- Whale exercise and a 79% quantity surge steered potential bullish momentum for Ethereum.

- On-chain metrics remained blended, however bulls held a slight edge within the Lengthy/Quick Ratio.

An Ethereum [ETH] ICO participant, who initially gained 150,000 ETH (now valued at $389.7 million), made a big transfer by depositing 3,510 ETH ($9.12 million) into Kraken after remaining inactive for over two years.

This massive-scale transaction suggests rising confidence in Ethereum’s future. With Ethereum buying and selling at $2,656.39, up by 3.02% at press time, the market is now targeted on whether or not this whale motion will spark a bullish momentum.

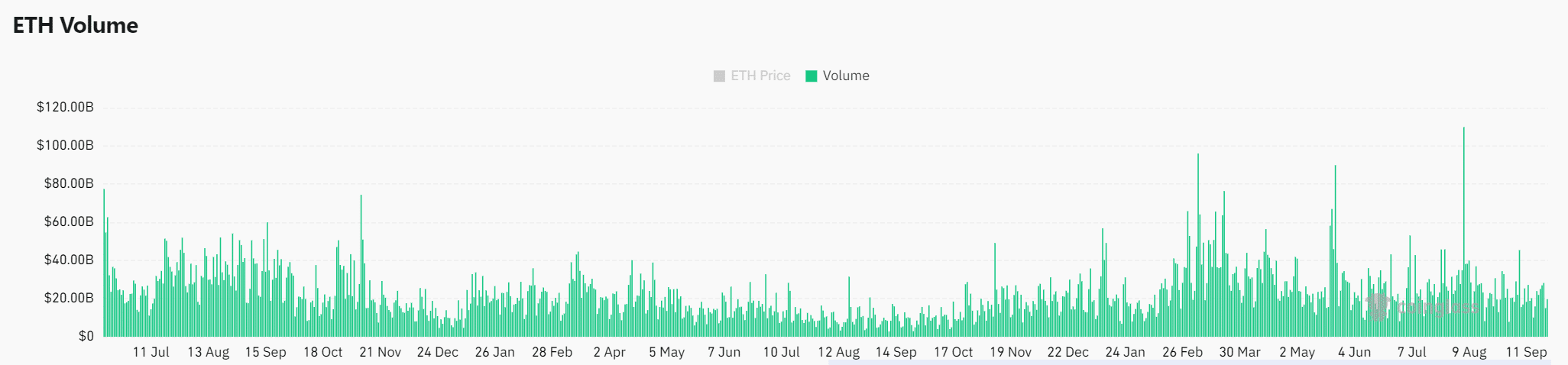

Ethereum’s quantity surge: A bullish sign?

Ethereum’s buying and selling quantity has seen a pointy improve, rising by 79.30% over the past 24 hours to $28.21 billion at press time.

This surge sometimes alerts a rising urge for food amongst merchants, which frequently results in greater value volatility.

Subsequently, elevated quantity can drive the market greater if consumers proceed to dominate. Nonetheless, if the quantity subsides with out follow-through shopping for, it might sign hesitation, probably resulting in a value dip.

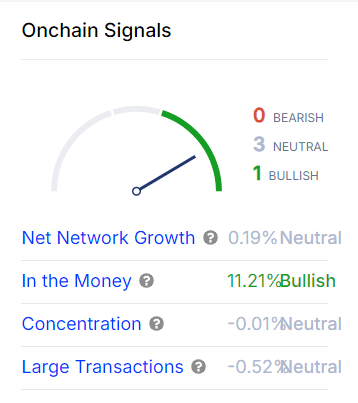

On-chain metrics: Blended alerts for Ethereum

Wanting on the on-chain metrics, AMBCrypto discovered a mixture of alerts.

Ethereum’s Internet Community Progress stays impartial at 0.19%, exhibiting no important inflow of latest customers.

Nonetheless, the Within the Cash metric, a key indicator of what number of traders are at present in revenue, reveals a bullish studying of 11.21%.

This implies a substantial portion of Ethereum holders stay in a revenue place, which might cut back promoting strain and assist value stability.

However, metrics like Focus and Giant Transactions additionally current impartial traits, with no important modifications in whale accumulation.

Subsequently, whereas the whale deposit into Kraken hints at renewed market exercise, it has not sparked a large shift in Ethereum’s on-chain dynamics but.

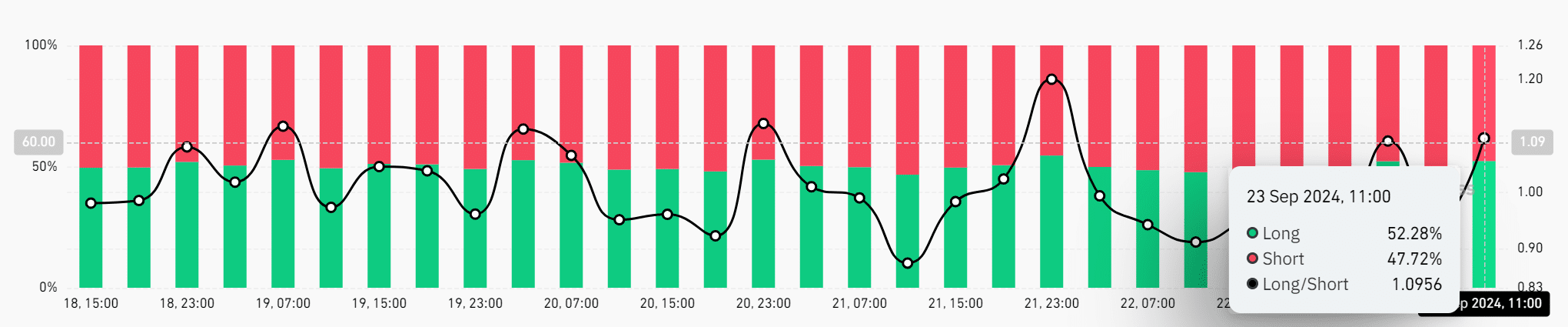

Bulls maintain an edge

The Lengthy/Quick Ratio is barely tilted in favor of bulls. As of the twenty third of September, 52.28% of merchants held lengthy positions, whereas 47.72% had been shorting the market.

This slight majority signifies that merchants are leaning towards Ethereum’s value growing additional. If the ratio continues to favor the bulls, Ethereum might preserve its upward momentum.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Ethereum’s latest whale exercise and the sharp rise in buying and selling quantity counsel bullish potential. Nonetheless, blended on-chain metrics present the market stays cautious.

The Lengthy/Quick Ratio offers bulls a slight edge, however broader market dynamics will finally dictate the path.