Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin dipped to $103,450 yesterday, wiping out about $1 billion in leveraged bets over the previous 24 hours. Many merchants hurried to promote, however the fall was short-lived.

Associated Studying

Bitcoin discovered its footing and climbed again to $104,400 by the point this report was filed. Based on a latest evaluation by crypto researcher Klarch, this pullback was anticipated and may simply be a pit cease earlier than one other run to contemporary highs.

Recurring Cycle Patterns

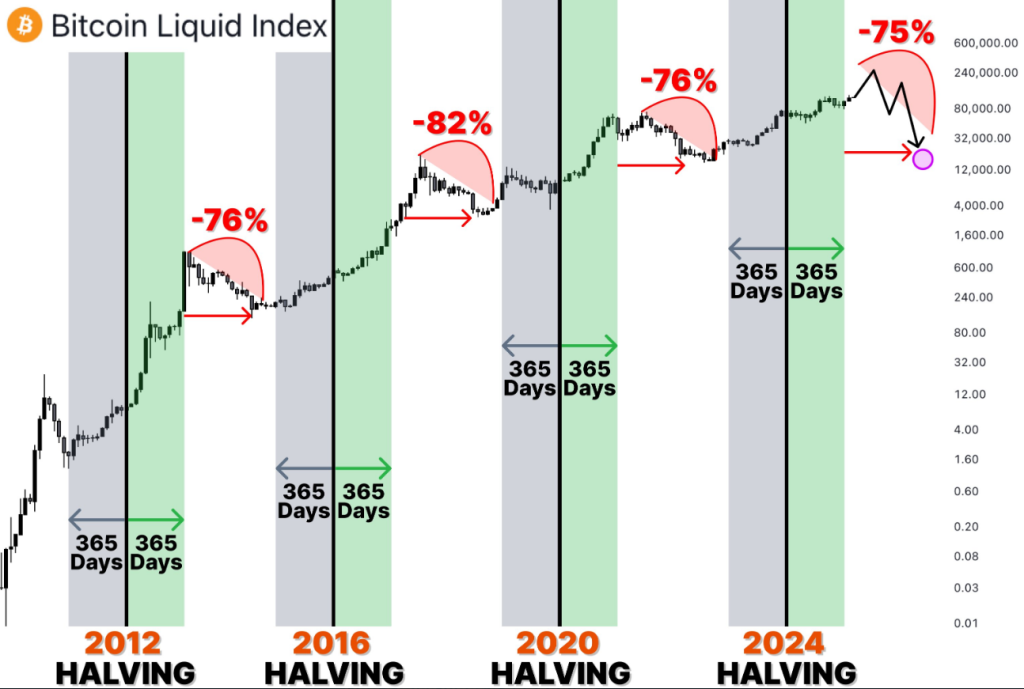

Based mostly on examination by Klarch, Bitcoin tends to observe a well-known path after every halving. One yr after the 2016 halving, it rose about 280%. After the 2020 halving, it jumped roughly 550% in 367 days.

Proper now, Bitcoin has solely moved up round 70% within the 416 days for the reason that final halving. Klarch factors out that in previous cycles, these numbers picked up velocity after a sluggish begin. So, he says, there’s nonetheless room for extra development.

Bitcoin cycles are similar…

– In 2016, $BTC grew by 280%, three hundred and sixty five days after Halving

– In 2020, $BTC grew by 550%, 367 days after Halving

– Now, 416 days post-Halving, $BTC +70% — development forward…Historical past repeats, right here’s $BTC’s close to future🧵👇 pic.twitter.com/wshX4egwbC

— Klarck (@0xklarck) June 5, 2025

These percentages matter as a result of they trace at what may come subsequent. If Bitcoin’s historical past repeats, one of the best positive aspects might be simply across the nook. Data from blockchain knowledge helps this too.

For instance, buying and selling quantity and on-chain addresses hit new highs in latest weeks. That matches the sample Klarch described—after the preliminary rise, there’s usually an even bigger rally.

Indicators Of The Subsequent Surge

Bitcoin set a record of $112,100 on January 20, then edged as much as $111,980 on Might 22. Fairly than signaling an finish, Klarch believes these milestones mark the beginning of a better peak. He sees these strikes as a part of the cycle’s build-up, not its climax. Based mostly on his chart work, every cycle has a number of tops earlier than it lastly tops out.

Klarch didn’t supply an actual date for a brand new peak, however he did counsel that Bitcoin has not but hit its ceiling. He notes {that a} collection of all-time highs often occurs when sentiment continues to be turning constructive. As soon as extra merchants really feel FOMO, the value usually accelerates quickly.

Associated Studying

Demand And Liquidity Driving Value

Liquidity pouring into the crypto market has been a key speaking level. Klarch says that regular buys from establishments and US Bitcoin spot ETFs have made Bitcoin scarcer on exchanges.

Michael Saylor’s Strategy and different massive cash gamers maintain shopping for, which pushes provide decrease. Based mostly on figures introduced by Klarch, this pattern may raise Bitcoin to round $180,000—an increase of about 75% from present ranges.

VanEck, an asset supervisor, has shared an identical goal. That makes Klarch’s outlook really feel much less like a lone voice. If massive funds maintain transferring in and retail curiosity stays excessive, Bitcoin’s value may keep on the upswing. Nonetheless, any pause in ETF inflows or a sudden shift in international markets may change that story.

Featured picture from Imagen, chart from TradingView