Intro

The Ethereum Merge, regardless of being some of the vital blockchain upgrades within the historical past of cryptocurrency, remains to be a poorly understood subject.

So what's the Ethereum Merge? What are its financial implications? And what are the primary merge dangers and misconceptions? You’ll discover solutions to those questions and extra on this article.

Let’s begin with understanding the motivations behind the Merge.

Motivations

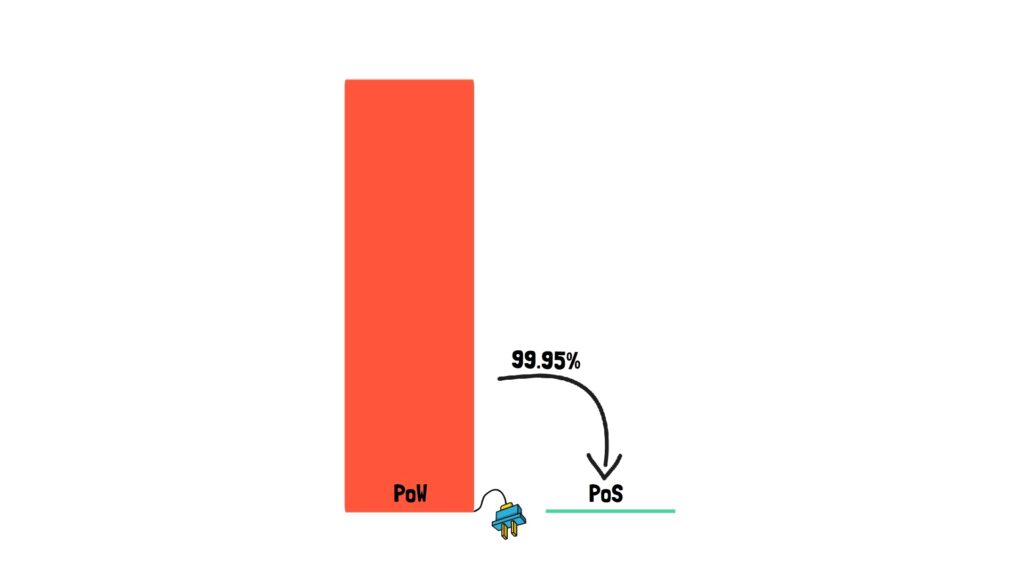

The primary objective of the Merge is to transition Ethereum from its present proof-of-work consensus mechanism to the proof-of-stake mannequin.

In brief, within the proof-of-work or PoW mannequin, the community is secured by miners who need to buy and run the mining {hardware}. On this mannequin, the miners eat electrical energy in change for block issuance and a portion of transaction charges.

Within the proof-of-stake or PoS mannequin, the community is secured by validators who need to stake ETH so as to validate the community. On this mannequin, the validators don’t eat a lot electrical energy.

The transition to PoS goals at making Ethereum extra energy-efficient, safer, and lays the groundwork for enabling extra scalability with sharding afterward.

The transfer to PoS was one of many huge milestones within the unique Ethereum roadmap and analysis started earlier than the Ethereum community launched.

As an alternative of transitioning Ethereum to PoS in a single enormous and probably harmful change, the Ethereum researchers and builders determined to separate it into two steps.

Step one – launching the Beacon Chain – was efficiently executed in December 2020.

This allowed for making a separate parallel PoS chain that may very well be examined in manufacturing for a time frame with out having any direct influence on the already current PoW community that secures lots of of billions of {dollars} of financial exercise.

One other necessary purpose for launching the Beacon Chain earlier was to offer sufficient time to stakers, so the quantity of staked ETH may be sufficiently massive to safe the community on the time of the Merge.

When writing this text, the Beacon chain had over 400k validators and over 13m ETH actively staking.

The Merge is the second step within the transition to PoS which merges the consensus layer of the Beacon Chain with the EVM state of the Ethereum PoW chain – extra on this later within the article.

The transition to PoS goals at lowering the ability consumption to safe Ethereum by round 99.95%.

This in flip brings down plenty of arguments about Ethereum, DeFi and NFTs “killing the planet”.

As a byproduct, it additionally makes Ethereum ESG compliant which may be good for extra regulatory-driven establishments that will wish to begin exploring the Ethereum ecosystem.

