- Ethereum leads in social dominance and growth exercise, sustaining a stronger developer presence.

- Each Ethereum and Solana present related whale curiosity, whereas Solana has decrease liquidation volumes.

With bullish sentiment from each crowd and good cash indicators, Solana [SOL] exhibits important upward momentum, sparking curiosity in whether or not it may rival Ethereum [ETH] as a number one platform for decentralized functions (dApps).

At press time, Ethereum trades at $2,680.82, marking a 2.17% improve over the previous 24 hours.

In the meantime, Solana was priced at $178.27, reflecting a 1.43% decline throughout the identical interval. Analyzing key metrics—social dominance, growth exercise, whale exercise, and liquidation information—highlights every community’s distinct place and strengths.

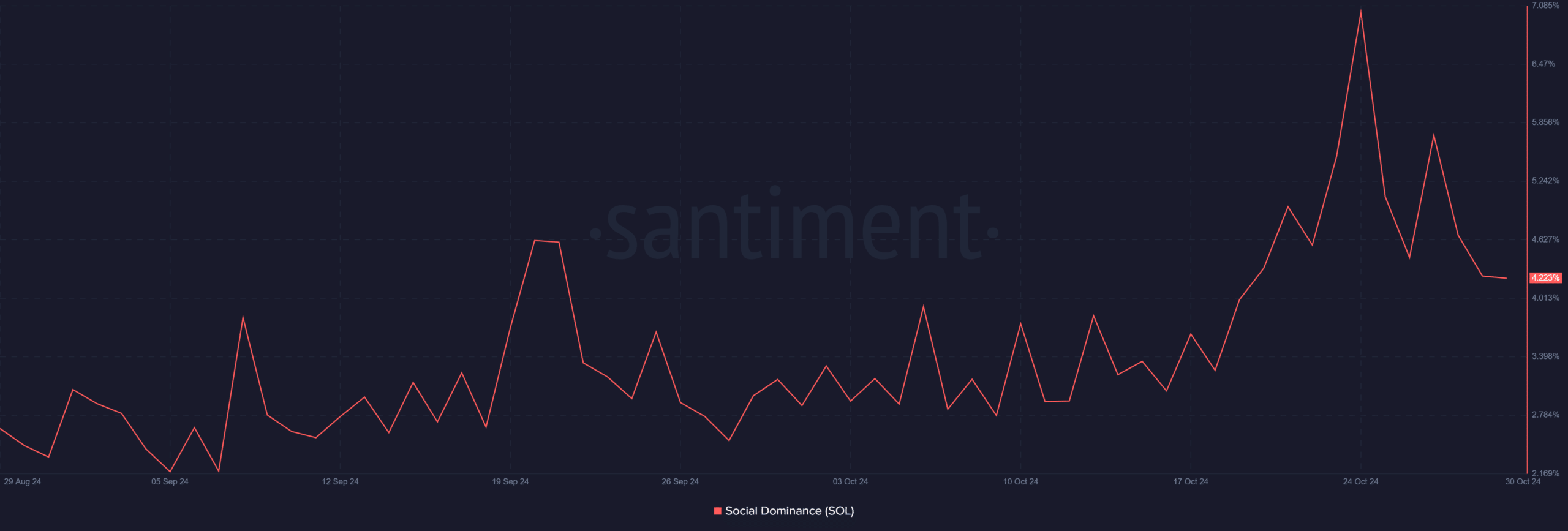

Social dominance: Does Ethereum nonetheless lead the dialog?

Ethereum instructions larger social dominance than Solana. Over the previous month, Ethereum’s social presence persistently peaked above 6%, whereas Solana’s highest level reached round 4.22%.

This metric measures the share of discussions and mentions on social platforms, reflecting the group’s curiosity ranges.

Consequently, Ethereum dominates on-line conversations greater than Solana. Nevertheless, Solana’s rising person base signifies upward momentum in its social presence, exhibiting rising consideration across the community.

