- Whale exercise and key help ranges urged a possible value breakout for Ethereum.

- Alternate reserves decline and liquidation factors signaled elevated volatility but additionally upward potential.

Ethereum [ETH] has just lately skilled vital whale exercise, with massive withdrawals from main exchanges sparking curiosity available in the market. A brand new pockets withdrew 7,100 ETH, valued at $14.27 million, from Gemini.

Moreover, substantial transfers of ETH passed off from Binance, OKX, and Kraken, amounting to thousands and thousands in worth.

A few of these property have been staked or deposited into lending platforms like Aave, which might sign bullish intentions.

What does the value motion say about Ethereum?

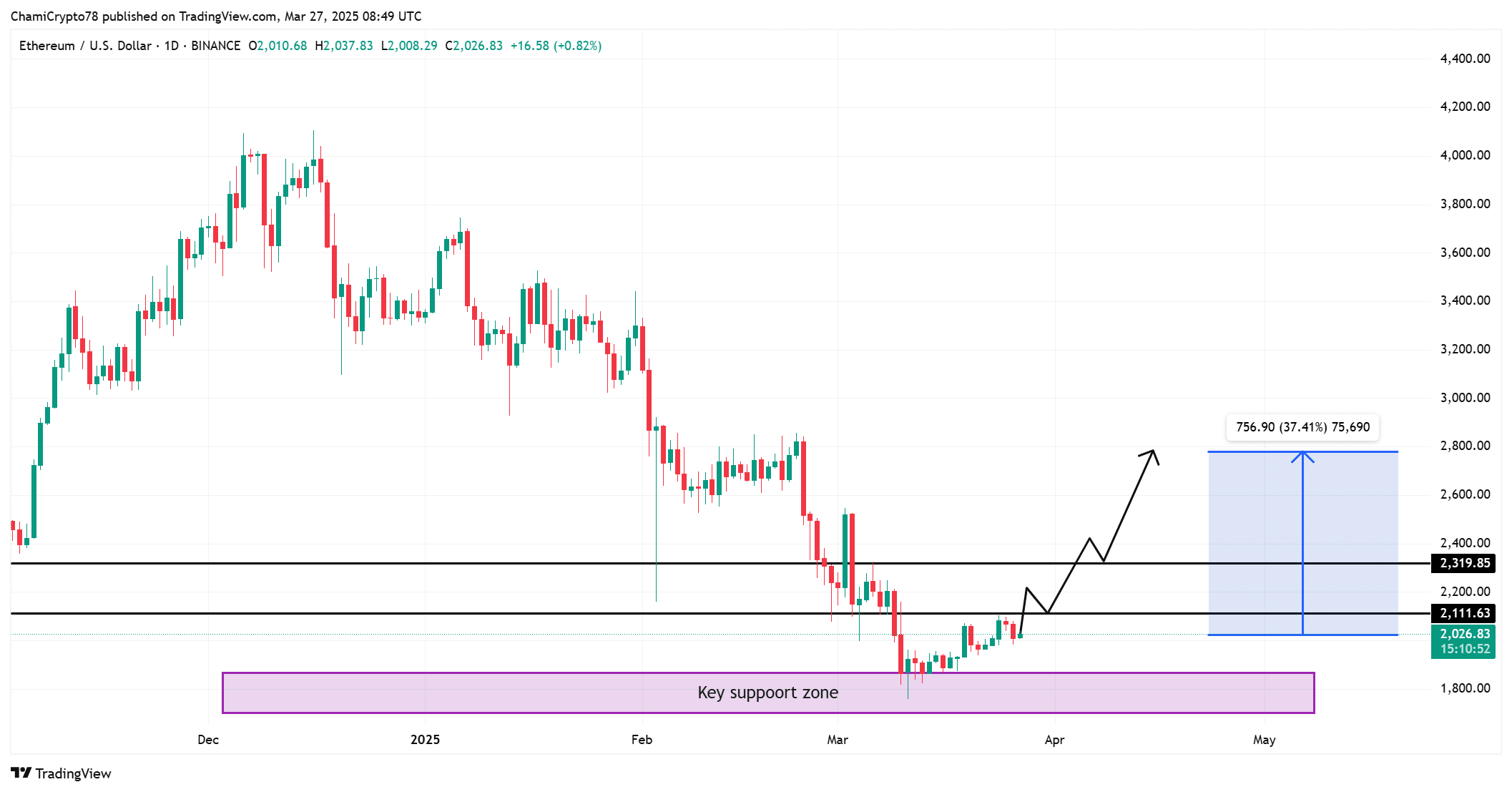

At press time, Ethereum was priced at $2,030.76, reflecting a slight 1.21% decline over the previous 24 hours.

