- ETH/BTC is a powerful indicator of a pattern reversal in Ethereum’s favor towards Bitcoin.

- Quantity indicators verify vendor exhaustion—will it translate to a worth enhance?

Following the latest Federal Open Market Committee (FOMC) assembly, which signaled a slowing financial system, each Bitcoin [BTC] and Ethereum [ETH] have efficiently reclaimed important resistance ranges.

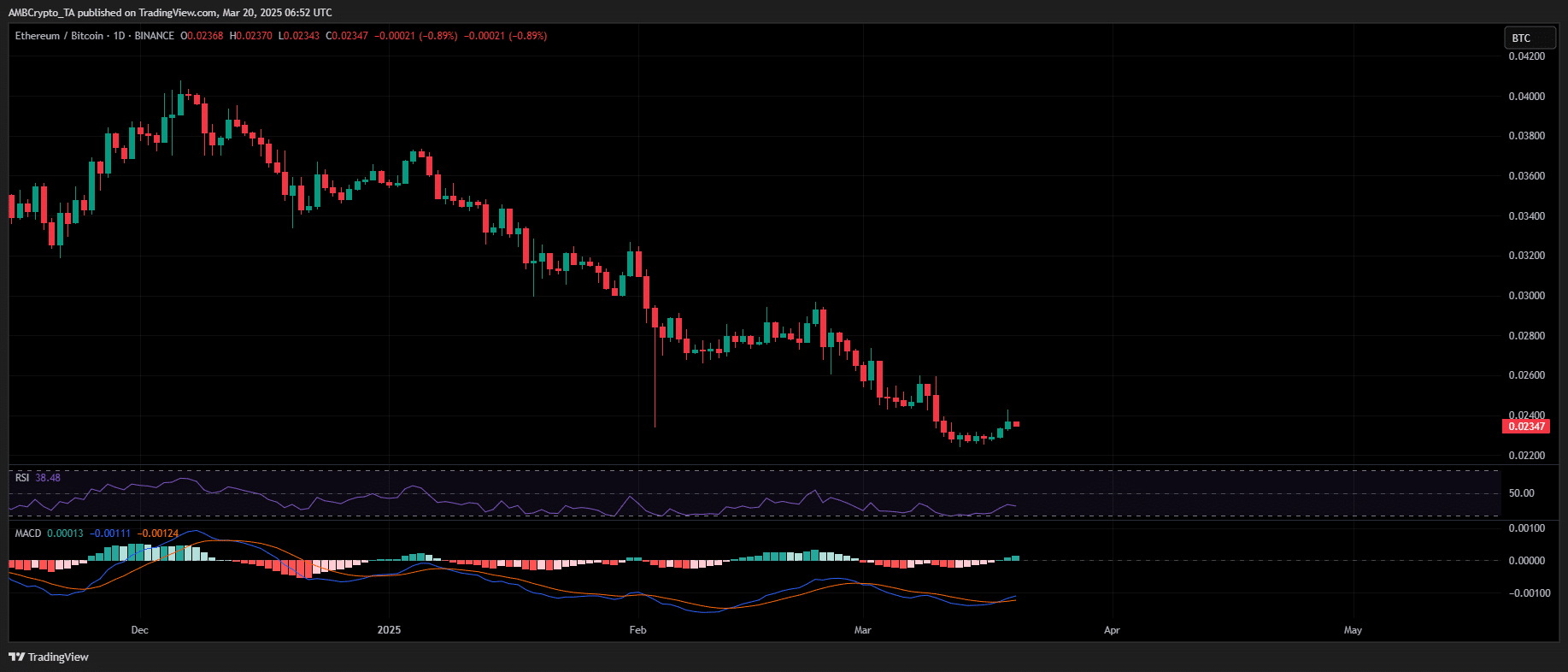

This growth raises whether or not ETH, at present at a five-year low towards BTC within the ETH/BTC pair, might outpace Bitcoin in an impending market rebound.

Market dilemma: Execution or hypothesis?

Amid issues concerning the financial affect of tariffs, the Federal Reserve maintained the borrowing charge at 4.25%-4.5%, unchanged since December.

Nevertheless, markets surged on ‘hypothesis’ that the Fed would possibly implement two charge cuts this 12 months as an alternative of 1. With inflation displaying signs of easing and labor market pressures intensifying, the central financial institution could also be compelled to undertake a extra accommodative coverage.

The anticipation of elevated liquidity and coverage easing sparked a pointy rally in danger belongings.

On the time of writing, Bitcoin climbed 5.02%, decisively breaking by the $85k resistance stage, whereas Ethereum gained 6.45%, reclaiming the $2k mark after a protracted interval of consolidation.

Moreover, the 1-day ETH/BTC MACD indicator turned bullish as buying and selling quantity reached a two-week-high, suggesting a possible shift in favor of Ethereum.

Nevertheless, holding this sample stays unsure. With out clear coverage “execution”, post-FOMC volatility has surged. This makes it more durable to verify these resistance zones as robust help ranges.

ETH vs. BTC: Who dominates the subsequent market restoration?

