- Ethereum’s value reclaimed $2,350, with technical indicators supporting a possible rally in the direction of $3,260

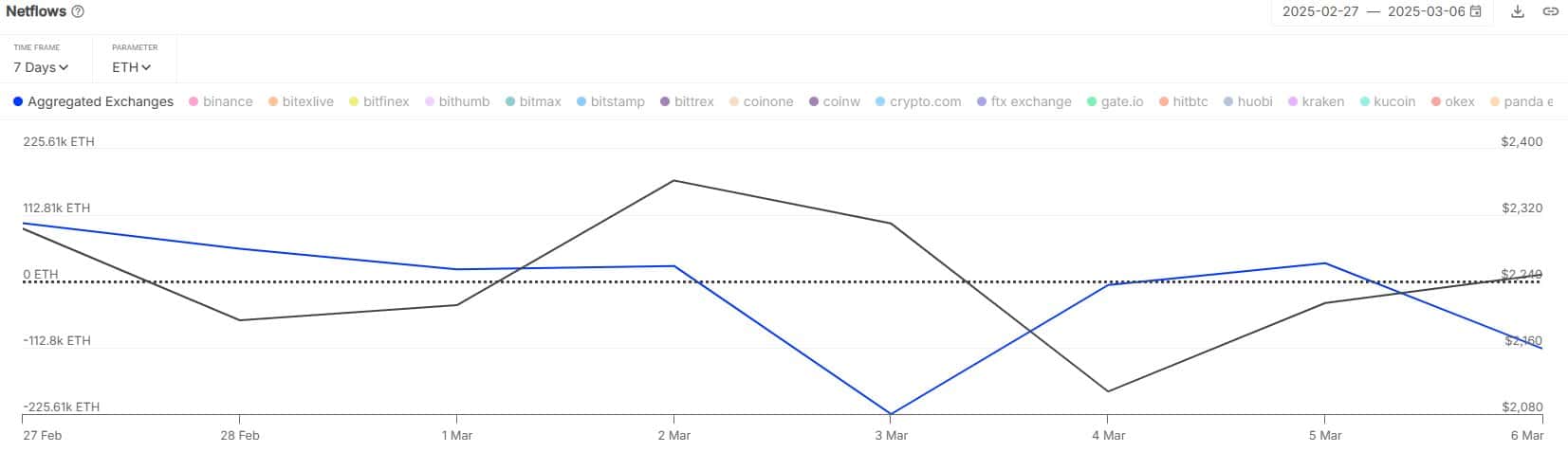

- Altcoin’s netflow evaluation alluded to shifting market sentiment

Ethereum’s value motion has captured the eye of merchants recently, with key indicators hinting on the potential for a robust upward transfer. In reality, the crypto has exhibited resilience, reclaiming important value ranges and demonstrating patterns that traditionally precede rallies.