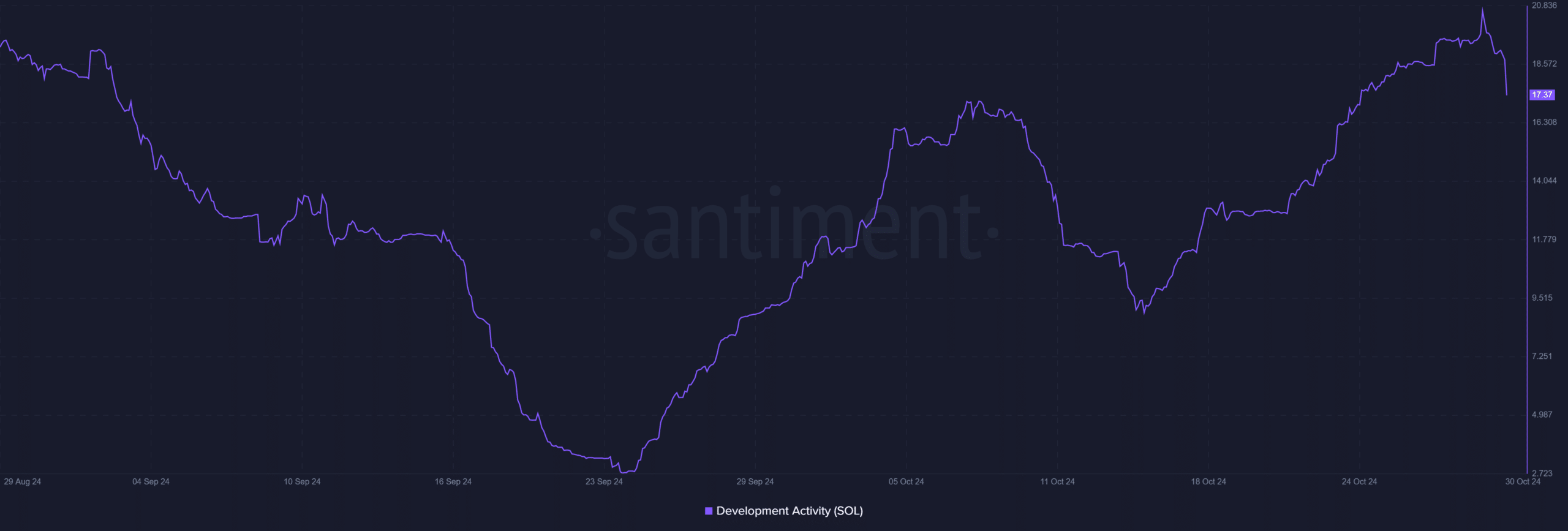

Improvement exercise: Is SOL innovation rising sooner?

Ethereum at the moment leads in growth exercise, with a rating of 25.5 in comparison with Solana’s 17.37. Improvement exercise displays code updates, venture contributions, and ongoing upkeep, exhibiting the well being and development of every ecosystem.

Due to this fact, Ethereum advantages from a extremely lively developer group centered on innovation and enhancements.

Moreover, Solana’s growth exercise exhibits a optimistic development, indicating growing developer engagement. Nevertheless, it nonetheless trails Ethereum in absolute phrases, underscoring Ethereum’s longstanding developer dominance.

