- Information indicated that BTC is now in an oversold area, which may sign an imminent value rebound

- Complete provide in revenue revealed that BTC shouldn’t be but on the cycle’s low, leaving room for a major upward transfer

Market sentiment has been steadily turning bullish. The truth is, over the past 24 hours, Bitcoin has gained by 2.57%, pushing its value to roughly $97,500 at press time. Nevertheless, this value soar shouldn’t be absolutely supported by market momentum, with the identical falling by 23.23% throughout the identical interval.

A broader market evaluation primarily based on historic developments underlined the potential for additional progress. What this implies is that BTC should still have the chance to set a brand new all-time excessive within the coming weeks.

An ‘undervalued’ place

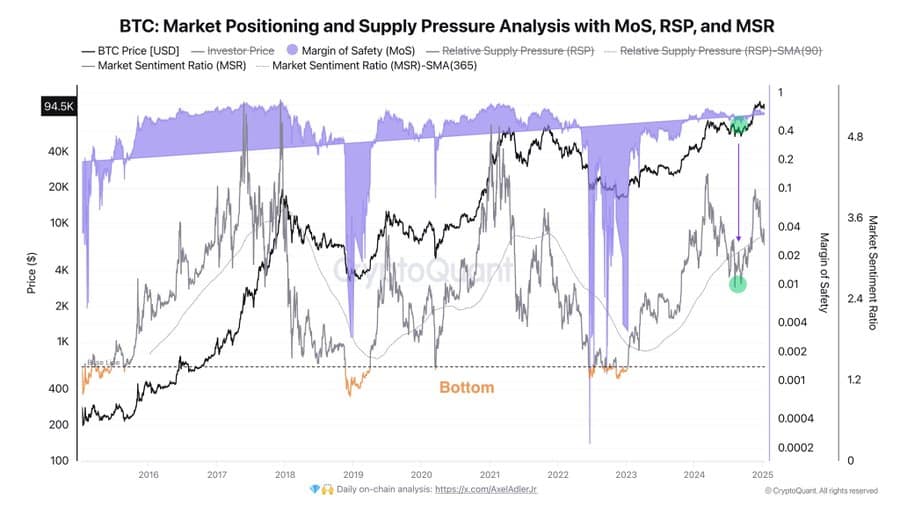

Information from CryptoQuant’s Market Place and Provide Strain metrics instructed that Bitcoin (BTC) could also be undervalued. This evaluation relies on the Margin of Security (MoS) and Market Sentiment Ratio (MSR) indicators.

The Margin of Security (MoS) evaluates whether or not BTC is overvalued or oversold relative to a crucial baseline. When the MoS developments above this line, it signifies overvaluation, whereas a place beneath suggests the asset is undervalued.

On the time of writing, the MoS (represented by the purple cloud) was trending beneath the baseline, valued close to the $90,000-zone (baseline). This implied that BTC is now in an oversold place – An indication {that a} rally could also be developing subsequent.

Equally, the Market Sentiment Ratio (MSR) measures the extent of optimism or pessimism available in the market by evaluating its worth to the yearly Easy Shifting Common (SMA). On the time of writing, it had a studying of at 1.4.

A worth above the SMA signifies prevailing optimism, whereas a worth beneath displays market pessimism. Press time information revealed that the MSR was beneath the yearly SMA – An indication of pessimistic sentiment.

Traditionally, as indicated by inexperienced dots on CryptoQuant’s chart, every time the MoS falls beneath the baseline and the MSR developments beneath the yearly SMA, these situations current a powerful shopping for alternative. In such instances, BTC has usually seen important rallies on the charts.

The identical sample appears to be forming now available in the market – An indication that BTC might be prepared for one more uptrend.

Removed from the market prime?

Information from Glassnode’s Complete Provide of Bitcoin in Revenue, a key metric for figuring out BTC’s cyclical tops and bottoms, instructed that Bitcoin continues to be removed from reaching its market prime.

In line with the identical, BTC has not but touched the crimson trendline, which traditionally marks these crucial ranges.

If BTC touches this crimson trendline, it might imply {that a} majority of the holders are in revenue. Traditionally, such eventualities have triggered main market sell-offs. Particularly as merchants start to understand earnings, exerting downward stress on the value.

Proper now, BTC stays effectively above this trendline, indicating a positive place for additional rallying as addresses holding this provide are incentivized to proceed holding in anticipation of upper positive factors.

