- Bitcoin and Ethereum Spot ETFs had been main catalysts for crypto costs and holders’ conviction

- Rising DeFi recognition may catch contributors abruptly subsequent yr

The previous yr has been extremely eventful. From Bitcoin’s [BTC] halving to the Ethereum [ETH] Spot ETF approval, from the quantum computing risk to Bitcoin briefly seizing headlines, listed here are a few of the yr’s huge highlights.

This yr in crypto

The largest growth by far was the Bitcoin Spot ETF approval. This got here after some false alarms triggered large BTC value volatility, such because the one from Cointelegraph in October 2023. On 10 January 2024, the U.S. Securities and Trade Fee (SEC) introduced the approval of Spot Bitcoin alternate traded merchandise, or ETFs.

Crypto Twitter went haywire, and buyers had been delirious on the concept of BTC being open to tens of millions of mainstream buyers. The emergence of BlackRock and Constancy as two of the biggest ETF funds was additionally a significant increase to sentiment. They presently maintain 550k and 200k BTC, respectively.

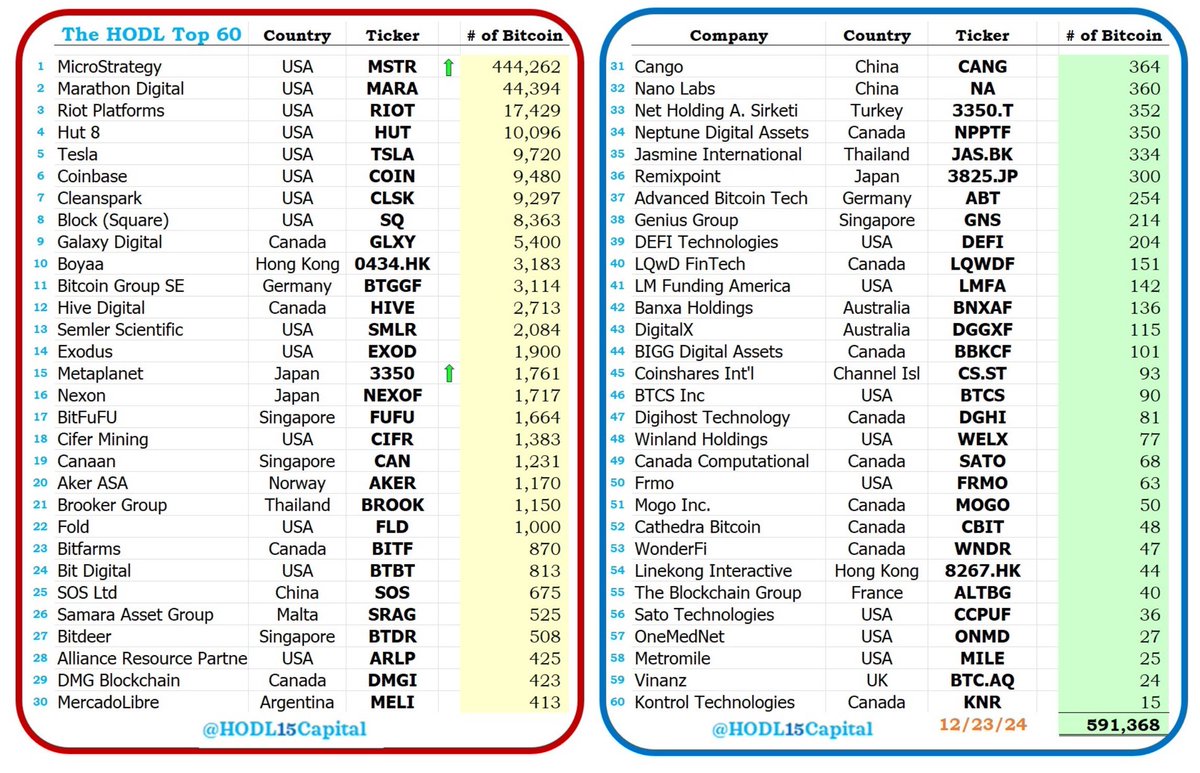

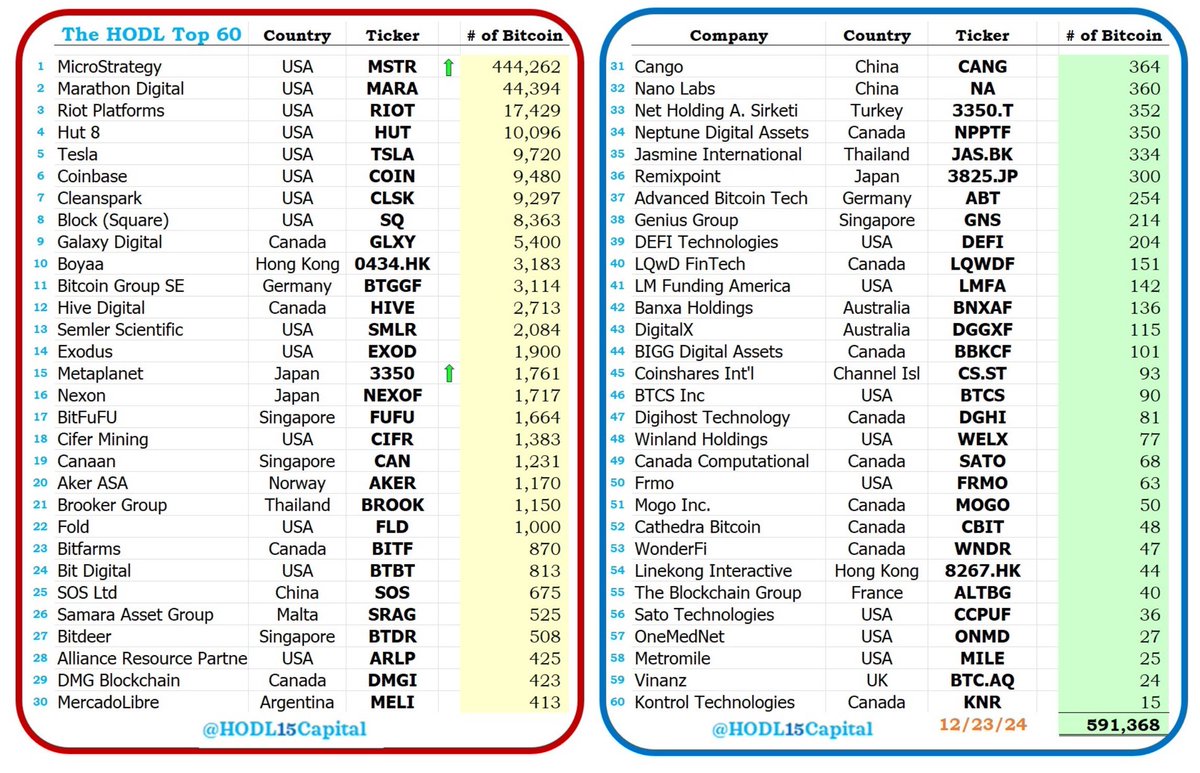

From being a distinct segment asset class, BTC is now open to the general public. The funds are regulated and managed by a few of the largest entities within the monetary world. Michael Saylor, Co-founder and former CEO of MicroStrategy, has additionally been relentlessly shopping for Bitcoin. Different corporations are starting to stack BTC too.

Supply: Michael Saylor on X

The Ethereum Spot ETF approval was additionally a lift to the trade.

U.S. Presidential elections deliver crypto to the fore

The 2024 presidential marketing campaign spurred many debates about both candidate and the sort of administration they might deliver. Trump’s embrace of crypto, his appearances at trade occasions, and his marketing campaign guarantees made his administration’s pro-crypto place clear. This boosted crypto sentiment massively.