Regardless of this minor dip, Ethereum continues to hover above essential help ranges, particularly round $2,000. As whale exercise picks up, there’s a sturdy chance that Ethereum might expertise a value rebound.

If the value stays above this help degree, it’d break previous the $2,100 resistance, doubtlessly triggering a rally.

Subsequently, a transfer above this threshold might spark additional shopping for, and the value might even rise by 37%, approaching $2,800.

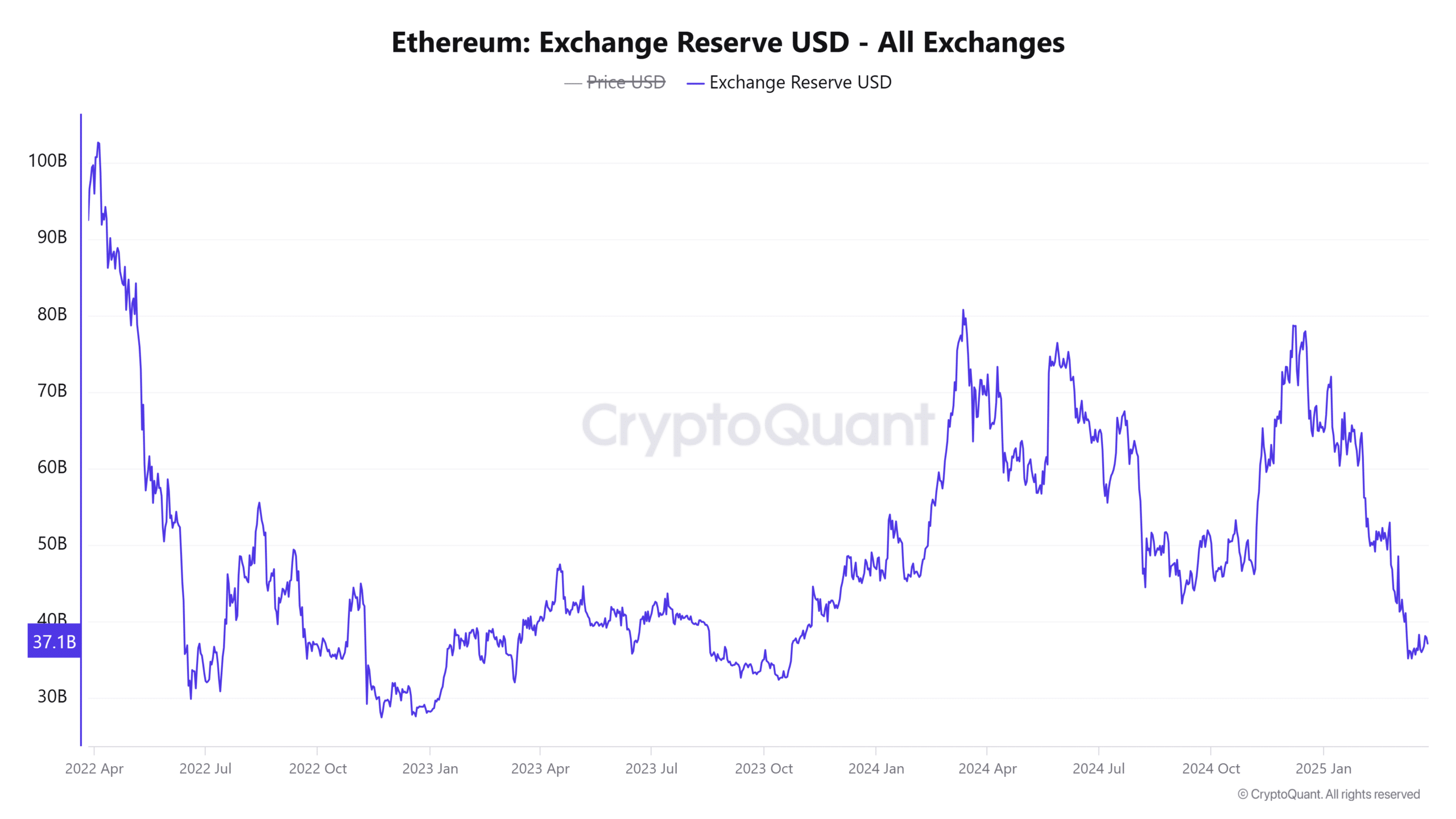

ETH’s alternate reserves: Liquidity dynamics at play

On the time of writing, Ethereum’s Alternate Reserve was at $37.1653 billion, exhibiting a 2.16% lower just lately. This decline means that extra ETH is transferring off exchanges, decreasing the liquidity obtainable for speedy trades.