This will additionally make Ethereum extra pleasant to players and NFT artists involved in regards to the environmental influence of crypto.

One other motivation for finishing the Merge is the discount within the ETH issuance because the safety of the PoW and PoS chains is funded by ETH issuance.

After the Merge, the PoW community will stop to exist which can dramatically cut back ETH issuance.

This was named Triple Halving because the issuance drop is just like 3 Bitcoin issuance halvings.

On high of all of this, one other argument for the merge and the transition to PoS is that Ethereum lovers will have the ability to safe Ethereum from dwelling. Being a consensus participant will now not primarily be for establishments and complex miners.

This could additional decentralise the community and make it much more immune to assaults.

Now that we all know the motivations behind The Merge, time to dive a bit deeper into the mechanics of this improve.

The Merge Mechanics

Let’s begin with a fast analogy.

Think about Ethereum as a automobile driving on the motorway. The Merge goals at transitioning the automobile’s engine from gasoline to electrical. A key problem is to take action with out stopping the automobile.

To realize this, the Ethereum builders constructed a separate electrical engine and have examined it with actual stake for over 1.5 years. This new, electrical engine runs in parallel to the present gasoline engine.

On the time of the Merge, the automobile will swap to utilizing the electrical engine and it'll cease utilizing its present gas-fuelled motor.

Doing it on this means, initially, permits for testing the electrical engine in parallel. The second profit is that we will swap the engines with out stopping the automobile.

Within the case of Ethereum, “stopping the automobile” would imply halting the block manufacturing which might end in no new transactions being appended to the blockchain.

As we will think about, this is able to be very disruptive particularly for DeFi, so Ethereum builders attempt to keep away from it in any respect prices.

I hope this analogy helps visualising the Merge. Right here is a little more technical clarification of this improve.

The Merge is answerable for merging the person state of the Ethereum community with the PoS Beacon chain.

In the intervening time, earlier than the transition to PoS, so as to validate the Ethereum community, the node operators run one of many current shopper implementations comparable to Geth, Erigon or Nethermind.

These shopper implementations bundle the execution layer (EVM) and the consensus layer (PoW).

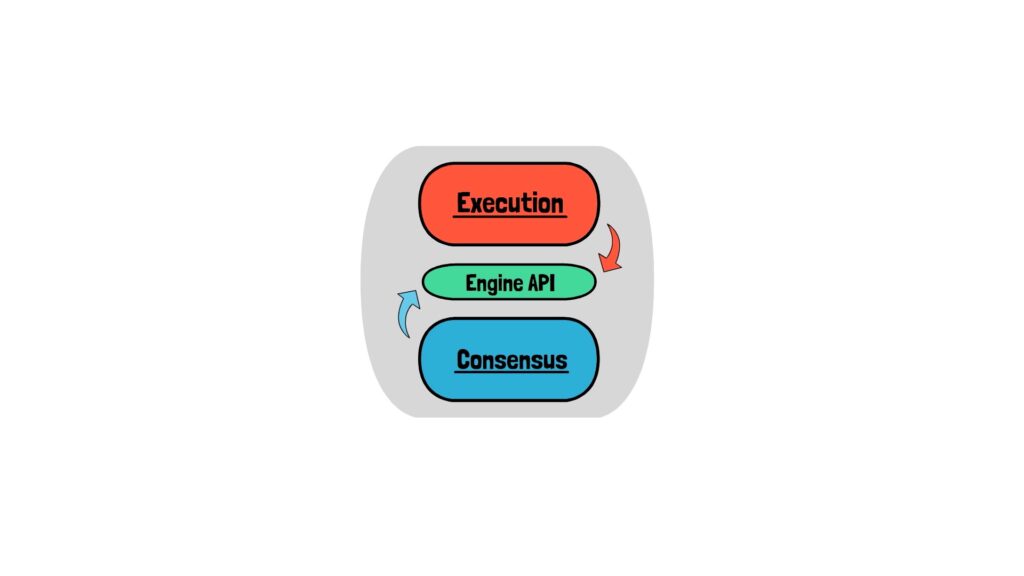

So as to transition the Ethereum community to the PoS mannequin easily, the execution and consensus layers are unbundled.

Which means that each of those layers may be run individually. They will also be developed by utterly totally different groups specialising in one of many layers.

