- Altcoin’s metrics revealed that ETH slipped beneath its potential market backside on the charts

- A fall underneath $2.4k might push ETH right down to $2.3k

Like most cryptos out there, Ethereum [ETH] additionally fell sufferer to cost corrections over the past 24 hours. In actual fact, ETH’s newest dip pushed the token in direction of an important assist degree on the charts.

Within the vent of a profitable take a look at, what are the possibilities ETH will return to hit $3k once more?

Ethereum’s newest assist

Ethereum’s losses over the past 24 hours have been over 5%, with the altcoin buying and selling simply above $2.5k at press time. Within the meantime, Ali, a well-liked crypto analyst, shared a tweet revealing an necessary growth. Based on the identical, ETH had beforehand efficiently held on to its assist at $2.4k. Nevertheless, the most-recent worth decline may as soon as once more push the token in direction of that degree.

Right here, it is usually attention-grabbing to notice that ETH has been transferring inside an upward channel sample since 2021. The token has examined the sample a number of instances. If historical past repeats itself, then it received’t be a protracted shot to anticipate the king of altcoins to maneuver in direction of $3k within the coming days.

In actual fact, if issues fall in place, then ETH may as effectively contact $4k within the coming months.

Odds of ETH touching $3k

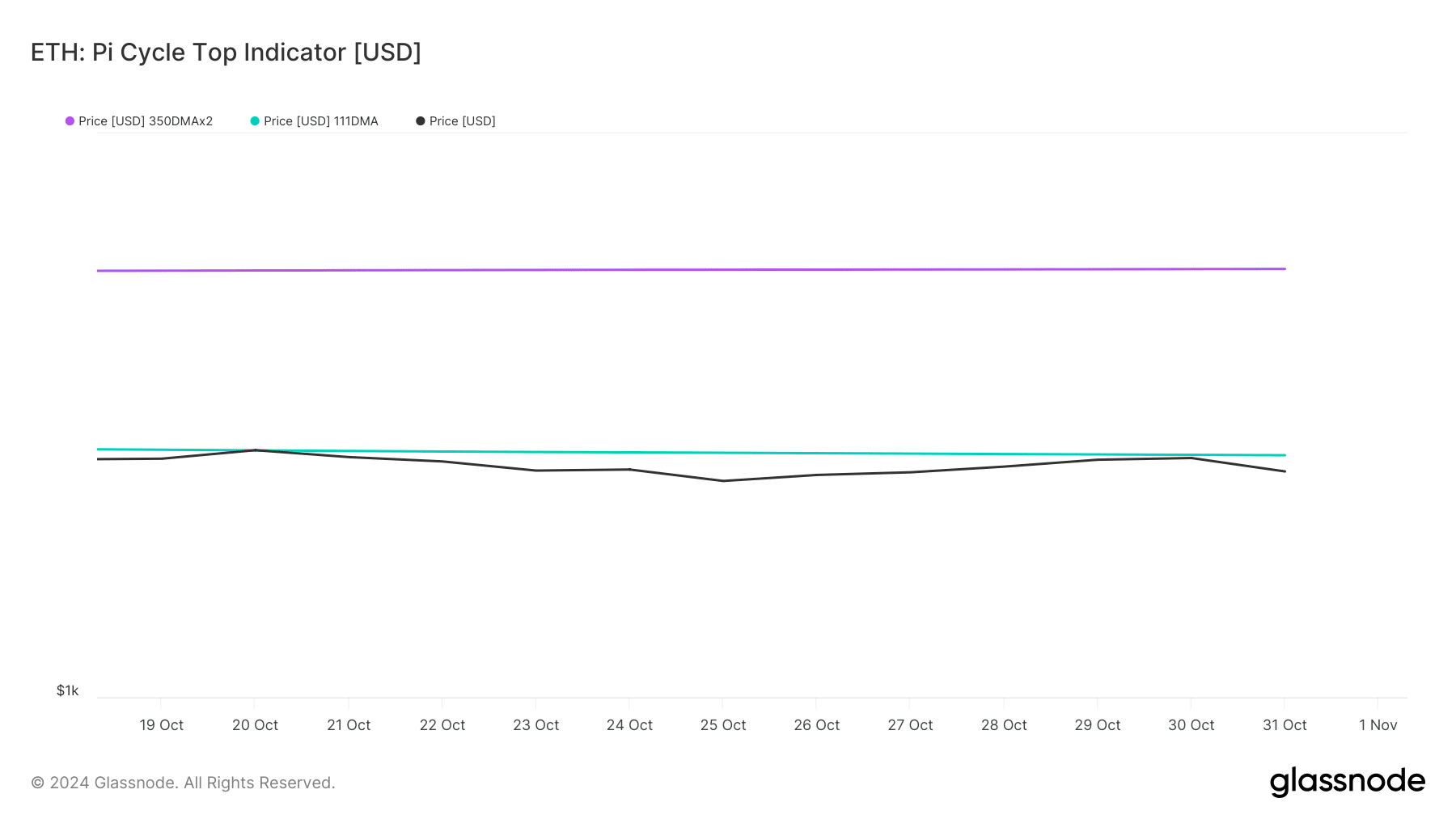

AMBCrypto then checked Ethereum’s on-chain information to seek out out whether or not the token can begin transferring in direction of $3k anytime quickly. Based on our evaluation of Glassnode’s information, ETH’s worth slipped underneath its potential market backside of $2.58k.

The Pi Cycle High indicator identified that ETH’s potential market prime might be at $5.7k. Due to this fact, anticipating ETH to hit $3k received’t be too bold for traders.

Our evaluation of CryptoQuant’s data additionally identified fairly a number of bullish metrics. As an illustration, ETH’s change reserve dropped. This meant that purchasing strain on ETH was excessive, which frequently leads to worth upticks.

On the derivatives market entrance, every part appeared optimistic. ETH’s funding price instructed that lengthy place merchants have been dominant and have been prepared to pay quick merchants. On prime of that, Ethereum’s taker purchase/promote ratio turned inexperienced. This indicated that purchasing sentiment was dominant amongst derivatives traders.

Lastly, AMBCrypto’s evaluation of CFGI.io’s data instructed that Ethereum’s worry and greed index was in a “worry” place. Every time the metric hits this degree, it signifies that the possibilities of a bullish pattern reversal are excessive.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Nevertheless, if the bearish pattern persists, then traders may quickly see ETH take a look at its $2.4k assist. An unsuccessful take a look at might push the token additional right down to $2.3k within the following days.