- Bitcoin and Ethereum noticed a notable decline in retail adoption, as mirrored by shrinking community exercise.

- Will Q2 sign the onset of a deeper corrective cycle?

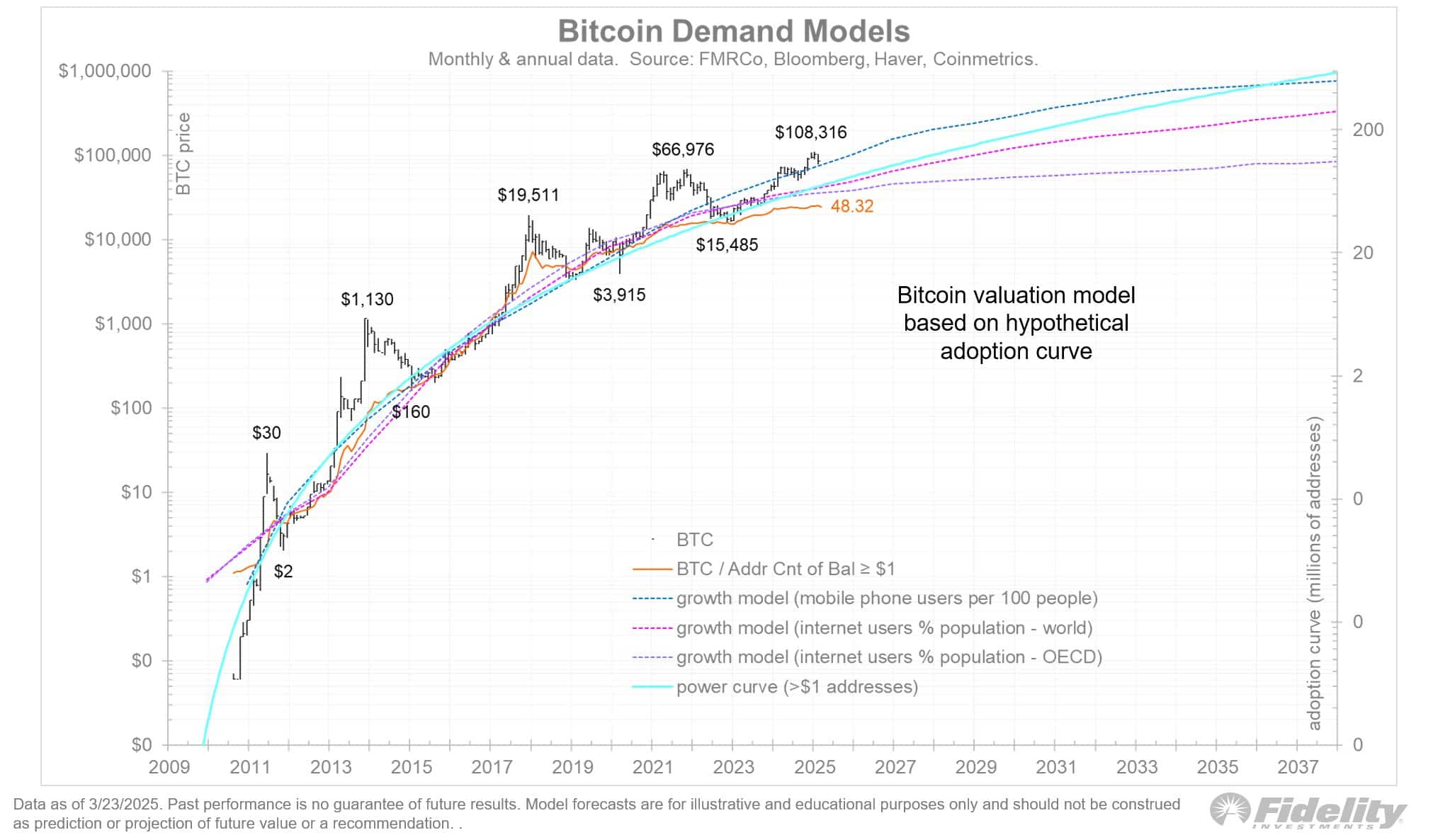

In response to the chart beneath, since Bitcoin’s [BTC] post-2020 bull cycle, the growth of distinctive wallets and energetic addresses has slowed, notably amongst wallets holding balances exceeding $1.

This stagnation aligns with the adoption curve model, suggesting institutional accumulation has consolidated BTC into fewer high-value wallets.

In easy phrases, large-scale entities, resembling MicroStrategy (MSTR) have concentrated holdings, lowering the necessity for broad pockets distribution. Consequently, broader distribution amongst retail individuals has declined.

Ethereum [ETH] has mirrored this development, registering its lowest adoption fee in 2025. As institutional dominance grows, on-chain metrics could turn into much less dependable for assessing retail adoption sooner or later.

The market impression of this structural shift could possibly be profound. Institutional wallets more and more dictate liquidity cycles. For example, Bitcoin’s sharp retracement to $77k in February straight correlated with sustained BTC ETF outflows.

On the twenty fifth of February, BTC ETFs registered a web outflow of $1.4 billion, catalyzing a 5.11% worth decline inside 24 hours. Ethereum ETFs have equally remained in a persistent sell-side section, struggling to draw recent inflows.

Extra critically, these institutional outflows have coincided with Trump’s aggressive tariff insurance policies, including a macroeconomic layer to crypto market volatility.

As Q2 unfolds, the administration seems to be in full “reset” mode. Whereas market reactions stay unsure, Bitcoin and Ethereum’s failure to copy their Q1 rally raises the query:

Will Q2 deliver a bleak bearish cycle?

Meals for thought: Is Bitcoin and Ethereum’s Q2 cycle in danger?

Inside two weeks, Bitcoin has reclaimed $88k as BTC ETFs reverted to web inflows. MSTR capitalized on this momentum, accumulating 6,911 BTC for $584 million at a median acquisition worth of $86k.

Ethereum adopted swimsuit, briefly retesting $2k. Nevertheless, its extended consolidation, coupled with declining network adoption and subdued institutional inflows, suggests underlying structural weak spot.

If BTC encounters resistance and retraces, ETH’s worth motion could possibly be weak to a deeper corrective section.

Weak fundamentals and selective accumulation by high-value wallets might act as a headwind for each Bitcoin and Ethereum’s Q2 rally.

Traditionally, BTC’s Q1 energy has triggered an altcoin surge, but this cycle’s worth motion has diverged. The important thing differentiator? Heightened macroeconomic volatility.

If institutional capital inflows fail to offset this volatility within the upcoming quarter, each Bitcoin and Ethereum could face distribution strain and delay a full-scale development continuation.