This shift could point out that buyers are both holding their positions or transferring property to different platforms for staking or long-term funding.

With a tighter provide on exchanges, Ethereum could expertise upward stress within the coming days.

The drop in alternate reserves displays evolving market dynamics and signifies decreased sell-side liquidity, doubtlessly driving value will increase.

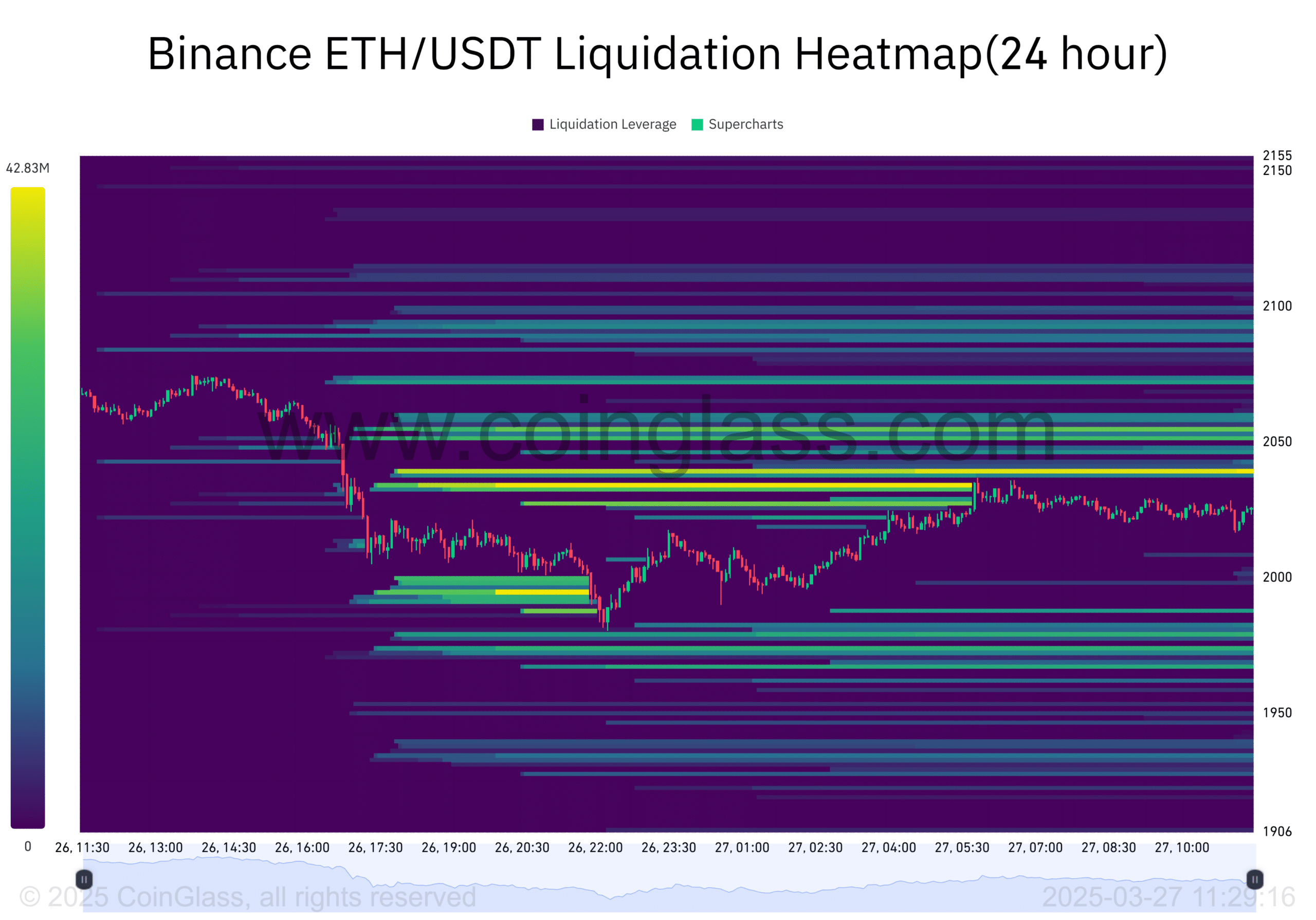

Liquidation heatmap: How do liquidation ranges influence value?