After the Merge, a full node will encompass an execution node and a consensus node. There's additionally an Engine API answerable for the communication between the execution and consensus nodes.

Decoupling the consensus and execution layers allowed for faster preliminary launch of the Beacon Chain with out having to fret in regards to the execution layer.

With regards to consensus layers, the preferred implementations in the intervening time are Prysm, Lighthouse and Teku.

The prevailing shopper implementations will transition to being execution layer shoppers and can work with the consensus layer shoppers to kind a full Ethereum node.

With a number of shopper implementations on each layers, there are a number of totally different combos of execution and consensus shoppers.

For instance, one validator could want to run Prysm with Geth. One other could want to run Lighthouse with Nethermind. With 4 common execution shoppers and 5 consensus shoppers, there are 20 pairwise combos.

On the time of the Merge, execution shoppers like Geth will begin listening to blocks coming from the PoS chain.

The set off for this swap shall be decided by a brand new variable known as TERMINAL_TOTAL_DIFFICULTY which represents the sum of the proof of labor difficulties of each block gathered on the Ethereum PoW community.

When the chain accumulates sufficient proof of labor to exceed the TERMINAL_TOTAL_DIFFICULTY, nodes swap to following the canonical PoS chain.

It’s attention-grabbing to note that for the primary time an Ethereum improve shall be triggered utilizing whole problem as an alternative of the standard block top.

That is to keep away from an attacker mining low-difficulty malicious forks that may fulfill the block top requirement on the time of the Merge and trigger confusion on the ultimate PoW block.

After the Merge, all purposes working on Ethereum ought to run precisely as pre-Merge with the state and transaction historical past maintained.

Which means that, for instance, if we have been a liquidity supplier on Uniswap earlier than the Merge, after the Merge the state would be the identical, therefore we’ll nonetheless be offering liquidity on Uniswap.

If we had an open mortgage on Aave, this mortgage will nonetheless be in place. Finish customers shouldn’t discover any modifications.

The transition has been going by means of a number of, intensive rounds of testing that embody merging shadow forks and merging testnets.

Shadow forks are copies of an current Ethereum community. Merging them helps catch potential points associated to the present state of the community. These forks are normally deserted after testing and their objective is to show any potential issues.

Not like most shadow forks, merged testnets normally persist as PoS networks. This helps builders with testing their purposes on a series that resembles Ethereum post-merge.

After Ropsten and Sepolia, the final and most-used long-lived testnet to merge is Goerli. After that is efficiently executed we will anticipate the announcement of the mainnet merge.

Now, let’s talk about one of many attention-grabbing subjects which was, to a sure extent, answerable for suspending the Merge which is shopper variety.

Consumer Range

Ethereum, in distinction to plenty of different platforms, doesn’t depend on one single shopper implementation. In truth, there are at the moment 4 mainstream implementations – Geth, Nethermind, Erigon and Besu.

Having a number of implementations permits for shortly switching to a special working shopper in case a bug is discovered within the software program we’re working. This makes Ethereum extra resilient to assaults as even a bug or an intentional exploit launched by one of many shoppers would have restricted penalties.

