- ETH’s efficiency towards Bitcoin was lower than very best, resulting in a weekly bearish construction.

- Till the $2.8k and $3k ranges are breached, the outlook will stay bearish.

Ethereum [ETH] witnessed a continued improve in gasoline charges because the community exercise marched greater. That is attributed partly to the rising use of decentralized finance (DeFi) platforms on the community and growing ETH switch volumes.

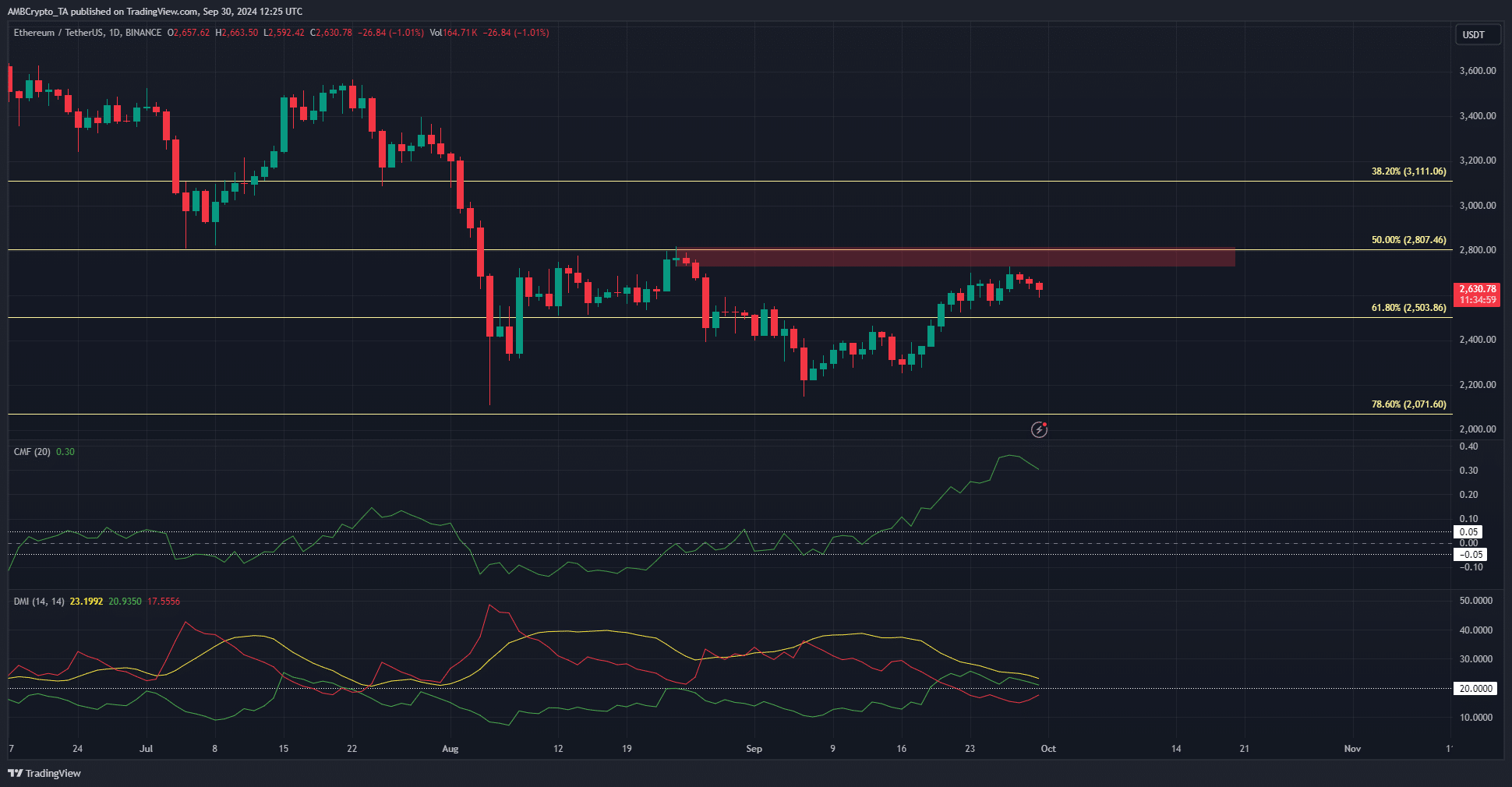

Technical evaluation confirmed that though the market construction and momentum had been bullish on the each day, key resistance ranges overhead have to be breached.

Ethereum has misplaced a lot floor throughout the consolidation

For the reason that highs of March, Bitcoin [BTC] was solely down by 13.4% at press time. By comparability, ETH was down by 35.8%. This bleak efficiency towards the king of crypto meant that the Ethereum value prediction favored a bearish outlook till the $3k resistance is damaged.