Breaking down Ethereum’s liquidation heatmap from Binance reveals key help and resistance zones.

The map exhibits vital liquidation factors between $2,000 and $2,100. As Ethereum approaches these ranges, compelled promoting might happen, growing market volatility.

This elevated volatility might both push Ethereum’s value by way of resistance ranges or trigger it to face downward corrections.

With the excessive variety of liquidation factors, Ethereum’s value is underneath stress however might additionally surge if the market absorbs these liquidations successfully.

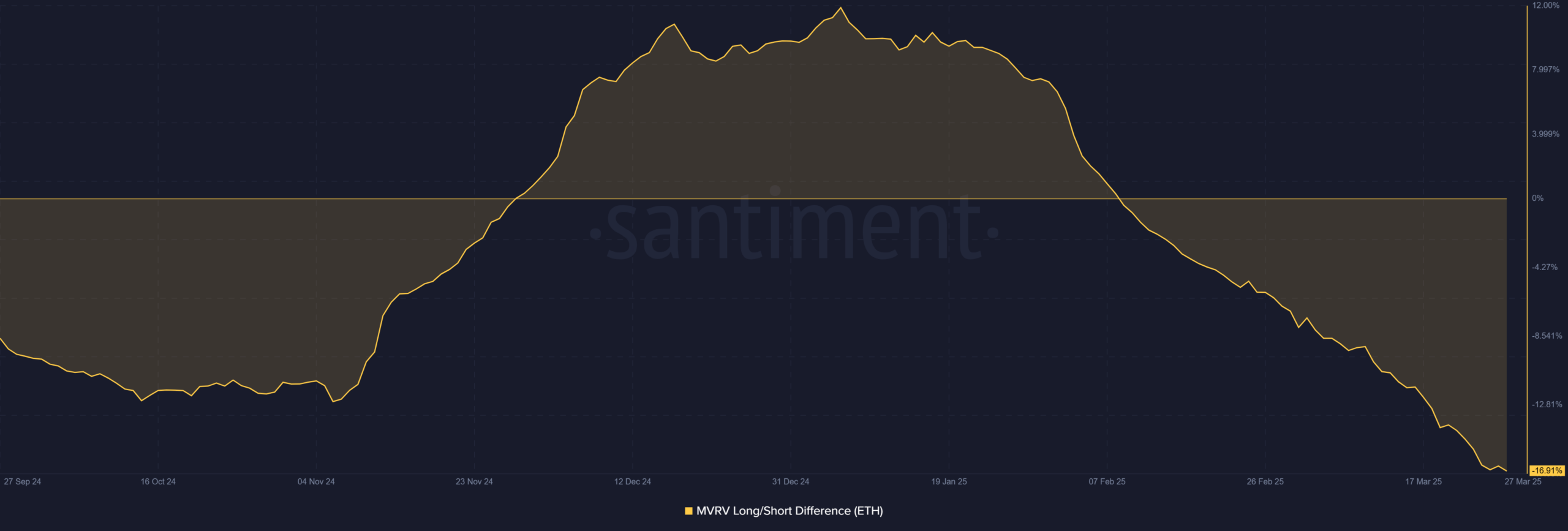

MVRV Lengthy/Brief Distinction: Market sentiment evaluation

The MVRV Lengthy/Brief Distinction for ETH stood at -16.91 %. This adverse worth signifies a bearish sentiment amongst long-term holders. Nonetheless, such a big divergence means that the market could also be oversold.

If merchants understand this as a shopping for alternative, ETH might see a value reversal.

As extra market individuals transfer in to capitalize on the low ranges, the value may rapidly recuperate, including gasoline to a possible breakout.

Is ETH set for a breakout?

Contemplating Ethereum’s whale exercise, key help ranges, and market sentiment, it appears doubtless that ETH is poised for a breakout. The mix of decreased alternate reserves, rising whale exercise, and technical indicators suggests upward value momentum.

Subsequently, ETH might expertise a big value surge if it breaks previous resistance ranges, doubtlessly reaching $2,800 quickly.