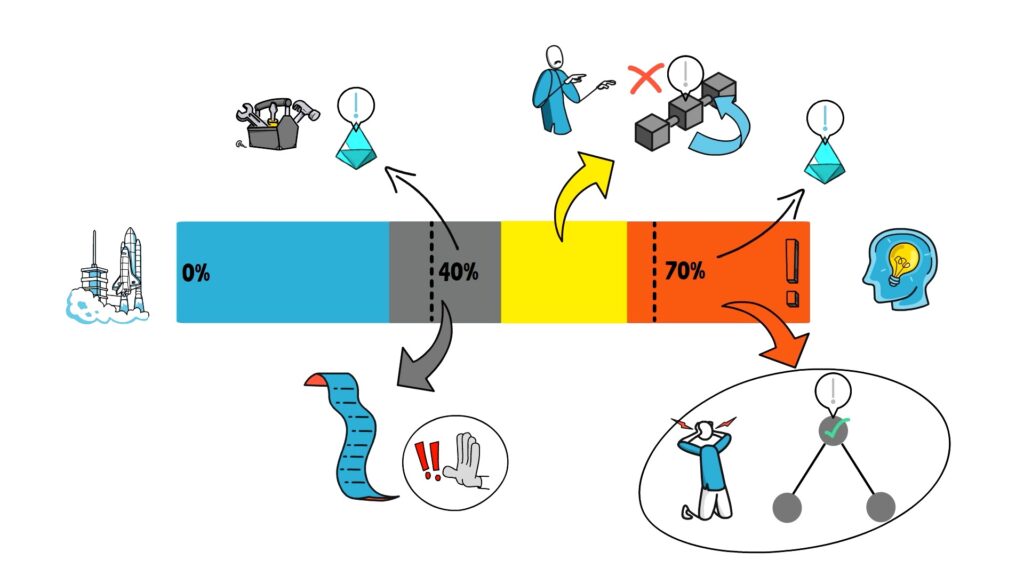

After the Merge, shopper variety performs a good larger position.

It is because a bug launched within the PoS community can have totally different penalties relying on the staking share it impacts.

Let’s begin with the worst scenario. If the issue impacts ⅔ or extra of the stake this can lead to finalising a nasty state root – not one thing we would like ever to occur.

If the issue impacts ½ or extra of the shoppers this can lead to the creation of a dominant invalid chain that received’t get finalised however shall be reverted. Higher than ⅔ or extra however nonetheless fairly unhealthy.

Lastly, if the issue impacts no less than ⅓ of shoppers no new transaction on the community would get finalised.

Now, understanding these potential outcomes we will perceive higher why shopper variety is so necessary.

Let’s assume that 70% of the consensus shoppers are working Prysm as their go-to answer. In case there's a bug discovered on this implementation, the community immediately suffers the worst state of affairs with greater than ⅔ of the shoppers being affected and Ethereum is susceptible to finalising a nasty state.

Now, if Prysm has 40% of the community and the same bug is discovered, the Ethereum community would cease finalising till both the bug is mounted or totally different backup shoppers are spun up so the community share of Prysm goes below ⅓.

On the time of writing this text, Prysm’s market share is at round 40% of the consensus shoppers. It is a enormous enchancment from round 70% in early 2022 and can increase community resilience.

Now, let’s talk about some necessary implications of the Merge.

Implications

To begin with, the block time won't be the identical as on the present PoW chain. The block time on PoW is normally quoted as averaging round 13 seconds.

After the Merge, time is split into fixed-duration slots of 12 seconds. Some slots can miss a block, so the common block time will virtually definitely be increased than 12 seconds, although it needs to be decrease than 13 seconds.

Secondly, the Merge will even cut back the block time variance and on common we will anticipate sooner transaction confirmations.

The Merge will even make the excellence between Bitcoin and Ethereum even clearer. Bitcoin will stay the battle-tested proof-of-work community whereas Ethereum shall be fuelled by the pretty new proof-of-stake energy-efficient mechanism.

One other necessary implication is that it will likely be tougher to assault the community due to the upper financial safety and the ability to slash attackers.

And likewise excellent news for players, the GPU market shall be almost definitely flooded with thousands and thousands of graphic playing cards as mining will now not be wanted.