The weekly chart is in a downtrend, and the newest decrease excessive to beat is at $2,820. Past these two ranges, the $3.6k space could be the following important problem.

The CMF was at +0.3, reaching a excessive on the each day chart not seen since March. This comparatively excessive shopping for stress has spurred the asset’s 16.7% beneficial properties previously two weeks.

The ADX (yellow) and the +DI (inexperienced) on the DMI had been above 20 to sign a powerful pattern and a bullish pattern respectively. Regardless of this, the 50% Fibonacci retracement stage continued to stall the bulls.

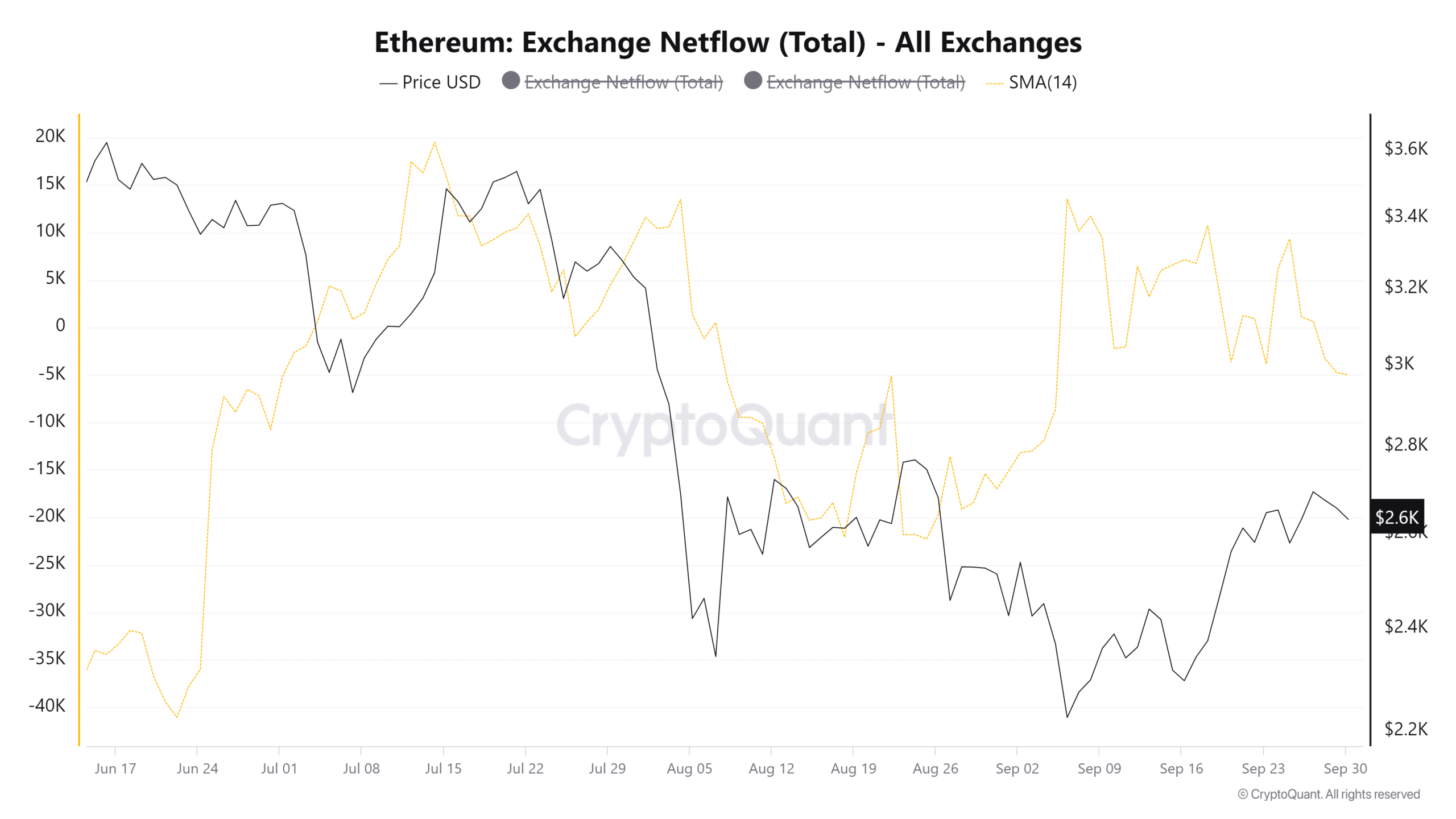

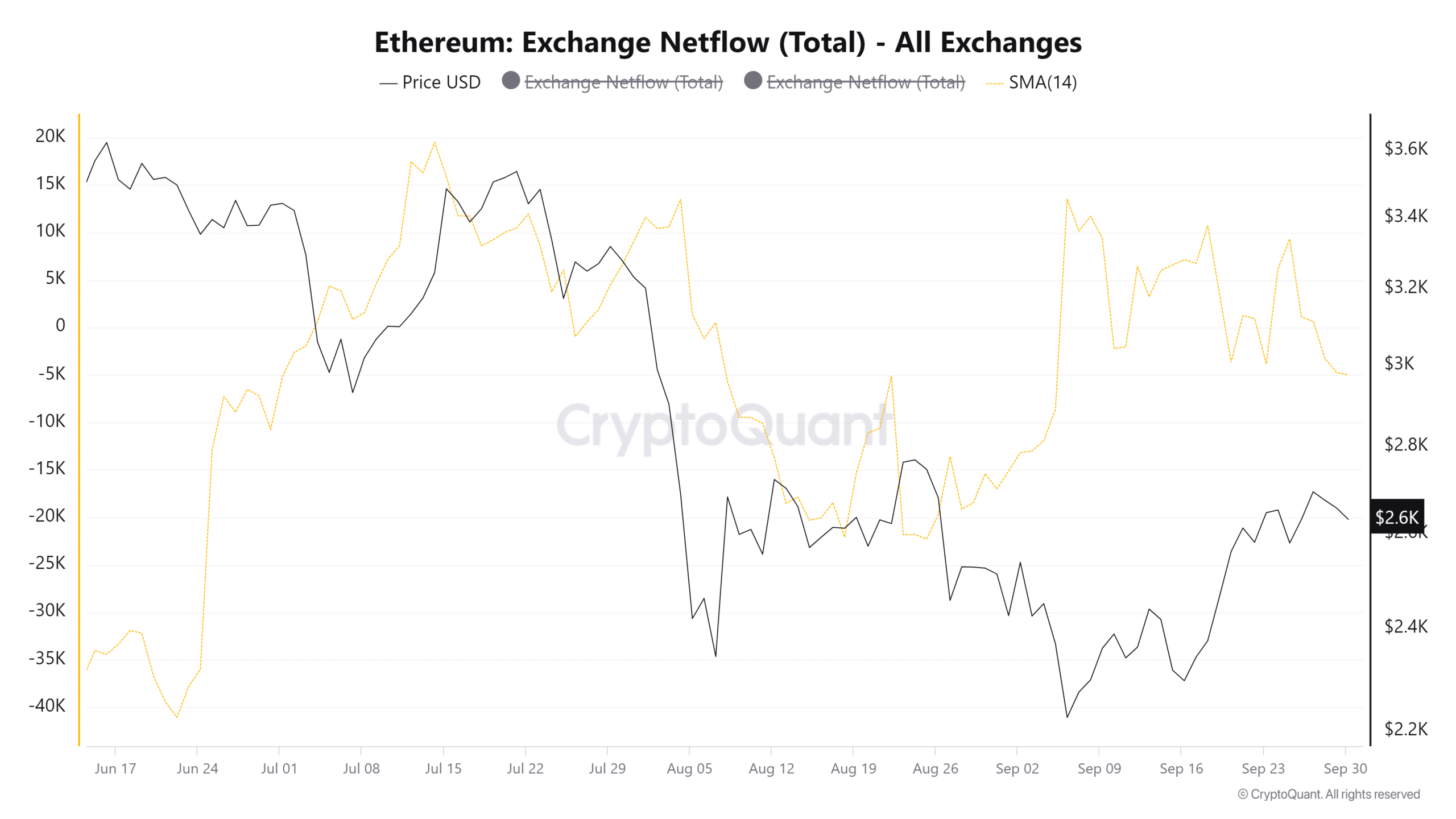

Netflows give clues on pattern energy

Supply: CryptoQuant

Since late July, the movement of Ethereum from centralized exchanges has been primarily directed outward. This supported the thought of accumulation. Nonetheless, it was not as heavy because it was throughout February or November 2023.

Is your portfolio inexperienced? Test the Ethereum Profit Calculator

Moreover, previously two weeks the netflows noticed many optimistic days. The quantity was not excessive sufficient to be termed an exodus, but it surely additionally confirmed that some holders had been pleased to take earnings. This might be as a result of efficiency of ETH since March.

As factor stand, the netflows chart didn’t assist a strongly bullish Ethereum value prediction for the following 4-8 weeks.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion