- Ethereum outflows surged regardless of ETH’s worth seeing volatility

- Whereas merchants received liquidated, long-term hodlers stay hopeful

Over the previous few weeks, Ethereum [ETH] has remained stagnant across the $3,500-price vary. Nevertheless, a latest correction pulled down ETH’s worth on the charts considerably, fueling a change in sentiment.

Outflows on the rise

Regardless of this correction, nevertheless, there have been important outflows of roughly 1,000,000 ETH, equal to $3.41 billion, from exchanges since March. This pattern persists regardless of macroeconomic challenges and apprehensions concerning a possible rejection of a spot ETH ETF by the SEC.

Such outflows point out that people are actively partaking in actual actions on the Ethereum community, reminiscent of transaction funds, staking, and restaking. This additionally means they’re assured in holding ETH regardless of unfavorable market circumstances, quite than solely partaking in speculative buying and selling. However, liquidity for spot ETH stays extremely valued.

Merchants bleed

At press time, ETH was buying and selling at $3,254.80, with its worth down by 2.68% during the last 24 hours. As a result of swift decline in ETH’s worth, many merchants’ positions received liquidated too. In truth, in line with Coinglass’ information, $57.22 million value of positions have been liquidated over this era. Of this quantity, roughly $41 million value of lengthy positions have been liquidated.

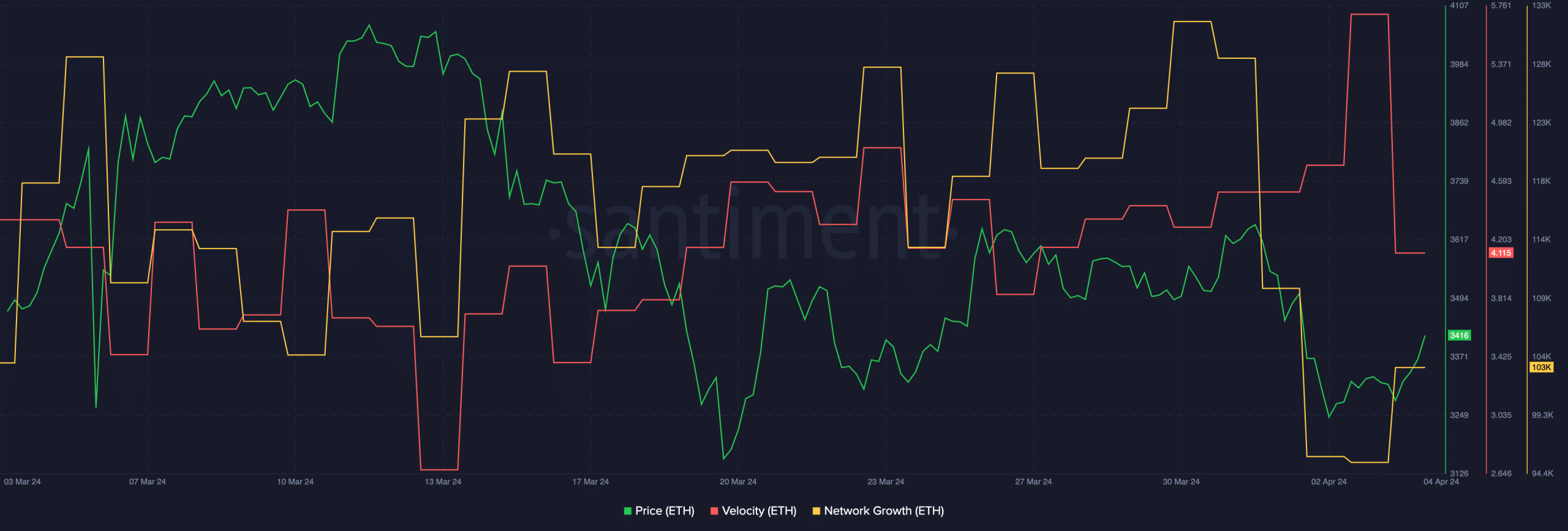

The speed at which ETH was buying and selling at additionally fell in the previous few days. This implied that the speed at which ETH was being traded declined materially. Furthermore, the community progress of ETH has additionally decreased significantly, indicating that new addresses have been shedding curiosity in ETH.

