- A notable shift is going on amongst BTC holders, signaling potential modifications in market dynamics.

- Bid-ask imbalances steered that promoting strain prevailed, which may doubtlessly set off a downturn.

Bitcoin’s [BTC] profitability has waned following the current market correction, with its positive factors now diminished. As of the newest information, BTC has posted a 19.86% enhance.

Regardless of a modest 0.37% value enhance, there may be lingering skepticism about whether or not BTC can maintain these positive factors, as promoting exercise continues to weigh in the marketplace.

Lengthy-term holders start promoting Bitcoin

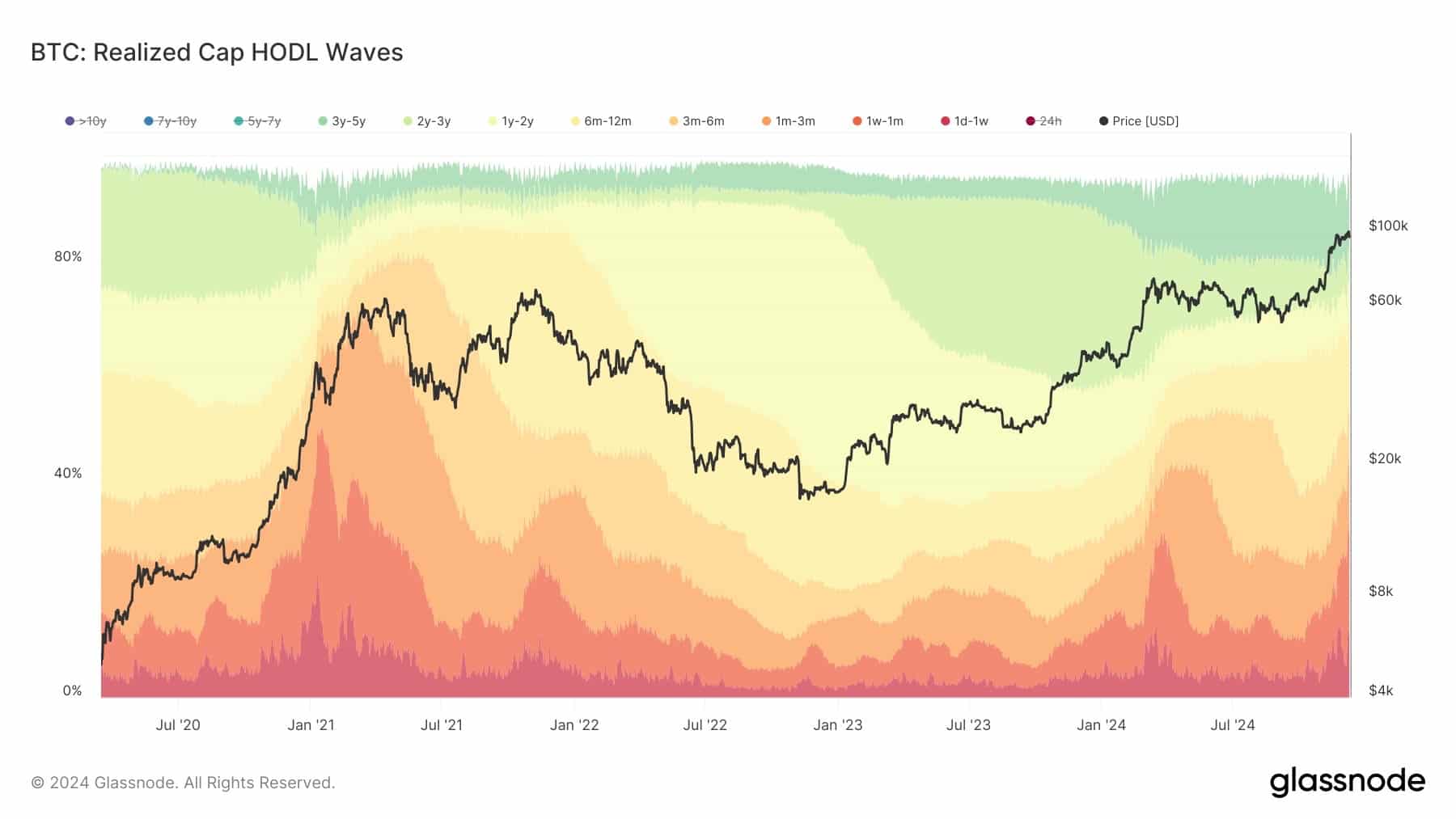

Knowledge from Glassnode revealed that long-term holders of Bitcoin have been partaking in profit-taking actions, besides “Extremely Lengthy-Time period Holders,” who’ve held their BTC for greater than seven years.

Lengthy-term holders are outlined as addresses which have held BTC for over six months (180 days).

As of the newest information, the proportion of BTC held by this cohort has dropped by roughly 10%, lowering from over 60% to round 50%.

The altering distribution of BTC possession is shaping the market’s development. Usually, throughout early phases, long-term and ultra-long-term holders management a big share of BTC.

Nonetheless, as promoting strain will increase, this steadiness shifts.

This shift is presently empowering short-term holders with better affect out there.

Nonetheless, till short-term holders account for 70-80% of the market, which has not but occurred, the market stays in its early to mid-range part.

In the course of the peak of the final bull run, the distribution of BTC between short-term and long-term holders was roughly 20% to 80%, respectively.

In distinction, present information from Coinglass exhibits a extra balanced market, with either side holding round 50%.

