- Ethereum long-term accumulation addresses now maintain over 19 million ETH, almost doubling since January 2024.

- With almost 29% of ETH’s whole provide staked, lowered market liquidity might assist future worth stability.

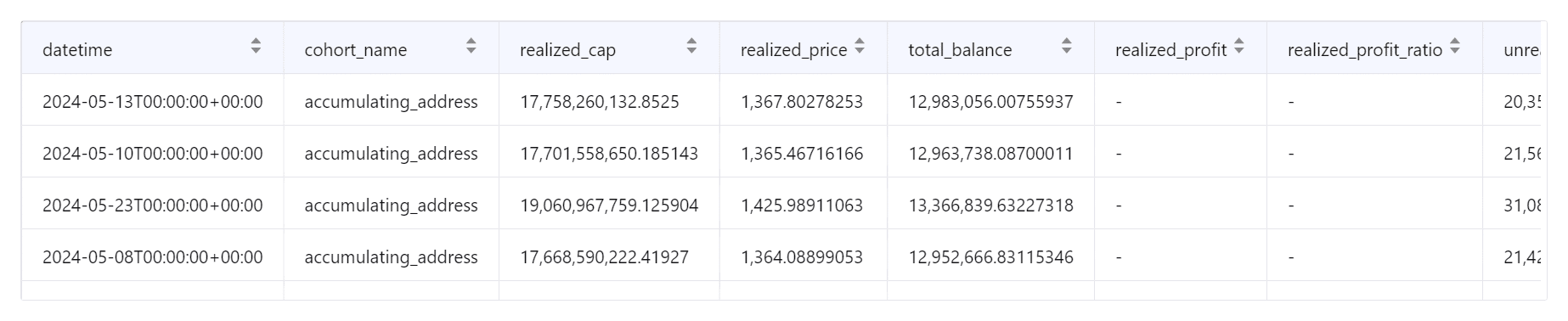

Ethereum [ETH] was experiencing a surge in long-term accumulation, with greater than 19 million ETH held in addresses as of the 18th of October.

This marks a big rise from 11.5 million ETH initially of the 12 months, reflecting rising confidence amongst buyers about Ethereum’s long-term prospects.

Ethereum accumulation rises

Information from CryptoQuant revealed a considerable enhance in Ethereum held in accumulation addresses. In January 2024, these addresses held 11.5 million ETH, and by October, this determine had almost doubled.

Consultants counsel that by the tip of the 12 months, the quantity held in these addresses might surpass 20 million ETH, persevering with this upward pattern.

This enhance in long-term holdings indicators that enormous buyers and ETH supporters are constructing their positions with the expectation of future progress.

The approval of Spot ETFs in early 2024 has additionally contributed to this accumulation by drawing extra mainstream consideration to ETH. The rise in ETH staking is one other driving power behind the elevated accumulation.

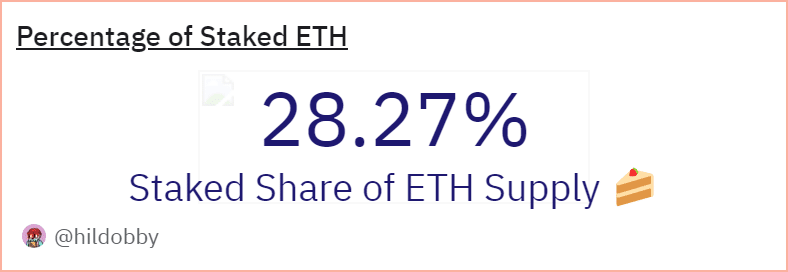

Staked Ethereum close to 30% of provide

As accumulation grows, staking has additionally develop into a key think about Ethereum’s market dynamics. Information from Dune Analytics reveals that 34,600,896 ETH was staked at press time, representing almost 29% of ETH’s whole provide.

With a considerable portion of ETH now locked up in staking contracts, the general market might expertise lowered sell-side stress.

This might present assist for Ethereum’s worth within the close to future, as much less ETH is out there for buying and selling, which might contribute to cost stability and even additional worth appreciation.

Ethereum maintains a constructive pattern

AT press time, Ethereum was buying and selling at $2,649, barely above key assist ranges.

The 50-day transferring common at $2,476 has supplied robust assist, whereas the 200-day transferring common at $3,022 served as a important resistance level.

A breakthrough above this resistance degree might be important for ETH to maintain a longer-term rally.

The Relative Energy Index (RSI) sits at 61.61, indicating reasonable bullish momentum with out coming into overbought territory.

Learn Ethereum’s [ETH] Price Prediction 2024-25

In the meantime, the Chaikin Cash Stream (CMF) was barely adverse at -0.07, reflecting restricted shopping for stress however not sufficient to sign a bearish pattern reversal.

Though Ethereum maintains a constructive outlook, surpassing the $3,022 resistance is vital for a stronger upward trajectory. If market volatility arises, the 50-day transferring common at $2,476 might act as essential assist.