- Staked ETH turned worthwhile for the primary time since March, boosting validator confidence and sentiment.

- Ethereum’s bullish momentum strengthens with $2,550 breakout, however indicators of overbought circumstances emerge.

Ethereum’s [ETH] again within the inexperienced – and so is validator sentiment. For the primary time since March, staked ETH is displaying unrealized positive aspects, a comeback in on-chain confidence.

However this isn’t only a blip on the charts; it might be the early starting of a broader shift in Ethereum’s worth seize story.

With the community maintaining a tally of L2 scaling incentives and software migration dangers, the community’s financial basis might be on the cusp of one thing enormous.

Staked ETH returns to revenue

A latest CryptoQuant report has revealed that Ethereum stakers are again within the inexperienced after greater than two months of unrealized losses.

Since March, staked ETH had been underwater, with the realized value sitting above market ranges. Nonetheless, on the ninth of Might, ETH crossed the $2297 mark, surpassing the realized value of – flipping stakers again into revenue territory.

This restoration strengthens Ethereum’s community stability by reassuring validators and staking members. As revenue returns to stakers, it might be an indication of a bigger bullish shift throughout the Ethereum ecosystem.

Ethereum as the most important on-chain economic system

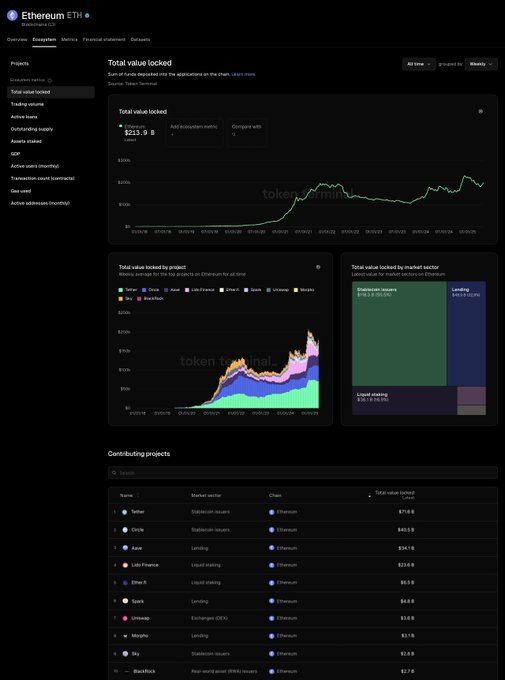

Ethereum continues to dominate as the biggest on-chain economic system, with over $213.9 billion in TVL throughout lending, staking, and different sectors.

This expansive exercise reveals Ethereum’s unmatched developer base and DeFi infrastructure, attracting the best quantity of app deployment and utilization.

Nonetheless, the dominance isn’t with out danger.

Incentives tied to scalability and app success create an actual menace of app migration – particularly to competing chains.

Ethereum’s new management has acknowledged these commencement dangers and are reportedly working towards methods that guarantee worth retention as apps evolve and increase.

Worth momentum builds

ETH’s latest breakout pushed it above $2,550 at press time, marking a powerful bullish continuation.

Technicals supported the rally – the RSI was at 80.58, indicating sturdy momentum however maybe the asset is getting into overbought territory.

In the meantime, the MACD confirmed a widening hole between the MACD and sign strains, a bullish sign reflecting elevated shopping for stress.

With quantity holding regular and sentiment turning optimistic post-staking revenue restoration, Ethereum’s value might take a look at greater resistances. Nonetheless, overextension may result in a quick consolidation earlier than the following leg up.