Lengthy-term holders shedding curiosity in BTC

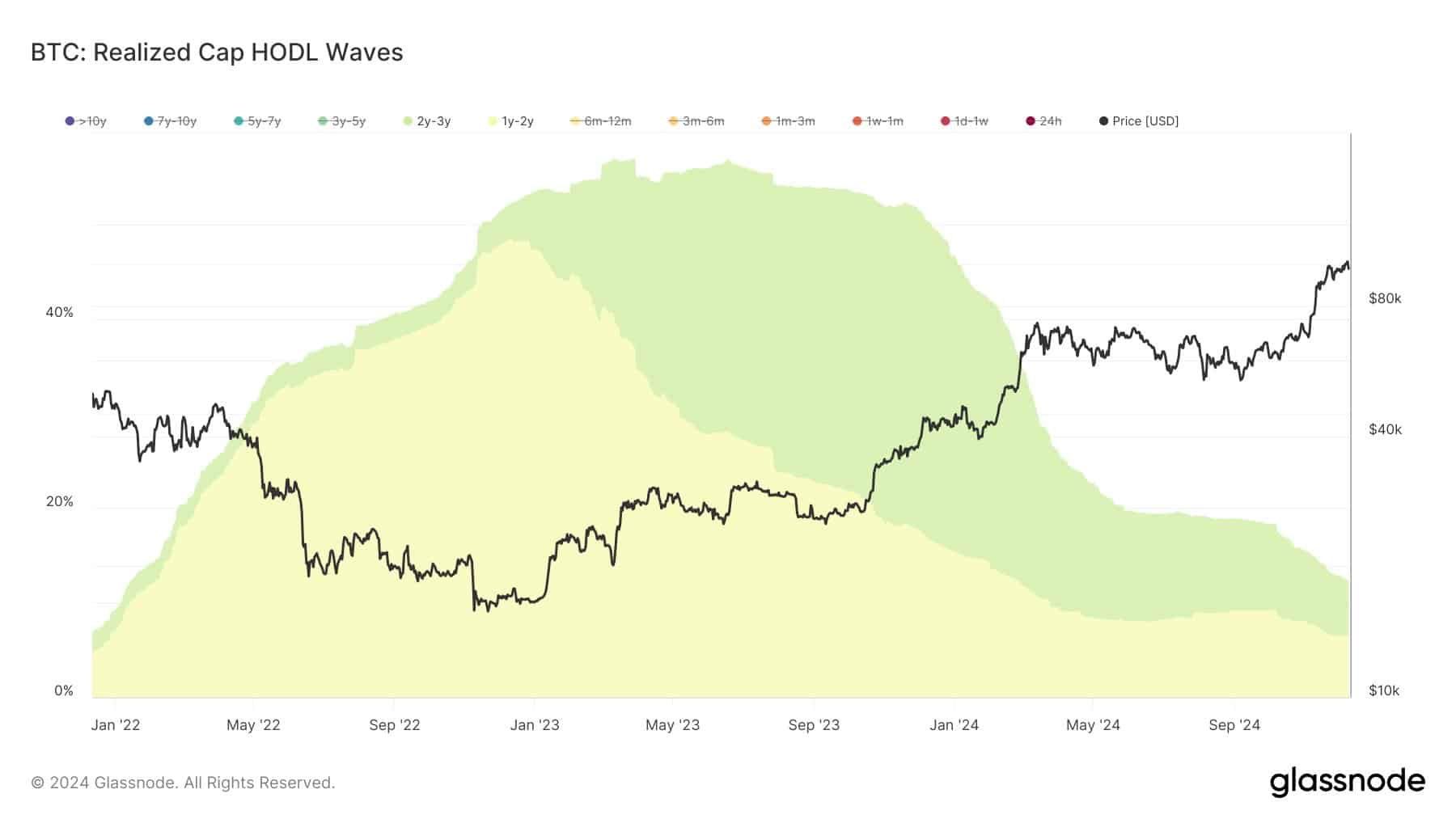

Lengthy-term holders of Bitcoin are shedding curiosity at a quicker fee than anticipated.

This pattern has been noticed throughout distinct cohorts of long-term holders: those that have held BTC for 1–2 years, 2–3 years, and three–5 years, significantly after accumulating through the bear market between June and November.

These cohorts have begun considerably downsizing their holdings, as indicated by the current tendencies out there chart.

Particularly, the 3-5 12 months cohort, which peaked at 15.3%, has since decreased to 13.9%. If promoting strain intensifies, BTC may see additional declines.

Not like earlier market cycles, the introduction of Bitcoin spot ETFs has added a brand new dynamic to the market.

Institutional buyers, who’ve been accumulating BTC over the previous months, are actually beginning to promote, with their holdings dropping from 25% to 16%.

Nonetheless, there may be nonetheless potential for a market rally. Since long-term holders haven’t but offered in massive portions, it suggests they might be ready for costs to rise additional earlier than taking earnings.

Low demand for BTC places strain on value

Latest information from Hyblock exhibits a 50% bid imbalance in 1-2% of the order guide depth, as indicated by vertical dots on the chart.

This imbalance suggests the market is presently in a promote part, characterised by low demand (fewer consumers) and excessive provide (extra sellers), which places downward strain on Bitcoin’s value.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Concurrently, information from CryptoQuant reveals a rise within the quantity of BTC obtainable on exchanges, with roughly 22,289 BTC being deposited.

This has brought on a gradual rise in Change Netflow, additional contributing to the rising provide of BTC on exchanges.