Alternate netflows’ findings

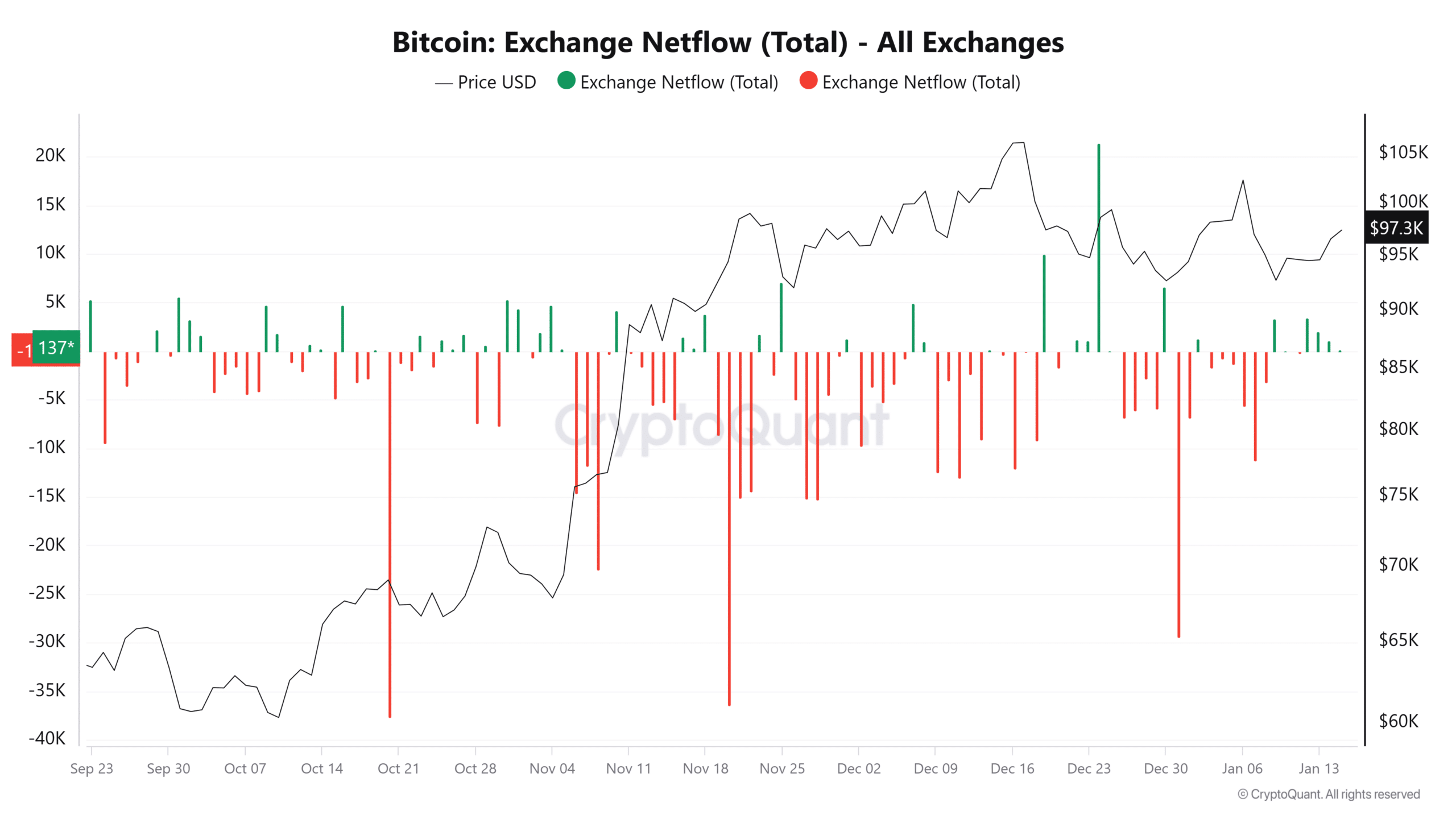

Lastly, change netflows revealed that there was a constant decline in change netflow from 12 January – Dropping considerably from roughly 3,431.69 BTC to simply 137 BTC.

A sustained decline in netflow means lowered promoting stress, as extra buyers transfer their BTC off exchanges into non-public wallets. This conduct might be interpreted to imply rising conviction amongst holders.

If the change netflow turns destructive, it might imply that spot merchants are more and more assured – A sentiment that traditionally correlates with a higher BTC price.

Merely put, BTC stays in a powerful place to maintain its upward rally, supported by diminishing promoting stress and rising market confidence.