- Solana’s worth momentum is approaching key resistance ranges as whale accumulation intensifies.

- Rising open curiosity and vital liquidations counsel elevated market volatility forward for Solana.

Solana [SOL] has flipped Ethereum in a surprising improvement, taking the highest spot in 7-day DEX (Decentralized Trade) quantity with $11.8 billion in comparison with Ethereum’s $9.2 billion. This surge has many questioning whether or not Solana is gearing up for a significant bull run.

Consequently, a deeper look into Solana’s worth motion, whale exercise, liquidation information, and open curiosity ranges is important to know if this could possibly be a defining second within the crypto market.

Can Solana break resistance and rally?

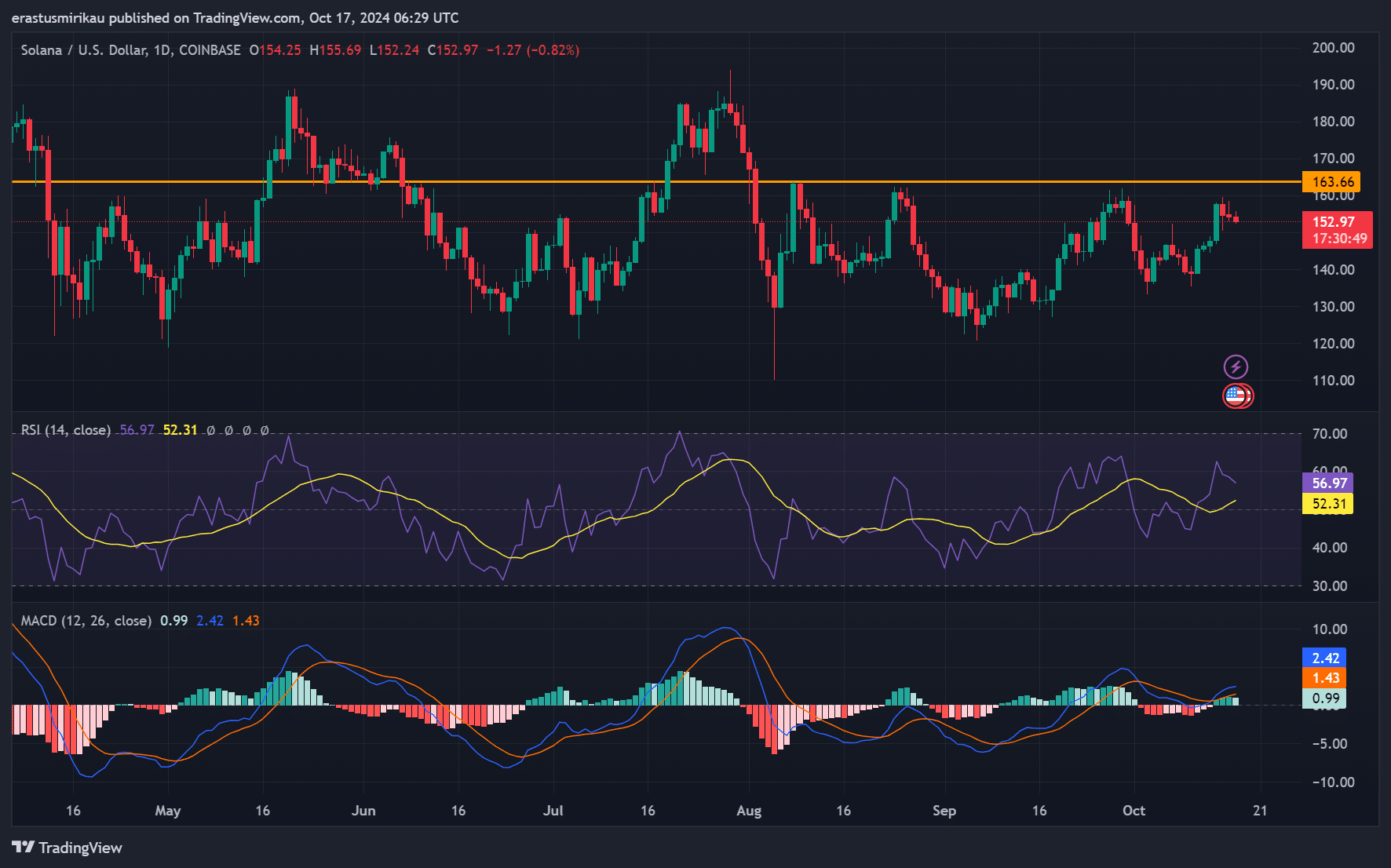

At press time, SOL was buying and selling at $153.09, reflecting a 0.99% decline over the previous day. Nonetheless, regardless of the minor drop, the worth stays on an upward trajectory.

