- Ethereum didn’t flip the $3.9K value into help, dipping 14% beneath that degree.

- Issues develop over Ethereum’s long-term value motion.

The crypto market is in ‘excessive’ volatility, and Ethereum [ETH] is the proper instance. After a 37% drop following Trump’s pro-tariff stance, it soared after Eric Trump’s pro-ETH publish. Two huge swings in 4 days.

The stakes are excessive

Ethereum is up simply 15% from its election day opening however continues to be 30% beneath its $4,016 peak throughout the Trump rally.

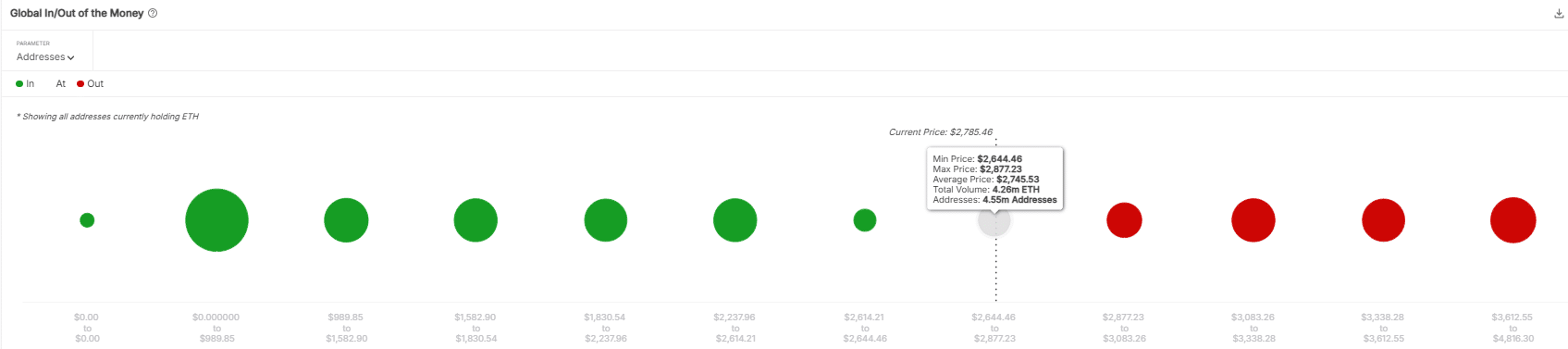

In the previous week, ETH broke its help zone, falling beneath $2,800, 3 times the drop of Bitcoin. Regardless of the RSI hitting oversold and OBV displaying indicators of life, the steep decline worn out over 14% of its good points, pushing 6.18 million addresses into the purple.

Why? Trump’s powerful financial policies triggered the largest 24-hour crypto liquidation ever, wiping out $10 billion in a single blow. But it surely didn’t cease there.

The ETH/BTC pair hit a four-year low, with every day declines over 3%. With little capital flowing from BTC into ETH, Ethereum’s future value motion is wanting extra unsure by the day.

In the meantime, mid-caps are dominating the weekly gainer’s chart, with DEXE main the best way with a 44% acquire. Buyers are shifting away from high-caps, both exiting the cycle or transferring funds into smaller property.

So, is Ethereum’s latest dip only a non permanent setback, or will the rising insecurity forestall it from breaking the $4,000 resistance?

Ethereum’s future unfolded

ETH ETFs have been on a robust run, with a four-day streak and a file $307.8 million in inflows in simply in the future—the best this yr. Blackrock’s ETHA alone pulled in a large $276.2 million.

This institutional shopping for is vital to preserving ETH from falling beneath $2,745. At this degree, 4.26 million ETH can be within the purple, risking an $11 billion sell-off—one thing to regulate within the coming days.

With a robust market rebound nonetheless nowhere in sight, inflation teetering, and investor sentiment cooling on Ethereum throughout these risky instances, if ETF inflows falter, ETH might lose the remaining 15% from the election day rally final yr.

Is your portfolio inexperienced? Test the Ethereum Profit Calculator

And as for breaking $4,000? The circumstances above might want to shift. Till then, maintain tight – the stakes for Ethereum are greater than ever.