A scarcity of curiosity from new addresses may have an effect on shopping for stress for ETH sooner or later and should affect its capacity to climb again to the $3,500-level.

Lengthy-term holders present religion

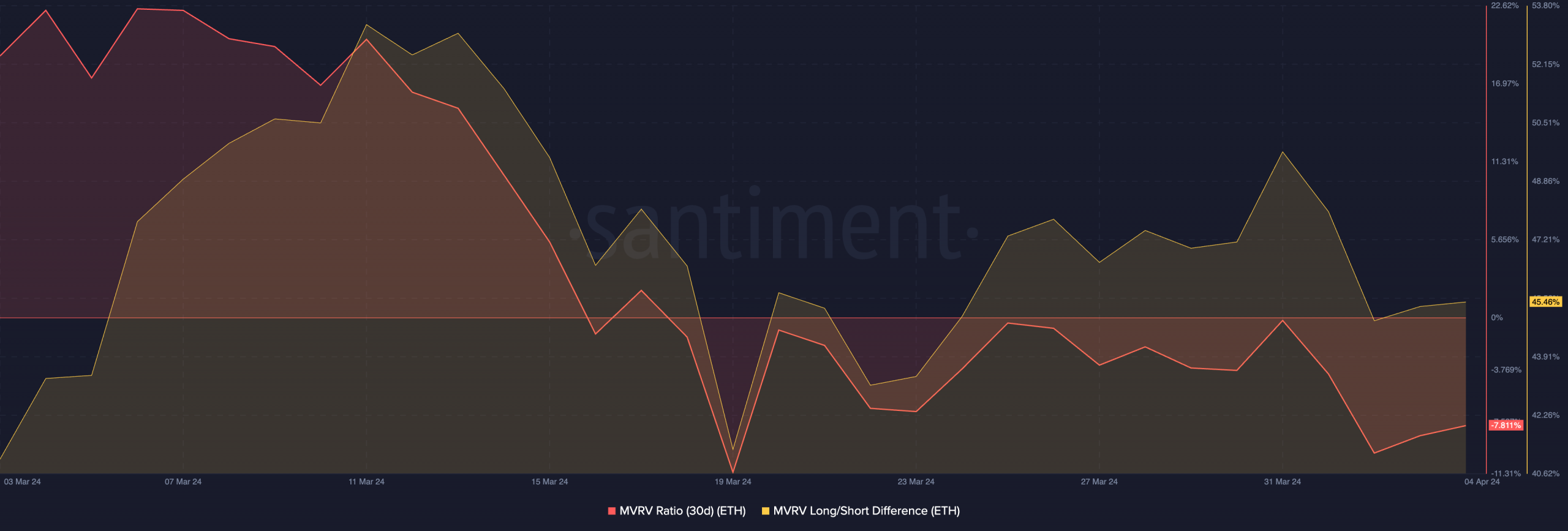

As a result of worth correction, ETH’s MVRV ratio fell considerably. This indicated that the majority ETH holders weren’t worthwhile, on the time of writing. This may very well be interpreted positively as most of those holders don’t have any incentive to promote their holdings and the worth of ETH may maintain its present ranges going ahead. Furthermore, the Lengthy/Quick distinction for ETH additionally spiked over the previous few weeks.

Learn Ethereum’s [ETH] Price Prediction 2024-25

A rising Lengthy/Quick distinction implies that long-term holders outnumber the short-term holders. These long-term holders are much less prone to promote their holdings and don’t are likely to react impulsively to cost fluctuations.