- Bitcoin’s value rebounds above $97,000, rising 2.3% after dropping to $94,000.

- A shift within the MVRV ratio and dormant coin motion might point out long-term holders are influencing market developments.

Bitcoin [BTC] has skilled a noteworthy shift in momentum after a gentle decline final week introduced its value as little as $94,000.

Within the early hours of the tenth of February, BTC started to get better, with its value climbing above $97,000—a 2.3% enhance over the day before today.

Whereas this upward motion is a optimistic growth, a deeper evaluation of the community’s underlying metrics sheds gentle on the potential future path for the main cryptocurrency.

A latest evaluation from CryptoQuant highlighted a major motion on the Bitcoin community. On the tenth of February, roughly 14,000 Bitcoins, dormant for seven to 10 years, had been instantly moved.

Importantly, these cash weren’t despatched to exchanges, suggesting they weren’t meant for rapid liquidation.

The CryptoQuant analyst reporting this notably wrote:

“It’s necessary to notice that the common acquisition value of those cash is kind of low, which might affect the holders’ future selections concerning potential gross sales.”

Bitcoin present MVRV ratio and its implications

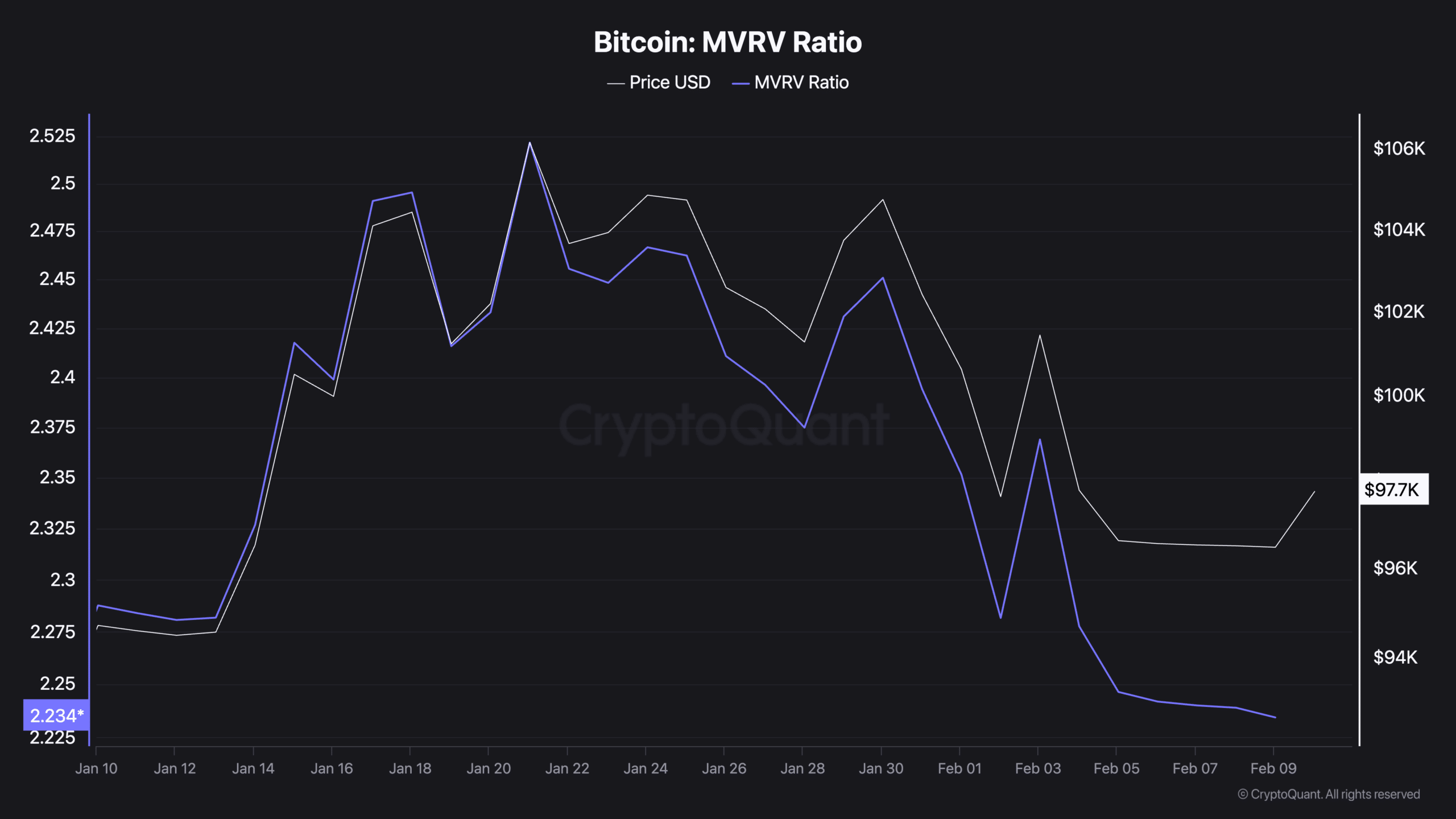

Extra importantly, the MVRV ratio additionally supplied priceless insights into Bitcoin’s market well being.

The MVRV (Market Worth to Realized Worth) ratio measures the market capitalization of Bitcoin towards its realized worth—the overall worth of all cash on the value they final moved on the blockchain.

This ratio can function an indicator of whether or not the asset is overvalued or undervalued at present value ranges.

Current data from CryptoQuant additionally revealed a downward pattern in Bitcoin’s MVRV ratio, aligning with its latest value declines.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

On the twenty first of January, the MVRV ratio stood at 2.52. Nevertheless, following the drop in BTC’s market value, it had fallen to 2.23 as of the ninth of February.

Traditionally, when the MVRV ratio dips, it has signaled potential entry factors for long-term traders. Nevertheless, if the ratio continues to say no, it could point out lingering market weak spot or warning amongst traders.