On-chain knowledge reveals probably the most large Ethereum whales management a lot of the provide, with their holdings solely persevering with to develop.

Ethereum Mega Whales Personal Extra Than 57% Of All Tokens In Existence

In a brand new post on X, the on-chain analytics agency Santiment has mentioned how the ETH provide held by the totally different segments of the consumer base has appeared not too long ago.

The indicator of relevance right here is the “Supply Distribution,” which retains monitor of the proportion of the Ethereum circulating provide {that a} given pockets group is holding proper now.

Addresses or traders are divided into these cohorts primarily based on the variety of cash they carry of their stability. As an illustration, the 1 to 10 cash group contains all wallets proudly owning between 1 and 10 ETH.

Within the context of the present subject, three broad ranges containing a number of cohorts are of curiosity: 0 to 100 cash, 100 to 100,000 cash, and 100,000+ cash. The primary contains the market’s small fingers, just like the retail traders.

These holders don’t have holdings that quantity to a lot within the grand scheme of issues, so that they individually don’t maintain any significance available in the market. Within the second cohort, the 100 to 100,000 cash one, the wallets begin changing into a bit giant, however solely towards the top of the vary.

The vary contains two of the important thing investor teams within the sector, the sharks and whales. The whales are considerably extra large than the sharks, so they’re the cohort carrying the extra significance available in the market.

Lastly, the biggest addresses on the community maintain greater than 100,000 ETH. On the present worth, this quantity nears $400 million, so the traders on this group can be fairly large certainly. An applicable identify for them would maybe be “mega whales.”

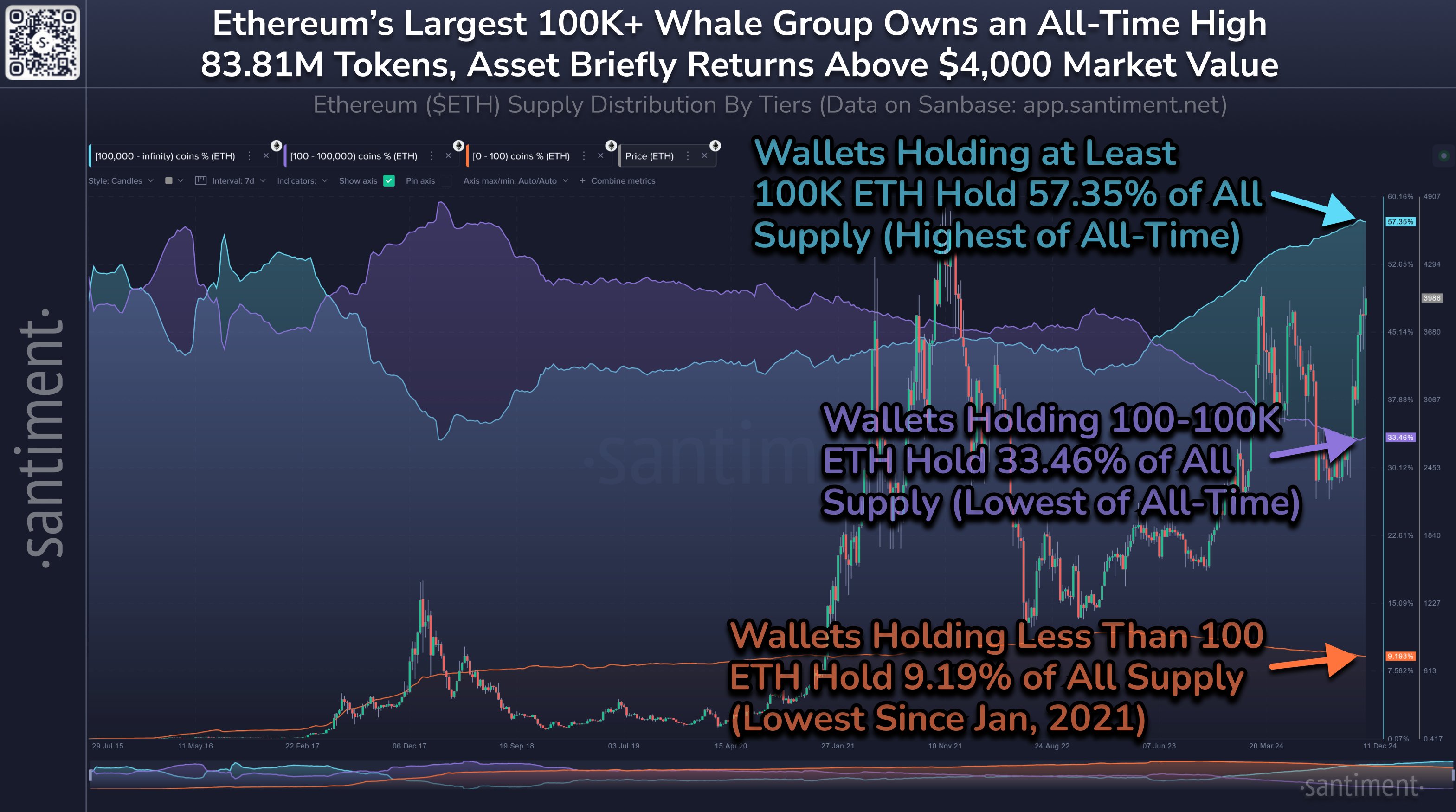

Now, right here is the chart shared by the analytics agency that reveals the pattern within the Provide Distribution for these three Ethereum pockets ranges over the previous decade:

The worth of the metric seems to have been on the rise for the mega whales in latest months | Supply: Santiment on X

As displayed within the above graph, the proportion of the Ethereum provide held by the mega whales has risen over the previous couple of years. On the similar time, each smaller pockets ranges have misplaced dominance, with the sharks and whales particularly witnessing a moderately steep drop.

The mega whales, consisting of solely 104 members, at this time personal 57.35% of the ETH provide, a brand new all-time excessive. In the meantime, the holdings of the sharks and whales sit at an all-time low of 33.46%.

Usually, the centralization of provide isn’t optimistic for any cryptocurrency. Nonetheless, it issues particularly for Ethereum because the community runs on a consensus mechanism primarily based on the Proof-of-Stake (PoS). Which means that if an entity or a bunch of entities controls 51% of the availability, they will take over the community.

That mentioned, many mega whales wouldn’t be ‘actual’ traders however wallets belonging to staking swimming pools and different platforms, who merely maintain the cash in a single place on behalf of many traders.

ETH Value

Ethereum has seen a pullback in the course of the previous day, as its worth is now $3,930.

Appears like the value of the coin has general been transferring sideways not too long ago | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com