On-chain information exhibits Ethereum whales have just lately ramped up their accumulation, an indication that may very well be bullish for the asset’s worth.

Ethereum Whales Have Been Shopping for Massive

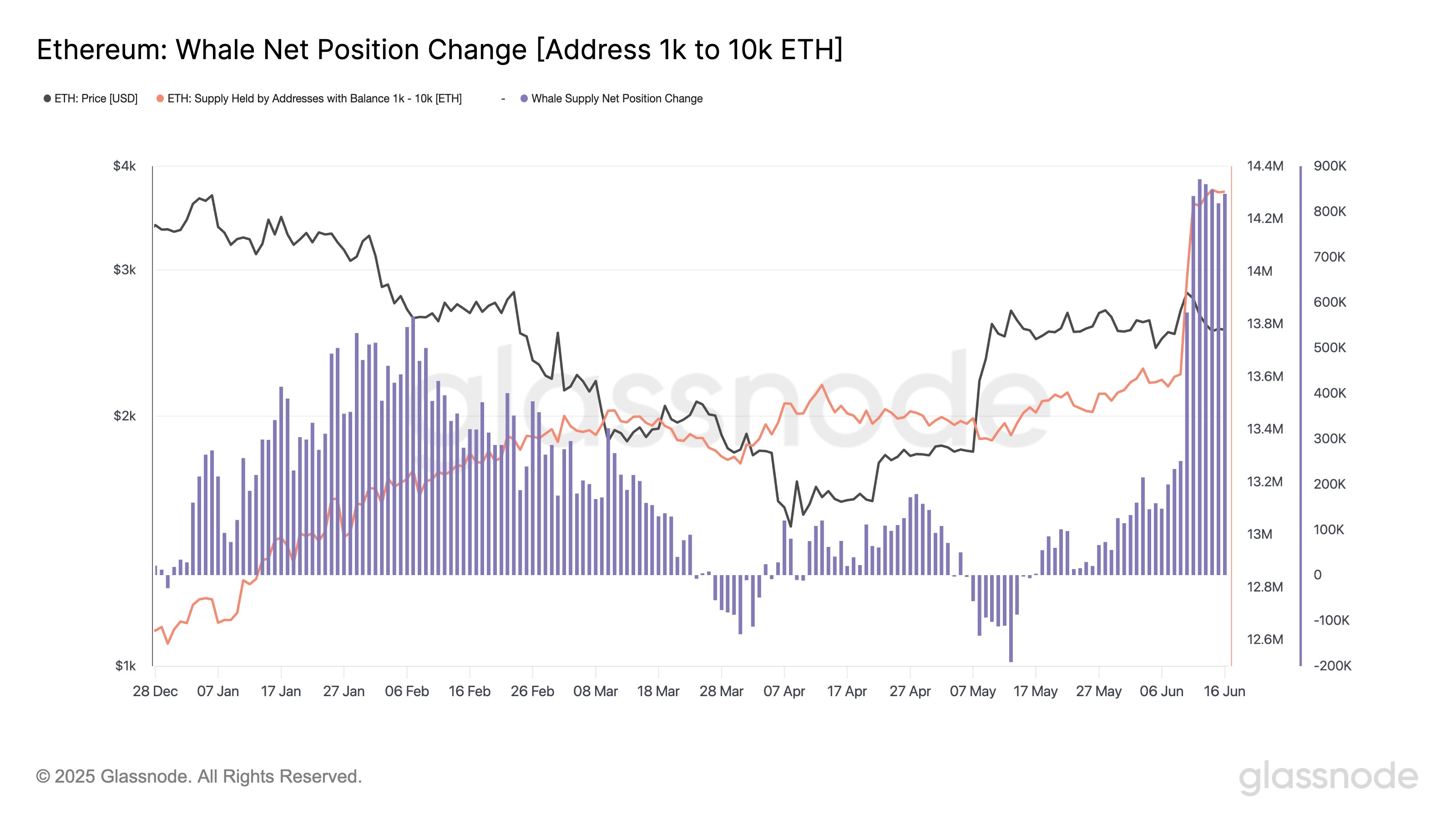

In keeping with information from the on-chain analytics agency Glassnode, the Ethereum whales have been taking part in a really important quantity of accumulation in the course of the previous week.

‘Whales‘ confer with the the ETH buyers holding between 1,000 and 10,000 tokens of the cryptocurrency. On the present alternate this vary converts to about $2.5 million on the decrease finish and $25 million on the higher one.

Whereas this vary doesn’t cowl absolutely the prime finish of the market, it nonetheless contains humongous buyers who could also be thought-about a key a part of the ecosystem. As such, contemplating this function, the actions associated to those holders may very well be value monitoring.

One method to watch the habits of the whales is thru the entire quantity of the Ethereum provide held by them. Under is the chart shared by Glassnode that exhibits the pattern on this metric over the previous few months.

The worth of the metric seems to have seen a steep climb in latest days | Supply: Glassnode on X

As is seen within the graph, the availability of the Ethereum whales has just lately shot up, an indication that big-money buyers have been accumulating the cryptocurrency. “For practically per week, day by day whale accumulation has exceeded 800K ETH, pushing holdings in 1k–10k wallets to >14.3M ETH,” notes the analytics agency.

From the chart, it’s obvious {that a} notably massive spike occurred on June twelfth. On this date, the ETH whales added greater than 871,000 ETH to their holdings, the very best day by day influx for the cohort year-to-date.

The newest accumulation spree isn’t simply notable by way of the yr, however quite additionally spectacular in a historic context. “This scale of shopping for hasn’t been seen since 2017,” says Glassnode. Naturally, the extraordinary shopping for push from these buyers may very well be a possible indication that they’re assured about the way forward for the coin.

Whereas this sturdy accumulation exercise has been noticed on-chain, one other aspect of the sector has additionally seen demand: the spot exchange-traded funds (ETFs). The spot ETFs are funding autos that present a means for buyers to get publicity to Ethereum with out immediately proudly owning the asset.

The spot ETFs commerce on conventional exchanges, so holders not aware of cryptocurrency wallets and exchanges can discover it simpler to take a position into the coin by means of them.

There was some excessive demand for the US ETH spot ETFs these days, because the netflow chart shared by Glassnode in an X post showcases.

The pattern within the netflow of the US ETH spot ETFs since their inception | Supply: Glassnode on X

“Final week noticed 195.32K ETH stream into US Spot ETH ETFs – the third-largest weekly internet influx on report,” explains the analytics agency.

ETH Value

Ethereum set its eyes on $2,700 on Monday, nevertheless it appears the worth has taken a bearish flip since then because it’s now buying and selling round $2,470.

Appears to be like like the worth of the coin has plunged over the past 24 hours | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.