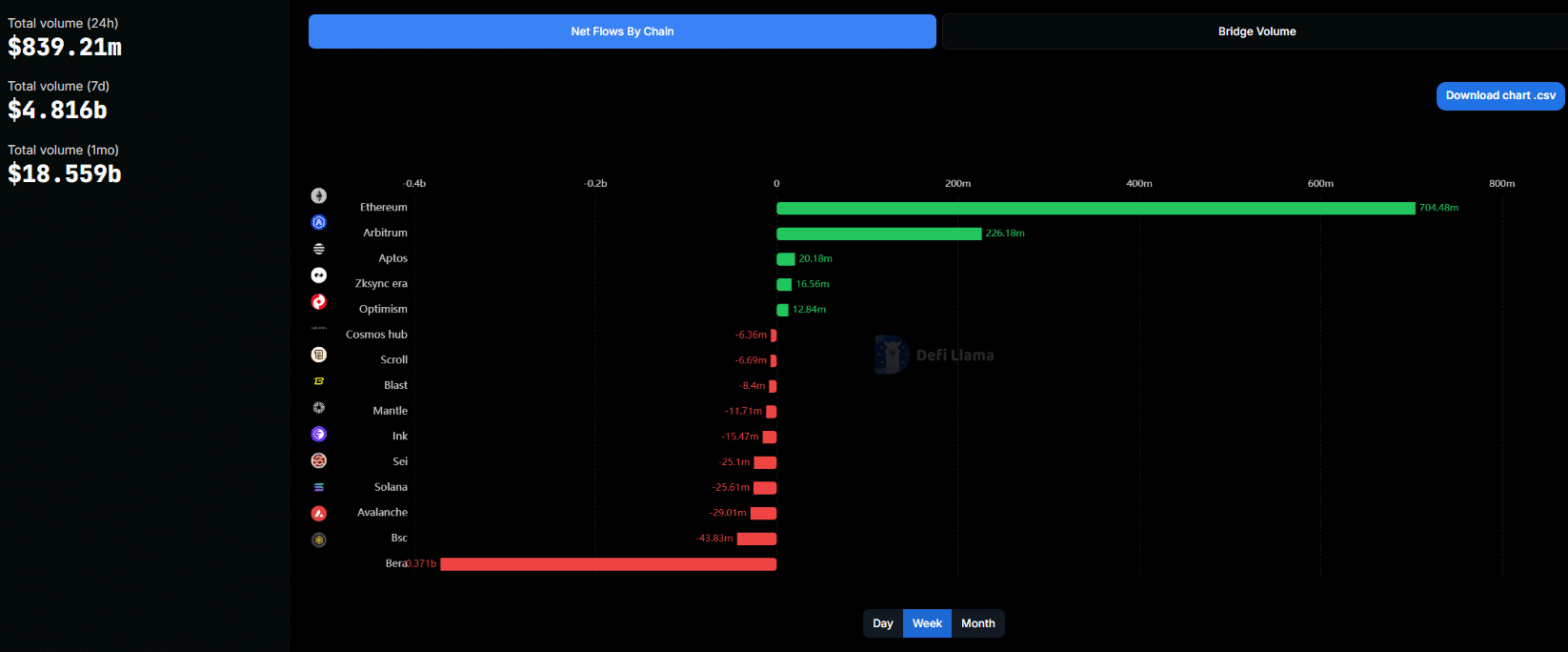

- Ethereum captured 85% of complete weekly inflows, reinforcing its dominance in DeFi liquidity.

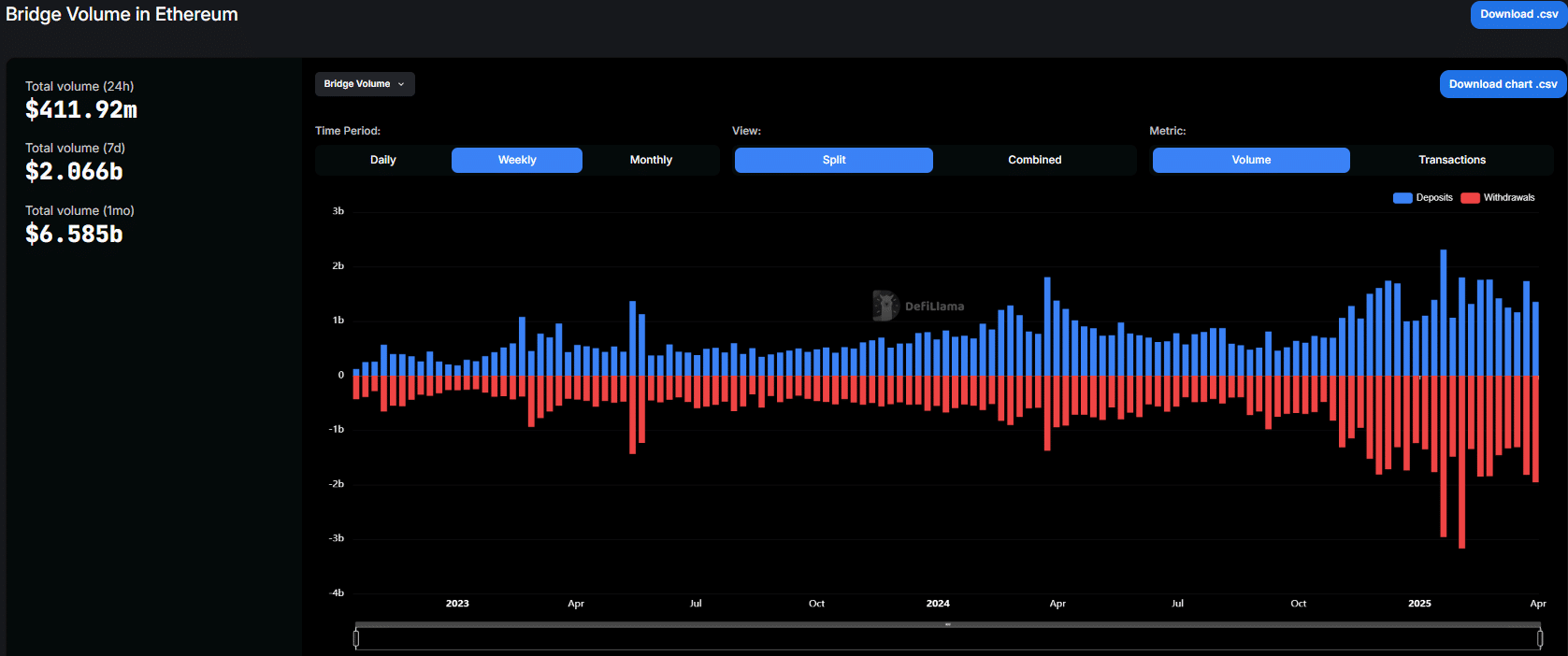

- Bridge quantity knowledge reveals constant weekly outflows exceeding deposits throughout Ethereum.

Ethereum [ETH] has as soon as once more asserted itself because the undisputed chief in blockchain capital inflows—and by a large margin.

On the time of writing, DeFiLlama’s newest data makes the image unmistakably clear.

Ethereum attracted a staggering $704.48 million in web inflows this week, dwarfing all different networks and signaling a deepening desire amongst capital allocators.

Naturally, the divergence doesn’t cease there. Arbitrum [ARB] trailed with $226.18 million, a distant second and simply 27% of Ethereum’s consumption.

In the meantime, smaller inflows trickled into Aptos [APT] ($20.18M), zkSync Era [ZK] ($16.56M), and Optimism [OP] ($12.84M)—all mixed barely grazing 8% of Ethereum’s complete.

When the tide turns, it leaves others behind

On the flip facet, losses have been simply as pronounced.

Binance Sensible Chain (BSC) led the outflow chart with -$43.83 million, adopted by Avalanche [AVAX] (-$29M) and Solana [SOL] (-$25M).

Taken collectively, these exits reveal mounting strain on various Layer-1 ecosystems, significantly as capital consolidates round high-activity, high-trust platforms.

After all, this capital migration isn’t occurring in a vacuum.

Ethereum alone accounted for over 85% of all constructive web inflows this week, showcasing its gravitational pull in a market more and more risk-aware.

Having mentioned that, it’s not simply inflows doing the speaking. Outflows, too, paint a revealing portrait.

Bridge knowledge provides one other layer of context. For the week ending on the thirtieth of March, Ethereum recorded $1.957 billion in withdrawals towards $1.353 billion in deposits, netting a $603 million outflow.

For instance, again on the nineteenth of January, Ethereum logged almost $2.96 billion in weekly withdrawals, the very best within the present dataset.

Nonetheless, even amid this exodus, Ethereum’s magnetism for contemporary capital stays unmatched. This seeming contradiction could mirror capital rotation throughout the ecosystem.

