- Ethereum’s trade reserves stay at historic lows, probably signaling a supply-driven worth improve.

- The extended low reserves might result in upward worth stress within the close to time period.

Ethereum [ETH] seems to nonetheless be lagging behind regardless of the broader crypto market bullish sentiment.

Whereas Bitcoin [BTC] created but once more one other all-time excessive, final week, ETH continues to nonetheless battle to interrupt previous main resistance.

Nevertheless, on the time of writing the asset is up 4% previously day with a press time buying and selling worth of $3,195.

Amid all of those, one vital issue influencing Ethereum’s worth actions is the reserve ranges on spot exchanges.

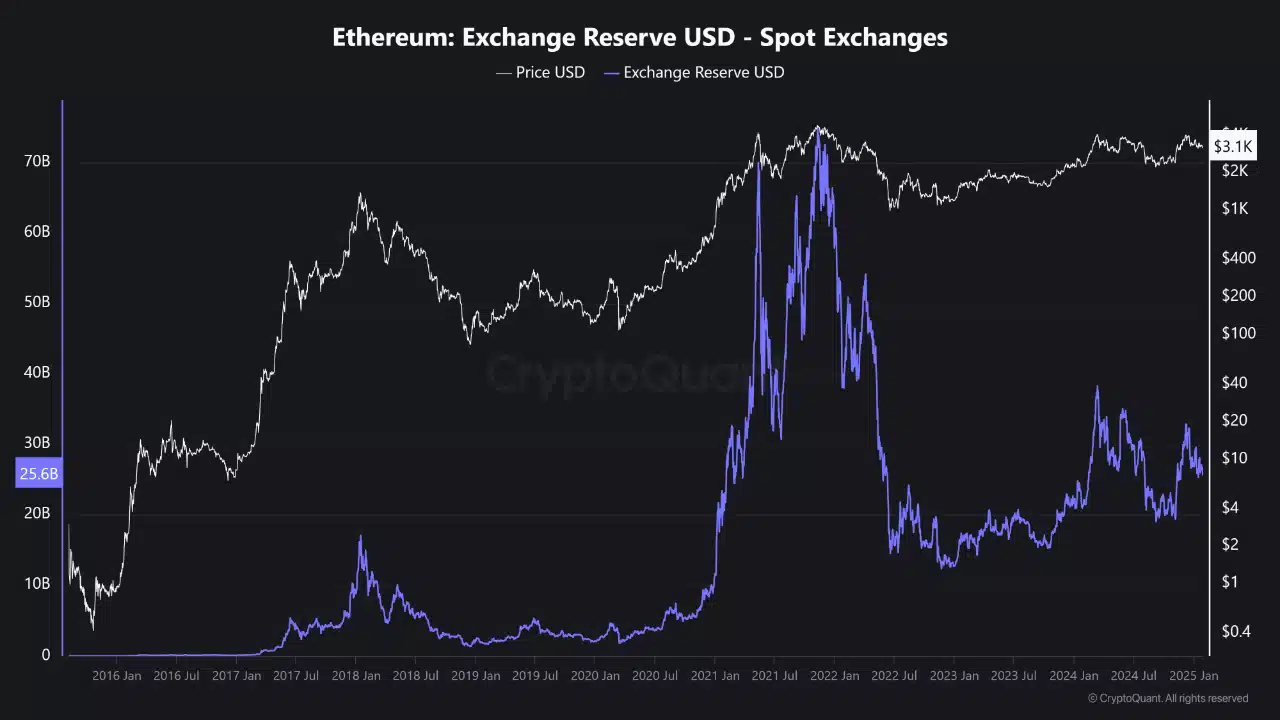

In line with an evaluation revealed on the CryptoQuant QuickTake platform, Ethereum reserves have exhibited notable historic traits.

Monitoring Ethereum reserves over time

The analyst outlined how Ethereum’s reserve ranges have shifted through the years, highlighting their potential affect on worth.

In the course of the 2017–2018 bull market, reserves steadily elevated, reaching a peak in early 2018. This surge coincided with the heightened curiosity in Ethereum and associated initiatives.

With the rise of decentralized finance (DeFi) in 2020 and 2021, Ethereum reserves noticed one other vital enhance as customers poured belongings into protocols and platforms constructed on the Ethereum community.

Nevertheless, because the market matured, the top of 2021 marked the start of a notable decline in reserves. Massive-scale withdrawals from exchanges set the stage for persistently low reserve ranges in 2023 and past.

These traditionally low reserve ranges have vital implications for Ethereum’s worth.

The continued drop means that many market contributors want to maneuver their Ethereum holdings off exchanges, probably for long-term storage.

This conduct usually signifies confidence in Ethereum’s worth as a long-term asset.

Present traits and market implications

As of 2024, Ethereum reserves on spot exchanges stay close to historic lows. This restricted provide on exchanges might contribute to upward worth stress, as fewer cash are available for buying and selling.

Over time, such circumstances can result in stronger worth actions if demand will increase.

Though Ethereum’s present worth stays beneath crucial resistance ranges, the continued low reserve setting might set the stage for a brand new bullish development.

For now, it’s price monitoring different on-chain metrics to achieve insights into Ethereum’s potential short-term trajectory.

For instance, data from CryptoQuant indicated a current improve in a single explicit metric from 0.58 on the fifteenth of January to 0.63 on the 18th of January, adopted by a slight lower to 0.61 on the twenty seventh of January.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

This fluctuation suggests a interval of consolidation, the place market contributors are adjusting their positions in response to altering circumstances.

If the metric continues to carry above sure thresholds, it might sign rising confidence amongst buyers and probably pave the way in which for upward worth actions.