- Establishments bought ETH price $105 million through the newest correction

- On-chain information urged the decline could possibly be a chance to purchase earlier than one other rally begins

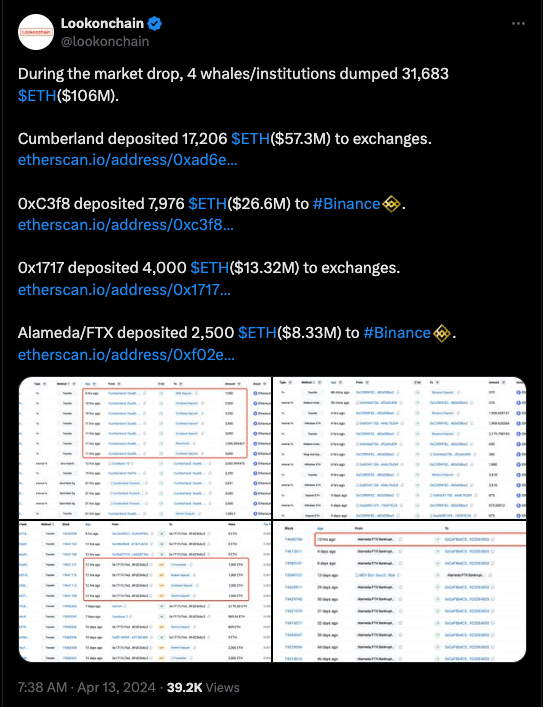

4 whales together with notable institutional buyers took half in promoting off a few of their Ethereum [ETH] holdings because the altcoin’s worth collapsed on the charts. Actually, ETH depreciated by over 7% in simply 24 hours.

In line with Lookonchain, Cumberland, a buying and selling agency, despatched a complete of 17,206 ETH to exchanges. On the time of the transactions, the cash have been price $57.3 million. FTX additionally deposited $8.33 million price of ETH to Binance. Lastly, the opposite two establishments bought a mixed $39.92 million in ETH.

Solely the short-sighted could also be affected

Whales promote their property for various causes. For some, it could possibly be a traditional profit-taking occasion. For others, it could possibly be an avenue to let go after a cryptocurrency has underperformed. Nonetheless, this altcoin doesn’t appear to fall into this class.

On the time of writing, AMBCrypto couldn’t affirm why the events bought. However one factor was sure— The sell-offs performed an enormous position as Ethereum’s worth fell to $3,169. At press time, ETH was valued at $3,262, indicating that the cryptocurrency recovered barely. Nonetheless, you will need to test if the cryptocurrency can maintain this gentle uptrend.

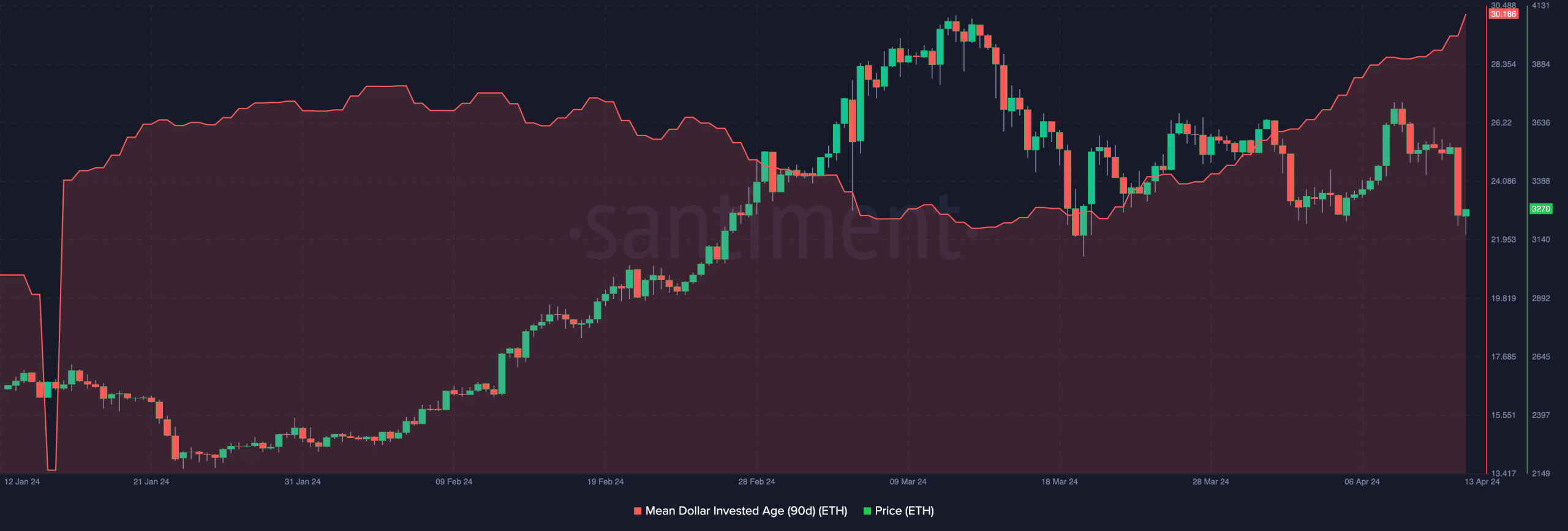

To do that, AMBCrypto checked out some metrics which may have an effect on the worth. First on the checklist was the Imply Greenback Invested Age (MDIA).