The stream is aware of earlier than the worth does

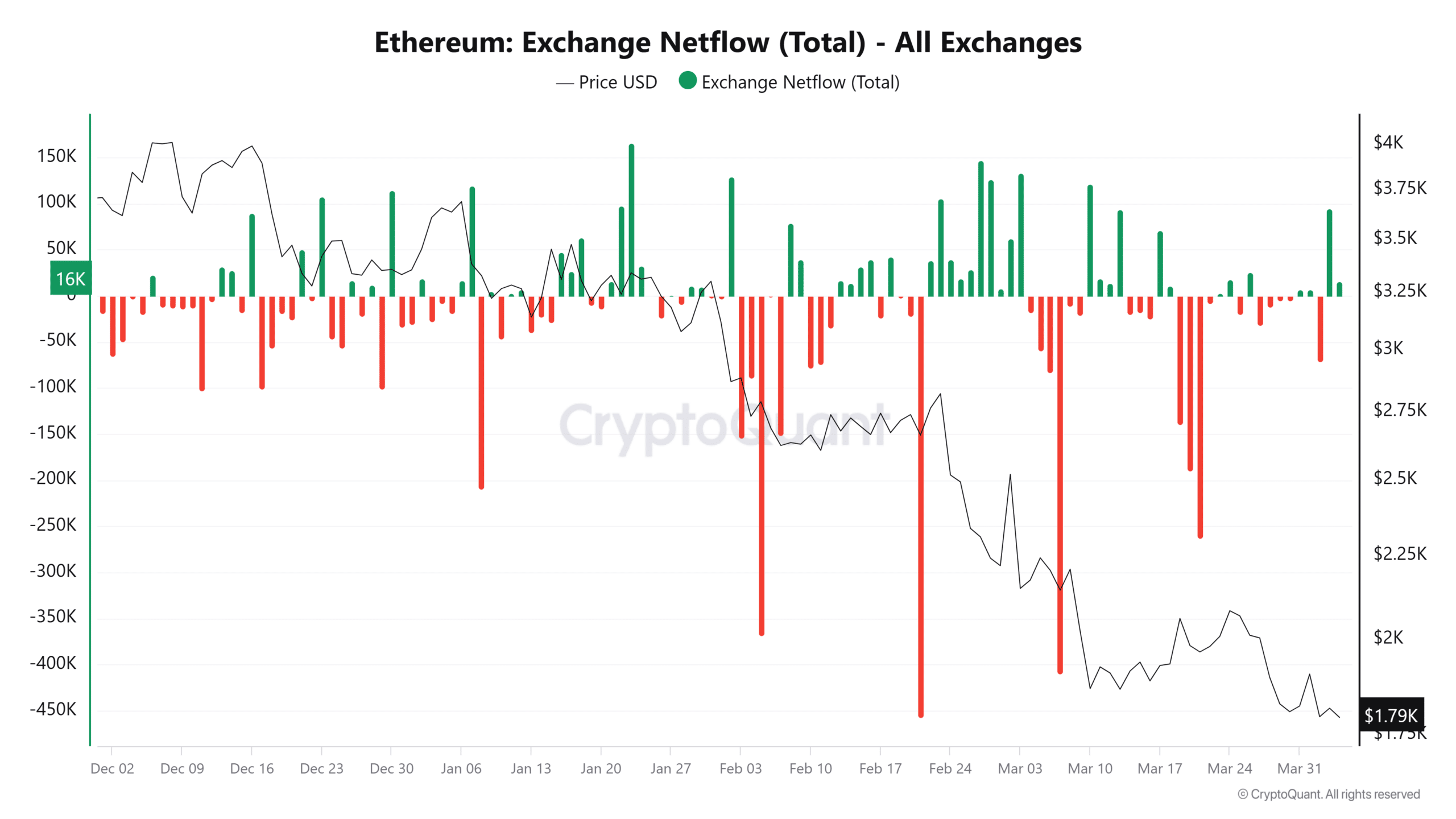

In truth, each day netflow conduct offers deeper context.

Between December 2024 and April 2025, Ethereum’s worth slid by 50.6%, tumbling from $3,630 to $1,794.

On the eighth of January, ETH plunged to $3,326 as 208K ETH exited exchanges—signaling panic. In contrast, the twenty third of February noticed a $2,819 rebound alongside a 105K ETH influx, hinting at strategic accumulation.

Seemingly, it reinforces a well-recognized rhythm that inflows and outflows don’t simply comply with worth; they usually precede it.

On high of that, in late March, Vitalik Buterin unveiled a forward-looking “multi-proof” Layer-2 mannequin that fuses optimistic, zero-knowledge, and TEE-based verification.

Whether or not this evolution can offset present outflow developments stays to be seen. Nonetheless, such architectural upgrades usually take time to affect sentiment. Markets are likely to reward confirmed stability over speculative enhancements.

Ethereum stays DeFi’s liquidity spine—commanding web flows, transaction quantity, and developer exercise with widening dominance.

Whereas BSC, Solana, and Avalanche bleed capital, Ethereum and Arbitrum now take in over 90% of constructive inflows, signaling a flight to trusted chains.

Outflows or not, ETH isn’t going wherever

Regardless of ongoing outflows, Ethereum’s simultaneous influx surge displays a posh however resilient ecosystem.

In a market the place belief drives capital, Ethereum nonetheless holds the crown—and with Layer-2s maturing quick, that grip appears firmer than ever. For now.