- Ethereum ETFs noticed a rebound, bringing aid to the 17 million holders within the crimson.

- ETH might want to step as much as keep forward within the aggressive altcoin race.

The New 12 months buzz continues to be fairly energetic now, particularly with Bitcoin [BTC] consolidating on the charts. Traditionally, Q1 has been bullish for the crypto market, sometimes creating an setting well-suited for altcoins to draw capital.

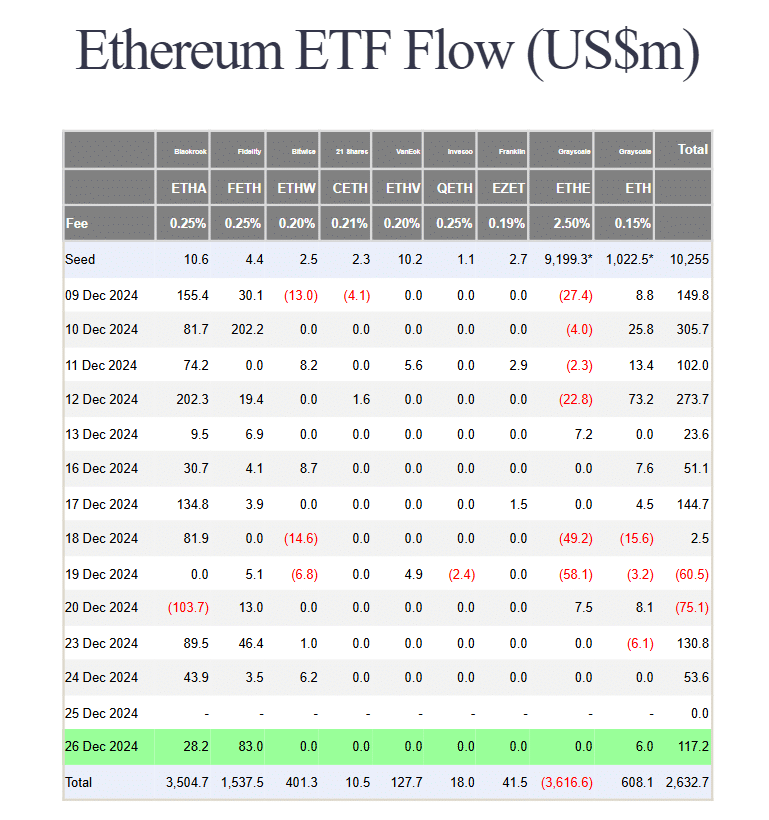

In the meantime, Ethereum [ETH] ETFs are gaining traction too, with spectacular inflows. In truth, Constancy’s Ethereum ETF (FETH) noticed $83 million in internet inflows – An indication that traders could also be beginning 2025 with a concentrate on diversification.

Whereas it might be too early to attract agency conclusions, Ethereum’s 1.04% value hike appeared to allude to an rising development price maintaining a tally of.

For Ethereum, it’s a protracted street forward

For the reason that “Trump pump,” the market has seen a number of shifts in momentum. What initially appeared like a powerful bull rally, with Bitcoin hitting the $100k milestone on the shut of the yr, has since tapered off. Consequently, the “excessive danger” sentiment is clearly holding traders cautious.

Ethereum hasn’t been proof against this shift both. After the preliminary surge, its value fell again to the place it was a month in the past, erasing a lot of its election-induced good points. With round 17 million Ethereum addresses now within the crimson, the strain for a rebound is increase.

And but, amidst the uncertainty, $117 million in internet inflows by means of ETH ETFs brings some much-needed aid.

This marks a constructive signal, significantly after two consecutive days of reasonable institutional curiosity – An indication that Ethereum may nonetheless be poised for a restoration.

That being stated, a full rebound to $4,000 nonetheless appears a great distance off. Technically, it might require an 18% bounce. And, given its latest performances during the last 30 days, this may appear a bit too optimistic within the quick time period.

There are different gamers within the race for dominance

Like Ethereum, different altcoins are enhancing their underlying tech to supply traders compelling long-term prospects. One which stands out particularly is XRP.

Apparently, XRP’s day by day value motion revealed indicators of consolidation at press time, with intense shopping for and promoting strain making a stand-off. This tug-of-war has attracted consideration from massive gamers, who’re betting on XRP for potential massive returns.

With its spectacular triple-digit good points, real-world use case integrations, and robust whale backing, XRP is positioning itself to doubtlessly take the highlight from Ethereum because the market rebounds—A development that should be intently adopted within the days forward.

Learn Ethereum [ETH] Price Prediction 2025-2026

On the flip aspect, Ethereum’s chart has been extra risky. After hitting its yearly excessive of $4,106 simply 10 days in the past, ETH dropped a staggering 21% in every week. So, whereas a restoration is feasible, it has been sluggish, indicating a scarcity of quick shopping for curiosity from the market.

Wanting forward, the subsequent few days might be make-or-break for Ethereum. Though recent capital may push BTC into consolidation, doubtlessly benefiting altcoins like Ethereum, the present lack of constant help in ETH’s value means a swift restoration is unlikely.

On high of that, the competitors amongst altcoins is heating up, and Ethereum must present extra consistency if it needs to remain on the forefront of the pack.

![Security alert [12/19/2016]: Ethereum.org Forums Database Compromised](https://finance-bitcoin.com/wp-content/uploads/2025/08/1754662638_eth-org-120x86.jpeg)