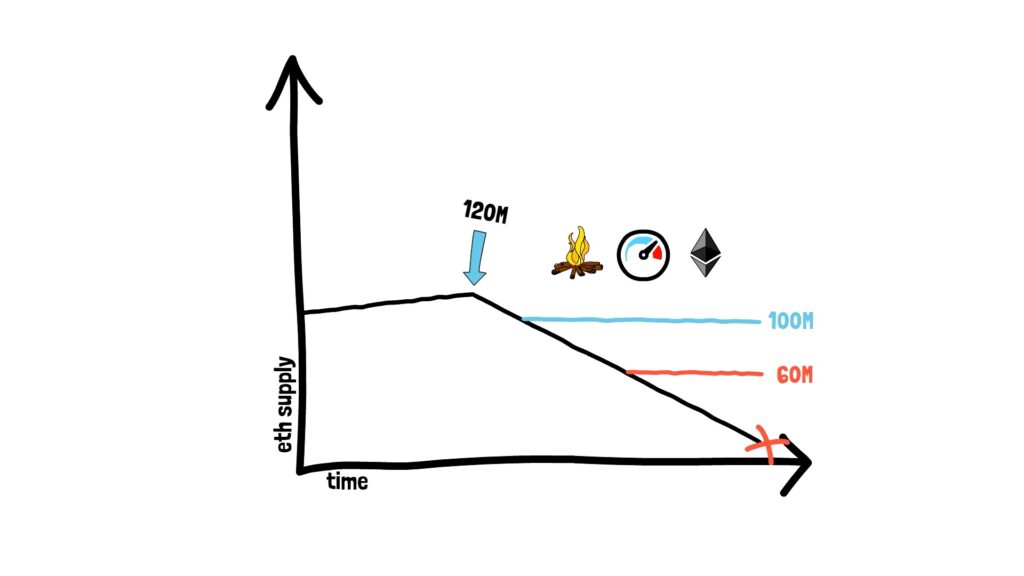

The merge will even almost definitely lower the ETH provide over time and spike extra media curiosity as a “deflationary asset”.

Additionally, one other necessary implication. In whole, there are round 100 individuals engaged on the Merge. After the Merge, these individuals can begin engaged on different enhancements comparable to sharding.

There are additionally a number of huge misconceptions in regards to the Merge.

Misconceptions

To begin with, the Merge doesn't enhance Ethereum’s scalability and it doesn’t cut back transaction charges – no less than in a roundabout way.

The beforehand talked about minor discount in block time can lead to a small enhance in throughput, however what's crucial is that the Merge and the transition to PoS lay the groundwork for additional scalability enhancements that shall be delivered within the subsequent community upgrades.

Secondly, the Merge doesn’t allow withdrawals of ETH from the validators right away. This shall be enabled in one of many subsequent hardforks after the Merge.

It’s price mentioning that transaction charges collected after the Merge have their very own recipient ETH handle on the EVM, so ETH gathered from the transaction charges shall be instantly accessible.

Additionally, as we all know from the earlier part, Ethereum doesn’t need to cease to allow the transition. That is yet one more frequent false impression.

One other frequent false impression is that there shall be one other ETH token on the beacon chain or for Ethereum 2.0.

The final false impression price mentioning is that ETH provide will maintain lowering and pattern in the direction of 0. That is additionally incorrect because the ETH provide will discover an equilibrium based mostly on the community demand, particularly the ETH burn charge from transaction charges, and the ETH issuance. This equilibrium may be established on totally different ranges and alter over time, however it would by no means attain 0.

The present estimates predict the ETH provide to peak round 120M ETH on the Merge and discover a long-term equilibrium anyplace between 60M to 100M ETH in a number of a long time.

Hopefully, this clears up a few of these frequent misconceptions.

The Merge, like some other difficult know-how improve, doesn’t come with none dangers.

Listed here are some potential dangers which might be price protecting in thoughts. Most of them are associated to the transition to PoS reasonably than the Merge itself, however they're nonetheless price mentioning.

Dangers

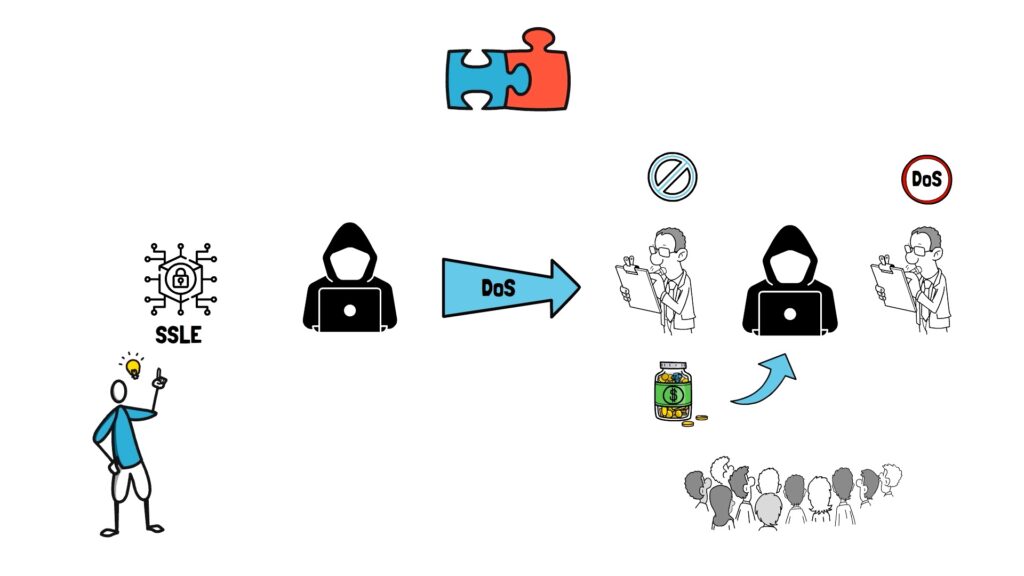

After the Merge, validators proposing the subsequent block shall be identified forward of time as a part of a public choice course of.

