Ethereum is buying and selling barely above probably the most crucial assist degree since December 2023, a value zone that might decide its short-term route. Bulls should maintain this degree to forestall additional declines and provoke a restoration part, however promoting strain stays sturdy. Analysts are divided, with some anticipating a chronic bear market whereas others see potential for a rebound.

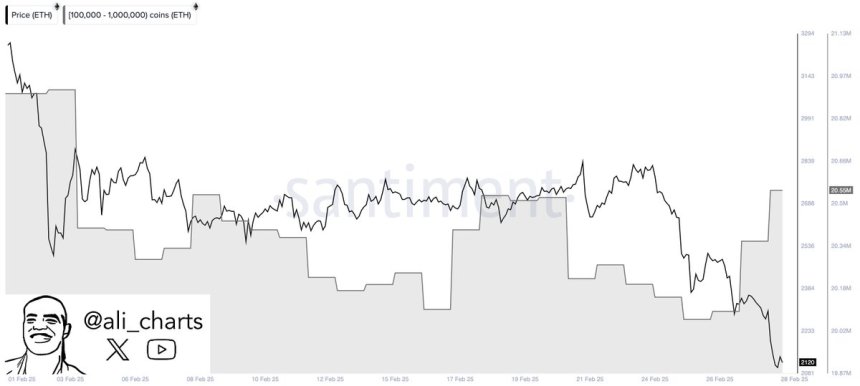

Crypto professional Ali Martinez shared Santiment data on X, revealing that whales purchased one other 190,000 ETH within the final 24 hours. This provides to the broader pattern of accumulation that has been ongoing for the previous month.

Traditionally, such whale exercise alerts confidence from massive buyers, who typically accumulate at discounted costs earlier than an uptrend resumes. If this pattern continues, Ethereum could possibly be organising for a robust restoration rally.

Associated Studying

Nevertheless, bullish momentum stays unsure. ETH must reclaim key ranges above $2,500 to substantiate a reversal, and failing to take action might result in additional corrections. The market is at the moment pushed by concern and uncertainty, however the steady whale accumulation means that sensible cash is positioning for future positive factors. The approaching days will probably be essential in figuring out whether or not Ethereum can bounce again or if the bearish pattern will persist.

ETH Testing Essential Lengthy-Time period Demand

Ethereum is buying and selling at $2,220 after reaching its lowest degree since late November 2023. The latest sell-off has pushed ETH beneath crucial assist zones, and bulls are struggling to regain management. The value is now beneath the 200-week exponential transferring common (EMA) at round $2,290 and the 200-week transferring common (MA) at round $2,480, signaling a bearish outlook except a robust restoration takes place quickly.

For Ethereum to regain momentum, bulls should reclaim the $2,500 degree within the coming days. A breakout above this degree would sign renewed power, doubtlessly main to an enormous restoration rally as merchants regain confidence. Nevertheless, ETH stays below strain, and failing to reclaim the $2,300 mark might affirm additional declines. If this state of affairs unfolds, Ethereum might face a deeper correction towards the $2,000 psychological assist, and even decrease, relying on market sentiment.

Associated Studying

With the market nonetheless dominated by concern and uncertainty, merchants are watching key technical ranges carefully. If ETH can stabilize above $2,200 and push greater, a aid rally could possibly be on the horizon. In any other case, Ethereum might stay trapped in a chronic downtrend, testing investor persistence and market resilience. The subsequent few days will probably be crucial for ETH’s value motion.

Featured picture from Dall-E, chart from TradingView