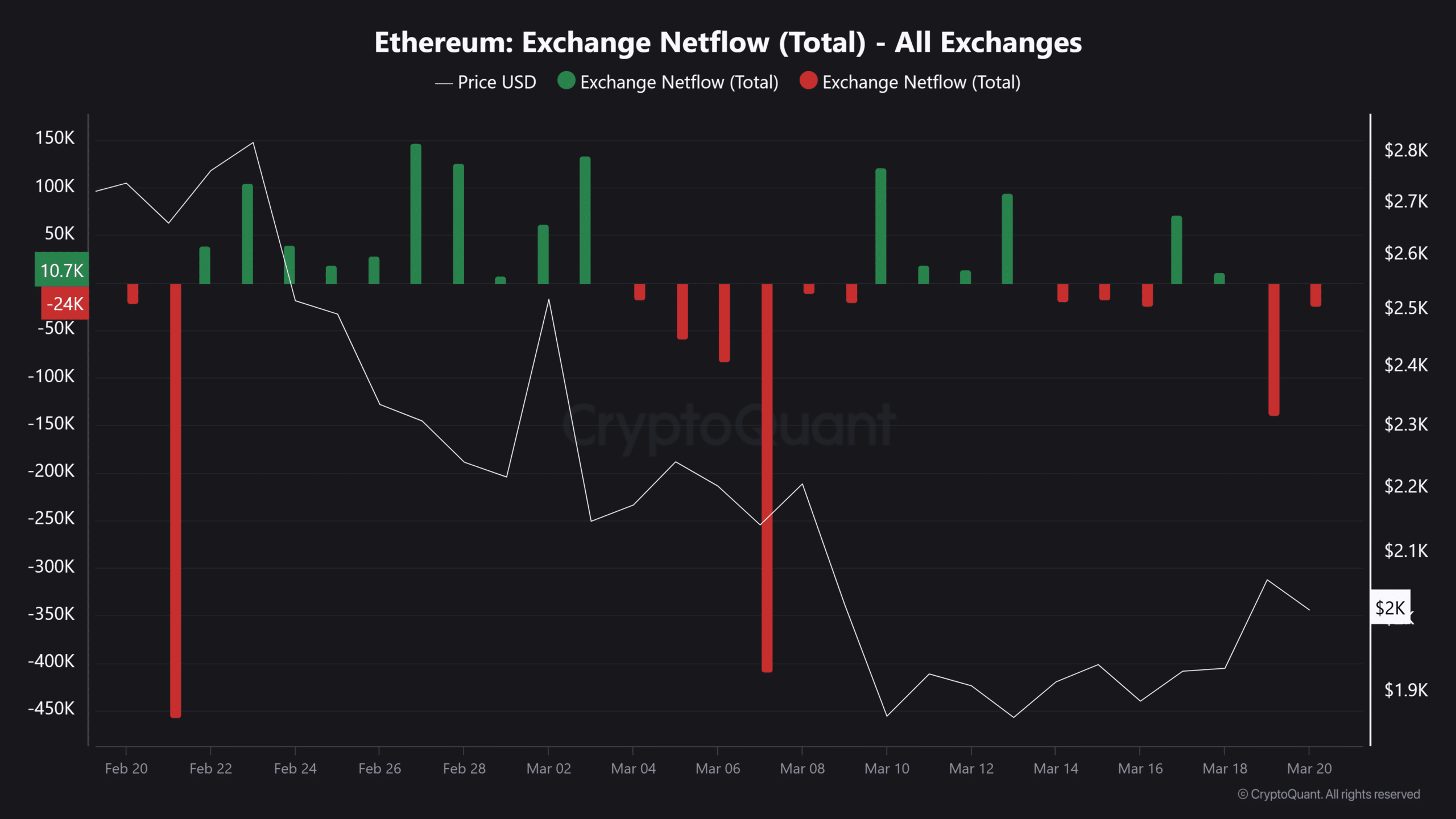

Fundamentals are key to confirming this pattern. As ETH reclaimed the $2k stage, massive capital inflows hinted at a possible backside formation.

On-chain knowledge confirms that Donald Trump’s World Liberty Monetary has resumed ETH accumulation. The fund moved 25 million USDC to a brand new multi-sig pockets and executed a 4,468 ETH ($10 million) buy at $2,238.

Concurrently, retail demand surged at $2,059, triggering the biggest ETH trade outflow in over two weeks – 139k ETH shifting off exchanges.

In the meantime, BTC ETFs recorded 4 consecutive days of web inflows, reinforcing its present market worth as a powerful “dip-buying” zone.

Nevertheless, for Ethereum to ascertain dominance, ETH/BTC should break key resistance at $0.025, backed by a sustained capital rotation from BTC into ETH.

At present, Bitcoin’s strong fundamentals proceed to drive long-term holding sentiment, whereas Ethereum’s restoration hinges on reclaiming the $2.5K resistance.

And not using a confirmed breakout, speculation-driven volatility persists, leaving the broader market rebound unsure. Failure to carry key help might see Ethereum danger shedding the important $2k help stage.