- ETH noticed its lowest Funding Price of the 12 months.

- ETH is buying and selling across the $2,300 value stage.

Ethereum [ETH] has seen a notable decline in its spinoff market, signaling a possible shift in market sentiment.

Nevertheless, deciphering this decline can result in completely different conclusions relying on how different components, such because the spot quantity, carry out.

Ethereum’s Funding Price declines

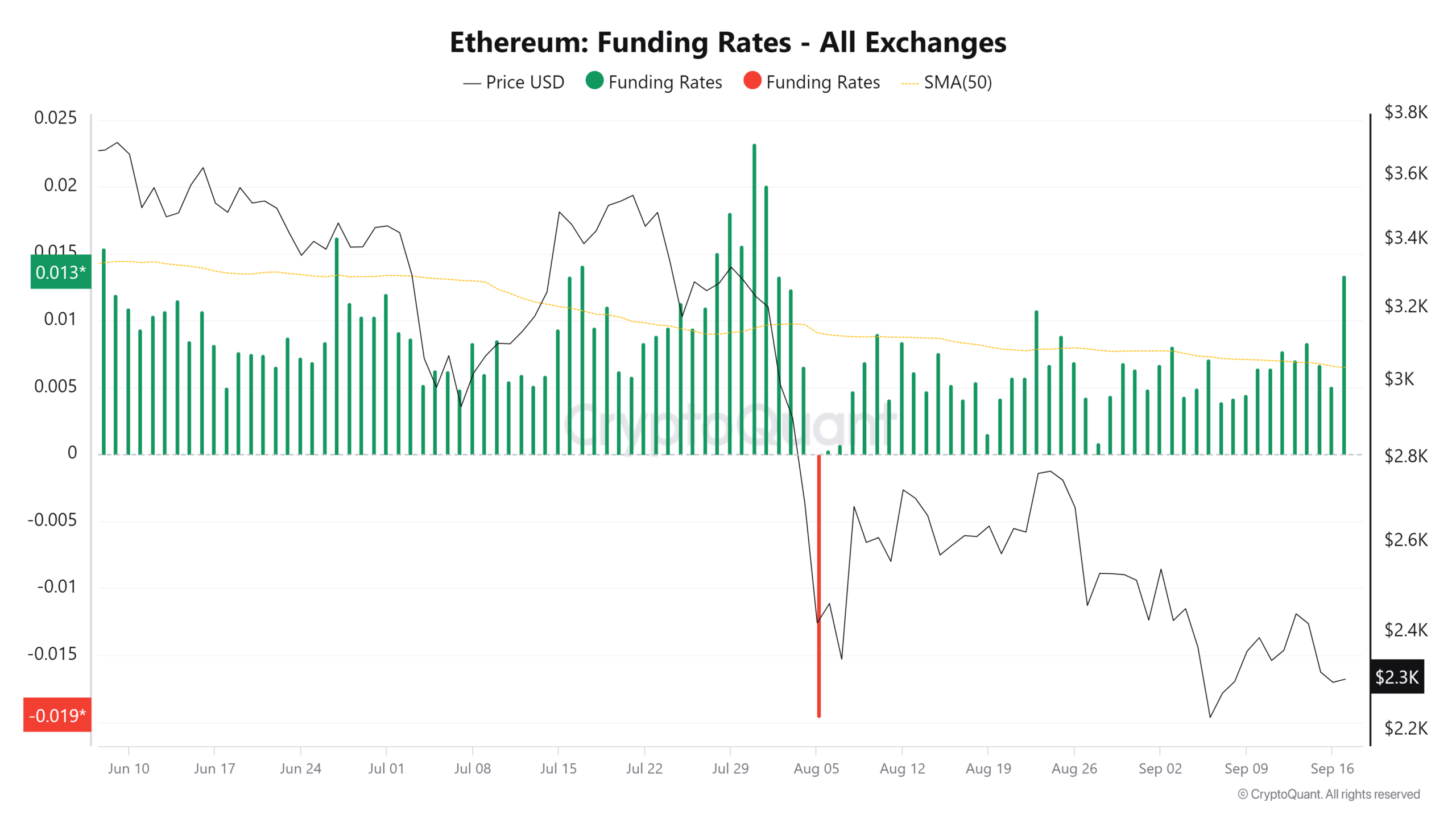

The latest information from CryptoQuant revealed that Ethereum’s Funding Price hit its lowest level of the 12 months, signaling a pointy decline in shopping for curiosity from spinoff merchants.

Funding Price is a key indicator utilized in Futures markets to measure the price of holding lengthy (purchase) or brief (promote) positions.

