The worth of Ethereum (ETH) has proven some important change prior to now day rising by 1.86%. Nonetheless, in response to trading data from CoinMarketCap, the favored altcoin has recorded damaging development since December 2024 regardless of some important beneficial properties prior to now month. Apparently, underlying market exercise factors to a possible value breakout.

Ethereum Sees Sturdy Accumulation Exercise Amid Worth Dip

Ever since touching the $4,000 price mark, Ethereum has slipped right into a downtrend falling as little as $3,000. Amidst notable gains by Bitcoin in January, Ethereum continues to battle hitting constant decrease lows throughout this era.

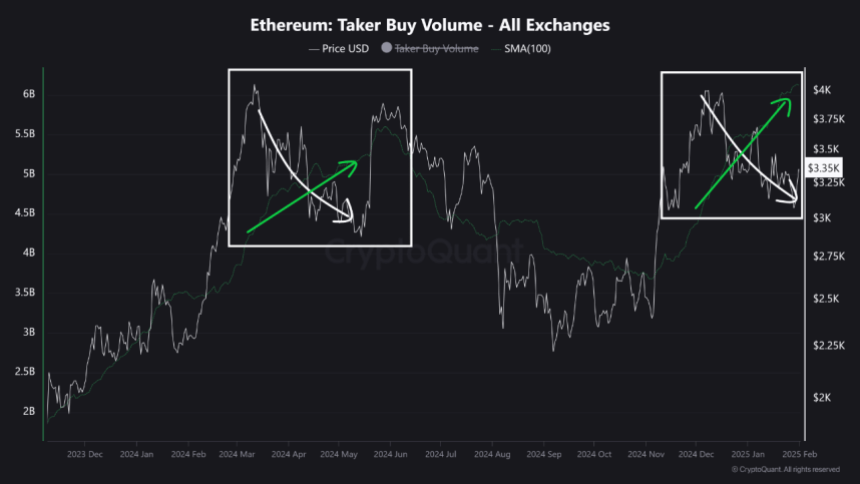

Nonetheless, a CryptoQuant market skilled with the username Crypto Sunmoon has noted a rise in market shopping for quantity amidst the present value dip indicating a bullish divergence within the ETH market. For context, a bullish divergence happens when an asset’s value is making decrease lows whereas a momentum indicator is making larger lows, thereby hinting at a possible reversal or upward motion.

As for Ethereum, the rise in shopping for quantity amid falling costs signifies a robust demand from patrons particularly on the present value ranges. This improvement additional suggests a robust confidence within the asset’s profitability as traders anticipate shopping for strain to surpass promoting exercise within the coming days.

Primarily based on historic knowledge, Crypto Sunmoon predicts Ethereum might expertise a value surge such because the one in Could 2024 when the same bullish divergence final occurred. Throughout that month, ETH rose by over 21% suggesting the altcoin will doubtless return to $4,000 if the projected value breakout happens, in response to present market costs.

ETH Lengthy-Time period Holders Sign Sturdy Market Confidence

In different information, IntoTheBlock reports that long-term holders of Ethereum at present boast a mean holding time of two.4 years displaying huge confidence in Ethereum’s future worth potential.

Nonetheless, Ethereum faces different points together with an absence of short-term contributors which prevents ETH from experiencing important ranges of speculative buying and selling that may drive up value appreciation. Moreover, the speedy development of layer 2 options resembling Optimism, and layer 1 blockchains resembling Solana are additionally tampering with the potential market demand and a focus for Ethereum.

At press time, ETH trades at $3,306 after a acquire of 1.86% over the previous day as earlier said. In the meantime, the asset’s day by day buying and selling quantity has elevated by 55.69% leading to a worth of $30.3 billion. On bigger time frames, Ethereum can also be up by 0.22% on its weekly chart however down by 2.27% on its month-to-month chart leaving a lot to want for a lot of short-term traders.