Extra importantly, the $163.66 degree stands as a significant resistance level. If Solana breaks by means of this degree, a rally might observe.

Moreover, the RSI studying of 52.31 reveals impartial momentum, whereas the MACD hints at potential bullish power constructing. Due to this fact, all eyes are on whether or not Solana can preserve its momentum and push larger.

SOL whale accumulation alerts potential surge

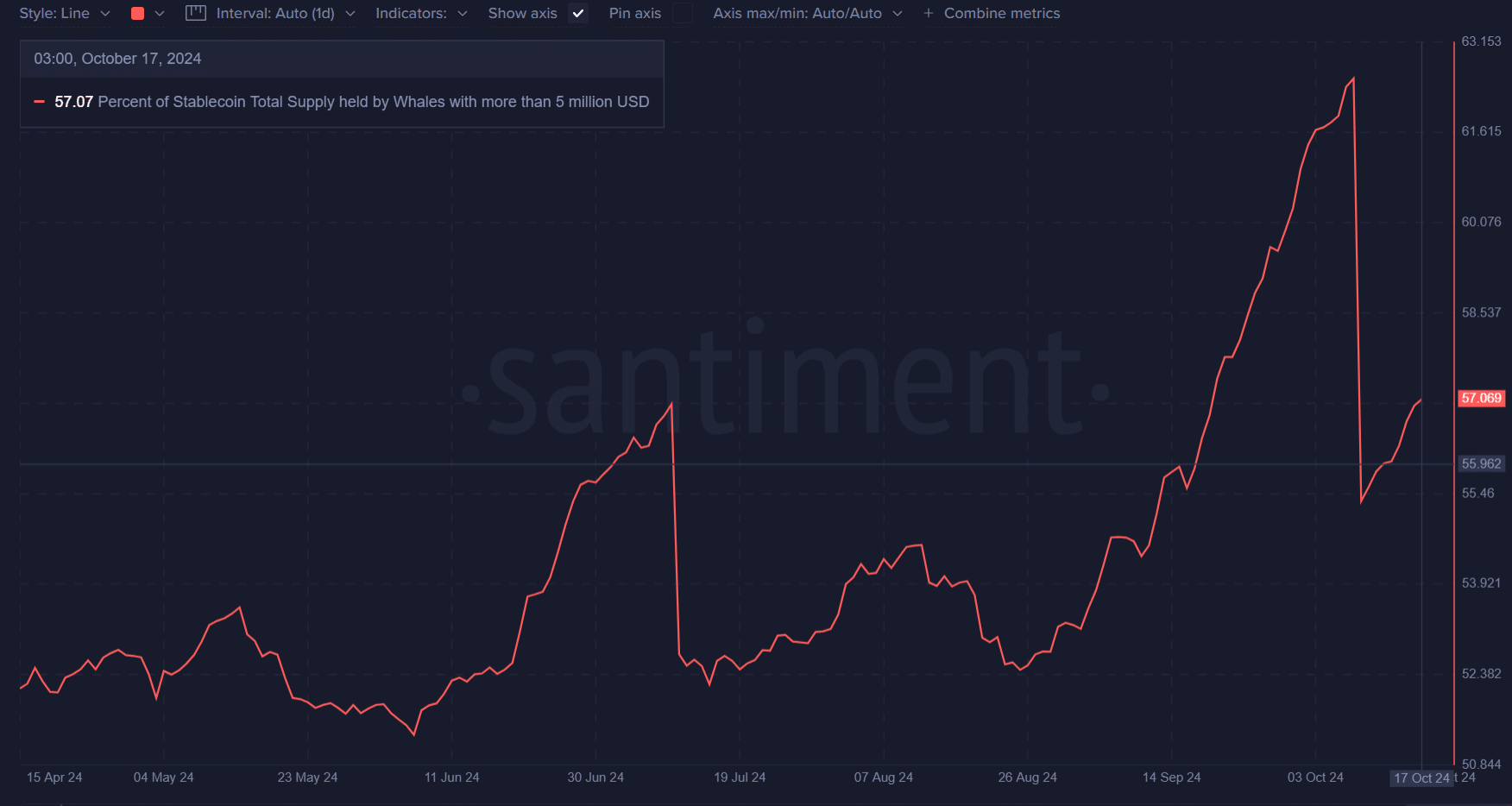

Apparently, Solana’s prime holders—whales with greater than $5 million—now management 57.07% of the stablecoin provide. This rise in whale focus suggests strategic accumulation. Traditionally, such conduct from massive holders has typically preceded worth will increase.

Consequently, this buildup raises expectations that SOL might quickly see vital upward motion. The whales are seemingly positioning themselves for a powerful push, indicating confidence within the long-term outlook of Solana.

Are SOL liquidations establishing for extra volatility?

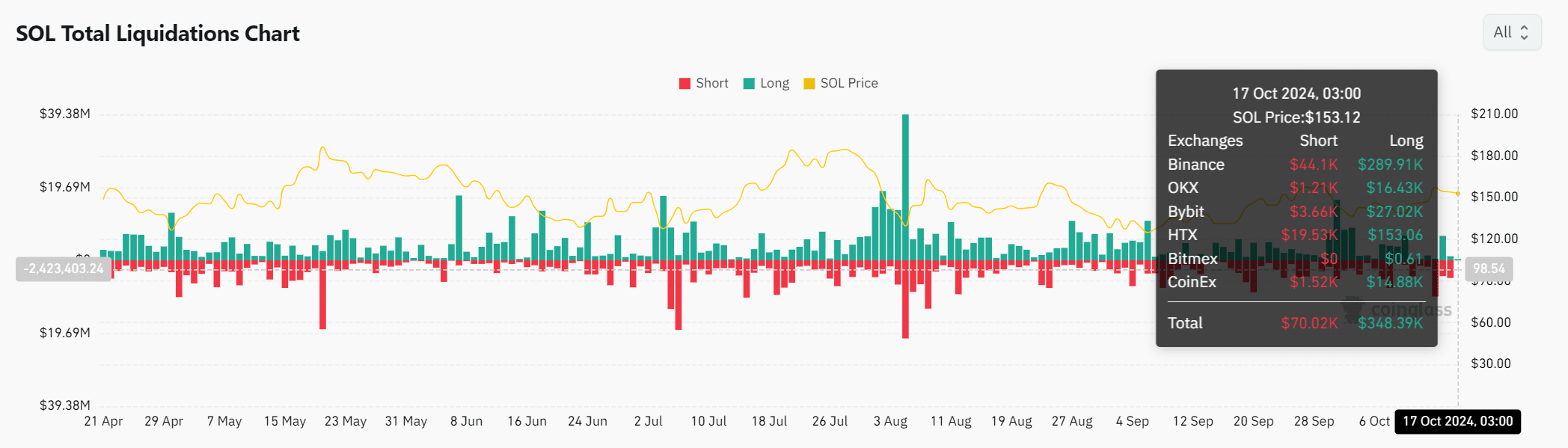

Liquidation information reveals that $348.39K price of lengthy positions had been liquidated within the final 24 hours, alongside $70.02K in shorts. This excessive degree of liquidation in lengthy positions factors to merchants betting on a continued rise.

Nonetheless, it additionally signifies a excessive degree of leverage out there, which might backfire if key resistance ranges fail to carry. In consequence, additional worth swings might happen if the market strikes towards overextended merchants.

Rising open curiosity hints at market optimism

Open curiosity in SOL has elevated by 2.26%, reaching $2.45 billion. This rise alerts rising dealer curiosity and an expectation of heightened volatility within the close to future.

Furthermore, with Solana dominating DEX quantity, merchants are betting on its potential to outperform the broader market.

Is your portfolio inexperienced? Take a look at the Solana Profit Calculator

Given SOL’s robust efficiency and whale accumulation, the potential for a bull run is plain. If the worth breaks by means of resistance and avoids additional liquidations, the market might see a speedy surge.

Nonetheless, merchants ought to proceed cautiously resulting from liquidation dangers. Nonetheless, Solana is well-positioned to guide the following main crypto rally.