In keeping with the newest on-chain knowledge, liquidity within the cryptocurrency markets has reached an all-time excessive. Right here’s the implication of the rising liquidity on the worth of Bitcoin and its future trajectory.

Stablecoin Market Cap Hits New Highs — Influence On Bitcoin Worth

In its newest report, CryptoQuant revealed that liquidity within the crypto market hit a document excessive in late September, sparking conversations in regards to the Bitcoin bull market resuming. In keeping with the on-chain analytics agency, crypto market liquidity is measured by stablecoin worth and market capitalization, which now stands at round $169 billion.

Information from CryptoQuant exhibits that the overall market capitalization of main US dollar-backed stablecoin has elevated considerably to this point in 2024, rising by 31% (equal to $40 billion) year-to-date. A lot of the progress, although, was triggered by the 2 largest stablecoins, Tether’s USDT and Circle’s USDC.

Supply: CryptoQuant

Unsurprisingly, USDT and USDC proceed to dominate the stablecoin business, with market shares of 71% and 21%, respectively. In keeping with knowledge from CryptoQuant, USDT’s market capitalization has grown by 30% in 2024 (about $28 billion) whereas USDC’s market cap is up by 44% (equal to $11 billion) year-to-date.

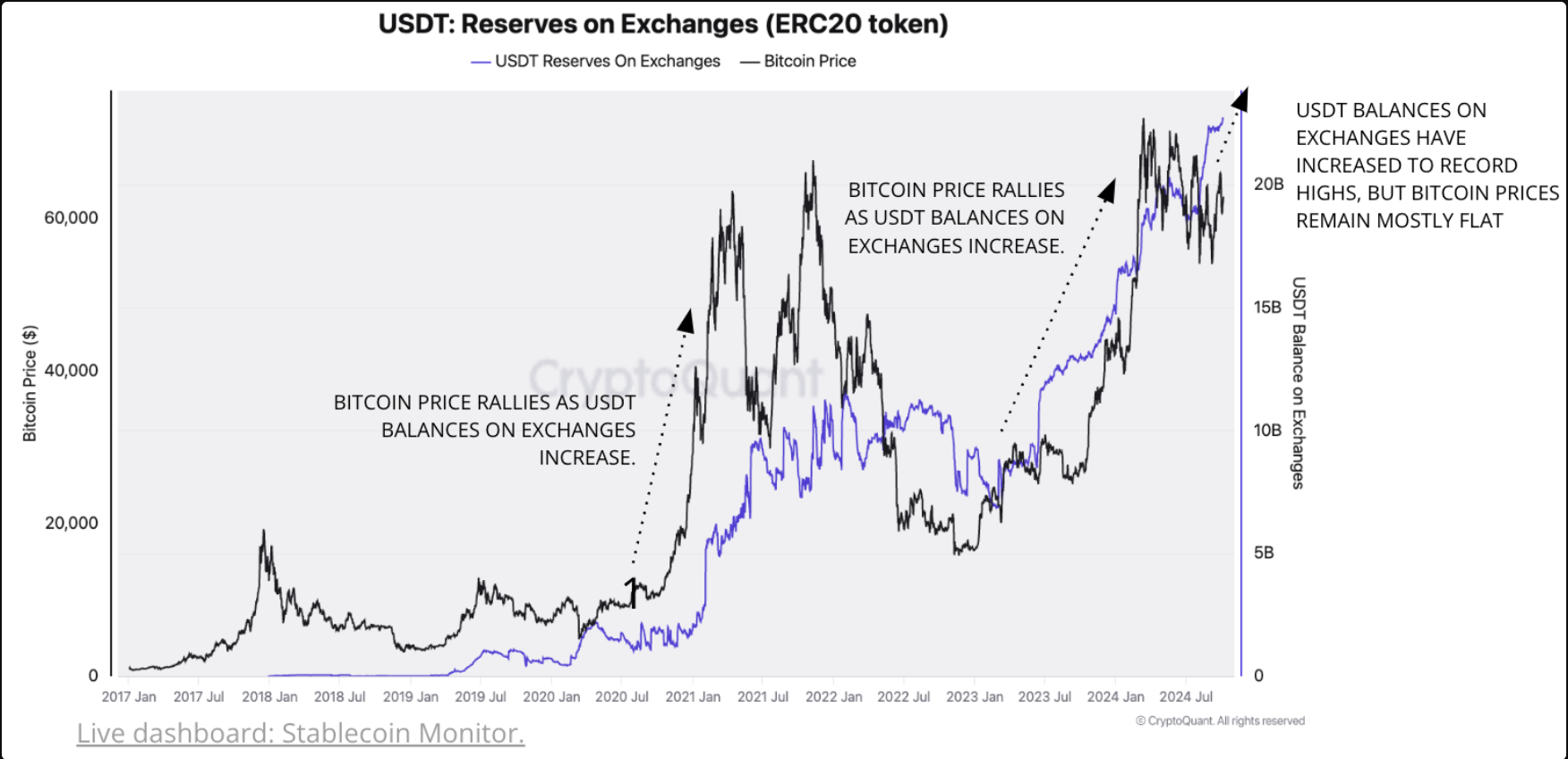

One other robust sign of rising market liquidity is the record-high stablecoin balances on centralized exchanges. Particularly, this progress is pushed by USDT (ERC20 on the Ethereum), which has seen its balances on exchanges hit a document excessive of twenty-two.7 billion in October. This displays a 54% improve (about $8 billion) to this point in 2024.

Traditionally, growing balances of stablecoins on exchanges are positively related to increased crypto market costs, particularly the Bitcoin worth. It’s because the bigger shops of stablecoins can sign extra shopping for energy for traders, as they will rapidly commerce stablecoins for different cryptocurrencies on exchanges (recognized to supply these buying and selling providers).

Bigger stablecoin balances on exchanges may sign the readiness of traders to accumulate crypto assets. In the end, this shopping for strain tends to push asset costs to the upside, particularly as traders usually buy anticipating upward worth motion.

With the rising liquidity out there, traders have been led to marvel in regards to the Bitcoin bull run resuming quickly. It’s price noting that the overall quantity of USDT (ERC20) on exchanges has risen by 146% from $9.2 billion to $22.7 billion since January 2023, when the present cycle formally began.

Nevertheless, traders would possibly wish to decrease expectations, contemplating that these USDT balances have elevated by 20% since August 2024 whereas Bitcoin’s worth has remained relatively quiet.

Bitcoin Worth At A Look

As of this writing, Bitcoin is valued at round $62,750, reflecting an virtually 3% improve up to now day.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView