- BTC has gained by 4.0% over the previous week.

- Do these 4 completely different cyclical indicators Bitcoin’s market high?

Over the previous day, Bitcoin [BTC] noticed a robust uptick to hit $88.7k breaking out of the consolidation. Nevertheless, since then, the Crypto has retraced to $86k reflecting heightened volatility.

These prevailing market circumstances have left stakeholders speculating over a possible market high. Inasmuch, CryptoQuant analyst Burak Kesmeci prompt 4 potential on-chain metrics signaling a possible finish of Bitcoin’s bull market.

Do these 4 cyclicals sign Bitcoin’s market high?

Supply: Cryptoquant

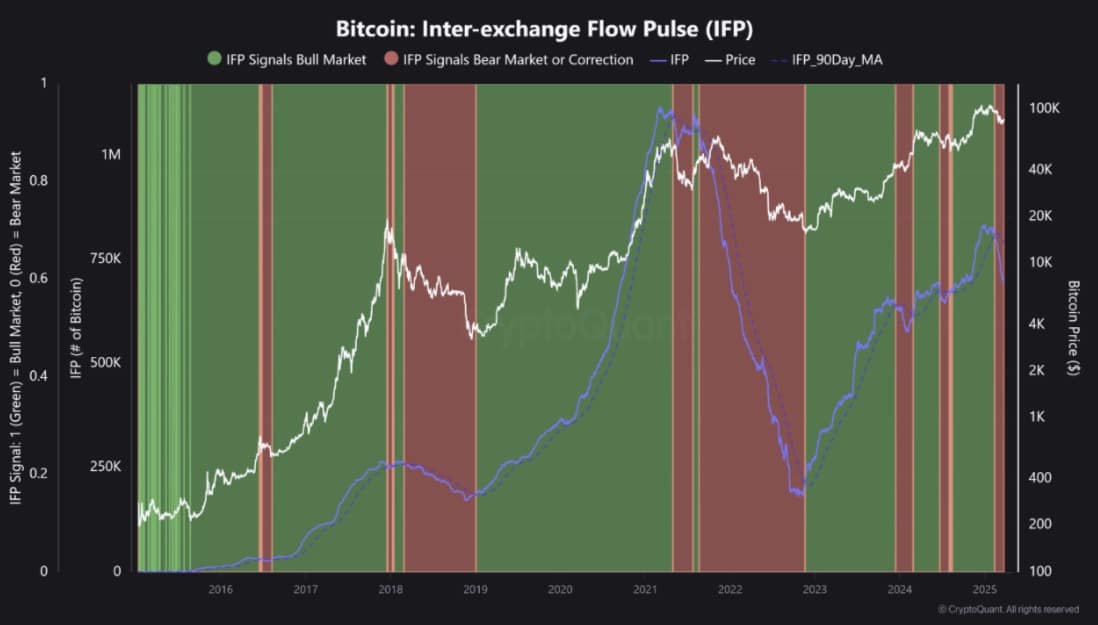

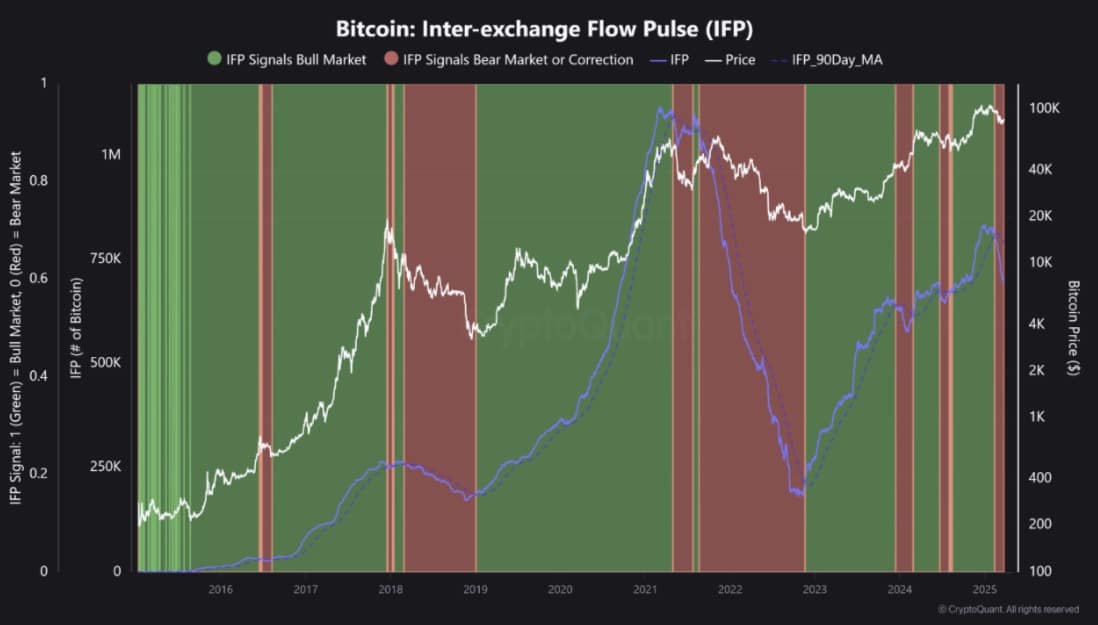

CryptoQuant highlights 4 indicators suggesting a possible market high, together with Bitcoin’s Inter-Trade Move Pulse (IFP), which stays bearish.

On the time of writing, IFP stood at 696k, under the SMA90 of 794k. So long as IFP stays underneath the SMA90, market corrections are prone to persist.

As an illustration, between December 2023 and February 2024, IFP stayed under SMA90. When it crossed above, BTC surged to $73k.

The Bitcoin CQ Bull & Bear Market Cycle Indicator additionally indicators bearishness. Throughout this uptrend, it has beforehand displayed weak bearish patterns, much like the present indicators.

At press time, DMA365 was at 0.18, whereas DMA30 stood at -0.16. With DMA30 under DMA365, it signifies important bearish momentum. A bullish development shift can’t be confirmed till DMA30 crosses above DMA365.

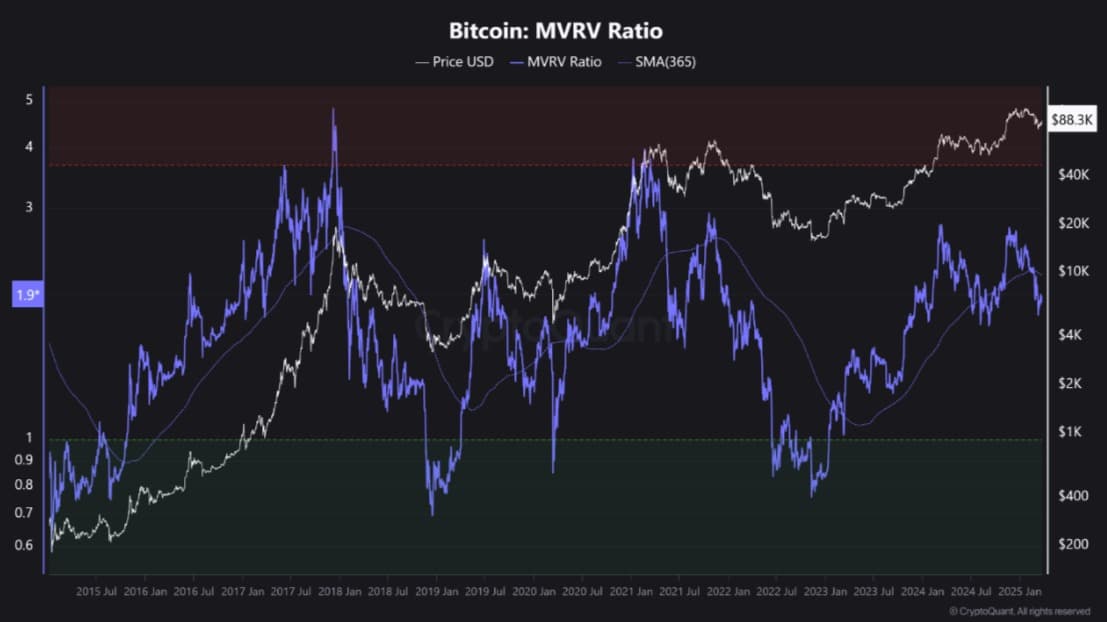

Thirdly, Bitcoin’s MVRV Rating remained under its SMA365, indicating a possible continuation of the correction. Traditionally, when the MVRV rating stays underneath the 365-day transferring common (SMA365), promoting stress tends to extend.

Within the present bull cycle, Bitcoin final dropped under this help degree in the course of the August 5, 2024, carry commerce disaster. After the disaster ended, the MVRV rating reclaimed SMA365, signaling a restoration.

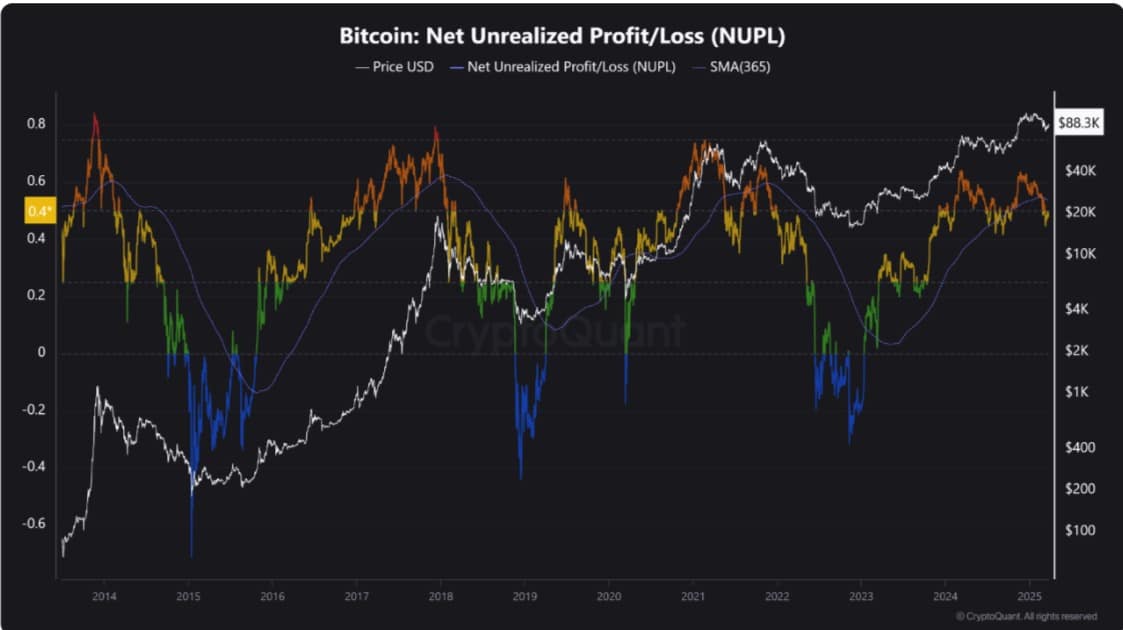

Lastly, Bitcoin’s NUPL remained under its SMA365, indicating ongoing bearishness. Whereas NUPL alone can not affirm the top of the bullish development, a restoration would require NUPL to climb above SMA365.

As of this writing, NUPL was at 0.49, whereas SMA365 stood at 0.53. With out an upward flip, corrections are prone to persist.

Collectively, these 4 metrics recommend Bitcoin is going through important turbulence within the quick to mid-term. Nevertheless, none point out an overheated market or a cycle-top situation. This case mirrors the carry commerce disaster of August 5, 2024, when macroeconomic circumstances drove Bitcoin decrease.

Trump’s tariff insurance policies and rising uncertainty have equally weighed on macro indices and Bitcoin. The same sample was seen a 12 months in the past—as soon as macro pressures eased, Bitcoin staged a restoration.

If historical past repeats, enhancing macroeconomic circumstances may pave the way in which for a sustained Bitcoin rebound.

What BTC charts recommend

Whereas the CryptoQuant evaluation exhibits a worrying development, AMBCrypto’s evaluation means that the market high just isn’t but and key gamers stay bullish.

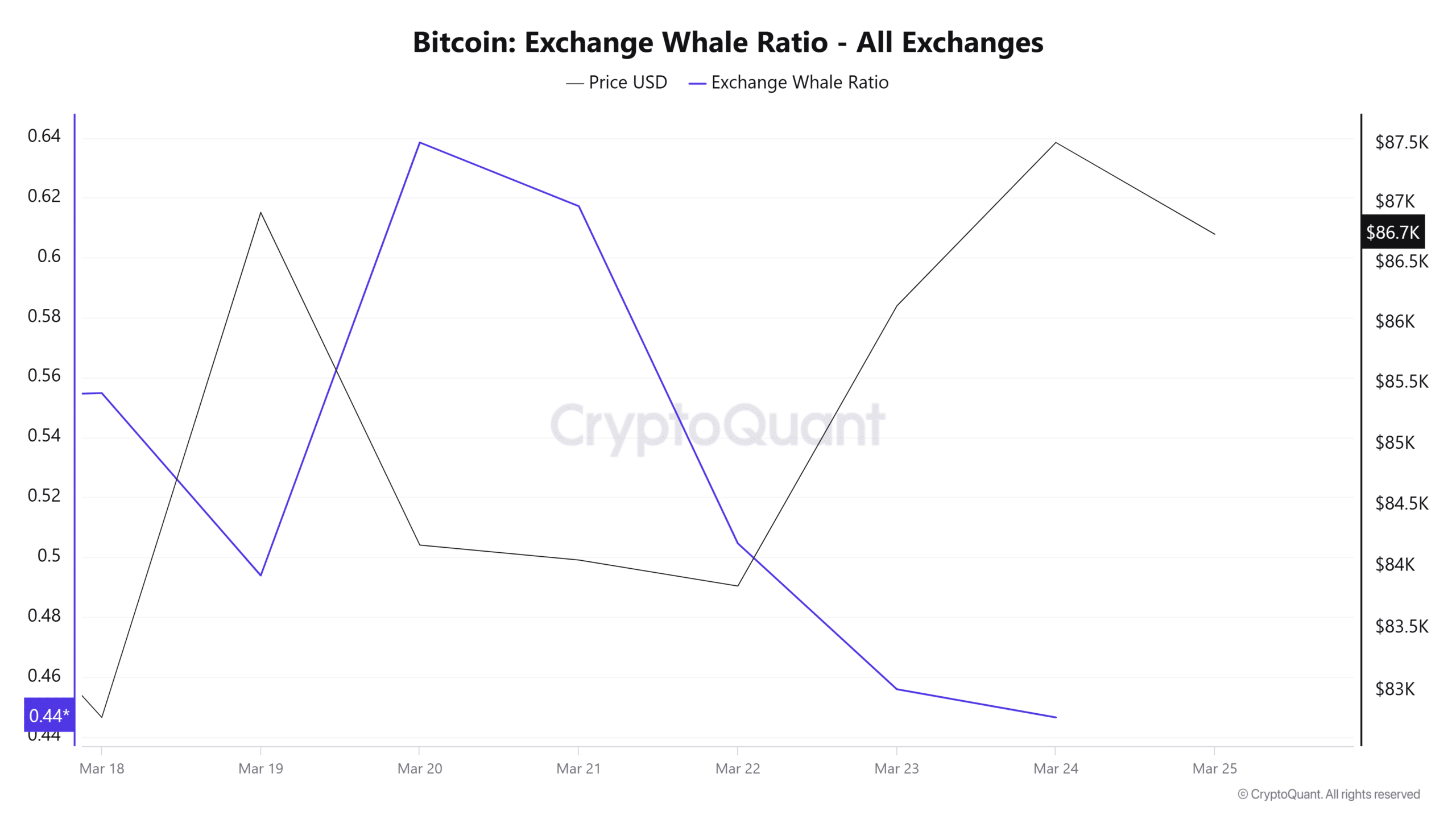

For starters, Bitcoin whales stay bullish as evidenced by a declining Whale change ratio. When this sees a pointy dip, it means that whale are holding their positions and should not transferring BTC to exchanges to promote.

This displays optimism with giant entities anticipating costs to rise additional.

