- Regardless of trailing Bitcoin ETFs, which closed 2024 with a formidable $35 billion in inflows, Ethereum ETFs have proven constant development.

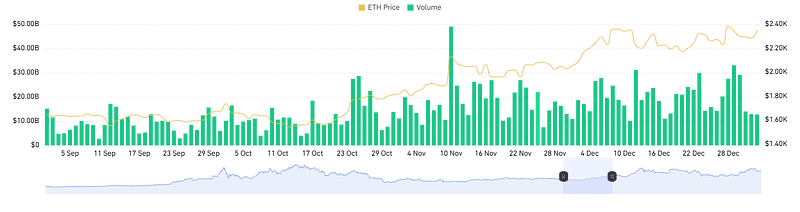

- ETH ETFs skilled a major surge in buying and selling quantity, with December’s figures reaching above $13 Billion.

Ethereum [ETH] ETFs achieved outstanding momentum in December, accumulating $2.6 billion in web inflows. This surge highlighted the rising institutional curiosity in Ethereum as a viable funding automobile.

As well as, ETH ETFs have proven constant development, whilst Bitcoin’s [BTC] ETFs trailed, closing 2024 with a formidable $35 billion in inflows. This development displays confidence in Ethereum’s long-term potential, fueled by its sturdy ecosystem and increasing use circumstances.

Can Ethereum ETFs outperform Bitcoin ETFs in 2025?

Latest market information means that Ethereum ETFs may surpass Bitcoin ETFs in 2025 if sure circumstances align. Analysts attribute this potential to Ethereum’s distinctive staking capabilities, which offer further yield-generation alternatives for traders.

Favorable regulatory developments additional place the ETFs to draw a broader institutional viewers.

In November and December 2024, ETH demonstrated sturdy market momentum with eight consecutive weeks of inflows. This era included a record-breaking $2.2 billion influx within the week, ending on the twenty sixth of November, showcasing heightened investor confidence.

Whereas BTC ETFs stay dominant, ETH ETFs are regularly narrowing the hole, indicating a shift in institutional preferences.

If Ethereum maintains its worth trajectory, pushed by elevated community exercise and technological developments, its ETFs may emerge as top-performing belongings in 2025.

Moreover, exterior components, such because the rising adoption of synthetic intelligence in Ethereum’s ecosystem, have bolstered its attraction.

Key challenges for Ethereum’s market ascent

For ETH ETFs to problem BTC ETFs’ dominance, Ethereum should tackle key obstacles, together with market dominance and competitors from rival networks.

Bitcoin’s intensive model recognition and first-mover benefit proceed to attract important inflows, leaving Ethereum with the duty of constructing related belief amongst institutional traders.

Ethereum’s present market dominance of 18.7%, as per latest information, trails Bitcoin’s 47.1%, reflecting the disparity in investor confidence.

Nonetheless, analysts spotlight that ETH’s market share may develop as its staking rewards change into extra engaging and regulatory readability improves. Sustaining a constant upward trajectory in ETF inflows might be essential to closing this hole.

One other hurdle lies in Ethereum’s historic volatility, which has often deterred risk-averse traders. To beat this, these ETFs should showcase stability and resilience, notably in response to broader market shifts.

With exterior components like macroeconomic circumstances and world regulatory modifications, Ethereum’s ecosystem should show its potential to adapt and thrive in a aggressive panorama.

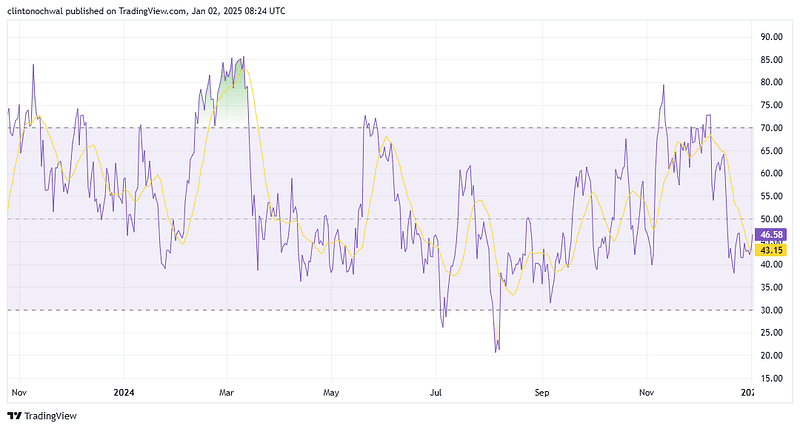

Ethereum’s RSI developments point out bullish momentum

Ethereum’s Relative Power Index (RSI), a key technical indicator, gives invaluable insights into its present efficiency.

As of late December, ETH’s RSI stood at 68, nearing the overbought threshold of 70. This means sturdy bullish momentum however raises considerations about potential short-term corrections.

Traditionally, the coin’s RSI actions close to the overbought zone have preceded non permanent pullbacks earlier than resuming an upward development. Moreover, ETH’s latest ETF inflows have fueled optimism amongst traders, with many anticipating additional RSI beneficial properties.

If Ethereum breaks by way of key resistance ranges, its RSI may stabilize inside the bullish vary, reinforcing confidence in its long-term outlook.

Surging buying and selling quantity highlights…

Ethereum ETFs skilled a major surge in buying and selling quantity, with December’s figures reaching above $13 Billion.

This development highlights the intensifying curiosity amongst traders, pushed by constant inflows and optimistic market sentiment.

This surge in quantity signifies sturdy liquidity, a crucial issue for institutional traders searching for steady and scalable choices. Analysts view the elevated buying and selling exercise as a precursor to stronger ETF efficiency, because it underscores heightened confidence in Ethereum’s future.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

Wanting forward, Ethereum ETFs might proceed to see rising volumes, notably if ETH’s worth developments stay bullish and community exercise intensifies.

Coupled with the optimistic momentum in staking yields and regulatory help, this quantity development may place ETH ETFs as dominant market gamers in 2025.