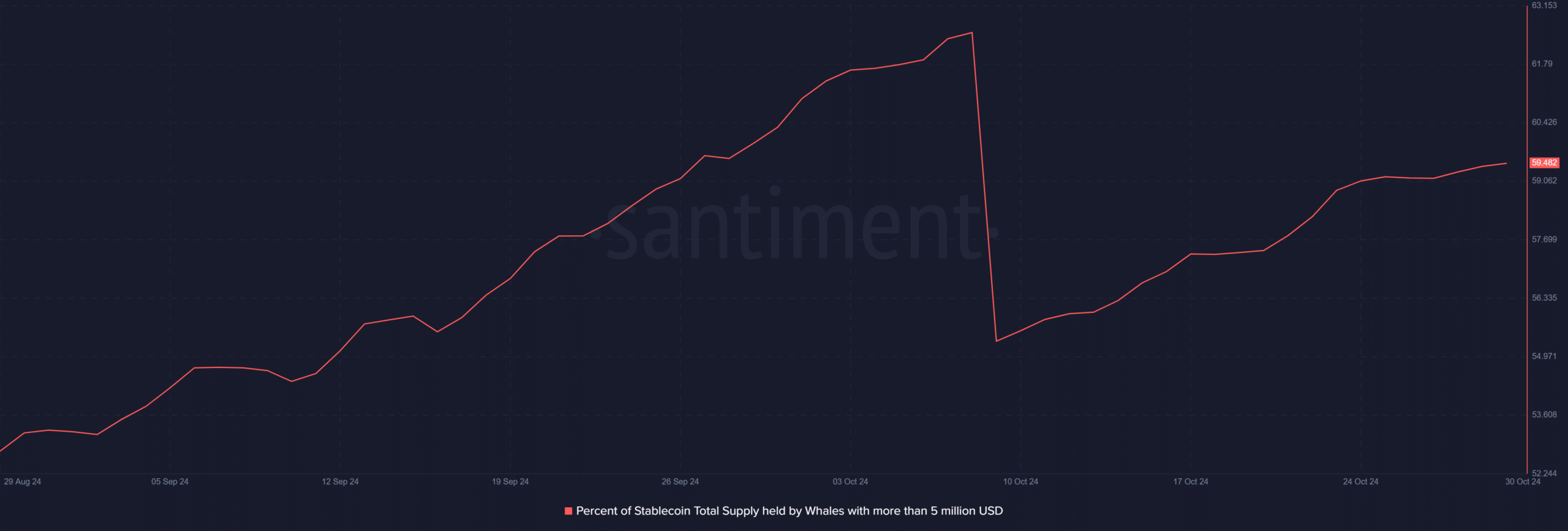

Whale exercise: Does SOL entice the larger traders?

Each Ethereum and Solana present important whale exercise, with every community’s high holders controlling roughly 59.48% of their stablecoin provide.

This excessive focus amongst massive holders displays robust curiosity from main traders throughout each ecosystems.

Consequently, whale curiosity is equally distinguished in Ethereum and Solana, suggesting that large-scale traders view each networks as worthwhile belongings throughout the blockchain panorama.

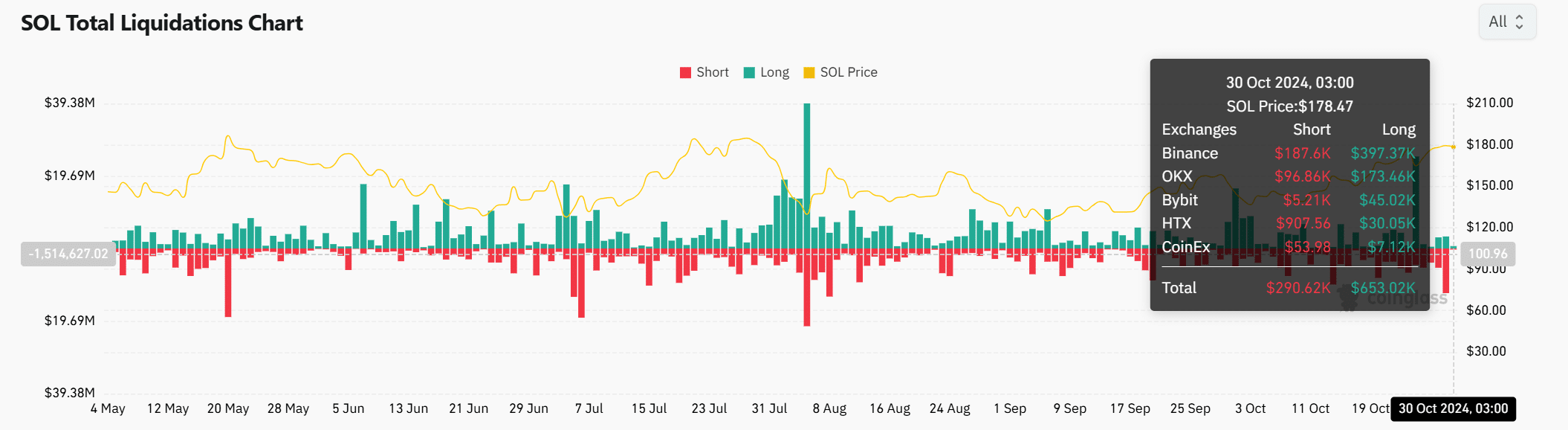

Liquidation information: Which community faces extra volatility?

Liquidation information gives perception into leverage-driven exercise. At present, Solana has skilled $653K in lengthy liquidations and $290K in shorts. By comparability, Ethereum noticed larger liquidation volumes, with $1.93M in lengthy liquidations and $3.94M in shorts.

Due to this fact, Ethereum’s larger leveraged buying and selling exercise suggests it might encounter extra frequent value swings, whereas Solana’s decrease liquidation ranges suggest comparatively much less volatility underneath sure circumstances.

Is your portfolio inexperienced? Try the SOL Profit Calculator

Conclusion

Throughout social dominance, growth exercise, whale involvement, and liquidation information, Ethereum maintains an edge in a number of metrics. Nevertheless, Solana exhibits concentrated funding from massive holders and growing developer curiosity, signaling potential development.

Whereas Ethereum’s broader person and developer base at the moment reinforces its dominance, Solana’s upward trajectory makes it a aggressive pressure within the blockchain area.