Actually, the President-elect even made guarantees to make the USA the crypto-capital of the world. Coverage reformations would in all probability be launched to deliver regulatory readability. Trump additionally made public the intention to fireside SEC Chair Gary Gensler, a recognized crypto critic with a bent to be aggressive in his oversight of crypto. Gensler can be stepping down on 20 January, Trump’s inauguration date.

Whether or not he follows by on these guarantees stays to be seen.

Polymarket and different markets acquire prominence

Election time noticed the cryptocurrency-based prediction market Polymarket acquire recognition. It permits customers to achieve or lose from the result of world occasions. Throughout these elections, it massively favored Trump to be the victor, which turned out to be correct.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

In late September, Trump and his three sons introduced World Liberty Monetary, a decentralized finance (DeFi) cash market platform. Fanatics see this as a constructive growth, whereas critics introduced the plain battle of curiosity to consideration. WLF’s buy of crypto tokens reminiscent of Chainlink [LINK] and Aave [AAVE] had been transparent as a result of nature of the blockchain, boosting these tokens’ costs.

Supply: DeFiLlama

The DeFi ecosystem basically has additionally been thriving. The DeFi revival is obvious from the rising total value locked (TVL) throughout totally different chains. It was at $120 billion, at press time, closing in on the $170 billion excessive it made in late 2021 over the last cycle.

Lastly, Uniswap [UNI], the world’s largest decentralized alternate (DEX) on Ethereum, set information in November. Its month-to-month buying and selling quantity for a Layer-2 answer hit $38 billion, surpassing the $34 billion excessive it set in March 2024.