Polymarket and Kalshi show near-unanimous consensus ahead of Wednesday's decision, with $14 million traded in the past 24 hours

Prediction markets show a 94% probability the Federal Reserve will cut interest rates on Wednesday. In the past 24 hours alone, $14 million has traded on the December decision across the two major prediction markets, with $310 million in all-time volume.

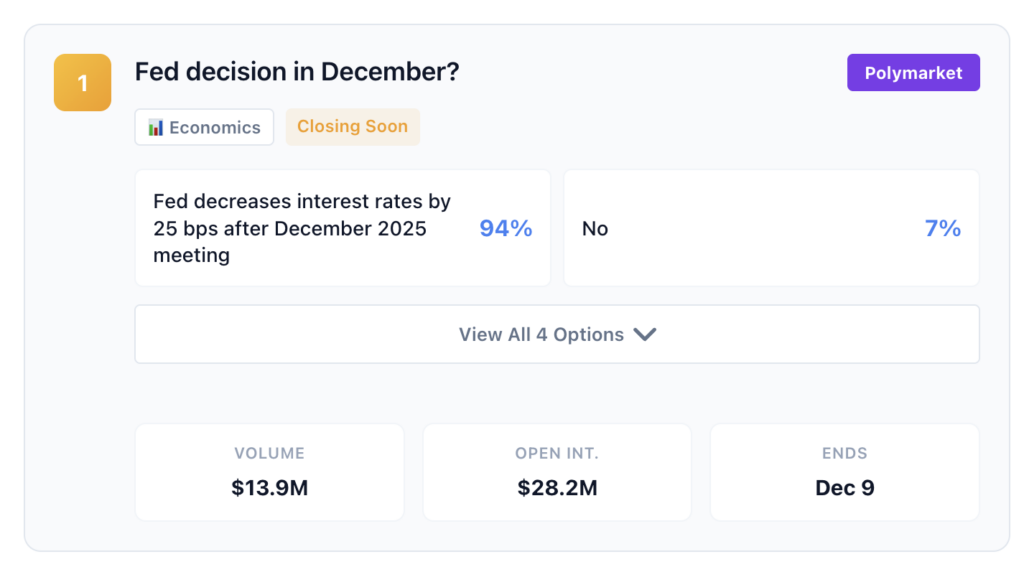

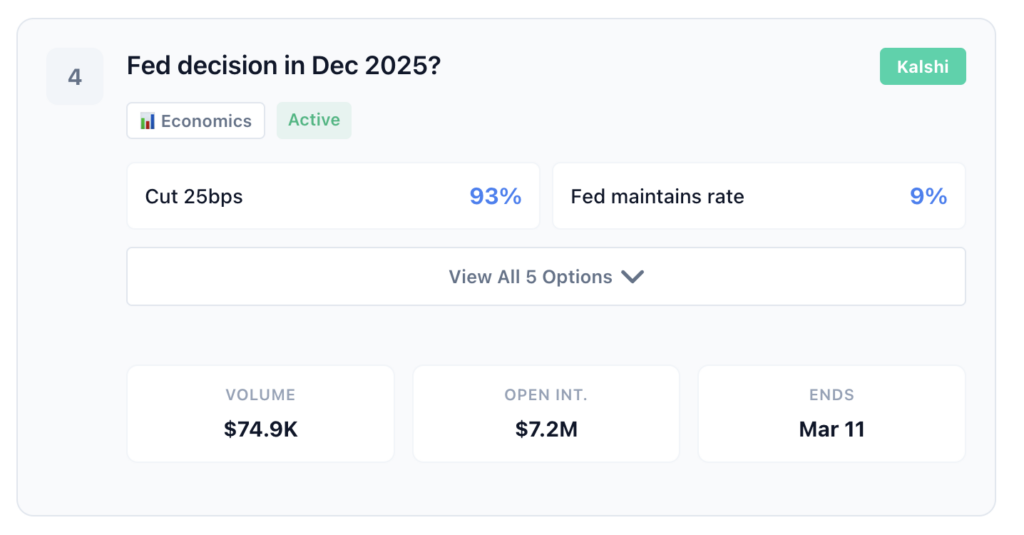

Polymarket shows 94% odds of a 25-basis-point reduction, with $28.2 million in open interest. Kalshi odds have the cut at 93%, with $7.2 million in open interest. Open interest reflects the $35 million currently at stake across both markets; volume counts every buy and sell, including traders who have since exited their positions.

24-hour and open interest figures per DeFi Rate tracker. All-time volume from Polymarket and Kalshi API.

For comparison, Polymarket’s October Fed decision market closed at $252.5 million in total volume—making December’s $287.1 million about 14% higher.

Markets weren’t always this confident

The current consensus masks sharp swings. When October’s FOMC minutes dropped on November 19, Polymarket’s “no change” outcome spiked above 60%. The minutes showed “strongly differing views” among committee members, with Powell having called a cut “not a foregone conclusion.”

Two Fed officials reversed the move. New York Fed President John Williams said in a November 21 speech in Santiago, Chile that he sees “room for a further adjustment in the near term.” Governor Christopher Waller also backed continued easing. Within 48 hours, the odds surged from roughly 40% to above 70%.

Even so, Bank of America economists expect at least two dissenting votes Wednesday. In October, Governor Stephen Miran voted for a larger 50 basis point cut while Kansas City Fed President Jeffrey Schmid preferred no cut at all.

What to watch this week

The Federal Open Market Committee meets Tuesday and Wednesday. Chair Jerome Powell will announce the decision Wednesday at 2:00 p.m. ET, alongside updated economic projections.

A cut would bring the federal funds rate target range from 3.75-4.00% to 3.50-3.75%, marking the Fed’s third consecutive quarter-point reduction following cuts in September and October. The central bank held rates steady through the first five meetings of 2025 before beginning to ease in September.

The December meeting includes an updated Summary of Economic Projections and the closely watched “dot plot,” which shows where each FOMC participant expects rates over the coming years.

Markets are already suggesting a pause could follow. Polymarket shows 68% odds the Fed holds rates steady at its January 28 meeting. Kalshi shows a January hold at 65%.