A unfavourable Funding Price signifies that brief sellers are paying lengthy holders to maintain their positions open, suggesting a bearish sentiment.

ETH’s Funding Price dropping to its lowest stage this 12 months displays a decline in demand for getting Ethereum on leverage by derivatives. This might be a bearish signal for the value within the brief time period.

The decline within the Funding Price signifies a scarcity of enthusiasm from merchants within the derivatives market, which might additional strain Ethereum’s value.

A possible for Ethereum brief squeeze

With fewer merchants keen to take lengthy positions, the Ethereum downward development might proceed except spot consumers step in to soak up the promote strain.

Nevertheless, whereas the low Funding Price suggests a bearish sentiment, it additionally units the stage for a possible brief liquidation cascade. The unfavourable Funding Price might shortly reverse if spot consumers enter the market sufficiently.

This forces brief sellers to shut their positions, leading to pressured shopping for (brief squeeze), which may enhance the value.

How ETH’s quantity has trended

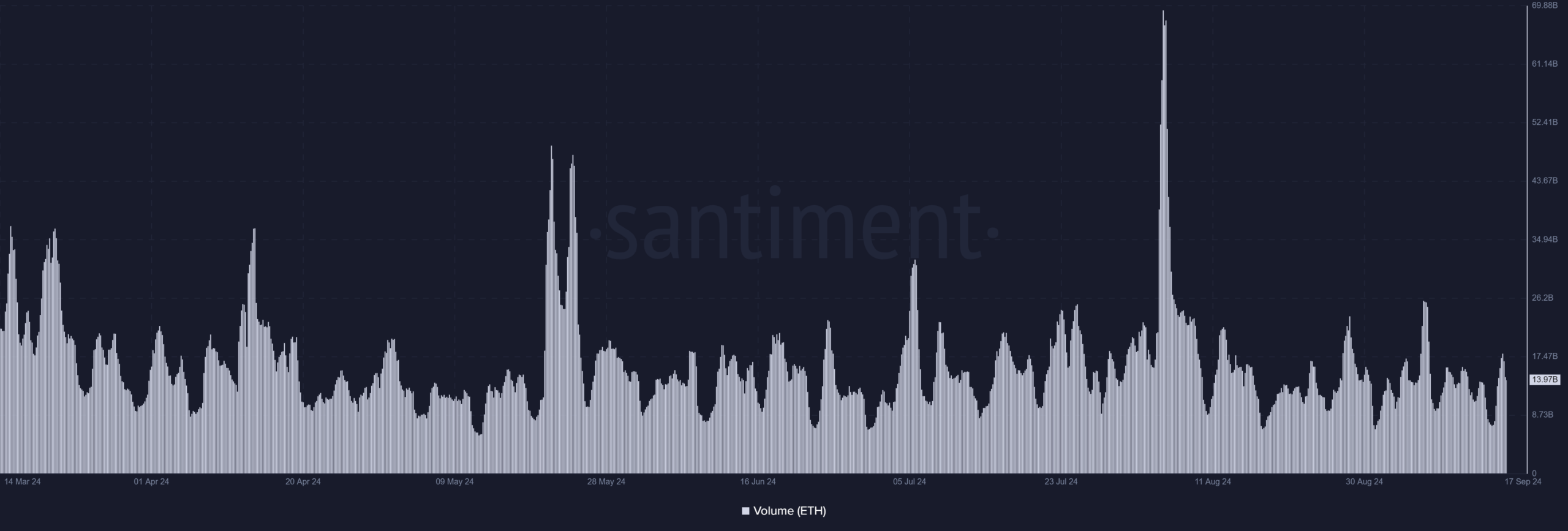

The evaluation of Ethereum’s spot quantity on Santiment confirmed that the present common quantity has held regular at round $14 billion in latest weeks.

This constant quantity is essential for sustaining value stability, particularly as Ethereum’s funding fee has dipped to its lowest stage of the 12 months.

The spot quantity for Ethereum has remained comparatively secure, averaging $14 billion. This constant quantity has possible helped ETH keep away from a extra extreme value decline.

That is regardless of the bearish sentiment from derivatives merchants, mirrored within the unfavourable funding fee.

Moreover, if the spot quantity drops under this $14 billion vary, Ethereum might face elevated downward strain.

Learn Ethereum’s [ETH] Price Prediction 2024-25

With the Funding Price already at file lows, a drop in spot quantity would scale back the shopping for curiosity. The shopping for curiosity is required to counterbalance the unfavourable sentiment within the derivatives market.

The present low Funding Price alerts that brief positions dominate the derivatives market. If spot quantity declines, there will not be sufficient demand to soak up the promote strain, main to cost declines.