The MDIA is the typical age of cash held in the identical pockets. If the metric will increase, then it means many cash are much less lively, and have remained in the identical place for an extended whereas. Then again, a falling MDIA implies that previous cash are transferring. For Ethereum, on-chain information from Santiment revealed that the 90-day MDIA spiked.

Traditionally, a large decline within the metric was accompanied by an area prime. Subsequently, the latest enhance urged that ETH could possibly be undervalued, and the most recent correction could possibly be an opportunity to purchase at decrease costs earlier than its potential rally begins.

Is the subsequent path nice?

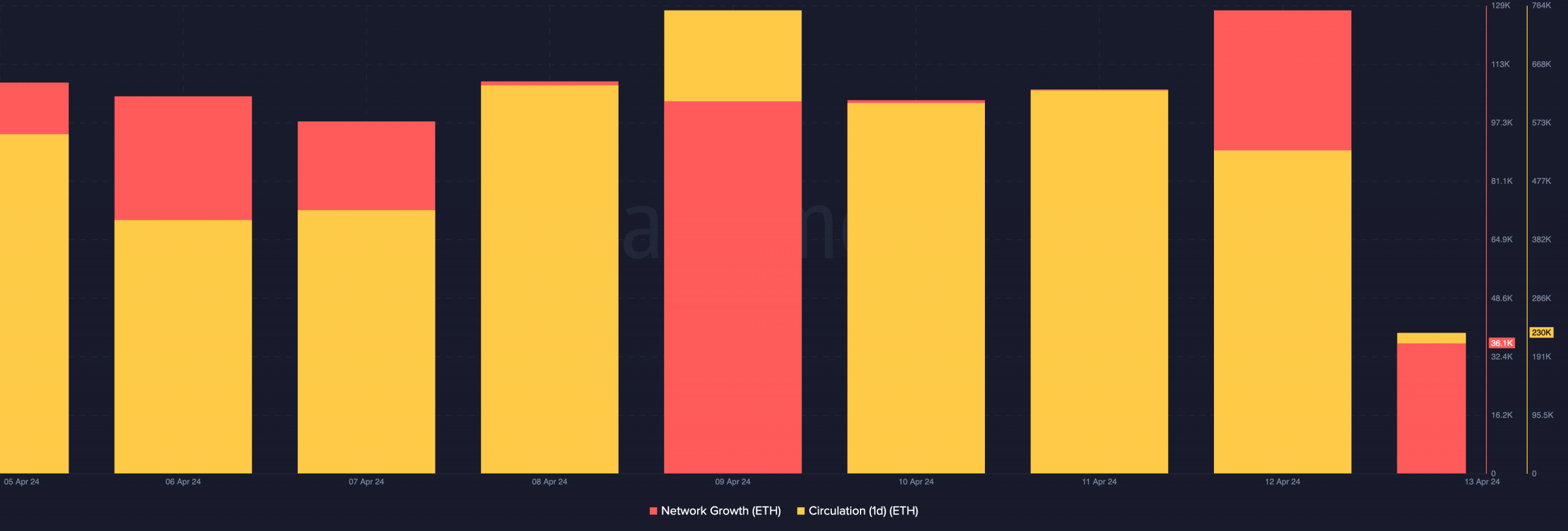

Community progress was one other metric AMBCrypto analyzed. This metric gauges person adoption over time. If it will increase, then it means a mission is gaining traction. If it decreases, it implies that the mission is dropping traction.

On 12 April, Ethereum’s community progress was 128,000, indicating that plenty of new addresses interacted with the mission.

Nonetheless, it appeared that the worth decline caused the quantity to fall to 36,100. If community progress improves, demand for ETH may assist the worth motion leap.

Conversely, a decline within the metric may end in stagnancy for the worth. As well as, the one-day circulation dropped to 230,000, reinforcing the notion of decreased utilization.

Is your portfolio inexperienced? Test the ETH Profit Calculator

That being mentioned, the drop in circulation could possibly be good for ETH because it could possibly be an indication of much less promoting strain. Ought to the variety of cash used proceed to fall, then ETH’s worth may exit the terrible state it has been in over the past 24 hours.