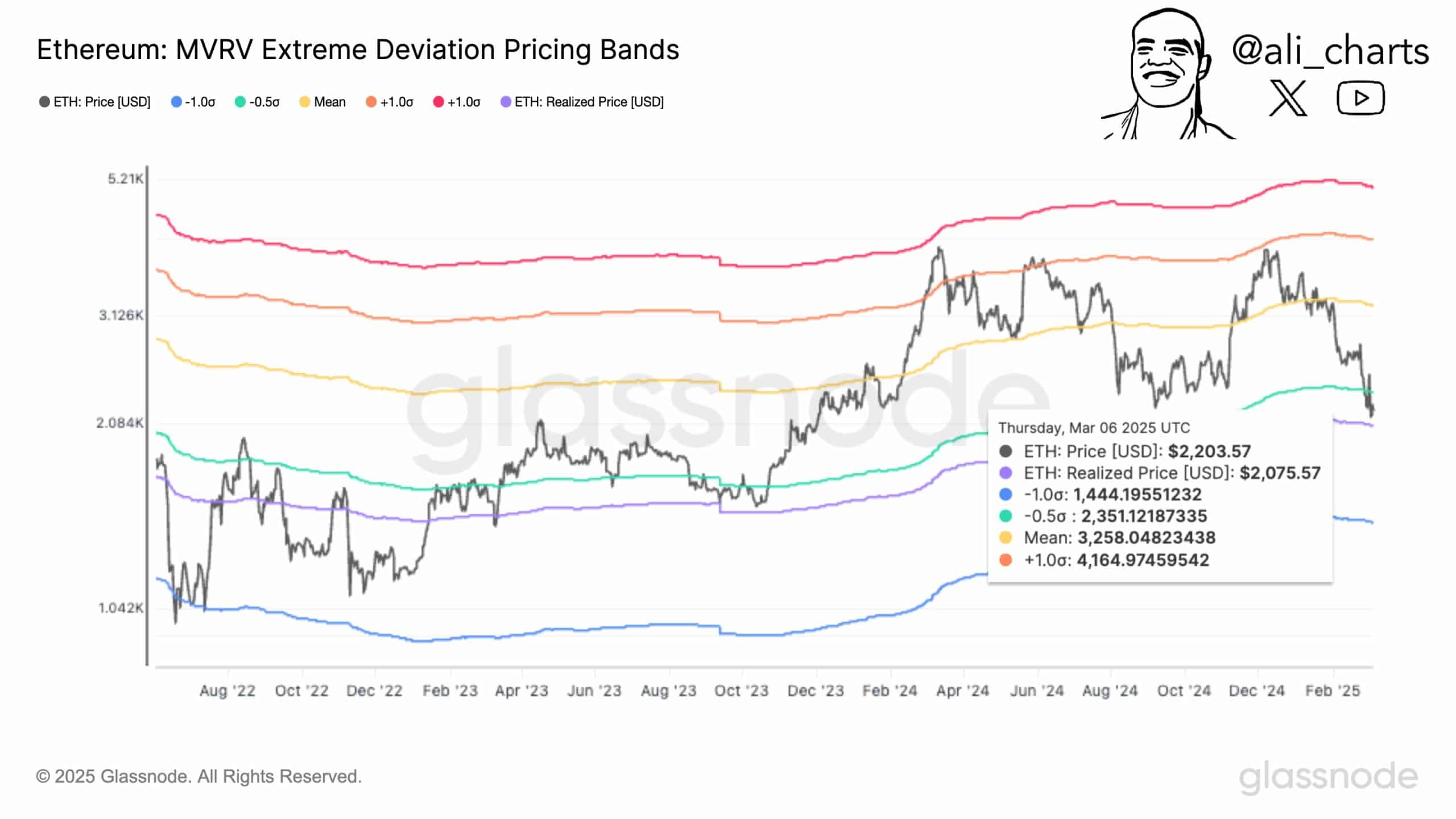

Ethereum[ETH] reclaimed $2,350 on the charts, with technical indicators supporting a possible rally in the direction of $3,260. On 6 March, ETH was buying and selling at $2,203.57, with the realized value at $2,075.57.

The altcoin’s pricing bands recognized key ranges, with ETH breaking above a vital threshold – An indication of sturdy bullish momentum.

Historic tendencies revealed that comparable breakouts led to cost surges, such because the rise from $1,042k in August 2022 to $3,126k by August 2024. This sample steered that ETH’s newest transfer alluded to accumulation and decreased promoting strain.

Therefore, a rally to $3,260 is perhaps possible, providing a possible 48% upside. Nonetheless, failure to carry $2,351 may push ETH all the way down to $1,444 – A doable 34% decline.

Alternate withdrawals – Which means?

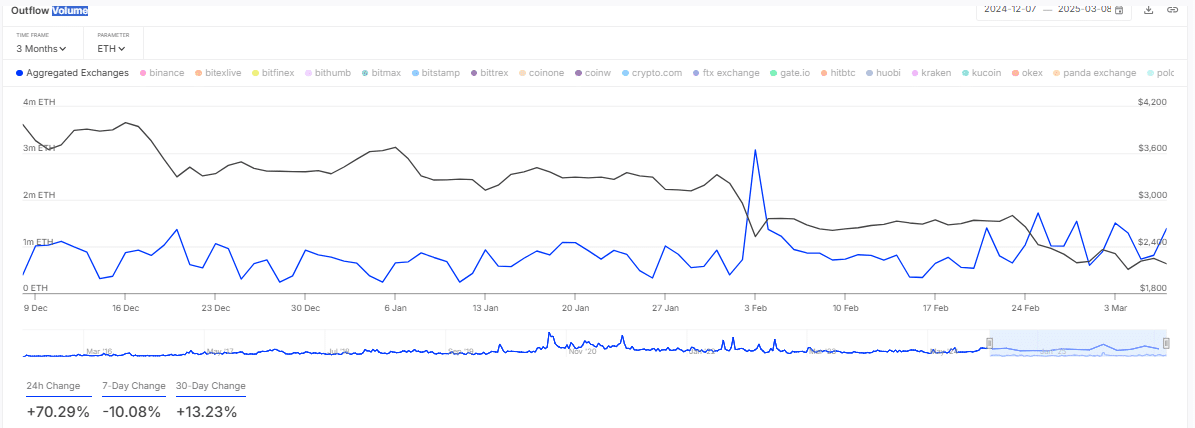

Over $500 million price of ETH was withdrawn from exchanges, indicating an uptick in accumulation amongst merchants. The outflow quantity chart on 8 March confirmed a 24-hour change of +70.29% – A 7-day change of -10.08% and a 30-day hike of +13.23%.

3 March’s outflows peaked at 1 million ETH, valued at $2.4 billion, earlier than declining to 400k ETH by 6 March. The sharp 24-hour surge mirrored sturdy shopping for strain, decreasing obtainable provide on main exchanges.

The 30-day development bolstered the long-term accumulation sample, usually a precursor to cost hikes. Nonetheless, the 7-day decline pointed to short-term profit-taking, which may momentarily gradual momentum.

This sample resembled early 2024 when outflows preceded a 20% value leap. If outflows proceed, ETH may transfer in the direction of $2,600. Conversely, if promoting strain returns, ETH may retest $2,200 on the charts.

Bearish indicators amid outflow tendencies

Ethereum’s netflow evaluation highlighted shifting market sentiment.

Web outflows peaked at -225.61K ETH on 5 March, equal to $540 million at $2,400 per ETH, earlier than decreasing to -112.81K ETH the subsequent day. The 7-day and 30-day netflow declines indicated ongoing accumulation, decreasing obtainable provide on platforms like Coinbase and Kraken.

This development traditionally preceded rallies, as seen in February 2024, when an identical outflow sample led to a 15% value hike. If sustained, this development may push ETH to $2,800. Nonetheless, if inflows surge, promoting strain may push ETH to $2,100 – Signaling a doable reversal.

A bullish horizon for the altcoin?

On the time of writing, Ethereum’s trajectory appeared bullish, pushed by sturdy technical indicators and accumulation tendencies. ETH was buying and selling at $2,203.57, with projections hinting at a possible hike to $3,260 – Marking a 48% improve.

Alternate withdrawals additionally climbed to 400k ETH, valued at $960 million, whereas netflows remained detrimental and reinforcing decreased promoting strain. Traditionally, ETH surged by 20% in 2024 following comparable patterns, supporting a transfer in the direction of $2,800 by mid-March.

If ETH holds agency above $2,351, additional upside is perhaps probably. A drop under $2,200, nonetheless, may point out a correction in the direction of $1,444, reflecting a possible 34% decline.