Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

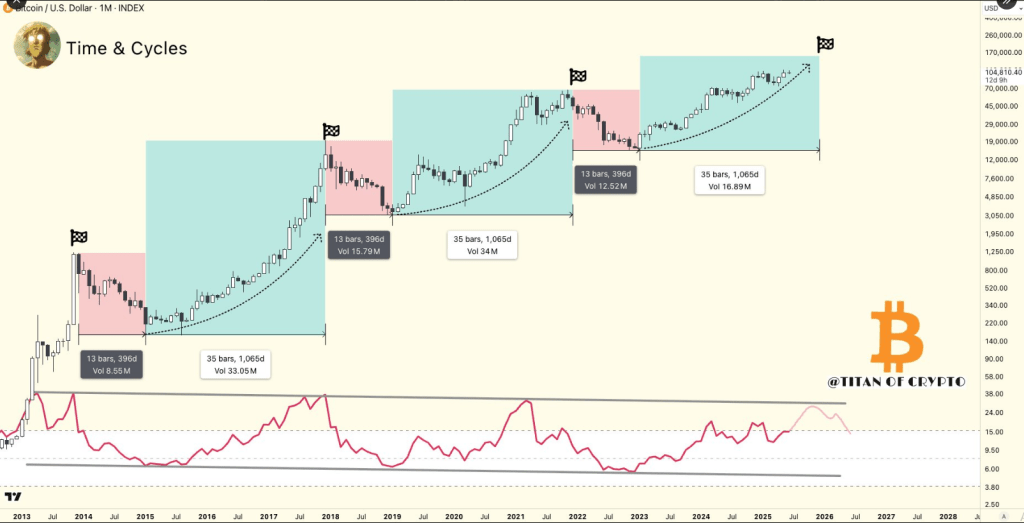

Bitcoin’s current pullback has sparked contemporary debate over whether or not the rally has run its course. In line with market watcher Titan of Crypto, the story isn’t over but.

Associated Studying

Bitcoin slipped simply 6% from its all‑time excessive of $112,000, however some analysts pointed to a cooling relative energy index (RSI) and warned of a prime. Titan’s take flips that view on its head, arguing that we’re nonetheless deep within the meat of the bull cycle.

Fractal Cycles Preserve Operating

Titan pointed to a transparent sample in Bitcoin’s final two cycles. Every cycle started with roughly 13 month-to-month bars—about 396 days—of steep decline. In 2014–15, Bitcoin fell from $1,240 to $161 over that span.

Costs then rallied for 35 bars (1,065 days) to hit $19,800 in December 2017. The identical 13‑bar slide adopted by 35 bars of beneficial properties performed out once more after 2018, ending at $69,000 in 2021.

#Bitcoin Bull Market Coming into Remaining Section 🏁

As in earlier cycles: ~1 yr of bear market, adopted by ~3 years of growth.$BTC appears to be within the ultimate leg however not finished but. pic.twitter.com/MGre5ahz3P

— Titan of Crypto (@Washigorira) June 18, 2025

Momentum And RSI In Focus

Some analysts flagged a weakening RSI as an indication that Bitcoin has peaked. That metric can’t be ignored—when momentum wanes, value usually takes a breather. Titan’s chart lays down the time‑primarily based sample, however RSI, buying and selling quantity, and on‑chain information give a stay learn on demand.

Bull Run Nonetheless Has Room

Based mostly on experiences, the present cycle’s bullish part kicked off in January 2023 and sits within the twenty ninth bar this month. Bitcoin has climbed 530% because the begin of that run.

If historical past holds, we’ve bought not less than 5 extra month-to-month bars of uptrend earlier than the rally tops out round November. Earlier research even level to a wedge breakout that might ship value to about $137,000 earlier than any critical pullback.

Massive Names See Larger Peaks

Samson Mow, the CEO of Jan3, foresees Bitcoin tearing previous the $1 million mark in a fierce upswing, powered by authorities rollouts, sovereign bond issuances, and an pressing surge in ‘hyperbitcoinization’ earlier than seeing any actual correction.

Raoul Pal (Actual Imaginative and prescient), the previous Goldman Sachs government, shares a well-recognized bullish view. He has laid out situations the place Bitcoin hits $1 million by 2030, primarily based on financial stimulus and restricted provide.

Associated Studying

Technique’s Michael Saylor has additionally mentioned Bitcoin may skyrocket to between $500,000 and $1 million earlier than seeing any actual correction.

These huge names within the crypto business spotlight rising institutional inflows and a looming provide squeeze after the subsequent halving as gasoline for a good greater peak.

This rally isn’t only a rerun of what we noticed in 2017 or 2021. Bitcoin right this moment strikes with ETFs, huge‑ticket company buys, and extra merchants watching on‑chain indicators than ever earlier than.

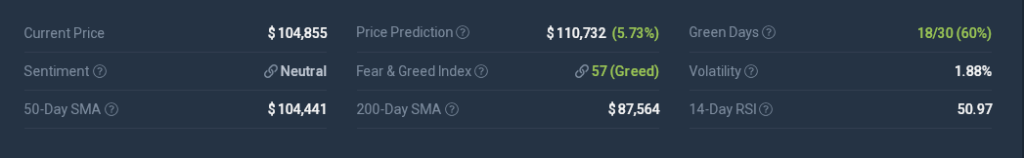

In the meantime, the most recent outlook by CoinCodex sees Bitcoin climbing 5.73% to hit roughly $110,732 by July 19, 2025. Proper now, technical indicators level to a Impartial temper, whereas the Worry & Greed Index sits at 57—squarely in Greed territory.

Featured picture from Pexels, chart from TradingView