This makes proposers weak to networking Denial-of-Service (DoS) assaults.

For example, if the attacker is aware of they're one of many subsequent proposers in line, they will attempt to DoS the present proposers inflicting them to lose their slots and never embody any high-value transactions that now may be picked up by the attacker.

The most well-liked answer to this drawback, in the intervening time, is a single secret chief election that makes use of intelligent cryptography to forestall the attacker from understanding who the subsequent proposer is whereas nonetheless offering this info to the precise proposer.

There are additionally centralisation dangers that include the focus of stake in swimming pools comparable to Lido and Coinbase. These can result in assaults comparable to censorship or extortion. Within the case of Lido, there's additionally governance takeover threat and sensible contract threat.

One of many attention-grabbing options advised by the Lido neighborhood was to permit individuals who deposit their ETH to Lido and obtain stETH to veto any potential harmful proposals.

It’s nice to see the Ethereum neighborhood anticipating plenty of potential dangers related to the Merge and the transition to PoS and already discovering some potential options.

These options, even when not applied right away, may be added to the community in one of many following hardforks making it extra resilient sooner or later.

Abstract

The Ethereum Merge is clearly one of many largest and most anticipated upgrades within the historical past of the cryptocurrency area.

With regards to the date of the Merge, in the intervening time, most individuals predict it to occur round September 2022. This needs to be attainable if there aren't any main points discovered through the Goerli testnet merge.

Regardless of a number of potential dangers, the researchers and builders have been spending numerous hours ensuring there aren't any surprises through the mainnet merge.

After the Merge, Ethereum will develop into safer and sustainable.

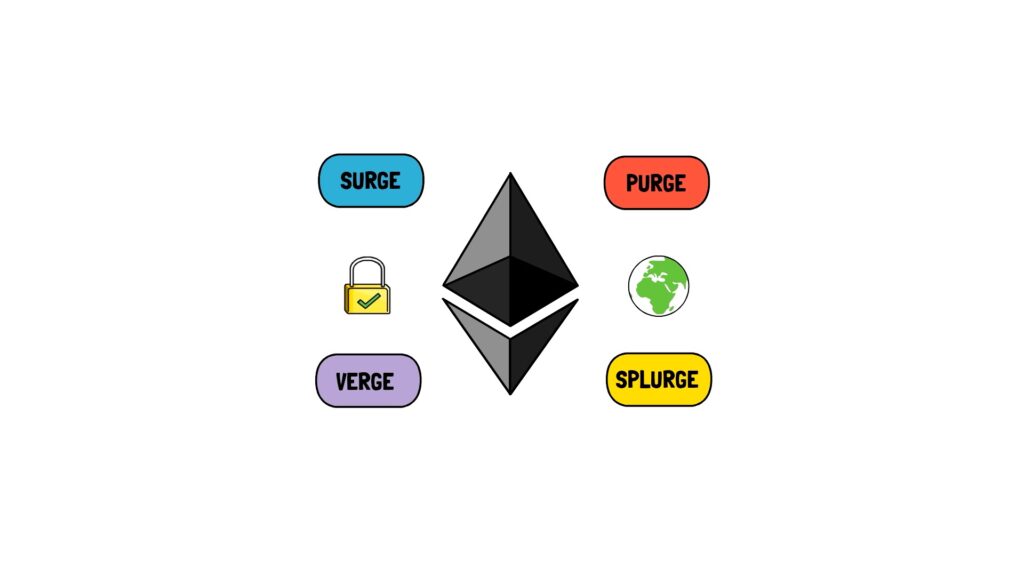

It'll even be completely positioned for the subsequent huge upgrades – the Surge, the Verge, the Purge and the Splurge. We are going to study extra about them within the following articles, nevertheless it’s price mentioning that each one of those subsequent phases may be labored on in parallel.

In the event you loved studying this text it's also possible to try Finematics on Youtube and Twitter.