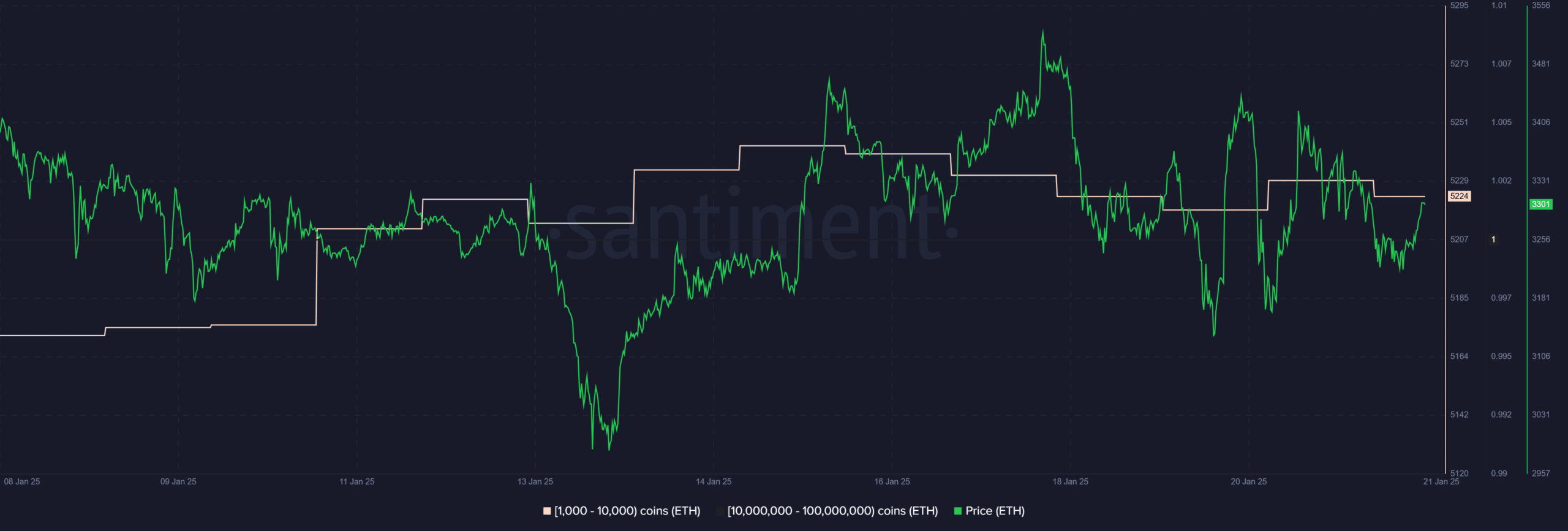

- ETH whales accrued over $1 billion price of tokens, signaling confidence in Ethereum’s future.

- Ethereum Basis’s management overhaul aimed to strengthen technical experience and ecosystem ties.

Ethereum [ETH] has skilled a comparatively delicate efficiency this yr in comparison with different main cryptocurrencies, however historic developments point out that the very best should be forward.

Because the market continues to evolve, Ethereum’s potential for progress stays robust, particularly with developments from throughout the Ethereum Basis.

Vitalik Buterin, the co-founder of Ethereum, has proposed vital adjustments that would reshape the muse and speed up the community’s evolution.

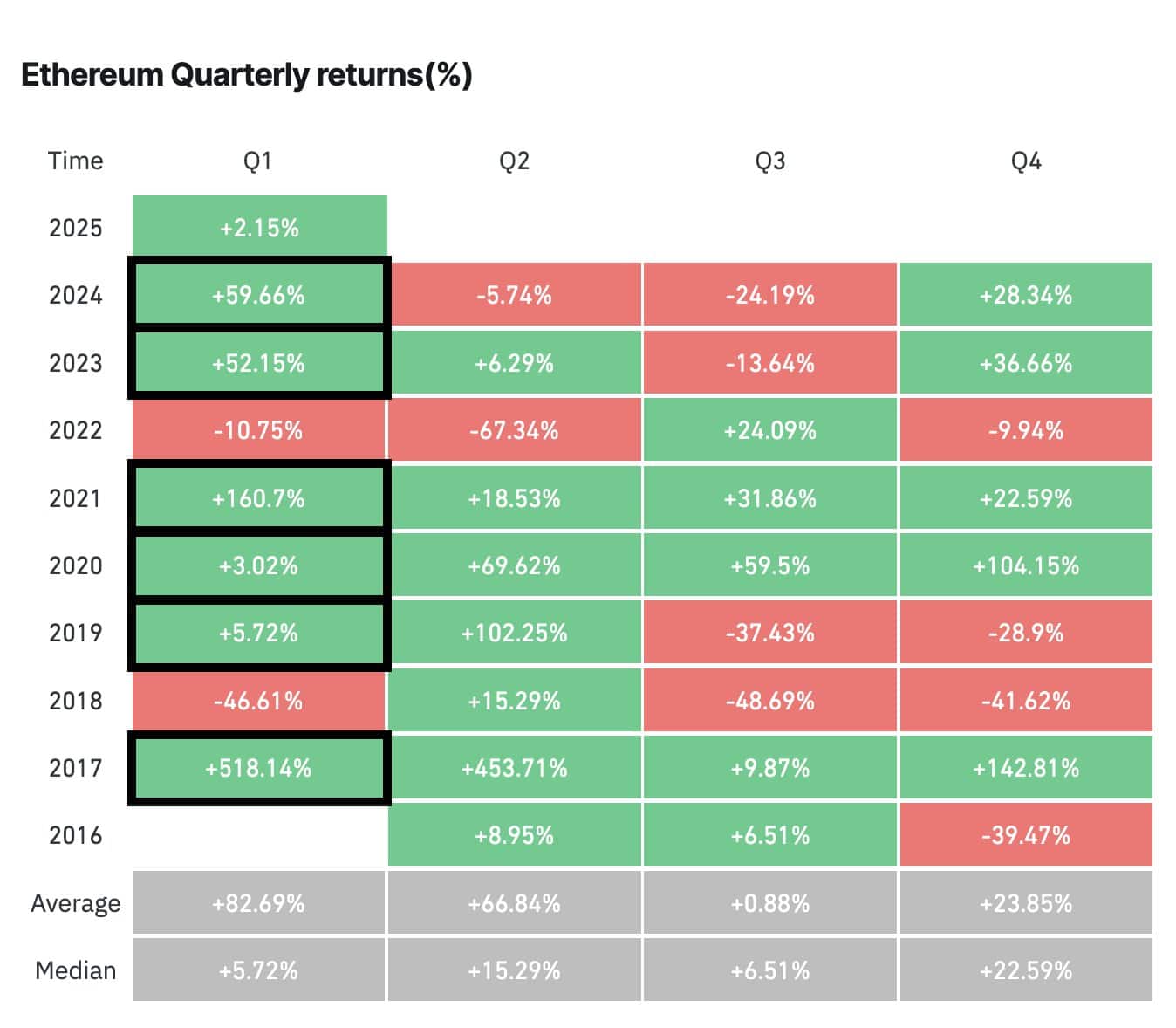

Ethereum’s historic post-halving power

Ethereum has a confirmed observe document of remarkable efficiency in the course of the first quarter of the yr.

Historic knowledge highlights that Q1 usually serves as a springboard for Ethereum’s value progress, with notable rallies occurring in previous cycles.

This seasonal development appears to be catching the eye of main market gamers, as evidenced by latest whale exercise.

Over $1 billion price of ETH has been accrued by whales in simply the previous week, signaling robust confidence within the asset’s potential.

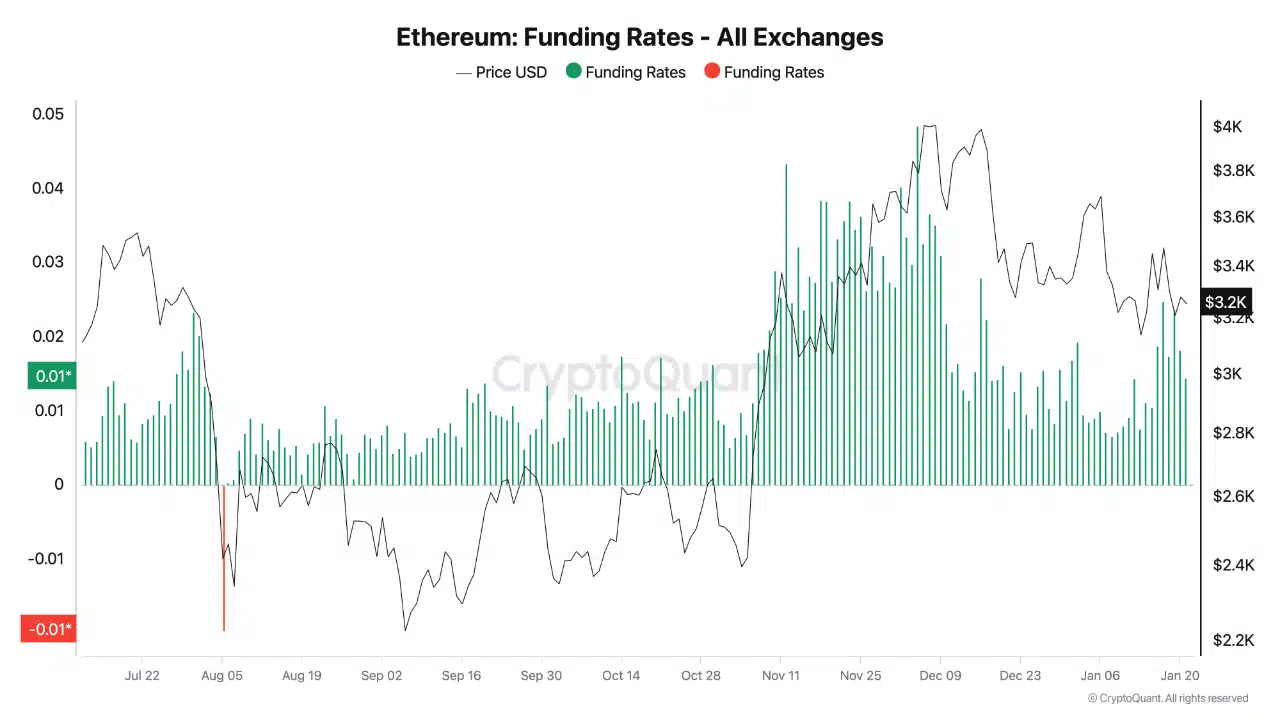

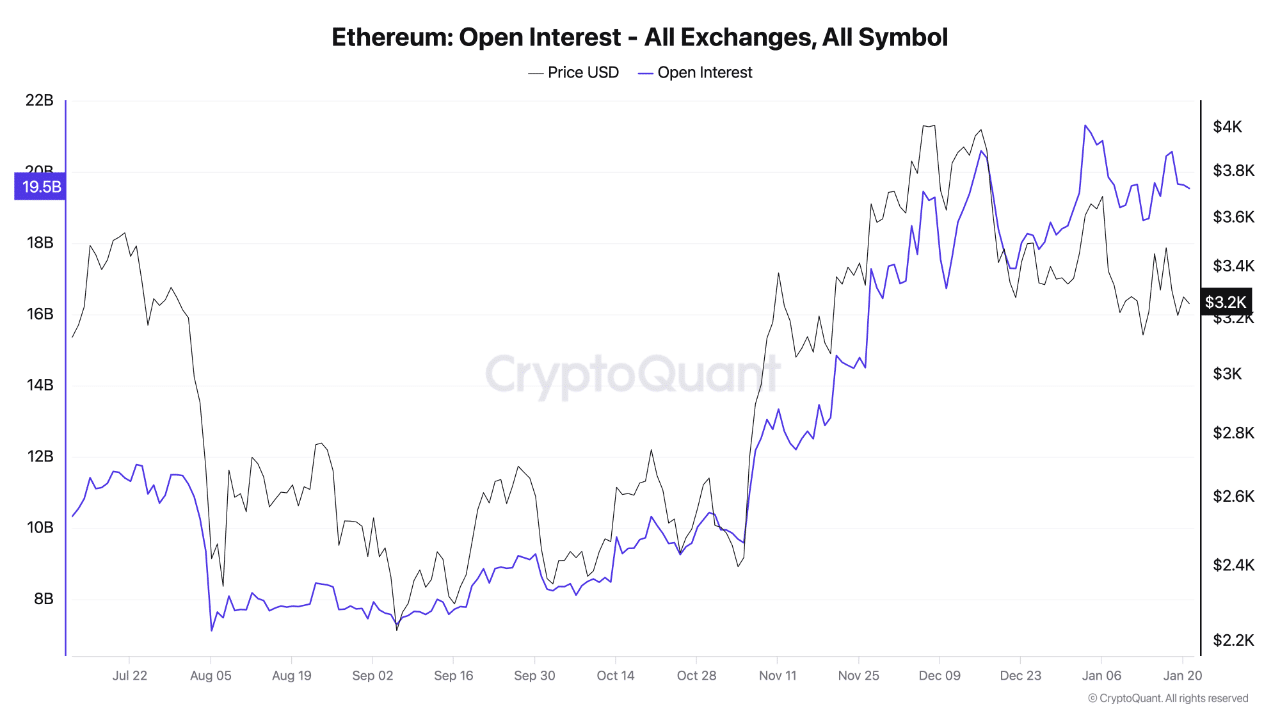

Current knowledge reveals rising Funding Charges, indicating merchants are paying premiums for lengthy positions — probably in anticipation of a possible upside.

ETH can be seeing rising Open Curiosity, suggesting extra capital is getting into leveraged positions. Nevertheless, extreme leverage can result in liquidations, inflicting short-term volatility.

If demand sustains and leverage stays managed, ETH might expertise an upside breakout, reinforcing the market’s confidence in additional value appreciation.

Key breakout ranges

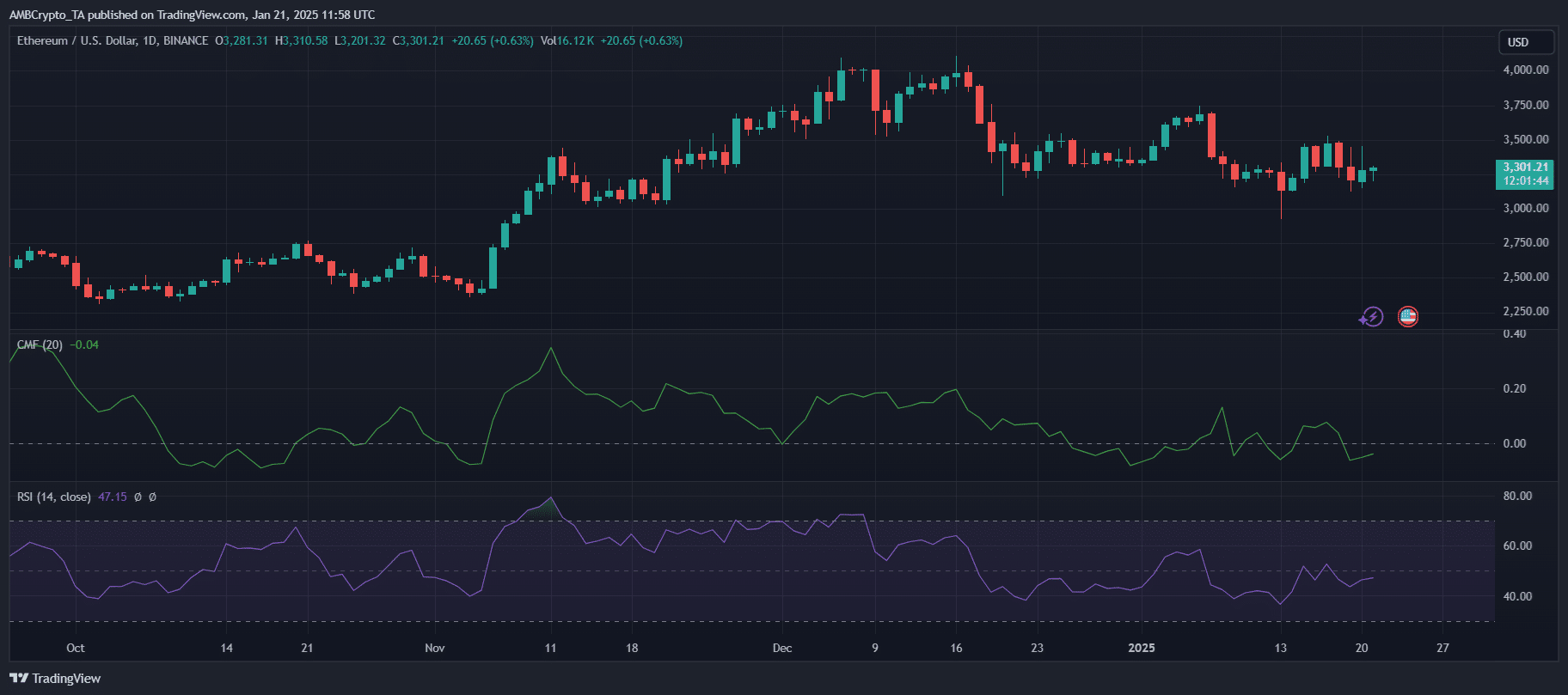

On the time of writing, Ethereum is buying and selling at $3,301, with key indicators suggesting potential volatility forward. The RSI indicators impartial momentum, whereas the CMF suggests weak capital inflows.

A decisive breakout above $3,500 might set off a powerful rise towards $3,750 and $4,000, marking vital resistance zones.

On the draw back, assist at $3,200 stays essential, with a breakdown probably exposing $3,000 and $2,750.

Bulls want stronger shopping for strain to regain management, whereas bears could capitalize on a liquidity squeeze if ETH struggles to reclaim $3,500 within the coming classes.

Learn Ethereum’s [ETH] Price Prediction 2025–2026