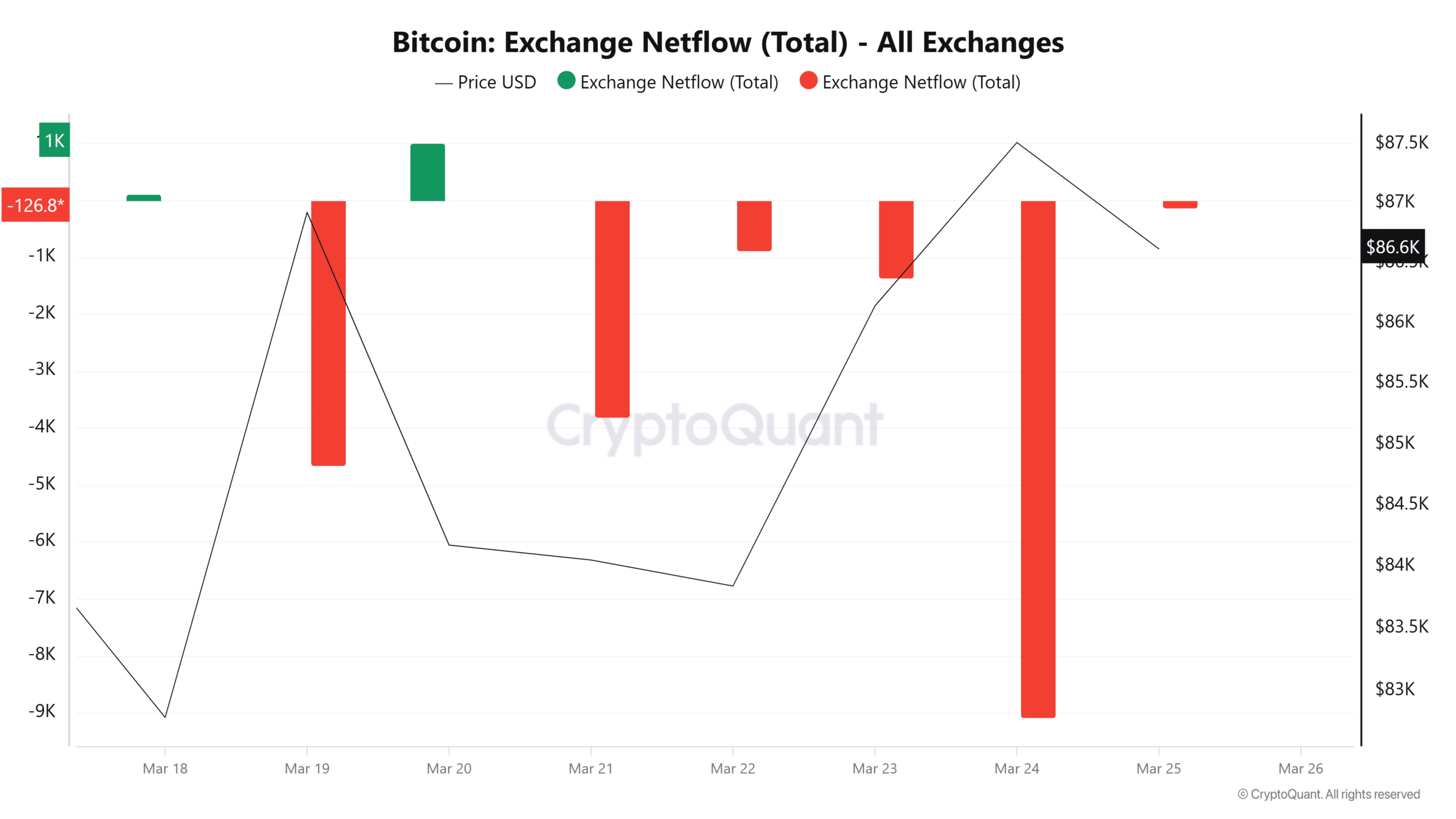

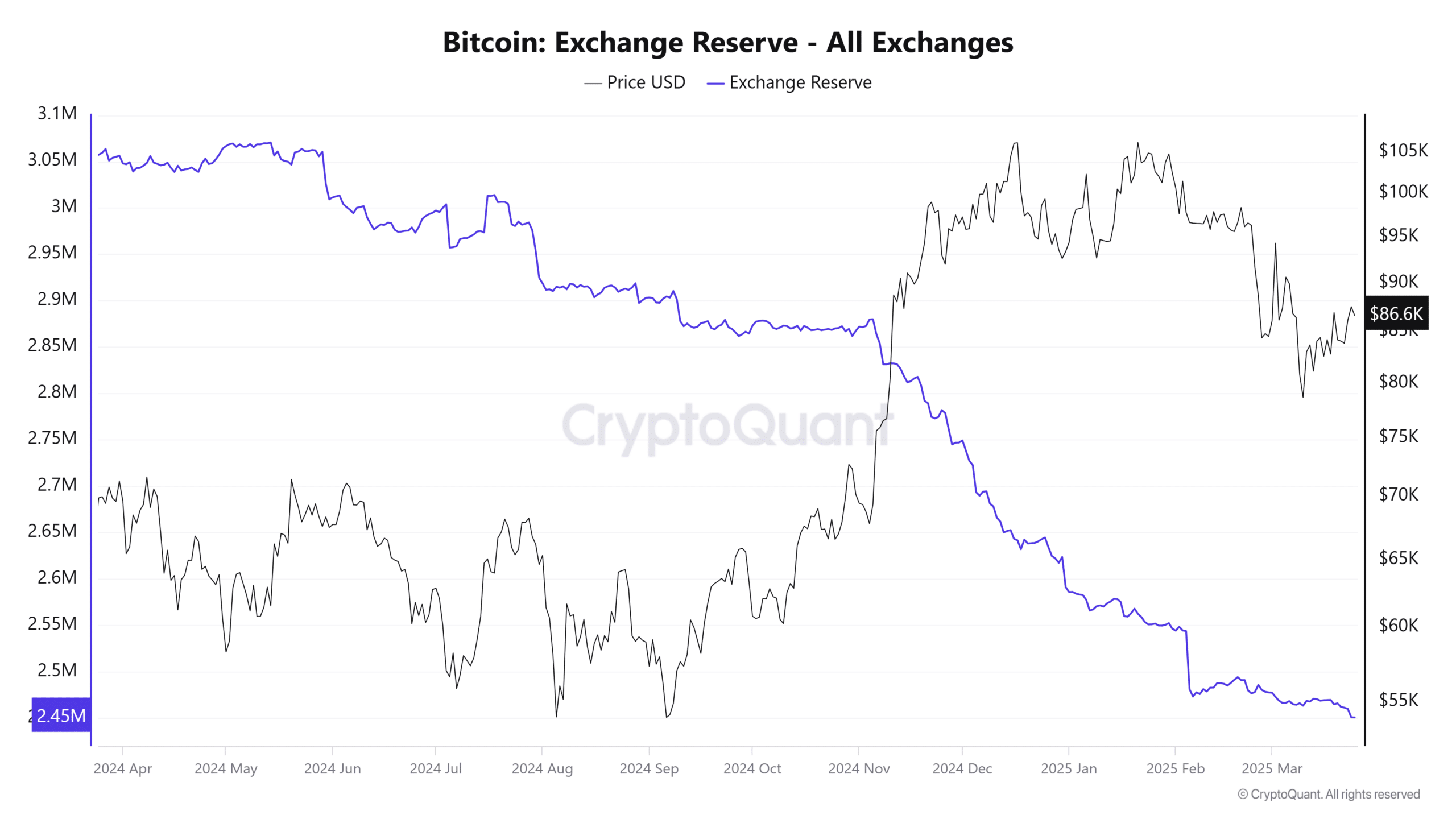

This development is perceived throughout market individuals. We are able to see this as Bitcoin’s change netflow has remained damaging for 5 consecutive days.

A five-day run of damaging netflow means that patrons have taken maintain of the market, with BTC experiencing a surge in accumulating addresses. If patrons really feel the market is nearing the highest, they’ll behave otherwise.

The elevated outflow has led Bitcoin’s change reserves to drop to a yearly low. This decline suggests fewer transfers into exchanges, as beforehand famous. So long as change inflows stay low, costs are anticipated to get well when market circumstances enhance.

In abstract, whereas some indicators level to a possible finish of the bull market, we aren’t there but. There’s nonetheless room for development, with each whales and retail buyers sustaining a bullish outlook.

If this sentiment persists, BTC may reclaim the $90k degree. Nevertheless, if a correction happens, BTC would possibly fall to $85,222.