation. He lowered financial development projections, suggesting improved market situations.

Nonetheless, he attributed financial challenges to aggressive insurance policies applied throughout President Donald Trump’s administration.

Arthur Hayes, co-founder of BitMEX, noted on X (previously Twitter), that Powell had delivered his aims resulting in an anticipated finish of quantitative tightening on the first of April.

Hayes mentioned that the true bullish shift would in all probability emerge from an SLR exemption or the return of Quantitative Easing (QE) measures.

This was backed by a put up by Trump on Truth Social studying;

“The Fed could be MUCH higher off CUTTING RATES as U.S. Tariffs begin to transition (ease!) their means into the economic system. Do the fitting factor. April 2nd is Liberation Day in America!!!”

Hayes noticed $77K because the potential backside for Bitcoin however predicted shares may decline additional earlier than reaching Powell’s desired insurance policies thus traders wanted to remain versatile with ample funds.

Market expectations had been impacted by predictions of rising inflation charges. Prolonged excessive charges had been anticipated to have bearish results.

Analyst Benjamin Cowen confirmed on X that Quantitative Tightening (QT) was ongoing. He said in response to Hayes;

“QT shouldn’t be “mainly over” on April 1st. They nonetheless have $35B/mo coming off from mortgage backed securities. They only slowed QT from $60B/mo to $40B/mo”

Crypto and blockchain enterprise investments

Information of a crypto summit that includes Trump, Michael Saylor, co-founder of Technique, and Brad Garlinghouse, the CEO of Ripple Labs fueled current market features.

The summit emphasizes crypto and institutional adoption. Bullish sentiment grew after Trump Media executives launched Renaus Tactical, aiming to boost $179M through a Particular Goal Acquisition Firm (SPAC) for blockchain investments.

Rising organizational curiosity in crypto continues to spice up confidence throughout the sector. Expectations of extra crypto-friendly authorities insurance policies additionally contributed to the market features.

Quick liquidations, sentiment, and ETF flows

Moreover, crypto markets gained as demand for brief positions decreased, and big quick closures signaled dissolving bearish bets.

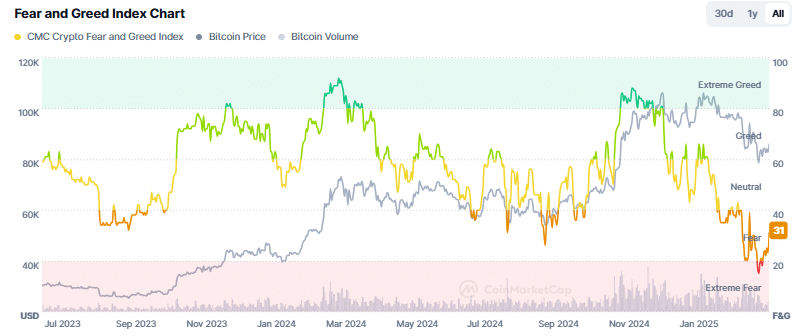

On the time of writing, the Crypto Worry and Greed Index reached 31 factors from its earlier degree of 15 over the past week, which indicated escalating dealer positivity and the event of bullish market sentiment.

Bitcoin spot ETFs noticed an influx of $11.7984 million, reflecting elevated demand. In distinction, Ethereum [ETH] spot ETFs recorded their eleventh consecutive day of outflows, totaling $11.7459 million.

With Bitcoin main the crypto markets, this pattern signaled robust bullish sentiment.